THIRD QUARTER HIGHLIGHTS

- Production of 121,815 Boe per day (58% oil), up 19% from the

third quarter of 2023

- Record oil volumes of 70,913 Bbl per day, despite only 9.5 net

turn-in-lines during the quarter

- GAAP net income of $298.4 million, Adjusted Net Income of

$141.1 million and Adjusted EBITDA of $412.4 million. See “Non-GAAP

Financial Measures” below

- Cash flow from operations of $385.8 million. Excluding changes

in net working capital, cash flow from operations was $377.1

million, an increase of 9% from the third quarter of 2023, up 1%

from the second quarter of 2024

- Generated record $177.1 million of Free Cash Flow, up 32% from

the second quarter of 2024. See “Non-GAAP Financial Measures”

below

- Capital expenditures of $198.0 million, excluding non-budgeted

acquisitions and other items

- D&C list increased to 52.2 net wells, up 11.1 net wells

from the second quarter of 2024

- Repurchased 397,301 shares of common stock at an average price

of $36.38 per share

POST-QUARTER HIGHLIGHTS

- Closed joint acquisition with SM Energy Company of Uinta Basin

properties from XCL Resources for $519.0 million net to NOG

Northern Oil and Gas, Inc. (NYSE: NOG) (“NOG” or “Company”)

today announced the Company’s third quarter results.

MANAGEMENT COMMENTS

“During the third quarter we generated record oil volumes and

free cash flow despite limited completion activity and a period of

weaker commodity prices. Importantly, we notched multiple

achievements on the business front executing on acquisitions of two

high-quality growth assets,” commented Nick O’Grady, NOG’s Chief

Executive Officer. “We closed our $220 million Point transaction on

time and on schedule, yet our net debt changed by only

approximately $50 million during the quarter, a testament to the

power of our cash generation and the strength of our asset base. On

October 1, we closed on XCL, our largest and most accretive

acquisition to date. With these two assets now closed and D&C

activity building, we look forward to continuing to generate

differentiated returns and growth for our investors.”

THIRD QUARTER FINANCIAL RESULTS

Oil and natural gas sales for the third quarter were $513.5

million. Third quarter GAAP net income was $298.4 million or $2.96

per diluted share. Third quarter Adjusted Net Income was $141.1

million or $1.40 per adjusted diluted share. Adjusted EBITDA in the

third quarter was $412.4 million, a 7% increase from the third

quarter of 2023. See “Non-GAAP Financial Measures” below.

PRODUCTION

Third quarter production was 121,815 Boe per day, a decrease of

1% from the second quarter of 2024 and an increase of 19% from the

third quarter of 2023. Oil represented 58% of total production in

the third quarter with 70,913 Bbls per day, an increase of 2% from

the second quarter of 2024 and an increase of 12% from the third

quarter of 2023. NOG had 9.5 net wells turned in-line during the

third quarter, compared to 30.1 net wells turned in-line in the

second quarter of 2024. Strong well performance drove volume growth

in both the Williston and Permian Basins, despite lower well

completions versus the prior quarter. Natural gas volumes were

lower driven by a decline in Appalachian gas activity.

PRICING

During the third quarter, NYMEX West Texas Intermediate (“WTI”)

crude oil averaged $75.27 per Bbl, and NYMEX natural gas at Henry

Hub averaged $2.23 per Mcf. NOG’s unhedged net realized oil price

in the third quarter was $71.82, representing a $3.45 differential

to WTI prices, a slight improvement compared to the second quarter.

NOG’s unhedged net realized gas price in the third quarter was

$1.60 per Mcf, representing a 72% realization compared with Henry

Hub pricing. Natural gas realizations were lower than prior periods

in the Appalachian, Permian and Williston Basins, driven by lower

benchmark prices, wider regional basis differentials and lower NGL

prices.

OPERATING COSTS

Lease operating costs were $106.9 million in the third quarter

of 2024, or $9.54 per Boe, 6% higher on a per unit basis compared

to the second quarter of 2024. LOE costs increased primarily due to

increased workover and water disposal costs. Production taxes were

$14.7 million in the third quarter of 2024, compared to $48.6

million in the second quarter of 2024, a decrease due to an

immaterial out-of-period accounting adjustment. Third quarter

general and administrative (“G&A”) costs totaled $10.0 million

or $0.89 per Boe, as compared to $1.21 per Boe in the second

quarter of 2024. NOG’s adjusted cash G&A costs, which excludes

non-cash and acquisition costs amounts of $3.0 million and a credit

of $1.9 million, respectively, totaled $8.9 million or $0.79 per

Boe in the third quarter, up $0.04 per Boe compared to the second

quarter of 2024.

