Ingredion Incorporated (NYSE: INGR), a leading global provider of

ingredient solutions to the food and beverage manufacturing

industry, today reported results for the first quarter of 2024. The

results, reported in accordance with U.S. generally accepted

accounting principles (“GAAP”) for the first quarter of 2024 and

2023, include items that are excluded from the non-GAAP financial

measures that the Company presents.

“Against a strong comparison with last year's record first

quarter performance, this quarter’s results exceeded expectations.

As anticipated, our net sales volumes in the quarter improved

sequentially, despite the impact of extreme cold weather on

shipments in the U.S. and taking into account the sale of our South

Korea business,” said Jim Zallie, Ingredion’s president and chief

executive officer. “Furthermore, we maintained our gross margins

above 22% as the strength of our business model effectively managed

the impact of variable rate contracts which require the pass

through of lower corn costs.”

“Looking forward, our Driving Growth Roadmap continues to guide

our long-term value creation. Also, in support of our new Winning

Aspiration, the reorganization is enabling clearer focus on the

opportunities presented by our global customers to drive growth. We

are encouraged by the levels of customer engagement, particularly

in our texture solutions business. Additionally, we anticipate

deploying cash this year toward organic investments, dividends, and

a step-up in share repurchases,” Zallie concluded.

As previously disclosed, effective January 1, 2024, Ingredion

will report financial and operational results under its new

reporting structure. For comparison purposes, results for the first

quarter of 2023 throughout this news release are unaudited and have

been revised to reflect the new reporting structure in which there

are three new reportable segments as described below. *Adjusted

diluted earnings per share (“adjusted EPS”), adjusted operating

income and adjusted effective income tax rate are non-GAAP

financial measures. See section II of the Supplemental Financial

Information entitled “Non-GAAP Information” following the Condensed

Consolidated Financial Statements included in this news release for

a reconciliation of these non-GAAP financial measures to the most

directly comparable GAAP measures.

Diluted Earnings Per Share (EPS)

| |

1Q23 |

|

1Q24 |

|

Reported EPS |

$ |

2.85 |

|

|

$ |

3.23 |

|

| Net gain on sale of

business |

|

— |

|

|

|

(1.09 |

) |

| Resegmentation cost |

|

— |

|

|

|

0.03 |

|

| Tax items and other

matters |

|

(0.05 |

) |

|

|

(0.09 |

) |

| Adjusted

EPS** |

$ |

2.80 |

|

|

$ |

2.08 |

|

| |

|

|

|

|

|

|

|

Estimated factors affecting changes in Reported and

Adjusted EPS

| |

1Q24 |

|

Total items affecting EPS** |

(0.72 |

) |

|

Total operating items |

(0.86 |

) |

|

Margin |

(0.47 |

) |

|

Volume |

(0.34 |

) |

|

Foreign exchange |

0.04 |

|

|

Other income |

(0.09 |

) |

|

Total non-operating items |

0.14 |

|

|

Other non-operating income |

0.00 |

|

|

Financing costs |

0.13 |

|

|

Tax rate |

(0.02 |

) |

|

Shares outstanding |

0.01 |

|

|

Non-controlling interests |

0.02 |

|

** Totals may not foot due to rounding

Other Financial Items

- At March 31,

2024, total debt and cash, including short-term investments, were

$1.9 billion and $445 million, respectively, versus

$2.2 billion and $409 million, respectively, at

December 31, 2023.

- Reported net

financing costs for the first quarter were $19 million versus

$32 million for the year-ago period.

- Reported and

adjusted effective tax rates for the first quarter were 21.0% and

28.4%, respectively, compared to 25.1% and 27.7%, respectively, for

the year-ago period. The decrease in the reported effective tax

rate was primarily driven by the low effective tax rate on the sale

of our South Korea business during the first quarter of 2024.

- Capital

expenditures, net were $65 million, down $10 million from the

year-ago period.

Business Review

Total Ingredion

Net Sales

|

$ in millions |

|

2023 |

|

FXImpact |

|

Volume |

|

S. Korea Volume* |

|

Price mix |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

2,137 |

|

12 |

|

(40) |

|

(51) |

|

(176) |

|

1,882 |

|

(12%) |

|

(13%) |

* Represents loss of volume due to the sale of South Korea

business

Reported Operating Income

|

$ in millions |

|

2023 |

|

FX Impact |

|

BusinessDrivers |

|

Acquisition /Integration |

|

Restructuring/Impairment |

|

Other |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

291 |

|

3 |

|

(83) |

|

— |

|

(3) |

|

5 |

|

213 |

|

(27%) |

|

(28%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Operating Income

|

$ in millions |

|

2023 |

|

FX Impact |

|

BusinessDrivers |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

296 |

|

3 |

|

(83) |

|

216 |

|

(27%) |

|

(28%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales

- First quarter net

sales were $1,882 million, a decrease of 12% from the year-ago

period, driven by both price mix and volume declines, partially

offset by foreign exchange impacts. The impact of the South Korea

divestiture resulted in a $51 million decrease in sales volume for

the period. Excluding foreign exchange impacts, net sales were down

13%.

