Company Sees 20% Year over Year Growth in

Production

Northern Oil and Gas, Inc. (NYSE: NOG) (the “Company” or “NOG”)

today announced a fourth quarter 2023 operations update, also

highlighting elective Ground Game acquisitions, and preliminary

2024 guidance.

HIGHLIGHTS

- Fourth quarter 2023 production estimated to be 114.4 Mboe per

day, resulting in annual production toward the high end of NOG’s

guidance range

- Executed on $25 million of opportunistic Ground Game

acquisitions in the fourth quarter

- Initiating preliminary 2024 production and capital spending

guidance

- 2024 production guidance implies ~20% year over year growth on

a flat capital budget at the midpoint of guidance ranges versus

preliminary 2023 actuals (excluding non-budgeted acquisitions)

FOURTH QUARTER OPERATIONAL UPDATE

Production volumes in the fourth quarter of 2023 are estimated

to have averaged 114.4 Mboe per day. Production increased 12%

compared to the third quarter, driven by a full quarter

contribution from the Novo acquisition (which closed mid-Q3) and

increased Williston Basin production. The increase was tempered in

part by planned shut-ins (~2,000 boe per day, 80% oil) due to

offset unit development in the Mascot Project. Oil production is

estimated at ~60.2% of total volumes for the fourth quarter.

Natural gas volumes materially exceeded internal forecasts. With

these results, the Company expects total 2023 annual production

toward the high end of its guidance range, or approximately 98.8

Mboe per day.

Mark-to-market gains on derivatives for the fourth quarter were

an estimated $235.6 million and realized hedge gains were an

estimated $11.8 million. Realized prices for natural gas are

estimated to be 96% - 97% of average NYMEX Henry Hub prices for the

fourth quarter, slightly better than internal expectations driven

by improved winter propane prices and tighter seasonal Appalachian

differentials. Realized prices for oil are estimated to be at a

discount of $4.02 - $4.05 of average NYMEX WTI benchmark prices for

the fourth quarter, reflecting markedly wider Williston Basin

differentials and modestly weaker Midland-Cushing pricing than the

prior quarters in 2023.

Lease operating costs in the fourth quarter were an estimated

$9.70 - $9.75 per boe. The Company saw more normalized levels of

expensed workover activity in the fourth quarter compared to lower

levels in the third quarter. Fourth quarter operating expenses also

included approximately $4.0 million in firm transport charges for

the Appalachian properties, reflecting a refinement in NOG’s

quarterly accrual process as compared to its prior practice. The

first quarter accrual is expected to be approximately $2.3 million

and, based on current natural gas prices, is expected to be lower

on a quarterly basis thereafter. NOG expects the firm transport

charges to sunset by mid-2025.

MASCOT UPDATE

The Company continues to experience strong well performance at

its Mascot Project and continues to work with MPDC to optimize

future development, which over time could add additional zones and

future inventory. Currently, the project has planned shut-in

activity as it completes its first large batch well development and

begins bringing curtailed wells back to production in stages

throughout the first quarter. The Company expects 17 gross wells to

be turned to sales early in the second quarter of 2024, followed by

another 12 gross wells in the third quarter before commencing

completion operations on another large pad. Based on recent

discussions with MPDC, NOG anticipates a ~10% reduction in average

well costs on current and future wells versus 2023; however, NOG

continues to budget based on original well cost expectations.

FOURTH QUARTER CAPITAL EXPENDITURES AND ELECTIVE GROUND GAME

ACQUISITIONS

The Company experienced a significant acceleration in drilling

activity in the fourth quarter, resulting in a material

pull-forward of capital expenditures. Although the overall pace of

turn-in-lines (TILs) remained consistent with previous

expectations, the development cadence of NOG's wells-in-process

advanced ahead of schedule. Consequently, NOG incurred

approximately $50 million of capital in the fourth quarter that was

previously planned for 2024. In line with this acceleration, NOG

has observed a meaningful reduction in development timelines for

recent wells-in-process.

During the fourth quarter, the Company turned-in-line an

estimated 27.6 net wells, representing a 20% increase from the

third quarter. Furthermore, the Company added 20.8 net wells to the

drilling and completing (D&C) list, concluding the quarter at

approximately 66.5 net wells-in-process, a 20% increase

year-over-year. The combined strong activity levels contributed

significantly to the increased capital expenditures in the fourth

quarter.

Additionally, NOG seized on market opportunities created by

significant dislocations from commodity price volatility in the

fourth quarter as budget constraints developed across the space.