CAPITAL EXPENDITURES AND ACQUISITIONS

Capital expenditures for the third quarter were $198.0 million

(excluding non-budgeted acquisitions and other). This was comprised

of $187.0 million of total drilling and completion (“D&C”)

capital on organic and Ground Game assets, and $11.1 million of

Ground Game activity inclusive of pre-closing development costs.

D&C spending was largely as expected during the quarter, with

significant spud activity and healthy growth to the D&C list,

despite a lower number of turn-in-lines. NOG’s weighted average

gross authorization for expenditure (or AFE) elected to in the

third quarter was $9.1 million, which was lower compared with the

second quarter of 2024.

NOG’s Permian Basin spending was 56% of the capital expenditures

for the third quarter, the Williston was 41%, and the Appalachian

was 3%. On the Ground Game acquisition front, NOG closed on six

transactions acquired through various structures during the third

quarter totaling 1,259 net acres and 0.1 net current and future

development wells.

LIQUIDITY AND CAPITAL RESOURCES

NOG had total liquidity in excess of $1.3 billion as of

September 30, 2024, consisting of $1.2 billion of committed

borrowing availability under its Revolving Credit Facility and

$59.9 million in total cash in the form of $34.4 million of

unrestricted cash and $25.5 million in the form of a restricted

cash deposit for the pending XCL acquisition.

SHAREHOLDER RETURNS

In the third quarter of 2024, the Company repurchased 397,301

shares of common stock at an average price, inclusive of

commissions, of $36.38 per share in the open market. Year-to-date,

the Company has repurchased 1,841,733 shares at an average price,

inclusive of commissions, of $37.64. In July 2024, the Company’s

board of directors terminated the prior stock repurchase program,

which was substantially depleted, and approved a new stock

repurchase program to acquire up to $150.0 million of the Company’s

outstanding common stock.

In August 2024, NOG’s Board of Directors declared a regular

quarterly cash dividend for NOG’s common stock of $0.42 per share

for stockholders of record as of September 27, 2024, which was paid

on October 31, 2024, a 5% increase from prior levels.

2024 ANNUAL GUIDANCE(1)

NOG is reiterating capital expenditure and production guidance

and adjusting certain line items. Production taxes are being

adjusted to reflect current expectations for the remainder of the

year. Natural gas realizations and oil differentials are being

adjusted to reflect results experienced year-to-date. Per unit cash

G&A is being lowered as the Company has reduced certain

external expenses and continues to benefit from increasing

production volumes.

Prior Guidance

Revised Guidance

Annual Production (Boe per day)

120,000 - 124,000

120,000 - 124,000

Annual Oil Production (Bbls per day)

73,000 - 76,000

73,000 - 76,000

Total Capital Expenditures ($ in

millions)

$890 - $970

$890 - $970

Net Wells Turned-in-Line (“TIL”)

93.0 - 98.0

93.0 - 98.0

Net Wells Spud

73.0 - 78.0

73.0 - 78.0

Operating Expenses and

Differentials:

Production Expenses (per Boe)

$9.15 - $9.40

$9.15 - $9.40

Production Taxes (as a percentage of Oil

& Gas Sales)

9.0% - 9.5%

8.5% - 9.0%(2)

Average Differential to NYMEX WTI (per

Bbl)

($4.00) - ($4.85)

($4.00) - ($4.50)

Average Realization as a Percentage of

NYMEX Henry Hub (per Mcf)

87.5% - 92.5%

90.0% - 95.0%

DD&A Rate (per Boe)

$16.50 - $17.50

$16.50 - $17.50

General and Administrative Expense (per

Boe):

Non-Cash

$0.25 - $0.27

$0.25 - $0.27

Cash (excluding transaction costs on

non-budgeted acquisitions)

$0.74 - $0.80

$0.72 - $0.77

________________

(1)

All forecasts are provided on a 2-stream

production basis.

(2)

Represents expected fourth quarter rate.

Actual annual production tax rate is expected to be lower, due to

an out-of-period adjustment made in the third quarter.

