GRESB Real Estate Assessment Ranks Macerich #1, U.S. Retail, for 10th Consecutive Year

01 Novembro 2024 - 8:00AM

Macerich (NYSE: MAC), one of the nation’s leading owners, operators

and developers of major retail properties in top markets, has

earned the #1 ranking among all U.S. retail in the GRESB Real

Estate Assessment for the 10th consecutive year.

Macerich ranked #3 in Retail, Americas, and earned

the prestigious GRESB Green Star rating based on absolute

performance.

“GRESB and our peers raise the bar every year. We

appreciate this comprehensive assessment of our progress, and we

are honored to receive this recognition of the results our

initiatives have delivered,” said Olivia Bartel Leigh,

Executive Vice President, Portfolio Operations and People,

Macerich. “As we operate thriving retail centers that bring

communities together, we take pride in continuing to set the

standard for sustainability in our industry. This work is a core

element of Macerich’s sharp focus on double materiality, which

measures our sustainability efforts by their ability to also

deliver a positive financial impact.”

Macerich implements sustainability activities that

will improve long-term operational performance, in alignment with

the Path Forward Plan that Macerich launched earlier this year. The

company has established a goal of achieving full net-zero carbon

emissions, including in its supply chain, by 2040. Macerich’s

sustainability accolades include ranking #23 on the EPA Green Power

Partnership On-Site Generation list for solar generation and

inclusion among Newsweek’s “America’s Most Responsible

Companies.”

“As the global push for sustainability intensifies,

the progress reflected in this year’s GRESB Benchmark is inspiring.

GRESB Members continue to lead the way, demonstrating the tangible

benefits of strong ESG performance,” said Sebastien Roussotte, CEO,

GRESB.

The GRESB Real Estate Assessment measures and

benchmarks global assets’ ESG performance against their peers,

providing financial markets with comparable insights on complex

sustainability topics. This year’s Real Estate

Assessment saw a record 2,223 listed and non-listed

portfolios participate, generating a benchmark covering

$7 trillion (US) of gross asset value (GAV) across

200,000-plus assets in 80 markets.

For more details about Macerich’s comprehensive ESG

focus, please review the most recent Corporate Responsibility

Report, which includes data for the period ending December 31,

2023, or visit the company’s corporate responsibility website.

About GRESBGRESB is a

mission-driven and industry-led organization providing standardized

and validated Environmental, Social, and Governance (ESG) data to

financial markets. Established in 2009, GRESB has become the

leading ESG benchmark for real estate and infrastructure

investments across the world, used by 150 institutional and

financial investors to inform decision-making. For more

information, visit GRESB.com.

About MacerichMacerich is a fully

integrated, self-managed, self-administered real estate investment

trust (REIT). As a leading owner, operator, and developer of

high-quality retail real estate in densely populated and attractive

U.S. markets, Macerich’s portfolio is concentrated in California,

the Pacific Northwest, Phoenix/Scottsdale, and the Metro New York

to Washington, D.C. corridor. Developing and managing properties

that serve as community cornerstones, Macerich currently owns 45

million square feet of real estate, consisting primarily of

interests in 41 retail centers. Macerich is firmly dedicated

to advancing environmental goals, social good, and sound corporate

governance. A recognized leader in sustainability, Macerich has

achieved a #1 Global Real Estate Sustainability Benchmark

(GRESB) ranking for the North American retail sector

for 10 consecutive years (2015-2024). For more information,

please visit www.Macerich.com.

Macerich uses, and intends to continue to use, its

Investor Relations website, which can be found at

investing.macerich.com, as a means of disclosing material nonpublic

information and for complying with its disclosure obligations under

Regulation FD. Additional information about Macerich can be found

through social media platforms such as LinkedIn. Reconciliations of

non-GAAP financial measures, including NOI and FFO, to the most

directly comparable GAAP measures are included in the earnings

release and supplemental filed on Form 8-K with the SEC, which are

posted on the Investor Relations website at

investing.macerich.com.

MAC-CSOURCE: MacerichMEDIA CONTACT: Arun Khosla, VP

Corporate Communications, Arun.Khosla@macerich.com

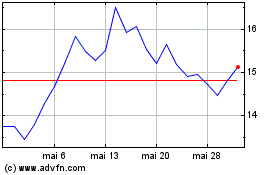

Macerich (NYSE:MAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Macerich (NYSE:MAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024