Quarterly Revenue Increases 30% Year over

Year to $54.6 Million

Year-to-Date Revenue Increases 29% Year over

Year to $153.5 Million

Proto Labs, Inc. (NYSE:PRLB), a leading online and

technology-enabled quick-turn manufacturer, today announced

financial results for the third quarter ended September 30,

2014.

Highlights include:

- Revenue for the third quarter of 2014

increased to a record $54.6 million, 30 percent above revenue of

$42.0 million in the third quarter of 2013.

- Revenue for the third quarter of 2014

from additive services (3D printing) through the Fineline

acquisition completed last April increased to $3.4 million, a 38%

increase when compared to Fineline’s third quarter of 2013.

- The record quarterly revenue was

achieved through a 19 percent increase in the number of product

developers served combined with an increase of 3 percent in

spending per product developer.

- Net income for the third quarter of

2014 increased to $10.4 million, or $0.40 per diluted share.

Non-GAAP net income, excluding the after tax expense of stock

compensation and amortization of intangibles, was $11.4 million, or

$0.44 per diluted share. See “Non-GAAP Financial Measure”

below.

“We achieved strong revenue growth in the third quarter,

especially in light of the weakness we experienced in our European

markets. While our European business was flat compared to the

previous year, our North American business excluding our Fineline

operation grew 26 percent,” said Vicki Holt, President and Chief

Executive Officer of Proto Labs. “We continue to add to our sales

and marketing teams worldwide as we believe this will drive further

revenue growth. In addition, best practices developed by our US

marketing team are being incorporated throughout all our

international operations to ensure consistent lead generation and

customer awareness. We remain extremely optimistic about the

outlook for Proto Labs and continue to make investments in the

business to drive sustainable growth long term.”

Additional highlights include:

- Gross margin was 60.6 percent of

revenue during the third quarter of 2014 compared with 61.8 percent

during the same quarter in 2013.

- During the third quarter of 2014,

spending on research and development, including the Protoworks

initiatives and integration activities related to Fineline, totaled

$4.6 million, or 8.3 percent of revenue. This compares to $3.0

million, or 7.2 percent of revenue, during the third quarter of

2013.

- Operating margin was 28.3 percent of

revenue during the third quarter of 2014 compared to 31.9 percent

during the third quarter of 2013.

- As measured on a year-to-date basis,

cash generated from operations totaled $40 million. Cash, cash

equivalents and investments totaled $119 million as of September

30, 2014.

“We remain on track with our integration of Fineline and

continue to see the value of our additive offering combined with

our legacy services of injection molding and CNC machining,”

commented Ms. Holt. “The new services we have rolled out this year

through our Protoworks initiatives, LSR molding and metal injection

molding, have been well-received and remain on track to provide

more meaningful revenue in 2015. In summary, I continue to be

impressed with the high-level of accomplishments of all our teams

and am confident our activities will continue to support our

long-term target model.”

Non-GAAP Financial Measure

The company has included non-GAAP net income, adjusted for

stock-based compensation expense and amortization expense, in this

press release to provide investors with additional information

regarding the company’s financial results. The company has provided

below a reconciliation of non-GAAP net income, adjusted for

stock-based compensation expense and amortization expense, to net

income, the most directly comparable measure calculated and

presented in accordance with GAAP. Non-GAAP net income, adjusted

for stock-based compensation expense and amortization expense, is

used by the company’s management and board of directors to

understand and evaluate operating performance and trends and

provides a useful measure for period-to-period comparisons of the

company’s business. Accordingly, the company believes that non-GAAP

net income, adjusted for stock-based compensation expense and

amortization expense, provides useful information to investors and

others in understanding and evaluating operating results in the

same manner as our management and board of directors.

Conference Call

The company has scheduled a conference call to discuss its third

quarter financial results today, October 23, 2014 at 8:30 a.m. ET.

To access the call in the U.S. please dial 877-709-8150. Outside

the U.S. please dial 201-689-8354. No participant code is required.

A simultaneous webcast of the call will also be available on the

investor relations section of the company’s website at

www.protolabs.com/investors. An audio replay will be available for

14 days following the call on the investor relations website of

Proto Lab’s website.