THIRD QUARTER 2024 RESULTS

The following tables set forth selected operating and financial

data for the periods indicated.

Three Months Ended September

30,

2024

2023

% Change

Net Production (in thousands):

Oil (MBbl)

6,524

5,848

12

%

Natural Gas (MMcf)

28,098

21,397

31

%

Total (MBoe)

11,207

9,414

19

%

Average Daily Production:

Oil (Bbl)

70,913

63,564

12

%

Natural Gas (Mcf)

305,413

232,576

31

%

Total (Boe)

121,815

102,327

19

%

Average Sales Prices:

Oil (per Bbl)

$

71.82

$

79.48

(10

)%

Effect of Gain (Loss) on Settled Oil

Derivatives on Average Price (per Bbl)

0.20

(2.58

)

Oil Net of Settled Oil Derivatives (per

Bbl)

72.02

76.90

(6

)%

Natural Gas and NGLs (per Mcf)

1.60

2.19

(27

)%

Effect of Gain on Settled Natural Gas

Derivatives on Average Price (per Mcf)

1.01

0.95

Natural Gas and NGLs Net of Settled

Natural Gas Derivatives (per Mcf)

2.61

3.14

(17

)%

Realized Price on a Boe Basis Excluding

Settled Commodity Derivatives

45.82

54.35

(16

)%

Effect of Gain on Settled Commodity

Derivatives on Average Price (per Boe)

2.65

0.55

Realized Price on a Boe Basis Including

Settled Commodity Derivatives

48.47

54.90

(12

)%

Costs and Expenses (per Boe):

Production Expenses

$

9.54

$

8.76

9

%

Production Taxes

1.31

4.48

(71

)%

General and Administrative Expenses

0.89

1.26

(29

)%

Depletion, Depreciation, Amortization and

Accretion

16.57

14.21

17

%

Net Producing Wells at Period

End

1,049.8

923.7

14

%

HEDGING

NOG hedges portions of its expected production volumes to

increase the predictability of its cash flow and to help maintain a

strong financial position. The following table summarizes NOG’s

open crude oil commodity derivative swap contracts scheduled to

settle after September 30, 2024.

Crude Oil Commodity Derivative

Swaps(1)

Crude Oil Commodity Derivative

Collars

Contract Period

Volume (Bbls/Day)

Weighted Average Price

($/Bbl)

Collar Call Volume

(Bbls)

Collar Put Volume

(Bbls)

Weighted Average Ceiling

Price

($/Bbl)

Weighted Average Floor

Price

($/Bbl)

2024:

Q4

32,969

$

73.85

2,195,749

1,998,800

$

81.32

$

71.58

2025:

Q1

32,791

$

74.82

2,303,286

1,889,849

$

78.25

$

69.68

Q2

27,123

74.54

2,502,671

2,019,233

77.45

69.41

Q3

19,413

73.57

2,304,994

1,817,970

77.43

69.15

Q4

18,933

73.29

2,278,511

1,791,487

77.55

69.15

2026:

Q1

2,930

$

70.38

1,325,726

894,289

$

74.41

$

66.15

Q2

2,930

70.31

1,340,457

904,227

74.41

66.15

Q3

2,930

70.24

1,355,187

914,163

74.41

66.15

Q4

2,930

70.15

1,355,187

914,163

74.41

66.15

_____________

(1)

Includes derivative contracts entered into

as of November 5, 2024. This table does not include volumes subject

to swaptions and call options, which are crude oil derivative

contracts NOG has entered into which may increase swapped volumes

at the option of NOG’s counterparties. This table also does not

include basis swaps. For additional information, see Note 10 to our

financial statements included in our Form 10-Q filed with the SEC

for the quarter ended September 30, 2024.

The following table summarizes NOG’s open natural gas commodity

derivative swap contracts scheduled to settle after September 30,

2024.

