Proto Labs, Inc. (NYSE: PRLB), a leading online and

technology-enabled quick-turn manufacturer, today announced its

financial results for the first quarter ended March 31, 2012.

Highlights for Q1 2012 include:

- Revenue increased to a record $30.0

million, 34 percent above revenue of $22.3 million in the first

quarter of 2011. On a sequential basis, revenue increased 17

percent compared to the fourth quarter of 2011.

- International revenue grew to $7.8

million, or 26 percent of revenue, in the first quarter of 2012

compared to $4.9 million, or 22 percent of revenue in the same

quarter in 2011.

- During the first quarter of 2012,

revenue from 753 new customer companies totaled $2.9 million and

revenue from 2,931 existing customer companies totaled $27.1

million.

- Gross margin was 59.1 percent of

revenue in the first quarter of 2012 compared with 62.3 percent in

the first quarter of 2011 and 56.8 percent in the fourth quarter of

2011.

- Net income totaled $4.8 million, or

$0.22 per share. After adding back the after-tax expense of stock

compensation, non-GAAP net income was $5.4 million, or $0.24 per

share. See “Non-GAAP Financial Measure” below.

“Our first quarter revenue demonstrates the growing demand for

our unique, technology-enabled manufacturing services,” said Brad

Cleveland, President and CEO of Proto Labs. “We are especially

pleased with the growth of new customers as our experience shows

that once a customer does business with us, they tend to come back

in future periods and do even more business with us. Our marketing

and sales engines continue to help drive our customer acquisition

and revenue opportunities.”

Additional Q1 highlights include:

- Operating margin was 25.5 percent of

revenue compared with 31.7 percent in the first quarter a year ago

and 19.1 percent in the 2011 fourth quarter.

- Cash generated through the completion

of the initial public offering was $72 million, net of offering

expenses. As of March 31, 2012, cash and investment balances

totaled $80 million.

- Expenditures on capital equipment were

$8.3 million in the first quarter of 2012.

“We significantly strengthened our balance sheet in the quarter,

enhancing our cash position and providing us with the financial

resources necessary to pursue our growth strategy to drive revenue

and enhanced profitability. We are focused on our opportunities to

increase penetration of existing customer accounts, acquire new

customers in existing markets, expand into new markets overseas,

and broaden our part envelope and introduce new manufacturing

processes to serve a broader range of customer needs. I would like

to thank the Proto Labs team who remained focused on execution and

generated excellent financial results in the quarter,” concluded

Mr. Cleveland.

Non-GAAP Financial Measure

The company has included non-GAAP net income, adjusted for

stock-based compensation expense in this press release to provide

investors with additional information regarding the company’s

financial results. The company has provided below a reconciliation

of non-GAAP net income, adjusted for stock-based compensation

expense, to net income, the most directly comparable measure

calculated and presented in accordance with GAAP. Non-GAAP net

income, adjusted for stock-based compensation expense, is used by

the company’s management and board of directors to understand and

evaluate operating performance and trends and provides a useful

measure for period-to-period comparisons of the company’s business.

Accordingly, the company believes that non-GAAP net income,

adjusted for stock-based compensation expense, provides useful

information to investors and others in understanding and evaluating

operating results in the same manner as our management and board of

directors.

Conference Call

The company has scheduled a conference call to discuss its first

quarter financial results today, May 3, at 8:30 a.m. ET. To access

the call, please dial 866-804-6929, or outside the U.S.

857-350-1675. Please use participant code 52469989. A simultaneous

webcast of the call will also be available on the investor

relations section of the company’s website at

www.protolabs.com/investors. An audio replay will be available for

14 days following the call on the investor relations website of

Proto Lab’s website.

About Proto Labs, Inc.Proto Labs is a leading online and

technology-enabled quick-turn manufacturer of custom parts for

prototyping and short-run production. Proto Labs provides “Real

Parts, Really Fast” to product developers worldwide. Proto Labs

utilizes computer numerical control (CNC) machining and injection

molding to manufacture custom parts for our customers. For more

information, visit protolabs.com.

Forward-Looking StatementsStatements contained in this

press release regarding matters that are not historical or current

facts are “forward-looking statements” within the meaning of The

Private Securities Litigation Reform Act of 1995. These statements

involve known and unknown risks, uncertainties and other factors

which may cause the results of Proto Labs to be materially

different than those expressed or implied in such statements.

Certain of these risk factors and others are described in the “Risk

Factors” section of the final prospectus relating to the Proto

Labs’ initial public offering, as filed with the SEC, as well as in

Proto Labs’ subsequent reports filed with the SEC. Other unknown or

unpredictable factors also could have material adverse effects on

Proto Labs’ future results. The forward-looking statements included

in this press release are made only as of the date hereof. Proto

Labs cannot guarantee future results, levels of activity,

performance or achievements. Accordingly, you should not place

undue reliance on these forward-looking statements. Finally, Proto

Labs expressly disclaims any intent or obligation to update any

forward-looking statements to reflect subsequent events or

circumstances.