Operating Income

- First quarter

reported and adjusted operating income were $213 million and $216

million, respectively, a decrease of 27% for both, versus the prior

year. The decrease in reported and adjusted operating income was

driven by downtime associated with cold weather, hyperinflation in

Argentina, and the carry-forward of higher cost inventory.

Excluding foreign exchange impacts, reported and adjusted operating

income were down 28% from the same period last year.

Texture & Healthful Solutions

Net Sales

|

$ in millions |

|

2023 |

|

FX Impact |

|

Volume |

|

Pricemix |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

665 |

|

(6) |

|

(1) |

|

(61) |

|

597 |

|

(10%) |

|

(9%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Operating Income

|

$ in millions |

|

2023 |

|

FX Impact |

|

Business Drivers |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

127 |

|

(1) |

|

(52) |

|

74 |

|

(42%) |

|

(41%) |

- First quarter

operating income for Texture & Healthful Solutions was $74

million, a decrease of $53 million from the year-ago period, driven

by less favorable price mix and the carry-forward of higher cost

inventory. Excluding foreign exchange impacts, segment operating

income was down 41% for the first quarter.

Food & Industrial Ingredients - LATAM

Net Sales

|

$ in millions |

|

2023 |

|

FXImpact |

|

Volume |

|

Pricemix |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

667 |

|

26 |

|

(16) |

|

(61) |

|

616 |

|

(8%) |

|

(12%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Operating Income

|

$ in millions |

|

2023 |

|

FXImpact |

|

Business Drivers |

|

Argentina JV |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

122 |

|

5 |

|

(15) |

|

(11) |

|

101 |

|

(17%) |

|

(21%) |

- First quarter

operating income for Food & Industrial Ingredients - LATAM was

$101 million, a decrease of $21 million from the year-ago period,

driven primarily by the devaluation of the Argentina peso on

results of our Argentina joint venture as well as higher fixed

costs and utilities. Excluding foreign exchange impacts, segment

operating income was down 21% for the first quarter.

Food & Industrial Ingredients -

U.S./Canada

Net Sales

|

$ in millions |

|

2023 |

|

FXImpact |

|

Volume |

|

Pricemix |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

608 |

|

— |

|

(24) |

|

(43) |

|

541 |

|

(11%) |

|

(11%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment Operating Income

|

$ in millions |

|

2023 |

|

FX Impact |

|

BusinessDrivers |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

92 |

|

— |

|

(5) |

|

87 |

|

(5%) |

|

(5%) |

- First quarter

operating income for Food & Industrial Ingredients -

U.S./Canada was $87 million, a decrease of $5 million from the

year-ago period, driven by downtime due to the impacts of cold

weather, partially offset by strong industrial demand during the

quarter.

All

Other**

Net Sales

|

$ in millions |

|

2023 |

|

FXImpact |

|

Volume |

|

S. Korea Volume* |

|

Price mix |

|

2024 |

|

Change |

|

Changeexcl. FX |

|

First Quarter |

|

197 |

|

(8) |

|

1 |

|

(51) |

|

(11) |

|

128 |

|

(35%) |

|

(31%) |

* Represents loss of volume due to the sale of South Korea

business

Operating Income (Loss)

|

$ in millions |

|

2023 |

|

FX Impact |

|

Business Drivers |

|

2024 |

|

Change |

|

Change excl. FX |

|

First Quarter |

|

(8) |

|

(1) |

|

5 |

|

(4) |

|

50% |

|

63% |

- First quarter

operating loss for All Other was ($4) million, up $4 million from

the year-ago period. The change was driven by lower operating loss

for protein fortification and other factors.

**All Other consists of the businesses of multiple operating

segments that are not individually or collectively classified as

reportable segments. Net sales from All Other are generated

primarily by sweetener and starch sales by our Pakistan business,

sales of stevia and other ingredients from our PureCircle and Sugar

Reduction businesses, and pea protein ingredients from our Protein

Fortification business.

Dividends and Share Repurchases

In the first quarter of 2024, the Company paid $51 million in

dividends to shareholders and declared a quarterly dividend of

$0.78 per share that was paid on April 23, 2024. During the

quarter, the Company repurchased $1 million of outstanding shares

of common stock.