About Proto Labs, Inc.

Proto Labs is a leading online and technology-enabled quick-turn

manufacturer of custom parts for prototyping and short-run

production. Proto Labs provides “Real Parts, Really Fast” to

product developers worldwide. Proto Labs utilizes computer

numerical control (CNC) machining, injection molding, and additive

manufacturing (3D printing), to manufacture custom parts for our

customers. For more information, visit protolabs.com.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical or current facts are “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements involve known and unknown

risks, uncertainties and other factors which may cause the results

of Proto Labs to be materially different than those expressed or

implied in such statements. Certain of these risk factors and

others are described in the “Risk Factors” section within reports

filed with the SEC. Other unknown or unpredictable factors also

could have material adverse effects on Proto Labs’ future results.

The forward-looking statements included in this press release are

made only as of the date hereof. Proto Labs cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, Proto Labs expressly disclaims

any intent or obligation to update any forward-looking statements

to reflect subsequent events or circumstances.

Proto Labs, Inc. Condensed Consolidated Balance

Sheets (In thousands)

September 30, December 31, 2014

2013 (Unaudited)

Assets Current assets Cash and cash equivalents $ 34,268 $

43,039 Short-term marketable securities 24,212 36,339 Accounts

receivable, net 25,460 18,320 Inventory 5,705 5,166 Other current

assets 7,953 6,931 Total current assets 97,598

109,795 Property and equipment, net 87,962 56,101 Long-term

marketable securities 60,449 64,023 Goodwill 28,916 - Other

intangible assets, net 4,269 - Other long-term assets 232

256 Total assets $ 279,426 $ 230,175

Liabilities

and shareholders' equity Current liabilities Accounts payable $

7,973 $ 6,455 Accrued compensation 8,154 6,196 Accrued liabilities

and other 3,804 808 Current portion of long-term debt obligations

164 204

Total current liabilities

20,095 13,663 Long-term deferred tax liabilities 4,112 3,682

Long-term debt obligations 42 159 Other long-term liabilities 854

1,028 Shareholders' equity 254,323 211,643

Total liabilities and shareholders' equity $ 279,426 $ 230,175

Proto Labs, Inc. Condensed Consolidated

Statements of Operations (In thousands, except share and per

share amounts) (Unaudited)

Three Months Ended Nine

Months Ended September 30,

September 30, 2014

2013 2014

2013 Revenue Protomold $ 35,655 $ 29,534 $

104,604 $ 84,338 Firstcut 15,549 12,474 43,407 34,732 Fineline

3,370 -

5,503 - Total revenue

54,574 42,008 153,514 119,070 Cost of revenue

21,492 16,053

58,725 44,983 Gross profit

33,082 25,955 94,789 74,087 Operating expenses Marketing and

sales 7,351 5,409 21,029 16,222 Research and development 4,555

3,026 11,925 8,405 General and administrative

5,733 4,118

15,970 12,035 Total

operating expenses

17,639

12,553 48,924

36,662 Income from operations 15,443 13,402 45,865

37,425 Other income (expense), net

(56

) 31 (19

) 149 Income before income taxes

15,387 13,433 45,846 37,574 Provision for income taxes

5,003 4,561

14,404 11,804 Net income

$ 10,384 $

8,872 $ 31,442

$ 25,770 Net income per share:

Basic

$ 0.40 $

0.35 $ 1.23

$ 1.03 Diluted

$

0.40 $ 0.34

$ 1.20 $

1.00 Shares used to compute net income per

share: Basic 25,757,593 25,384,940 25,651,156 25,121,941 Diluted

26,200,741 26,002,240 26,109,539 25,794,950

Proto Labs, Inc. Condensed Consolidated Statements of

Cash Flows (In thousands) (Unaudited)

Nine Months Ended September 30,

2014 2013 Operating activities Net

income $ 31,442 $ 25,770 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 7,696 5,528 Stock-based compensation expense 3,561

