Mueller Industries, Inc. Agrees to Acquire Nehring Electrical Works Company

22 Abril 2024 - 8:00AM

Business Wire

Mueller Industries, Inc. (NYSE: MLI) today announced that it has

entered into a definitive agreement to acquire Nehring Electrical

Works Company and certain of its affiliated companies

(collectively, “Nehring”) for approximately $575 million, subject

to customary purchase price adjustments, plus an additional $25

million earn out. Founded in 1912 and headquartered in DeKalb,

Illinois, Nehring produces high-quality wire and cable solutions

for the utility, telecommunication, electrical distribution, and

OEM markets. Operating through its three business units (Nehring

Electrical Works Company, Conex Cable, L.L.C., and Unified Wire

& Cable, Inc.), Nehring is a recognized and trusted supplier to

numerous utilities, REAs, municipalities, telecommunications and

electrical distribution companies throughout the U.S. For the

twelve months ended December 31, 2023, Nehring’s annual net sales

were approximately $400 million.

Greg Christopher, Mueller’s CEO commented, “We are excited to

welcome Nehring into our portfolio of companies. This acquisition

provides a substantial platform for long-term growth in the

electrical and power infrastructure space and complements the other

critical infrastructure sectors we support. In addition to its

operational culture, which is well aligned with our own, the

addition of Nehring leverages our deep expertise in metals,

particularly copper and aluminum extrusion, and provides synergies

to both companies.”

Mr. Christopher added, “The acquisition is expected to be

accretive to our 2024 financial results. Moreover, Nehring’s

attractive margin and cash flow profile, combined with significant

investments that are underway, make it well positioned to benefit

from the highly anticipated infrastructure investment cycle to

come.”

The acquisition, which will be funded with cash on hand, is

expected to close during the second quarter of 2024, subject to

regulatory approval and customary closing conditions. Mueller will

retain significant cash reserves after the transaction to support

additional growth opportunities.

Mueller Industries, Inc. (NYSE: MLI) is an industrial

corporation whose holdings manufacture vital goods for important

markets such as air, water, oil and gas distribution; climate

comfort; food preservation; energy transmission; medical; aerospace

and automotive. It includes a network of companies and brands

throughout North America, Europe, Asia, and the Middle East.

Statements in this release that are not strictly historical may

be “forward-looking” statements, which involve risks and

uncertainties. These include risks relating to the timely

satisfaction of the conditions to the closing of the Nehring

acquisition and our ability to successfully realize the anticipated

benefits of the transaction, economic and currency conditions,

continued availability of raw materials and energy, market demand,

pricing, competitive and technological factors, and the

availability of financing, among others, as set forth in the

Company’s SEC filings. The words “outlook,” “estimate,” “project,”

“intend,” “expect,” “believe,” “target,” “encourage,” “anticipate,”

“appear,” and similar expressions are intended to identify

forward-looking statements. The reader should not place undue

reliance on forward-looking statements, which speak only as of the

date of this report. The Company has no obligation to publicly

update or revise any forward-looking statements to reflect events

after the date of this report.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240419211377/en/

Jeffrey A. Martin (901) 753-3226

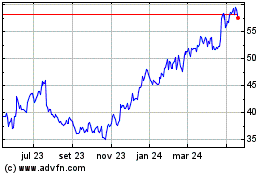

Mueller Industries (NYSE:MLI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

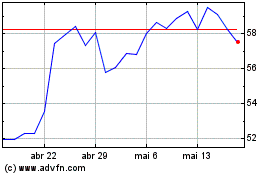

Mueller Industries (NYSE:MLI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025