Updated Second Quarter and Full-Year 2024

Outlook

For the second quarter of 2024, the Company expects net sales to

be flat to down low single-digits and reported and adjusted

operating income to be up low to mid-single-digits.

The Company now expects its full-year 2024 reported EPS to be in

the range of $10.35 to $11.00, which includes the impact of the

gain on the divestiture of the South Korea business completed on

February 1, 2024, and adjusted EPS to be in the range of $9.20 to

$9.85.

Excluding the effects of the divestiture of the South Korea

business, the Company expects full-year 2024 net sales to be flat

to up low single-digits, reflecting the pass-through of lower corn

values. Reported and adjusted operating income is expected to be up

mid-single-digits.

Corporate costs are still expected to be up

mid-single-digits.

For full-year 2024, the Company now expects a reported and

adjusted effective tax rate of 24.5% to 25.5%, and 26.5% to 27.5%,

respectively.

Cash from operations for full-year 2024 is still expected to be

in the range of $750 million to $900 million. Capital expenditures

for the full year are still expected to be approximately $340

million.

Conference Call and Webcast Details

Ingredion will host a conference call on Wednesday, May 8, 2024,

at 8 a.m. CT/ 9 a.m. ET, hosted by Jim Zallie, president and chief

executive officer, and Jim Gray, executive vice president and chief

financial officer. The call will be webcast in real-time and can be

accessed at

https://ir.ingredionincorporated.com/events-and-presentations. A

presentation containing additional financial and operating

information will be accessible through the Company’s website at

https://ir.ingredionincorporated.com/events-and-presentations and

available to download a few hours prior to the start of the call. A

replay will be available for a limited time at

https://ir.ingredionincorporated.com/financial-information/quarterly-results.

About the Company

Ingredion Incorporated (NYSE: INGR) headquartered in the suburbs

of Chicago, is a leading global ingredient solutions provider

serving customers in more than 120 countries. With 2023 annual net

sales of approximately $8 billion, the Company turns grains,

fruits, vegetables and other plant-based materials into value-added

ingredient solutions for the food, beverage, animal nutrition,

brewing and industrial markets. With Ingredion’s Idea Labs®

innovation centers around the world and approximately 12,000

employees, the Company co-creates with customers and fulfills its

purpose of bringing the potential of people, nature and technology

together to make life better. Visit ingredion.com for more

information and the latest Company news.

Forward-Looking Statements

This news release contains or may contain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Ingredion intends these forward-looking

statements to be covered by the safe harbor provisions for such

statements.

Forward-looking statements include, among others, any statements

regarding our expectations for full-year 2024 reported and adjusted

earnings per share, net sales, reported and adjusted operating

income, corporate costs, reported and adjusted effective tax rate,

cash from operations, working capital, and capital expenditures,

our expectations for second quarter 2024 net sales and reported and

adjusted operating income, and any other statements regarding our

prospects and our future operations, financial condition, volumes,

cash flows, expenses or other financial items, including

management’s plans or strategies and objectives for any of the

foregoing and any assumptions, expectations, or beliefs underlying

any of the foregoing.

These statements can sometimes be identified by the use of

forward-looking words such as “may,” “will,” “should,”

“anticipate,” “assume,” “believe,” “plan,” “project,” “estimate,”

“expect,” “intend,” “continue,” “pro forma,” “forecast,” “outlook,”

“propels,” “opportunities,” “potential,” “provisional,” or other

similar expressions or the negative thereof. All statements other

than statements of historical facts therein are “forward-looking

statements.”

These statements are based on current circumstances or

expectations, but are subject to certain inherent risks and

uncertainties, many of which are difficult to predict and beyond

our control. Although we believe our expectations reflected in

these forward-looking statements are based on reasonable

assumptions, investors are cautioned that no assurance can be given

that our expectations will prove correct.

Actual results and developments may differ materially from the

expectations expressed in or implied by these statements, based on

various risks and uncertainties, including geopolitical conflicts

and actions arising from them, including the impacts on the

availability and prices of raw materials and energy supplies,

supply chain interruptions, and volatility in foreign exchange and

interest rates; changing consumer consumption preferences that may

lessen demand for products we make; the effects of global economic

conditions and the general political, economic, business, and

market conditions that affect customers and consumers in the

various geographic regions and countries in which we buy our raw

materials or manufacture or sell our products, and the impact these

factors may have on our sales volumes, the pricing of our products

and our ability to collect our receivables from customers; future

purchases of our products by major industries which we serve and

from which we derive a significant portion of our sales, including,

without limitation, the food, animal nutrition, beverage and

brewing industries; the risks associated with pandemics; the

uncertainty of acceptance of products developed through genetic

modification and biotechnology; our ability to develop or acquire

new products and services at rates or of qualities sufficient to

gain market acceptance; increased competitive and/or customer

pressure in the corn-refining industry and related industries,

including with respect to the markets and prices for our primary

products and our co-products, particularly corn oil; price

fluctuations, supply chain disruptions, and shortages affecting

inputs to our production processes and delivery channels, including

raw materials, energy costs and availability and cost of freight

and logistics; our ability to contain costs, achieve budgets and

realize expected synergies, including with respect to our ability

to complete planned maintenance and investment projects on time and

on budget as well as with respect to freight and shipping costs and

hedging activities; operating difficulties at our manufacturing

facilities and liabilities relating to product safety and quality;

