Lincoln National Income Fund Announces Proposed Reorganization Into Delaware Corporate Bond Fund

15 Fevereiro 2006 - 8:31PM

PR Newswire (US)

PHILADELPHIA, Feb. 15 /PRNewswire-FirstCall/ -- The Board of

Directors of Lincoln National Income Fund, Inc. (NYSE:LND) (the

"Fund") today announced its decision to approve a proposal

providing for the reorganization of the Fund into the Delaware

Corporate Bond Fund (the "Corporate Bond Fund"), an open-end series

of Delaware Group Income Funds. Under the terms of the proposed

reorganization, the Corporate Bond Fund would acquire substantially

all of the assets of the Fund in exchange for Class A shares of the

Corporate Bond Fund; those Class A shares of the Corporate Bond

Fund would then be distributed pro rata to the shareholders of the

Fund's common stock; and the Fund would subsequently be liquidated

and dissolved. This transaction (the "Reorganization"), which is

expected to be tax-free, is subject to the approval of the Fund's

shareholders. The Board of Trustees of Delaware Group Income Funds

also approved the proposed Reorganization today. If approved by

shareholders of the Fund, shares will be exchanged based on the

respective net asset values of the Fund's common stock and the

Class A shares of the Corporate Bond Fund. It is currently

anticipated that, during the three months following the closing of

the Reorganization, redemptions of the Corporate Bond Fund shares

issued to shareholders of the Fund in the Reorganization will be

subject to a redemption fee of two percent (2%). This redemption

fee will be paid to the Corporate Bond Fund to help defray the

transaction costs associated with such redemptions. The Fund's

Board of Directors plans to submit the proposed Reorganization to

the Fund's shareholders at a special meeting, currently expected to

take place in June 2006. Any solicitation of proxies by the Fund in

connection with this shareholder meeting will be made only pursuant

to separate proxy materials filed under the federal securities

laws. It is anticipated that these proxy materials will be

distributed to the Fund's shareholders at the end of March 2006.

There can be no assurance that the shareholders of the Fund will

vote in favor of the proposed Reorganization. The Fund is a

closed-end, non-diversified investment management company managed

by Delaware Management Company. Delaware Management Company is a

series of Delaware Management Business Trust, a wholly owned

subsidiary of Lincoln National Corporation. The Fund's primary

objective is to seek to produce increasing dollar amounts of income

for distribution to its shareholders over the long term. As of

February 14, 2006, the Fund had total assets of approximately $93.5

million. The Corporate Bond Fund is an open-end, diversified mutual

fund managed by Delaware Management Company. The Fund's investment

objective is to seek to provide investors with total return. As of

February 14, 2006, the Corporate Bond Fund had total assets of

approximately $443.3 million. In connection with the proposed

Reorganization, the Fund and Delaware Group Income Funds, on behalf

of the Corporate Bond Fund, intend to file relevant materials with

the U.S. Securities and Exchange Commission (the "SEC"), including

a Form N-14 combined proxy statement for the Fund and a

registration statement for the Corporate Bond Fund that will

contain a prospectus. Because those documents will contain

important information, the Fund's shareholders are urged to read

them carefully when they become available. When filed with the SEC,

those documents will be available free of charge at the SEC's

website, http://www.sec.gov/. The Fund's shareholders will also be

able to obtain copies of these documents and other

transaction-related documents, when available, by calling Delaware

Investments toll-free at 800-523-1918. The foregoing is not an

offer to sell, nor a solicitation of an offer to buy, shares of any

fund, nor is it a solicitation of any proxy. About Delaware

Investments: Delaware Investments, an affiliate of Lincoln

Financial Group, is a Philadelphia-based diversified asset

management firm with more than $110 billion in assets under

management as of December 31, 2005. Through a broad range of

managed accounts and portfolios, mutual funds, retirement plan

services, subadvised funds, college savings plans and other

investment products, Delaware Investments provides investment

services to individual investors and to institutional investors

such as private and public pension funds, foundations, and

endowment funds. Delaware Investments is the marketing name for

Delaware Management Holdings, Inc. and its subsidiaries. For more

information on Delaware Investments, visit the company at

http://www.delawareinvestments.com/. Lincoln Financial Group is the

marketing name for Lincoln National Corporation (NYSE:LNC) and its

affiliates. For more information on Lincoln Financial Group, visit

http://www.lfg.com/. First Call Analyst: FCMN Contact: DATASOURCE:

Delaware Investments CONTACT: Ayele Ajavon, Corporate

Communications, +1-215-255-1632, , or Laurel O'Brien, Corporate

Communications, +1-215-255-1520, , both of Delaware Investments Web

site: http://www.delawareinvestments.com/ http://www.lfg.com/

Copyright

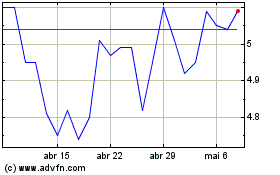

Brasilagro Cia Brasileir... (NYSE:LND)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Brasilagro Cia Brasileir... (NYSE:LND)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024