Proto Labs, Inc.

Condensed Consolidated Balance Sheets (In thousands)

March 31, December 31,

2012

2011

(Unaudited) Assets Current assets Cash $

79,679 $ 8,135 Short-term marketable securities - 250 Accounts

receivable, net 14,782 11,533 Inventory 3,905 3,797 Other current

assets 4,310 4,362 Total current assets

102,676 28,077 Property and equipment, net 41,099

34,249 Total assets $ 143,775 $ 62,326

Liabilities, redeemable convertible stock and

shareholder's equity (deficit) Current liabilities Accounts

payable $ 5,788 $ 4,431 Accrued compensation 3,464 4,767 Accrued

liabilities and other 4,053 351 Current portion of long-term debt

obligations 389 390 Total current liabilities

13,694 9,939 Deferred tax liability 4,252 4,252 Long-term

debt obligations 526 613 Other 856 871 Redeemable

convertible preferred and common stock - 66,894

Shareholders' equity (deficit) 124,447 (20,243 )

Total liabilities, redeemable convertible stock and shareholders'

equity (deficit) $ 143,775 $ 62,326

Proto Labs, Inc. Condensed Consolidated

Statements of Operations (In thousands, except share and per

share amounts) (Unaudited) Three Months

Ended March 31, 2012

2011 Revenues Protomold $ 21,793 $ 16,921

Firstcut

8,177 5,414

Total revenues 29,970 22,335 Cost of revenues Protomold

8,936 6,198 Firstcut

3,307

2,231 Total cost of revenues

12,243 8,429 Gross profit

17,727 13,906 Operating expenses Marketing and sales 4,441

3,215 Research and development 1,660 1,112 General and

administrative

3,988 2,506

Total operating expenses

10,089

6,833 Income from operations 7,638 7,073 Other

expense, net

577 81

Income before income taxes 7,061 6,992 Provision for income taxes

2,279 2,269 Net

income 4,782 4,723 Less: dividends on redeemable preferred stock -

(1,031 ) Less: undistributed earnings allocated to preferred

shareholders

- (1,259

) Net income attributable to common shareholders

$ 4,782 $ 2,433

Net income per share: Basic

$

0.23 $ 0.21 Diluted

$ 0.22 $ 0.19

Shares used to compute net income per share: Basic

20,934,948 11,581,430 Diluted 22,226,356 12,868,254

Proto Labs, Inc. Condensed Consolidated Statements of

Cash Flows (In thousands) (Unaudited)

Three Months Ended March 31,

2012 2011 Operating activities Net

income $ 4,782 $ 4,723 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 1,328 893 Stock-based compensation expense 850 198

Changes in operating assets and liabilities:

451 182 Net cash

provided by operating activities 7,411 5,996

Investing

activities Purchases of property and equipment (8,264 ) (2,262

) Proceeds from sale of marketable securities

250 250 Net cash

used in investing activities (8,014 ) (2,012 )

Financing

activities Proceeds from initial public offering, net of

offering costs 71,675 - Payments on debt, net (94 ) (647 ) Proceeds

from exercises of warrants and stock options

30

222 Net cash provided by (used

in) financing activities 71,611 (425 ) Effect of exchange

rate changes on cash

536

27 Net increase in cash 71,544

3,586

Cash, beginning of period

8,135 6,101

Cash, end of period $ 79,679

$ 9,687

Proto Labs, Inc. Reconciliation of GAAP to

Non-GAAP Financial Measure (In thousands, except share and

per share amounts) (Unaudited) Three

Months Ended March 31, 2012 Non-GAAP net

income, adjusted for stock-based compensation expense: GAAP net

income $ 4,782 Add back: Stock-based compensation expense Cost of

revenue 45 Marketing and sales 73 Research and development 78

General and administrative

654 Total

stock-based compensation expense 850 Less: Tax benefit on

stock-based compensation

(265 )

Non-GAAP net income

$ 5,367

Non-GAAP net income per share: Basic

$

0.26 Diluted

$ 0.24

Shares used to compute non-GAAP net income per share:

Basic 20,934,948 Diluted 22,226,356

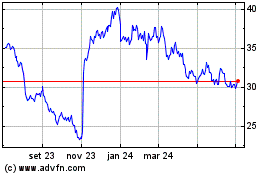

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

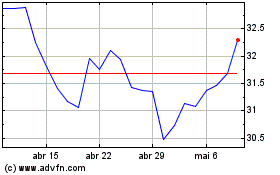

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024