the effects of climate change and legal, regulatory, and market

measures to address climate change; our ability to successfully

identify and complete acquisitions, divestitures, or strategic

alliances on favorable terms as well as our ability to successfully

conduct due diligence, integrate acquired businesses or implement

and maintain strategic alliances and achieve anticipated synergies

with respect to all of the foregoing; economic, political and other

risks inherent in conducting operations in foreign countries and in

foreign currencies; the failure to maintain satisfactory labor

relations; our ability to attract, develop, motivate, and maintain

good relationships with our workforce; the impact on our business

of natural disasters, war, threats or acts of terrorism, or the

occurrence of other significant events beyond our control; the

impact of impairment charges on our goodwill or long-lived assets;

changes in government policy, law, or regulation and costs of legal

compliance, including compliance with environmental regulation;

changes in our tax rates or exposure to additional income tax

liability; increases in our borrowing costs that could result from

increased interest rates; our ability to raise funds at reasonable

rates and other factors affecting our access to sufficient funds

for future growth and expansion; interruptions, security incidents,

or failures with respect to information technology systems,

processes, and sites; volatility in the stock market and other

factors that could adversely affect our stock price; risks

affecting the continuation of our dividend policy; and our ability

to maintain effective internal control over financial

reporting.

Our forward-looking statements speak only as of the date on

which they are made, and we do not undertake any obligation to

update any forward-looking statement to reflect events or

circumstances after the date of the statement as a result of new

information or future events or developments. If we do update or

correct one or more of these statements, investors and others

should not conclude that we will make additional updates or

corrections. For a further description of these and other risks,

see “Risk Factors” and other information included in our Annual

Report on Form 10-K for the year ended December 31, 2023, and our

subsequent reports on Form 10-Q and Form 8-K filed with the

Securities and Exchange Commission.

