Quarterly Revenue Increases 27% Year over

Year to $58.5 Million

Proto Labs, Inc. (NYSE: PRLB), a leading online and

technology-enabled, quick-turn, on-demand manufacturer, today

announced financial results for the first quarter ended March 31,

2015.

Highlights include:

- Revenue for the first quarter of 2015

increased to a record $58.5 million, 27 percent above revenue of

$46.1 million in the first quarter of 2014, and an increase of 31

percent versus the prior year in constant currencies.

- Revenue from additive services (3D

printing) through the FineLine acquisition completed last April

totaled $4.5 million in the first quarter, a 79 percent increase

compared to FineLine’s first quarter of 2014.

- Revenue growth was driven by a 44

percent increase in the number of unique product developers and

engineers served over the prior year period.

- Net income for the first quarter of

2015 was $10.5 million, or $0.40 per diluted share. Non-GAAP net

income, excluding the after tax expense of stock compensation,

amortization of intangibles, and non-cash unrealized foreign

currency losses, was $11.9 million, or $0.45 per diluted share. See

“Non-GAAP Financial Measure” below.

“We generated strong revenue growth in the first quarter, with

growth on a constant currency basis in all three of our

geographies,” said Vicki Holt, President and Chief Executive

Officer. “Revenue in North America grew 36%, reflecting strong

demand across our product lines and a significant contribution from

the additive business. Japan continues to perform well with revenue

up 44% on a constant currency basis and 23% as reported. Revenue in

Europe grew 10% in constant currencies, reflecting an increase in

the volume of units sold, while declining 5% as reported. During

the quarter, we served 11,000 unique product developers and

engineers, a 44% increase over the prior year.”

Additional Highlights include:

- Gross margin was 60.2 percent of

revenue for the first quarter of 2015 compared with 63.0 percent

during the same quarter last year and 59.9 percent in the fourth

quarter of 2014. Contributing to the year over year decline was a

lower gross margin on the additive business, representing

approximately 110 basis points, and a 220 basis point impact from

foreign currency exchange rates.

- GAAP operating margin was 27.1 percent

of revenue during the first quarter of 2015 compared to 31.4

percent for the first quarter of 2014 and 26.2 percent in the

fourth quarter of 2014.

- Cash generated from operations during

the first quarter totaled $15.4 million. Cash, cash equivalents and

investments totaled $137.2 million at March 31, 2015.

“We remain focused on the growth initiatives we established for

2015. We continue to invest in sales and marketing efforts, adding

staff in select areas, installing new sales and marketing

automation software and pursuing new approaches to expand awareness

and drive sales. Expansion of new materials and processes is

proceeding on plan. We completed the full launch of lathe-turned

parts in North America and Europe in the first quarter and while

early, we are pleased with its reception in the market. We are

excited about the potential for Proto Labs and continue to be

confident in the successful execution of our growth strategies to

drive revenue and enhanced profitability in 2015 and beyond,”

concluded Ms. Holt.

Non-GAAP Financial Measures

The company has included non-GAAP adjusted revenue growth that

excludes the impact of changes in foreign currency exchange rates

from total revenues in this press release to provide investors with

additional information regarding the company’s financial results.

Management believes this metric is useful in evaluating the

underlying business trends and ongoing operating performance of the

company.

The company has also included non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, and

non-cash unrealized foreign currency activity (collectively

“non-GAAP net income”), in this press release to provide investors

with additional information regarding the company’s financial

results. The company has provided below a reconciliation of

non-GAAP net income to net income, the most directly comparable

measure calculated and presented in accordance with GAAP. Non-GAAP

net income is used by the company’s management and board of

directors to understand and evaluate operating performance and

trends and provides a useful measure for period-to-period

comparisons of the company’s business. Accordingly, the company

believes that non-GAAP net income provides useful information to

investors and others in understanding and evaluating operating

results in the same manner as our management and board of

directors.