This facilitated NOG’s completion of multiple Ground Game

transactions, spending approximately $25 million of total elective

acquisition and development capital in the fourth quarter. These

transactions included 4.6 net wells-in-process and future drilling

locations and approximately 663 net acres. Approximately half of

the acquired 4.6 net wells turned in line at the end of the fourth

quarter, incurring substantially all of their capital in 2023, with

production contributions expected in the first quarter of 2024. The

transactions are expected to generate strong returns on capital

employed, with cash flow contributions primarily in 2024 and

beyond.

Given the acceleration of 2024 development capital and the

additional elective Ground Game capital, total fourth quarter

capital expenditures were approximately $260 million, excluding

non-budgeted acquisitions and other items.

FIRST QUARTER UPDATE

Extreme regional freezing conditions experienced in January had

a slight impact on overall production levels. These weather-related

disruptions led to modest curtailments in the Williston Basin as

well as minor effects on certain areas of the Permian Basin. NOG

estimates a 2.0% reduction to overall production levels in the

first quarter from the freeze-off conditions.

NOG expects first quarter 2024 production volumes to be slightly

lower than the fourth quarter of 2023. The Company expects first

quarter production to be affected by a modestly reduced completions

count sequentially driven by a typical seasonal slowdown in the

Williston Basin, the aforementioned weather disruptions early in

the first quarter, and planned curtailments at the Mascot Project

prior to its second quarter ramp. Offsetting these factors are the

expected contributions from the recently closed Delaware and Utica

acquisitions. Overall, the Company expects 5 – 7 fewer net

turn-in-lines in the first quarter of 2024 compared to the fourth

quarter of 2023, though overall development activity will continue

to build momentum. With a strong backlog of wells-in-process, the

Company expects re-acceleration of turn-in-line activity as the

year progresses.

PRELIMINARY 2024 PRODUCTION AND CAPITAL EXPENDITURE

GUIDANCE

The Company will provide detailed line-item 2024 guidance with

year-end 2023 results but is providing preliminary production and

spending guidance for 2024 as follows:

- Full year 2024 production expected between 115,000 – 120,000

boe per day, with oil production estimated at 70,000 – 73,000 bbl

per day

- Quarterly production expected to decline slightly in the first

quarter, and increase modestly thereafter on a sequential quarterly

basis throughout 2024

- Budgeting approximately 90 net turn-in-lines (TILs) and over 70

net well spuds for 2024

- Total 2024 capital expenditure budget of $825 – $900 million,

inclusive of drilling and completion, Ground Game acquisitions and

workover expenses

Approximately 58% – 60% of the capital budget is expected to be

incurred in the first half of 2024, driven primarily by activity

ramps on NOG’s Mascot and Novo properties. Development plans for

2024 also reflect steady activity in the Williston and other assets

throughout the year. The Company forecasts modestly reduced

Appalachian natural gas activity from prior plans due to lower

strip prices, which has a small impact on total volumes and minimal

effect on cash flows. In total, the Company expects to turn in line

approximately 3.1 net Appalachian wells in 2024, however the

majority of the associated capital was incurred in 2023.

NOG’s preliminary capital expenditure budget anticipates 50%

allocated to the Permian Basin, 35% to the Williston Basin and 1%

to the Appalachian Basin. The remainder of the budget is for Ground

Game capital and increased workover and other items. Given elevated

levels of development since 2021, NOG has experienced increased

workover activity and is budgeting for this to continue in

2024.

The Company’s capital budget does not forecast any significant

change in well drilling and completion costs, although NOG has

recently seen anecdotal evidence of cost reductions, particularly

on the Mascot project and its Novo and Forge properties.

MANAGEMENT COMMENTS

“NOG enters 2024 guiding toward 20% year over year production

growth on a flat budget, something few companies can offer in our

space,” commented Nick O’Grady, NOG’s Chief Executive Officer. “Our

balance sheet is stronger than ever, our cash flow is hedged and

protected, and we will allocate our capital dynamically to seek the

best possible total return for our investors. The opportunity set

in front of us in 2024 is as strong as it has ever been during my

tenure at the Company.”

“The fourth quarter was a testament to our ability to be

creative, nimble and opportunistic on the deal front,” commented

Adam Dirlam, NOG’s President. “Deal by deal, we continue to add

value setting the stage for growth in 2024 and beyond. We remain

pleased with the performance of our larger projects, assets and

operating partners, a testament to our underwriting process here at

NOG.”

