MRC Global Downgraded to Sell - Analyst Blog

21 Março 2013 - 10:10AM

Zacks

Zacks Investment Research

downgraded MRC Global Inc. (MRC) to a Zacks Rank

#4 (Sell) on Mar 19 on a weak earnings outlook for 2013, despite

reporting better- than-expected results in the fourth quarter of

2012.

Why the

Downgrade?

MRC Global has witnessed sharp

downward estimate revisions after guiding for lower than expected

earnings for 2013. MRC expects earnings in the range of $2.10 to

$2.35 per share in 2013, which was below the Zacks Consensus

Estimate of $2.43 at the time of earnings announcement. Although

the guidance was higher compared to the 2012 levels, it missed the

market expectations, and, therefore, most of the estimates were

revised downwards subsequently.

The Zacks Consensus Estimate for

2013 decreased 8.5% to $2.27 per share over the last 30 days, due

to a downward revision of more than 85% of the estimates. For 2014

also, a number of estimates were revised downward over the same

timeframe, sinking the Zacks Consensus Estimate by 3.5% to $2.73

per share.

Moreover, MRC Global’s upstream

segment which experienced a year-over-year decline in the fourth

quarter of 2012 due to the planned slowdown in the Oil Country

Tubular Goods (OCTG) product line is expected to face the same

turbulence in the coming quarters.

Other Stocks to

Consider

The following machinery tools

companies with favorable Zacks Rank are performing well and are

worth considering.

- Valmont Industries

Inc. (VMI) carries a Zacks Rank #1 (Strong Buy)

- Proto Labs Inc.

(PRLB) carries a Zacks Rank #2 (Buy)

- Actuant

Corporation (ATU) carries a Zacks Rank #2 (Buy).

ACTUANT CORP (ATU): Free Stock Analysis Report

MRC GLOBAL INC (MRC): Free Stock Analysis Report

PROTO LABS INC (PRLB): Free Stock Analysis Report

VALMONT INDS (VMI): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

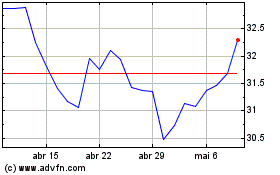

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

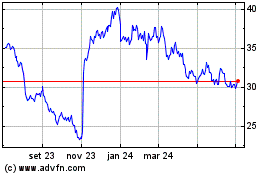

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024