Conference Call

The company has scheduled a conference call to discuss its first

quarter financial results today, April 23, 2015 at 8:30 a.m. ET. To

access the call in the U.S. please dial 877-709-8150. Outside the

U.S. please dial 201-689-8354. No participant code is required. A

simultaneous webcast of the call will be available via the investor

relations section of the Proto Labs website and the following link:

http://edge.media-server.com/m/p/j3cc47as/lan/en. An audio replay

will be available for 14 days following the call on the investor

relations section of Proto Labs’ website.

About Proto Labs, Inc.

Proto Labs is a leading online and technology-enabled,

quick-turn, on-demand manufacturer of custom parts for prototyping

and short-run production. Proto Labs provides “Real Parts, Really

Fast” to product developers and engineers worldwide. Proto Labs

utilizes computer numerical control (CNC) machining, injection

molding, and additive manufacturing (3D printing), to manufacture

custom parts for our customers. For more information, visit

protolabs.com.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical or current facts are “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements involve known and unknown

risks, uncertainties and other factors which may cause the results

of Proto Labs to be materially different than those expressed or

implied in such statements. Certain of these risk factors and

others are described in the “Risk Factors” section within reports

filed with the SEC. Other unknown or unpredictable factors also

could have material adverse effects on Proto Labs’ future results.

The forward-looking statements included in this press release are

made only as of the date hereof. Proto Labs cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, Proto Labs expressly disclaims

any intent or obligation to update any forward-looking statements

to reflect subsequent events or circumstances.

Proto Labs, Inc. Condensed Consolidated Balance

Sheets (In thousands)

March 31, December

31, 2015 2014

(Unaudited) Assets Current assets Cash

and cash equivalents $ 52,553 $ 43,329 Short-term marketable

securities 29,055 30,706 Accounts receivable, net 28,382 24,226

Inventory 6,386 6,194 Other current assets 4,836

3,889 Total current assets 121,212 108,344 Property and

equipment, net 94,028 91,626 Long-term marketable securities 55,594

54,318 Goodwill 28,916 28,916 Other intangible assets, net 3,896

4,083 Other long-term assets 226 227 Total assets $

303,872 $ 287,514

Liabilities and shareholders'

equity Current liabilities Accounts payable $ 8,566 $ 7,882

Accrued compensation 7,865 6,067 Accrued liabilities and other

2,048 2,718 Income taxes payable 3,958 1,953 Current portion of

long-term debt obligations 95 139 Total current

liabilities 22,532 18,759 Long-term deferred tax liabilities

2,170 1,846 Long-term debt obligations

-

10 Other long-term liabilities 1,522 1,360 Shareholders'

equity 277,648 265,539 Total liabilities and

shareholders' equity $ 303,872 $ 287,514

Proto

Labs, Inc. Condensed Consolidated Statements of

Operations (In thousands, except share and per share

amounts) (Unaudited)

Three Months Ended March 31,

2015

2014

Revenue Protomold $ 37,618 $ 32,694 Firstcut 16,370 13,380 Fineline

4,548 - Total

revenue 58,536 46,074 Cost of revenue

23,282 17,050 Gross profit

35,254 29,024 Operating expenses Marketing and sales 8,854

6,417 Research and development 4,314 3,456 General and

administrative

6,245

4,703 Total operating expenses

19,413 14,576 Income from

operations 15,841 14,448 Other income (expense), net

(457 ) 103 Income

before income taxes 15,384 14,551 Provision for income taxes

4,931 4,449 Net income

$ 10,453 $

10,102 Net income per share: Basic

$ 0.40 $

0.40 Diluted

$ 0.40

$ 0.39 Shares used to compute net

income per share: Basic 25,850,274 25,573,851 Diluted 26,214,204

26,091,069

Proto Labs, Inc. Condensed

Consolidated Statements of Cash Flows (In thousands)

(Unaudited) Three Months

Ended March 31, 2015 2014

Operating activities Net income $ 10,453 $ 10,102

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 3,399 2,106

Stock-based compensation expense 1,342 998 Deferred taxes 343 107

Excess tax benefit from stock-based compensation (510 ) (897 )

Amortization of held-to-maturity securities 305 482 Changes in

operating assets and liabilities

85

2,368 Net cash provided by operating

activities

15,417

15,266 Investing activities

Purchases of property and equipment (6,230 ) (9,892 ) Purchases of

marketable securities (11,575 ) (32,385 ) Proceeds from sales and

maturities of marketable securities

11,646

26,590 Net cash used in investing

activities

(6,159 )

