Wynn Resorts Pinned at Neutral - Analyst Blog

22 Maio 2013 - 2:30PM

Zacks

We remain Neutral on Wynn Resorts Limited

(WYNN) following announcement of strong first-quarter 2013 results

last month. However, competitive pressure in Macau keeps us on the

sidelines.

Why the Reiteration?

On Apr 25, 2013, Wynn Resorts reported its first-quarter 2013

adjusted earnings of $2.03 per share, which breezed past the Zacks

Consensus Estimate of $1.55 by 31.0% as well as the prior-year

earnings of $1.33 per share by 52.6%. The earnings upside can be

attributed to a strong mass market business in Macau, continued

demand in the Las Vegas market and operational efficiency. Net

revenue grew 5.0% year over year to nearly $1.4 billion bolstered

by a respective 4.4% and 6.6% increase in Macau and Las Vegas

revenues.

Macau, which is one of the largest gaming destinations in the

world, has been sluggish in the recent past. Wynn Macau experienced

weakness for three consecutive quarters in 2012. However, the

situation seems to have improved buoyed by the mass market boom in

the recently reported quarter. Moreover, its pipeline project in

the Cotai region of Macau is expected to expand Wynn’s operations

in Macau further.

At Las Vegas, the company is experiencing an uptrend as leisure

demand continues to improve with a gradual recovery of the U.S.

economy. Management remains hopeful as average daily rates are

trending higher. Also, in the domestic market, Wynn seeks to build

properties in higher-priced U.S. markets like Philadelphia and

Boston where room rates are very high.

However, despite these enthusiastic facts, some concerns prevent us

from being too optimistic on the stock. Fierce competition in

Macau, the only Chinese city where gambling is legal and which

accounts for around 70% of the company’s revenues, remains a

blemish on Wynn’s scorecard.

The company’s upcoming project at Cotai in Macau will also face

extreme peer pressure from several Chinese casino operators and the

U.S.-based company Las Vegas Sands Corp. (LVS).

Another U.S.-based casino giant, MGM Resorts

International (MGM) is also slated to come up with a

casino-resort in Cotai.

Wynn Resorts currently carries a Zacks Rank #2 (Buy). Another

player in the same industry, Monarch Casino & Resort

Inc. (MCRI) also looks attractive at current levels with a

Zacks Rank #1 (Strong Buy) .

LAS VEGAS SANDS (LVS): Free Stock Analysis Report

MONARCH CASINO (MCRI): Free Stock Analysis Report

MGM RESORTS INT (MGM): Free Stock Analysis Report

WYNN RESRTS LTD (WYNN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

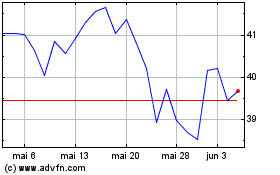

MGM Resorts (NYSE:MGM)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

MGM Resorts (NYSE:MGM)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024