Lincoln National Income Fund, Inc. Announces Results of Special Shareholders' Meeting

01 Junho 2006 - 6:48PM

PR Newswire (US)

PHILADELPHIA, June 1 /PRNewswire-FirstCall/ -- Lincoln National

Income Fund, Inc. (NYSE:LND) (the "Fund") announced the final

results of voting at the Special Meeting of Shareholders held

today. Shareholders of the Fund approved an Agreement and Plan of

Acquisition (the "Plan of Acquisition") that provides for: (i) the

acquisition of substantially all of the assets of the Fund by

Delaware Corporate Bond Fund ("Corporate Bond Fund"), an open-end

series of Delaware Group Income Funds, in exchange for Class A

shares of Corporate Bond Fund; (ii) the pro rata distribution of

such shares to the Fund's shareholders in exchange for their shares

of the Fund; and (iii) the subsequent liquidation and dissolution

of the Fund. The transaction, which is expected to be a tax-free

reorganization, is currently anticipated to become effective after

the close of trading on June 16, 2006 (the "Closing Date"). As set

forth in the Plan of Acquisition, shareholders of the Fund will

receive Class A shares of Corporate Bond Fund having the same

aggregate net asset value as their shares of the Fund. The exchange

of shares will be based on each fund's net asset value per share

determined as of 4:00 p.m. Eastern time on the Closing Date. For

the three months after the Closing Date, former Fund shareholders

who redeem or exchange shares of Corporate Bond Fund received in

connection with the transaction will pay a 2% redemption fee. The

Fund is a closed-end, non-diversified investment management company

managed by Delaware Management Company. Delaware Management Company

is a series of Delaware Management Business Trust, a subsidiary of

Lincoln National Corporation. The Fund's primary objective is to

seek to produce increasing dollar amounts of income for

distribution to its shareholders over the long term. As of May 31,

2006, the Fund had total assets of approximately $91.1 million.

About Delaware Investments Delaware Investments, an affiliate of

Lincoln Financial Group, is a Philadelphia-based diversified asset

management firm with more than $120 billion in assets under

management as of March 31, 2006. Through a broad range of managed

accounts and portfolios, mutual funds, retirement accounts,

subadvised funds, education savings plans and other investment

products, Delaware Investments provides investment services to

individual investors and to institutional investors such as private

and public pension funds, foundations, and endowment funds.

Delaware Investments is the marketing name for Delaware Management

Holdings, Inc. and its subsidiaries. For more information on

Delaware Investments, visit the company at

http://www.delawareinvestments.com/. Lincoln Financial Group is the

marketing name for Lincoln National Corporation (NYSE:LNC) and its

affiliates. For more information on Lincoln Financial Group, visit

http://www.lfg.com/. DATASOURCE: Delaware Investments CONTACT:

Ayele Ajavon, +1-215-255-1632, , or Laurel O'Brien,

+1-215-255-1520, , both Corporate Communications of Delaware

Investments Web site: http://www.lfg.com/ Web site:

http://www.delawareinvestments.com/

Copyright

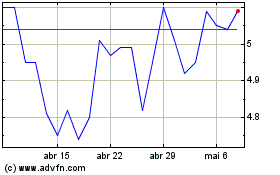

Brasilagro Cia Brasileir... (NYSE:LND)

Gráfico Histórico do Ativo

De Dez 2024 até Dez 2024

Brasilagro Cia Brasileir... (NYSE:LND)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024