(15,687 ) Financing

activities Payments on debt (49 ) (50 ) Acquisition-related

contingent consideration (1,000 ) - Proceeds from exercises of

stock options and other 878 665 Excess tax benefit from stock-based

compensation

510 897

Net cash provided by financing activities

339 1,512 Effect of

exchange rate changes on cash and cash equivalents

(373 ) 71

Net increase in cash and cash equivalents 9,224 1,162

Cash and cash equivalents, beginning of period

43,329 43,039

Cash and cash equivalents, end of period $

52,553 $ 44,201

Proto Labs, Inc. Reconciliation of

GAAP to Non-GAAP Financial Measure (In thousands, except

share and per share amounts) (Unaudited)

Three Months Ended March

31,

2015

2014

Non-GAAP net income, adjusted for stock-based compensation expense,

amortization expense and unrealized loss (gain) on foreign

currency: GAAP net income $ 10,453 $ 10,102 Add back: Stock-based

compensation expense Cost of revenue 111 82 Marketing and sales 236

195 Research and development 294 215 General and administrative

701 506

Total stock-based compensation expense

1,342 998 Income tax benefits on stock-based compensation expense

(406 ) (312

) Non-GAAP net income adjusted for stock-based

compensation expense

11,389

10,788 Add back: Amortization expense General

and administrative 186 - Income tax benefits on amortization

expense

(65 )

- Non-GAAP net income adjusted for stock-based

compensation and amortization expenses

11,510

10,788 Add back: Unrealized loss

(gain) on foreign currency Other income (expense), net 453 (13 )

Income tax benefits on unrealized loss (gain) on foreign currency

(97 ) 4

Non-GAAP net income adjusted for stock-based compensation expense,

amortization expense and unrealized loss (gain) on foreign currency

$ 11,866 $

10,779 Non-GAAP net income per

share: Basic

$ 0.46 $

0.42 Diluted

$ 0.45

$ 0.41 Shares used

to compute non-GAAP net income per share: Basic 25,850,274

25,573,851 Diluted 26,214,204 26,091,069

Proto

Labs, Inc. Comparison of GAAP to Non-GAAP Revenue Growth

(In thousands) (Unaudited)

Three Months Ended %

Change March 31, % Constant

2015

2014

Change

Currencies1 Revenues United

States $ 47,429 $ 34,984 35.6 % 35.6 % Europe 8,781 9,205 -4.6 %

10.3 % Japan

2,326 1,885

23.4 % 43.5 %

Total Revenue

$ 58,536 $

46,074 27.0 %

30.9 %

1 First quarter 2015 growth has been recalculated using first

quarter 2014 foreign currency exchange rates to provide information

useful in evaluating the underlying business trends excluding the

impact of changes in foreign currency exchange rates.

Proto Labs, Inc. Revenue by Geography - Based on

Shipping Location (In thousands) (Unaudited)

Three Months Ended

March 31,

2015

2014

Revenues Domestic United States $ 44,845 $ 33,022 International

Europe 8,781 9,205 Japan 2,326 1,885 United States

2,584 1,962 Total international

13,691 13,052 Total revenue

$ 58,536 $

46,074 Proto Labs, Inc.

Product Developer Information (Unaudited)

Three Months Ended March 31,

2015 2014 Unique product

developers and engineers served

11,009

7,669

For Proto Labs, Inc.Investor Relations:John Way,

763-479-7726john.way@protolabs.comorJenifer Kirtland,

408-656-9496jkirtland@evcgroup.comorMedia Relations:Bill Dietrick,

763-479-7664bill.dietrick@protolabs.com

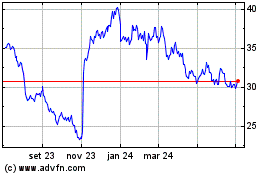

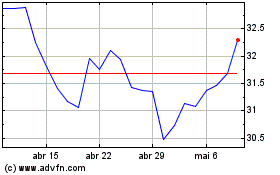

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024