Natural Gas Commodity

Derivative Swaps(1)

Natural Gas Commodity

Derivative Collars

Contract Period

Volume (MMBTU/Day)

Weighted Average Price

($/MMBTU)

Collar Call Volume

(MMBTU)

Collar Put Volume

(MMBTU)

Weighted Average Ceiling

Price

($/MMBTU)

Weighted Average Floor

Price

($/MMBTU)

2024:

Q4

100,738

$

3.48

9,406,586

9,406,586

$

4.60

$

3.07

2025:

Q1

72,500

$

3.46

10,086,417

10,086,417

$

4.98

$

3.12

Q2

30,330

3.47

9,691,297

9,691,297

4.71

3.11

Q3

30,000

3.47

9,327,569

9,327,569

4.73

3.11

Q4

24,891

3.53

8,228,723

8,228,723

4.86

3.11

2026:

Q1

14,889

$

3.74

5,828,249

5,828,249

$

5.06

$

3.09

Q2

15,165

3.74

6,024,706

6,024,706

5.06

3.09

Q3

15,000

3.74

6,024,706

6,024,706

5.06

3.09

Q4

11,576

3.66

4,304,642

4,304,642

4.97

3.09

2027:

Q1

1,722

$

3.20

890,000

890,000

$

3.83

$

3.00

Q2

—

—

920,000

920,000

3.83

3.00

Q3

—

—

920,000

920,000

3.83

3.00

Q4

—

—

610,000

610,000

3.83

3.00

____________

(2)

Includes derivative contracts entered into

as of November 5, 2024. This table does not include basis swaps.

For additional information, see Note 10 to our financial statements

included in our Form 10-Q filed with the SEC for the quarter ended

September 30, 2024.

The following table presents NOG’s settlements on commodity

derivative instruments and unsettled gains and losses on open

commodity derivative instruments for the periods presented, which

is included in the revenue section of NOG’s statement of

operations:

Three Months Ended

September 30,

(In thousands)

2024

2023

Cash Received on Settled Derivatives

$

29,709

$

5,164

Non-Cash Mark-to-Market Gain (Loss) on

Derivatives

208,441

(204,712

)

Gain (Loss) on Commodity Derivatives,

Net

$

238,150

$

(199,548

)

CAPITAL EXPENDITURES & DRILLING

ACTIVITY

(In thousands, except for net well

data)

Three Months Ended September

30, 2024

Capital Expenditures Incurred:

Organic Drilling and Development Capital

Expenditures

$

161,945

Ground Game Drilling and Development

Capital Expenditures

$

25,010

Ground Game Acquisition Capital

Expenditures inclusive of pre-closing development costs

$

11,073

Other

$

1,890

Non-Budgeted Acquisitions

$

198,726

Net Wells Added to Production

9.5

Net Producing Wells (Period-End)

1,049.8

Net Wells in Process (Period-End)

52.2

Weighted Average Gross AFE for Wells

Elected to

$

9,147

THIRD QUARTER 2024 EARNINGS RELEASE CONFERENCE CALL

In conjunction with NOG’s release of its financial and operating

results, investors, analysts and other interested parties are

invited to listen to a conference call with management on

Wednesday, November 6, 2024 at 8:00 a.m. Central Time.

Those wishing to listen to the conference call may do so via

webcast or phone as follows:

Webcast:

https://events.q4inc.com/attendee/395412196 Dial-In Number: (800) 715-9871 (US/Canada) and

(646) 307-1963 (International) Conference

ID: 4503139 - NOG Third Quarter 2024 Earnings Conference

Call Replay Dial-In Number: (800)

770-2030 (US/Canada) and (609) 800-9909 (International)

Replay Access Code: 4503139 - Replay

will be available through November 20, 2024

ABOUT NOG

NOG is a real asset company with a primary strategy of acquiring

and investing in non-operated minority working and mineral

interests in the premier hydrocarbon producing basins within the

contiguous United States. More information about NOG can be found

at www.noginc.com.

SAFE HARBOR

This press release contains forward-looking statements regarding

future events and NOG’s future results that are subject to the safe

harbors created under the Securities Act of 1933, as amended, and

the Securities Exchange Act of 1934, as amended. All statements

other than statements of historical facts included in this release

regarding NOG’s financial position, operating and financial

performance, business strategy, dividend plans and practices, plans

and objectives of management for future operations, industry

conditions, and indebtedness covenant compliance are

forward-looking statements. When used in this release,

forward-looking statements are generally accompanied by terms or

phrases such as “estimate,” “project,” “predict,” “believe,”

“expect,” “continue,” “anticipate,” “target,” “could,” “plan,”

“intend,” “seek,” “goal,” “will,” “should,” “may” or other words

and similar expressions that convey the uncertainty of future

events or outcomes. Items contemplating or making assumptions about

actual or potential future production and sales, market size,

collaborations, and trends or operating results also constitute

such forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and important factors (many of which are beyond

