Summit Hotel's Joint Venture Refinances $200 Million in Debt

20 Setembro 2023 - 8:18AM

Dow Jones News

By Dean Seal

Summit Hotel Properties' joint venture with Singapore's

sovereign wealth fund has completed the refinancing of a $200

million senior credit facility.

The new credit agreement provides for a fully extended maturity

date of September 2028 for both a $125 million revolving credit

facility and a $75 million term loan.

The interest rate from the prior credit facility has been

maintained at the Secured Overnight Financing Rate plus 215 basis

points for the revolver and the Secured Overnight Financing Rate

plus 210 basis points for the term loan.

Because of the refinancing, Summit Hotel has a no material debt

maturities through 2024 and its average length to maturity is more

than three years.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

September 20, 2023 07:03 ET (11:03 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

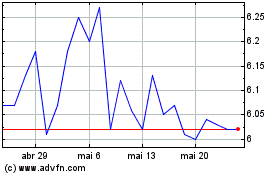

Summit Hotel Properties (NYSE:INN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Summit Hotel Properties (NYSE:INN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025