2,595 Deferred taxes 487 (61 ) Excess tax benefit from stock-based

compensation (4,383 ) (8,198 ) Amortization of held-to-maturity

securities 1,194 1,007 Loss on disposal of property and equipment -

111 Changes in operating assets and liabilities

7 8,148 Net cash

provided by operating activities

40,004

34,900 Investing

activities Purchases of property and equipment (35,928 )

(12,976 ) Acquisitions, net of cash acquired (33,864 ) - Purchases

of marketable securities (47,338 ) (82,657 ) Proceeds from sales

and maturities of marketable securities

61,896

50,663 Net cash used in investing

activities

(55,234 )

(44,970 ) Financing

activities Payments on debt (1,005 ) (211 ) Acquisition-related

contingent consideration (800 ) - Proceeds from exercises of stock

options and other 3,962 4,635 Excess tax benefit from stock-based

compensation

4,383

8,198 Net cash provided by financing activities

6,540 12,622

Effect of exchange rate changes on cash and cash equivalents

(81 ) 71

Net increase (decrease) in cash and cash equivalents (8,771

) 2,623

Cash and cash equivalents, beginning of period

43,039 36,759

Cash and cash equivalents, end of period $

34,268 $ 39,382

Proto Labs, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measure (In

thousands, except share and per share amounts)

(Unaudited) Three

Months Ended Nine Months Ended September 30,

2014 September 30, 2014

Non-GAAP net income, adjusted for

stock-based compensation and amortization expenses:

GAAP net income $ 10,384 $ 31,442 Add back: Stock-based

compensation expense Cost of revenue 103 282 Marketing and sales

250 685 Research and development 287 770 General and administrative

673 1,824

Total stock-based compensation expense 1,313 3,561 Income tax

benefits on stock-based compensation expense

(417 ) (1,128

) Non-GAAP net income adjusted for stock-based

compensation expense

11,280

33,875 Add back: Amortization expense General

and administrative 186 311 Income tax benefits on amortization

expense

(65 )

(109 )

Non-GAAP net income adjusted for

stock-based compensation and amortization expenses

$ 11,401 $

34,077 Non-GAAP net income per share:

Basic

$ 0.44 $

1.33 Diluted

$ 0.44

$ 1.31 Shares used

to compute non-GAAP net income per share: Basic 25,757,593

25,651,156 Diluted 26,200,741 26,109,539

Proto Labs, Inc. Revenue by Geography - Based on

Shipping Location (In thousands) (Unaudited)

Three Months Ended

Nine Months Ended September 30, 2014

September 30, 2014 Revenues Domestic United

States $ 40,822 $ 113,810 International Europe 9,333 27,523 Japan

1,878 5,210 United States

2,541

6,971 Total international

13,752

39,704 Total revenue

$

54,574 $ 153,514

Proto Labs, Inc. Customer Information (In

thousands, except customer amounts) (Unaudited)

Nine Months

Ended September 30, 2014 2013 Number of

Number of Customers Revenue ($)

Customers Revenue ($) New customers -

Protomold and Firscut 2,564 $ 16,054 2,261 $ 14,636 Existing

customers - Protomold and Firscut

6,154

131,957 5,315 104,434

Total

8,718 $ 148,011

7,576 $ 119,070

Note: the data above does not include

customers who purchased Fineline products during the periods

presented

Proto Labs, Inc. Product

Developer Information (Unaudited)

Three Months Ended

Nine Months Ended September 30, September 30,

2014 2013 2014 2013 Unique

product developers served - Protomold and Firscut

8,680 7,308 15,942

13,421

Note: the

data above does not include product developers who purchased

Fineline products during the periods presented

For Proto Labs, Inc.Investor Relations:Jack Judd,

763-479-7408jack.judd@protolabs.comorJenifer Kirtland,

408-656-9496jkirtland@evcgroup.comorMedia Relations:Bill

Dietrick, 763-479-7664bill.dietrick@protolabs.com

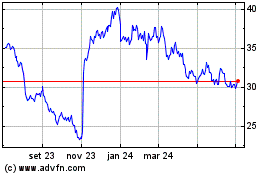

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

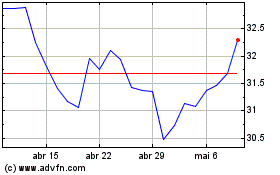

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024