NOG’s control) that could cause actual results to differ materially

from those set forth in the forward-looking statements, including

the following: changes in crude oil and natural gas prices, the

pace of drilling and completions activity on NOG’s current

properties and properties pending acquisition; infrastructure

constraints and related factors affecting NOG’s properties; cost

inflation or supply chain disruptions; ongoing legal disputes over,

and potential shutdown of, the Dakota Access Pipeline; NOG’s

ability to acquire additional development opportunities, potential

or pending acquisition transactions, the projected capital

efficiency savings and other operating efficiencies and synergies

resulting from NOG’s acquisition transactions, integration and

benefits of property acquisitions, or the effects of such

acquisitions on NOG’s cash position and levels of indebtedness;

changes in NOG’s reserves estimates or the value thereof;

disruption to NOG’s business due to acquisitions and other

significant transactions; general economic or industry conditions,

nationally and/or in the communities in which NOG conducts

business; changes in the interest rate environment, legislation or

regulatory requirements, conditions of the securities markets;

risks associated with NOG’s 3.625% convertible senior notes due

2029 (the “Convertible Notes”), including the potential impact that

the Convertible Notes may have on NOG’s financial position and

liquidity, potential dilution, and that provisions of the

Convertible Notes could delay or prevent a beneficial takeover of

NOG; the potential impact of the capped call transaction undertaken

in tandem with the Convertible Notes issuance, including

counterparty risk; increasing attention to environmental, social

and governance matters; NOG’s ability to consummate any pending

acquisition transactions; other risks and uncertainties related to

the closing of pending acquisition transactions; NOG’s ability to

raise or access capital; cyber-incidents could have a material

adverse effect on NOG’s business, financial condition or results of

operations; changes in accounting principles, policies or

guidelines; events beyond NOG’s control, including a global or

domestic health crisis, acts of terrorism, political or economic

instability or armed conflict in oil and gas producing regions; and

other economic, competitive, governmental, regulatory and technical

factors affecting NOG’s operations, products and prices. Additional

information concerning potential factors that could affect future

results is included in the section entitled “Item 1A. Risk Factors”

and other sections of NOG’s most recent Annual Report on Form 10-K

for the year ended December 31, 2023, and Quarterly Report on Form

10-Q, as updated from time to time in amendments and subsequent

reports filed with the SEC, which describe factors that could cause

NOG’s actual results to differ from those set forth in the

forward-looking statements.

NOG has based these forward-looking statements on its current

expectations and assumptions about future events. While management

considers these expectations and assumptions to be reasonable, they

are inherently subject to significant business, economic,

competitive, regulatory and other risks, contingencies and

uncertainties, most of which are difficult to predict and many of

which are beyond NOG’s control. Accordingly, results actually

achieved may differ materially from expected results described in

these statements. NOG does not undertake any duty to update or

revise any forward-looking statements, except as may be required by

the federal securities laws.

CONDENSED STATEMENTS OF

OPERATIONS

(UNAUDITED)

Three Months Ended

September 30,

(In thousands, except share and per

share data)

2024

2023

Revenues

Oil and Gas Sales

$

513,541

$

511,651

Gain (Loss) on Commodity Derivatives,

Net

238,150

(199,548

)

Other Revenues

1,947

1,870

Total Revenues

753,638

313,973

Operating Expenses

Production Expenses

106,902

82,506

Production Taxes

14,671

42,158

General and Administrative Expenses

10,005

11,846

Depletion, Depreciation, Amortization and

Accretion

185,657

133,791

Other Expenses

2,463

1,234

Total Operating Expenses

319,698

271,535

Income From Operations

433,940

42,438

Other Income (Expense)

Interest Expense, Net of

Capitalization

(36,837

)

(37,040

)

Loss on Unsettled Interest Rate

Derivatives, Net

(20

)

—

Other Income

140

21

Total Other Expense, Net

(36,717

)

(37,019

)

Income Before Income Taxes

397,223

5,419

Income Tax Expense (Benefit)

98,777

(20,691

)

Net Income

$

298,446

$

26,111

Net Income Per Common Share – Basic

$

3.00

$

0.28

Net Income Per Common Share – Diluted

$

2.96

$

0.28

Weighted Average Common Shares Outstanding

– Basic

99,494,313

92,768,035

Weighted Average Common Shares Outstanding

– Diluted

100,724,784

93,742,407

CONDENSED BALANCE

SHEETS

(In thousands, except par value and

share data)