|

Ingredion IncorporatedCondensed Consolidated

Statements of Income(Unaudited)(in millions,

except per share amounts) |

| |

Three Months EndedMarch 31, |

|

Change % |

|

|

2024 |

|

|

|

2023 |

|

|

Net sales |

$ |

1,882 |

|

|

$ |

2,137 |

|

(12 |

%) |

| Cost of sales |

|

1,465 |

|

|

|

1,650 |

|

|

|

Gross profit |

|

417 |

|

|

|

487 |

|

(14 |

%) |

| Operating expenses |

|

189 |

|

|

|

187 |

|

1 |

% |

| Other operating expense |

|

12 |

|

|

|

9 |

|

33 |

% |

| Restructuring/impairment

charges |

|

3 |

|

|

|

— |

|

|

|

Operating income |

|

213 |

|

|

|

291 |

|

(27 |

%) |

| Financing costs |

|

19 |

|

|

|

32 |

|

|

| Net gain on sale of

business |

|

(82 |

) |

|

|

— |

|

|

|

Income before income taxes |

|

276 |

|

|

|

259 |

|

7 |

% |

| Provision for income

taxes |

|

58 |

|

|

|

65 |

|

|

|

Net income |

|

218 |

|

|

|

194 |

|

12 |

% |

| Less: Net income attributable

to non-controlling interests |

|

2 |

|

|

|

3 |

|

|

|

Net income attributable to Ingredion |

$ |

216 |

|

|

$ |

191 |

|

13 |

% |

| |

|

|

|

|

|

| Earnings per common share

attributable to Ingredion common shareholders: |

|

|

|

|

|

| |

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

Basic |

|

65.7 |

|

|

|

66.1 |

|

|

|

Diluted |

|

66.8 |

|

|

|

67.1 |

|

|

| |

|

|

|

|

|

| Earnings per common share of

Ingredion: |

|

|

|

|

|

|

Basic |

$ |

3.29 |

|

|

$ |

2.89 |

|

14 |

% |

|

Diluted |

$ |

3.23 |

|

|

$ |

2.85 |

|

13 |

% |

|

Ingredion IncorporatedCondensed

Consolidated Balance Sheets(in millions, except share and

per share amounts) |

| |

March 31, 2024 |

|

December 31, 2023 |

| |

(Unaudited) |

|

|

|

|

| Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

438 |

|

|

$ |

401 |

|

|

Short-term investments |

|

7 |

|

|

|

8 |

|

|

Accounts receivable, net |

|

1,284 |

|

|

|

1,279 |

|

|

Inventories |

|

1,344 |

|

|

|

1,450 |

|

|

Prepaid expenses and assets held for sale |

|

52 |

|

|

|

261 |

|

|

Total current assets |

|

3,125 |

|

|

|

3,399 |

|

|

Property, plant and equipment, net |

|

2,334 |

|

|

|

2,370 |

|

|

Intangible assets, net |

|

1,286 |

|

|

|

1,303 |

|

|

Other non-current assets |

|

574 |

|

|

|

570 |

|

| Total

assets |

$ |

7,319 |

|

|

$ |

7,642 |

|

| |

|

|

|

| Liabilities and

equity |

|

|

|

|

Current liabilities |

|

|

|

|

Short-term borrowings |

$ |

141 |

|

|

$ |

448 |

|

|

Accounts payable, accrued liabilities and liabilities held for

sale |

|

1,142 |

|

|

|

1,324 |

|

|

Total current liabilities |

|

1,283 |

|

|

|

1,772 |

|

|

Long-term debt |

|

1,740 |

|

|

|

1,740 |

|

|

Other non-current liabilities |

|

471 |

|

|

|

480 |

|

|

Total liabilities |

|

3,494 |

|

|

|

3,992 |

|

| |

|

|

|

|

Share-based payments subject to redemption |

|

43 |

|

|

|

55 |

|

|

Redeemable non-controlling interests |

|

42 |

|

|

|

43 |

|

| |

|

|

|

|

Ingredion stockholders' equity: |

|

|

|

|

Preferred stock — authorized 25.0 shares — $0.01 par value, none

issued |

|

— |

|

|

|

— |

|

|

Common stock — authorized 200.0 shares — $0.01 par value, 77.8

shares issued at March 31, 2024 and December 31, 2023 |

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

1,146 |

|

|

|

1,146 |

|

|

Less: Treasury stock (common stock: 12.2 and 12.6 shares at

March 31, 2024 and December 31, 2023) at cost |

|

(1,179 |

) |

|

|

(1,207 |

) |

|

Accumulated other comprehensive loss |

|

(1,062 |

) |

|

|

(1,056 |

) |

|

Retained earnings |

|

4,818 |

|

|

|

4,654 |

|

|

Total Ingredion stockholders' equity |

|

3,724 |

|

|

|

3,538 |

|

|

Non-redeemable non-controlling interests |

|

16 |

|

|

|

14 |

|

|

Total stockholders’ equity |

|

3,740 |

|

|

|

3,552 |

|

| Total liabilities and

equity |

$ |

7,319 |

|

|

$ |

7,642 |

|

|

Ingredion IncorporatedCondensed Consolidated

Statements of Cash Flows(Unaudited)(in

millions) |

| |

Three Months Ended March 31, |

|

|

2024 |

|

|

|

2023 |

|

| Cash from operating

activities: |

|

|

|

|

Net income |

$ |

218 |

|

|

$ |

194 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

53 |

|

|

|

54 |

|

|

Mechanical stores expense |

|

14 |

|

|

|

18 |

|

|

Net gain on sale of business |

|

(82 |

) |

|

|

— |

|

|

Margin accounts |

|

(11 |

) |

|

|

(19 |

) |

|

Changes in other trade working capital |

|

(25 |

) |

|

|

(302 |

) |

|

Other |

|

42 |

|

|

|

4 |

|

|

Cash provided by (used for) operating activities |

|

209 |

|

|

|

(51 |

) |

| Cash from investing

activities: |

|

|

|

|

Capital expenditures and mechanical stores purchases |

|

(65 |

) |

|

|

(76 |

) |

|

Proceeds from disposal of manufacturing facilities and

properties |

|

— |

|

|

|

1 |

|

|

Proceeds from sale of business |

|

247 |

|

|

|

— |

|

|

Other |

|

(1 |

) |

|

|

(6 |

) |

|

Cash provided by (used for) investing activities |

|

181 |

|

|

|

(81 |

) |

| Cash from financing

activities: |

|

|

|

|

Proceeds from borrowings, net |

|

15 |

|

|

|

51 |

|

|

Commercial paper borrowings (repayments), net |

|

(312 |

) |

|

|

107 |

|

|

Repurchases of common stock, net |

|

(1 |

) |

|

|

— |

|

|

Issuances of common stock for share-based compensation, net |

|

2 |

|

|

|

2 |

|

|

Dividends paid, including to non-controlling interests |

|

(51 |

) |

|

|

(47 |

) |

|

Cash (used for) provided by financing activities |

|

(347 |

) |

|

|

113 |

|

|

Effect of foreign exchange rate changes on cash |

|

(6 |

) |

|

|

(1 |

) |

|

Increase (decrease) in cash and cash equivalents |

|

37 |

|

|

|

(20 |

) |

|

Cash and cash equivalents, beginning of period |

|

401 |

|

|

|

236 |

|

|

Cash and cash equivalents, end of period |

$ |

438 |

|

|

$ |

216 |

|

Ingredion

IncorporatedSupplemental Financial

Information(Unaudited)