ABOUT NOG

NOG is a real asset company with a primary strategy of acquiring

and investing in non-operated minority working and mineral

interests in the premier hydrocarbon producing basins within the

contiguous United States. More information about NOG can be found

at www.noginc.com.

PRELIMINARY INFORMATION

The preliminary unaudited fourth quarter and full year 2023

financial and operating information and estimates included in this

press release (including with respect to production, hedge gains,

realized prices, lease operating costs, capital expenditures and

other matters) are based on estimates and subject to completion of

NOG’s financial closing procedures and audit processes. Such

information has been prepared by management solely based on

currently available information. The preliminary information does

not represent and is not a substitute for a comprehensive statement

of financial and operating results, and NOG’s actual results may

differ materially from these estimates because of final

adjustments, the completion of NOG’s financial closing and audit

procedures, and other developments after the date of this

release.

SAFE HARBOR

This press release contains forward-looking statements regarding

future events and future results that are subject to the safe

harbors created under the Securities Act of 1933, as amended (the

“Securities Act”), and the Securities Exchange Act of 1934, as

amended (the “Exchange Act”). All statements other than statements

of historical facts included or referenced in this press release

regarding NOG’s dividend plans and practices (including timing,

amounts and relative performance), financial position, business

strategy, plans and objectives for future operations, industry

conditions, cash flow, and borrowings are forward-looking

statements. When used in this presentation, forward-looking

statements are generally accompanied by terms or phrases such as

“estimate,” “project,” “predict,” “believe,” “expect,” “continue,”

“anticipate,” “target,” “could,” “plan,” “intend,” “seek,” “goal,”

“will,” “should,” “may” or other words and similar expressions that

convey the uncertainty of future events or outcomes. Items

contemplating or making assumptions about actual or potential

future sales, market size, collaborations, and trends or operating

results also constitute such forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and important factors (many of which are beyond

NOG’s control) that could cause actual results to differ materially

from those set forth in the forward-looking statements, including

the following: changes in NOG’s capitalization, changes in crude

oil and natural gas prices; the pace of drilling and completions

activity on NOG’s properties and properties pending acquisition;

NOG’s ability to acquire additional development opportunities; the

projected capital efficiency savings and other operating

efficiencies and synergies resulting from NOG’s acquisition

transactions; integration and benefits of property acquisitions, or

the effects of such acquisitions on NOG’s cash position and levels

of indebtedness; changes in NOG’s reserves estimates or the value

thereof; general economic or industry conditions, nationally and/or

in the communities in which NOG conducts business; changes in the

interest rate environment or market dividend practices, legislation

or regulatory requirements; conditions of the securities markets;

NOG's ability to consummate any pending acquisition transactions;

other risks and uncertainties related to the closing of pending

acquisition transactions; NOG’s ability to raise or access capital;

changes in accounting principles, policies or guidelines; and

financial or political instability, acts of war or terrorism, and

other economic, competitive, governmental, regulatory and technical

factors affecting NOG’s operations, products, services and prices.

Additional information concerning potential factors that could

affect future plans and results is included in the section entitled

“Item 1A. Risk Factors” and other sections of NOG’s most recent

Annual Report on Form 10-K and subsequent Quarterly Reports on Form

10-Q, as updated from time to time in amendments and subsequent

reports filed with the SEC, which describe factors that could cause

NOG’s actual results to differ from those set forth in the

forward-looking statements.

NOG has based these forward-looking statements on its current

expectations and assumptions about future events. While management

considers these expectations and assumptions to be reasonable, they

are inherently subject to significant business, economic,

competitive, regulatory, and other risks, contingencies, and

uncertainties, most of which are difficult to predict and many of

which are beyond NOG’s control. You are urged not to place undue

reliance on these forward-looking statements, which speak only as

of the date they are made. Except as may be required by applicable

law or regulation, NOG does not undertake, and specifically

disclaims, any obligation to update any forward-looking statements

to reflect events or circumstances occurring after the date of such

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240215714731/en/

Evelyn Leon Infurna Vice President of Investor Relations (952)

476-9800 ir@northernoil.com

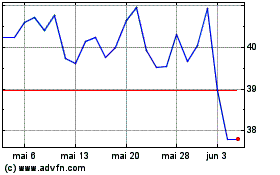

Northern Oil and Gas (NYSE:NOG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Northern Oil and Gas (NYSE:NOG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024