September 30, 2024

December 31, 2023

Assets

(Unaudited)

Current Assets:

Cash and Cash Equivalents

$

34,356

$

8,195

Accounts Receivable, Net

316,933

370,531

Advances to Operators

18,153

49,210

Prepaid Expenses and Other

12,111

2,489

Derivative Instruments

100,797

75,733

Income Tax Receivable

36,573

3,249

Total Current Assets

518,923

509,407

Property and Equipment:

Oil and Natural Gas Properties, Full Cost

Method of Accounting

Proved

9,524,785

8,428,518

Unproved

23,006

36,785

Other Property and Equipment

8,182

8,069

Total Property and Equipment

9,555,973

8,473,372

Less – Accumulated Depreciation, Depletion

and Impairment

(5,075,954

)

(4,541,808

)

Total Property and Equipment, Net

4,480,019

3,931,563

Derivative Instruments

14,730

10,725

Acquisition Deposit

25,500

17,094

Other Noncurrent Assets, Net

16,155

15,466

Total Assets

$

5,055,327

$

4,484,255

Liabilities and Stockholders’

Equity

Current Liabilities:

Accounts Payable

$

152,455

$

192,672

Accrued Liabilities

237,244

147,943

Accrued Interest

28,034

26,219

Derivative Instruments

804

16,797

Other Current Liabilities

1,751

2,130

Total Current Liabilities

420,288

385,761

Long-term Debt, Net

1,953,099

1,835,554

Deferred Tax Liability

210,738

68,488

Derivative Instruments

112,442

105,831

Asset Retirement Obligations

42,867

38,203

Other Noncurrent Liabilities

2,391

2,741

Total Liabilities

$

2,741,825

$

2,436,578

Commitments and Contingencies

Stockholders’ Equity

Common Stock, Par Value $.001; 270,000,000

Shares Authorized;

99,825,164 Shares Outstanding at

9/30/2024

100,761,148 Shares Outstanding at

12/31/2023

502

503

Additional Paid-In Capital

1,942,181

2,124,963

Retained Earnings (Deficit)

370,819

(77,790

)

Total Stockholders’ Equity

2,313,502

2,047,676

Total Liabilities and Stockholders’

Equity

$

5,055,327

$

4,484,255

Non-GAAP Financial Measures

Adjusted Net Income, Adjusted EBITDA and Free Cash Flow are

non-GAAP measures. NOG defines Adjusted Net Income (Loss) as income

(loss) before income taxes, excluding (i) (gain) loss on unsettled

commodity derivatives, net of tax, (ii) (gain) loss on

extinguishment of debt, net of tax, (iii) contingent consideration

(gain) loss, net of tax, (iv) acquisition transaction costs, net of

tax, and (v) (gain) loss on unsettled interest rate derivatives,

net of tax. NOG defines Adjusted EBITDA as net income (loss) before

(i) interest expense, (ii) income taxes, (iii) depreciation,

depletion, amortization and accretion, (iv) non-cash stock-based

compensation expense, (v) (gain) loss on extinguishment of debt,

(vi) contingent consideration (gain) loss (vii) acquisition

transaction costs, (viii) (gain) loss on unsettled interest rate

derivatives, and (ix) (gain) loss on unsettled commodity

derivatives. NOG defines Free Cash Flow as cash flows from

operations before changes in working capital and other items, less

(i) capital expenditures, excluding non-budgeted acquisitions and

changes in accrued capital expenditures and other items. A

reconciliation of each of these measures to the most directly

comparable GAAP measure is included below.

Management believes the use of these non-GAAP financial measures

provides useful information to investors to gain an overall

understanding of current financial performance. Management believes

Adjusted Net Income and Adjusted EBITDA provide useful information

to both management and investors by excluding certain expenses and

unrealized commodity gains and losses that management believes are

not indicative of NOG’s core operating results. Management believes

that Free Cash Flow is useful to investors as a measure of a

company’s ability to internally fund its budgeted capital

expenditures, to service or incur additional debt, and to measure

success in creating stockholder value. In addition, these non-GAAP

financial measures are used by management for budgeting and

forecasting as well as subsequently measuring NOG’s performance,

and management believes it is providing investors with financial

measures that most closely align to its internal measurement

processes. The non-GAAP financial measures included herein may be

defined differently than similar measures used by other companies

and should not be considered an alternative to, or more meaningful

than, the comparable GAAP measures. From time to time NOG provides

forward-looking Free Cash Flow estimates or targets; however, NOG

is unable to provide a quantitative reconciliation of the forward

looking non-GAAP measure to its most directly comparable forward

looking GAAP measure because management cannot reliably quantify

certain of the necessary components of such forward looking GAAP

measure. The reconciling items in future periods could be

significant.