I. Segment Information of Net Sales and

Operating Income

| (in

millions, except for percentages) |

|

Three Months EndedMarch 31, |

|

Change |

|

Change Excl. FX |

| |

|

2024 |

|

|

|

2023 |

|

|

|

|

Net Sales* |

|

|

|

|

|

|

|

|

|

Texture & Healthful Solutions |

|

$ |

597 |

|

|

$ |

665 |

|

|

(10%) |

|

(9%) |

|

Food & Industrial Ingredients - LATAM |

|

|

616 |

|

|

|

667 |

|

|

(8%) |

|

(12%) |

|

Food & Industrial Ingredients - U.S./Canada |

|

|

541 |

|

|

|

608 |

|

|

(11%) |

|

(11%) |

|

All Other |

|

|

128 |

|

|

|

197 |

|

|

(35%) |

|

(31%) |

| Total Net Sales |

|

$ |

1,882 |

|

|

$ |

2,137 |

|

|

(12%) |

|

(13%) |

| |

|

|

|

|

|

|

|

|

| Operating Income |

|

|

|

|

|

|

|

|

|

Texture & Healthful Solutions |

|

$ |

74 |

|

|

$ |

127 |

|

|

(42%) |

|

(41%) |

|

Food & Industrial Ingredients - LATAM |

|

|

101 |

|

|

|

122 |

|

|

(17%) |

|

(21%) |

|

Food & Industrial Ingredients - U.S./Canada |

|

|

87 |

|

|

|

92 |

|

|

(5%) |

|

(5%) |

|

All Other |

|

|

(4 |

) |

|

|

(8 |

) |

|

50% |

|

63% |

|

Corporate |

|

|

(42 |

) |

|

|

(37 |

) |

|

(14%) |

|

(14%) |

| Sub-total |

|

|

216 |

|

|

|

296 |

|

|

(27%) |

|

(28%) |

|

Resegmentation costs |

|

|

(3 |

) |

|

|

— |

|

|

|

|

|

|

Other matters |

|

|

— |

|

|

|

(5 |

) |

|

|

|

|

| Total Operating Income |

|

$ |

213 |

|

|

$ |

291 |

|

|

(27%) |

|

(28%) |

*For the quarter ended March 31, 2024, net sales are net of

intersegment sales of $15 million for Texture & Healthful

Solutions, $10 million for Food & Industrial Ingredients -

LATAM, $26 million for Food & Industrial Ingredients -

U.S./Canada, and $3 million for All Other. For the quarter ended

March 31, 2023, net sales are net of intersegment sales of $33

million for Texture & Healthful Solutions, $10 million for Food

& Industrial Ingredients - LATAM, $27 million for Food &

Industrial Ingredients - U.S./Canada, and $4 million for All

Other.

II. Non-GAAP Information

To supplement the consolidated financial results prepared in

accordance with U.S. generally accepted accounting principles

(“GAAP”), the company uses non-GAAP historical financial measures,

which exclude certain GAAP items such as resegmentation costs, net

gain on sale of business, Mexico tax items, and other specified

items. The company generally uses the term “adjusted” when

referring to these non-GAAP amounts.

Company management uses non-GAAP financial measures internally

for strategic decision making, forecasting future results and

evaluating current performance. By disclosing non-GAAP financial

measures, management intends to provide investors with a more

meaningful, consistent comparison of the company’s operating

results and trends for the periods presented. These non-GAAP

financial measures are used in addition to and in conjunction with

results presented in accordance with GAAP and reflect an additional

way of viewing aspects of the company’s operations that, when

viewed with its GAAP results, provide a more complete understanding

of factors and trends affecting its business. These non-GAAP

measures should be considered as a supplement to, and not as a

substitute for or superior to, the corresponding measures

calculated in accordance with GAAP.