Reconciliation of Adjusted Net

Income

Three Months Ended

September 30,

(In thousands, except share and per

share data)

2024

2023

Income Before Income Taxes

$

397,223

$

5,419

Add:

Impact of Selected Items:

(Gain) Loss on Unsettled Commodity

Derivatives

(208,441

)

204,712

Acquisition Transaction Costs

(1,901

)

3,385

Loss on Unsettled Interest Rate

Derivatives

20

—

Adjusted Income Before Adjusted Income Tax

Expense

186,901

213,516

Adjusted Income Tax Expense (1)

(45,791

)

(52,311

)

Adjusted Net Income (non-GAAP)

$

141,110

$

161,205

Weighted Average Shares Outstanding –

Basic

99,494,313

92,768,035

Weighted Average Shares Outstanding –

Diluted

100,724,784

93,742,407

Less:

Dilutive Effect of Convertible Notes

(2)

115,626

434,944

Weighted Average Shares Outstanding –

Adjusted Diluted

100,609,158

93,307,463

Income Before Income Taxes Per Common

Share – Basic

$

3.99

$

0.06

Add:

Impact of Selected Items

(2.11

)

2.24

Impact of Income Tax

(0.46

)

(0.56

)

Adjusted Net Income Per Common Share –

Basic

$

1.42

$

1.74

Income Before Income Taxes Per Common

Share – Adjusted Diluted

$

3.95

$

0.06

Add:

Impact of Selected Items

(2.09

)

2.23

Impact of Income Tax

(0.46

)

(0.56

)

Adjusted Net Income Per Common Share –

Adjusted Diluted

$

1.40

$

1.73

______________

(1)

For the three months ended September 30,

2024 and September 30, 2023, this represents a tax impact using an

estimated tax rate of 24.5%.

(2)

Weighted average shares outstanding -

diluted, on a GAAP basis, includes diluted shares attributable to

the Company’s Convertible Notes due 2029. However, the offsetting

impact of the capped call transactions that the Company entered

into in connection therewith is not recognized on a GAAP basis. As

a result, for purposes of this calculation, the Company excludes

the dilutive shares to the extent they would be offset by the

capped calls.

Reconciliation of Adjusted

EBITDA

Three Months Ended

September 30,

(In thousands)

2024

2023

Net Income

$

298,446

$

26,111

Add:

Interest Expense

36,837

37,040

Income Tax Expense

98,777

(20,691

)

Depreciation, Depletion, Amortization and

Accretion

185,657

133,791

Non-Cash Stock-Based Compensation

3,018

1,178

Acquisition Transaction Costs

(1,901

)

3,385

Loss on Unsettled Interest Rate

Derivatives

20

—

(Gain) Loss on Unsettled Commodity

Derivatives

(208,441

)

204,712

Adjusted EBITDA

$

412,413

$

385,525

Reconciliation of Free Cash

Flow

Three Months Ended

September 30,

(In thousands)

2024

Net Cash Provided by Operating

Activities

$

385,761

Exclude: Changes in Working Capital and

Other Items

(8,704

)

Less: Capital Expenditures (1)

(199,918

)

Free Cash Flow

$

177,139

_______________

(1) Capital expenditures are calculated as

follows:

Three Months Ended

September 30,

(In thousands)

2024

Cash Paid for Capital Expenditures

$

381,824

Less: Non-Budgeted Acquisitions

(204,571

)

Plus: Change in Accrued Capital

Expenditures and Other

22,665

Capital Expenditures

$

199,918

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105233580/en/

Evelyn Infurna Vice President of Investor Relations 952-476-9800

ir@northernoil.com

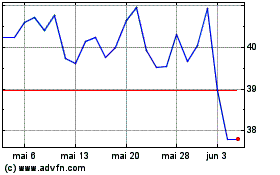

Northern Oil and Gas (NYSE:NOG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Northern Oil and Gas (NYSE:NOG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024