Non-GAAP financial measures are not prepared in accordance with

GAAP; so the non-GAAP information is not necessarily comparable to

similarly titled measures presented by other companies. A

reconciliation of each non-GAAP financial measure to the most

comparable GAAP measure is provided in the tables below.

|

Ingredion IncorporatedReconciliation of GAAP Net

Income attributable to Ingredion and Diluted Earnings Per Share

(“EPS”) to Non-GAAP

Adjusted Net Income attributable to Ingredion and Adjusted Diluted

EPS(Unaudited) |

| |

Three Months EndedMarch 31,

2024 |

|

Three Months EndedMarch 31,

2023 |

| |

(in millions) |

|

Diluted EPS |

|

(in millions) |

|

Diluted EPS |

|

Net income attributable to Ingredion |

$ |

216 |

|

|

$ |

3.23 |

|

|

$ |

191 |

|

|

$ |

2.85 |

|

| |

|

|

|

|

|

|

|

| Add back: |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Resegmentation costs (i) |

|

2 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

Net gain on sale of business (ii) |

|

(73 |

) |

|

|

(1.09 |

) |

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

Other matters (iii) |

|

— |

|

|

|

— |

|

|

|

4 |

|

|

|

0.06 |

|

| |

|

|

|

|

|

|

|

|

Tax item - Mexico (iv) |

|

(6 |

) |

|

|

(0.09 |

) |

|

|

(7 |

) |

|

|

(0.11 |

) |

| |

|

|

|

|

|

|

|

| Non-GAAP adjusted net income

attributable to Ingredion |

$ |

139 |

|

|

$ |

2.08 |

|

|

$ |

188 |

|

|

$ |

2.80 |

|

Notes

- During the first quarter of 2024, the company recorded pre-tax

resegmentation costs of $3 million primarily related to the

company’s resegmentation effective January 1, 2024.

- During the first quarter of 2024, the company recorded a net,

pre-tax gain of $82 million as a result of the sale of its business

in South Korea completed on February 1, 2024.

- During the first quarter of 2023, the company recorded pre-tax

charges of $5 million primarily related to the impacts of a

U.S.-based work stoppage.

- During the first quarter of 2024 and 2023, the company recorded

tax benefits of $6 million and $7 million as a result of the

movement of the Mexican peso against the U.S. dollar and its impact

on the remeasurement of its Mexico financial statements during the

periods.

|

Ingredion IncorporatedReconciliation of GAAP

Operating Income to Non-GAAP Adjusted Operating

Income(Unaudited) |

| (in

millions, pre-tax) |

|

Three Months Ended March 31, |

| |

2024 |

|

2023 |

|

Operating income |

|

$ |

213 |

|

$ |

291 |

| |

|

|

|

|

| Add back: |

|

|

|

|

| |

|

|

|

|

|

Resegmentation costs (i) |

|

|

3 |

|

|

— |

| |

|

|

|

|

|

Other matters (iii) |

|

|

— |

|

|

5 |

| |

|

|

|

|

| Non-GAAP adjusted operating

income |

|

$ |

216 |

|

$ |

296 |

For notes (i) through (iii), see Notes included in the

Reconciliation of GAAP Net Income attributable to Ingredion and

Diluted EPS to Non-GAAP Adjusted Net Income attributable to

Ingredion and Adjusted Diluted EPS.

|

Ingredion IncorporatedReconciliation of GAAP

Effective Income Tax Rate to Non-GAAP Adjusted Effective Income Tax

Rate(Unaudited) |

| (in

millions) |

|

Three Months Ended March 31, 2024 |

| |

Income before Income Taxes

(a) |

|

Provision for Income Taxes

(b) |

|

Effective Income Tax Rate

(b/a) |

|

As Reported |

|

$ |

276 |

|

|

$ |

58 |

|

|

21.0 |

% |

| |

|

|

|

|

|

|

| Add back: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Resegmentation costs (i) |

|

|

3 |

|

|

|

1 |

|

|

|

| |

|

|

|

|

|

|

|

Net gain on sale of business (ii) |

|

|

(82 |

) |

|

|

(9 |

) |

|

|

| |

|

|

|

|

|

|

|

Tax item - Mexico (iv) |

|

|

— |

|

|

|

6 |

|

|

|

| |

|

|

|

|

|

|

| Adjusted Non-GAAP |

|

$ |

197 |

|

|

$ |

56 |

|

|

28.4 |

% |

| (in

millions) |

|

Three Months Ended March 31, 2023 |

| |

Income before Income Taxes

(a) |

|

Provision for Income Taxes

(b) |

|

Effective Income Tax Rate

(b/a) |

|

As Reported |

|

$ |

259 |

|

$ |

65 |

|

25.1 |

% |

| |

|

|

|

|

|

|

| Add back: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Other matters (iii) |

|

|

5 |

|

|

1 |

|

|

| |

|

|

|

|

|

|

|

Tax item - Mexico (iv) |

|

|

— |

|

|

7 |

|

|

| |

|

|

|

|

|

|

| Adjusted Non-GAAP |

|

$ |

264 |

|

$ |

73 |

|

27.7 |

% |

For notes (i) through (iv), see Notes included in the

Reconciliation of GAAP Net Income attributable to Ingredion and

Diluted EPS to Non-GAAP Adjusted Net Income attributable to

Ingredion and Adjusted Diluted EPS.

|

Ingredion IncorporatedReconciliation of Expected

GAAP Diluted Earnings per Share (“GAAP

EPS”) to Expected Adjusted

Diluted Earnings per Share (“Adjusted

EPS”)(Unaudited) |

| |

Expected EPS Range for Full-Year

2024 |

|

Low End ofGuidance |

|

High End ofGuidance |

|

GAAP EPS |

$ |

10.35 |

|

|

$ |

11.00 |

|

| |

|

|

|

| Add: |

|

|

|

| |

|

|

|

|

Resegmentation costs (i) |

|

0.03 |

|

|

|

0.03 |

|

|

|

|

|

|

|

Net gain on sale of business (ii) |

|

(1.09 |

) |

|

|

(1.09 |

) |

|

|

|

|

|

|

Tax item - Mexico (iii) |

|

(0.09 |

) |

|

|

(0.09 |

) |

| |

|

|

|

| Adjusted EPS |

$ |

9.20 |

|

|

$ |

9.85 |

|

Above is a reconciliation of the company’s expected full-year

2024 diluted EPS to its expected full-year 2024 adjusted diluted

EPS. The amounts above may not reflect certain future charges,

costs and/or gains that are inherently difficult to predict and

estimate due to their unknown timing, effect and/or significance.

The company generally excludes these adjustments from its adjusted

EPS guidance, which makes it more confident in its ability to

forecast adjusted EPS than it is in its ability to forecast GAAP

EPS. These amounts include, but are not limited to, adjustments to

GAAP EPS for resegmentation costs, net gain on sale of business and

certain Mexico tax items.

These adjustments to GAAP EPS for 2024 include the

following:

- Resegmentation costs related to the company’s resegmentation

effective January 1, 2024

- Net gain as a result of the sale of company’s business in South

Korea completed on February 1, 2024

- Tax benefit from the movement of the Mexican peso against the

U.S. dollar and its impact on the remeasurement of the company's

Mexico financial statements during the period

|

Ingredion IncorporatedReconciliation of Expected

GAAP Effective Tax Rate (“GAAP

ETR”)to Expected Adjusted

Effective Tax Rate (“Adjusted

ETR”)(Unaudited) |

| |

Expected Effective Tax Rate Range for

Full-Year 2024 |

|

Low End of Guidance |

|

High End of Guidance |

|

GAAP ETR |

24.5 |

% |

|

25.5 |

% |

| |

|

|

|

| Add: |

|

|

|

| |

|

|

|

|

Resegmentation costs (i) |

— |

% |

|

— |

% |

| |

|

|

|

|

Net gain on sale of business (ii) |

1.3 |

% |

|

1.3 |

% |

| |

|

|

|

|

Tax item - Mexico (iii) |

0.7 |

% |

|

0.7 |

% |

| |

|

|

|

| Adjusted ETR |

26.5 |

% |

|

27.5 |

% |

Above is a reconciliation of the company’s expected full-year

2024 GAAP ETR to its expected full-year 2024 adjusted ETR. The

amounts above may not reflect certain future charges, costs and/or

gains that are inherently difficult to predict and estimate due to

their unknown timing, effect and/or significance. The company

generally excludes these adjustments from its adjusted ETR

guidance, which makes the company more confident in its ability to

forecast adjusted ETR than it is in its ability to forecast GAAP

ETR. These amounts include, but are not limited to, adjustments to

GAAP ETR for resegmentation costs, net gain on sale of business and

certain Mexico tax items.

These adjustments to GAAP ETR for 2024 include the

following:

- Tax impact from resegmentation costs related to the company’s

resegmentation effective January 1, 2024

- Tax impact as a result of the sale of the company’s business in

South Korea completed February 1, 2024

- Tax benefit as a result of the movement of the Mexican peso

against the U.S. dollar and its impact to the remeasurement of the

company’s Mexico financial statements during the period

CONTACT:Investors: Noah Weiss,

773-896-5242Media: corpcomm@ingredion.com

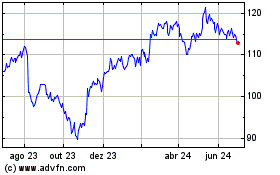

Ingredion (NYSE:INGR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

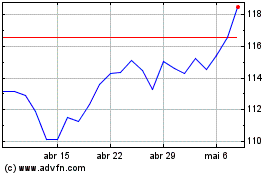

Ingredion (NYSE:INGR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024