Quarterly Revenue Increases 21% Year over

Year to $64.0 Million

Record Quarterly Net Income of $11.7

Million

Proto Labs, Inc. (NYSE: PRLB), a leading online and

technology-enabled, quick-turn, on-demand manufacturer, today

announced financial results for the second quarter ended June 30,

2015.

Highlights include:

- Revenue for the second quarter of 2015

increased to a record $64.0 million, 21 percent above revenue of

$52.9 million in the second quarter of 2014. On a constant currency

basis, revenue was up 25 percent versus the prior year.

- Revenue from additive services (3D

printing) through the Fineline acquisition completed in April 2014

totaled $5.4 million, an increase of 86 percent from the second

quarter of 2014.

- Revenue growth reflected a 28 percent

increase in the number of unique product developers and engineers

served over the prior year period.

- Net income for the second quarter of

2015 was a record $11.7 million, or $0.44 per diluted share.

Non-GAAP net income, excluding the after-tax expense of stock

compensation, amortization of intangibles, and non-cash unrealized

foreign currency losses, was $13.0 million, or $0.50 per diluted

share. See “Non-GAAP Financial Measure” below.

“Our second quarter results reflected strong execution in many

areas,” said Vicki Holt, President and Chief Executive Officer.

“Revenue in North America grew 23 percent, driven primarily by

growth in additive manufacturing and Firstcut services. We were

especially pleased with the growth in European revenue, up 33.5

percent on a constant currency basis, 12 percent when translated to

dollars. Japan also executed well, generating an increase in

revenue of 33 percent on a constant currency basis, 12 percent as

reported. The growth across all regions reflected the actions we

took earlier in the year to strengthen the leadership team and

drive more focused marketing and sales efforts.”

Additional Highlights include:

- Gross margin was 58.7 percent of

revenue for the second quarter of 2015 compared with 61.8 percent

during the same quarter last year. The current period reflects a

lower gross margin on the additive business, representing

approximately 90 basis points. Foreign currency exchange rates had

an 80 basis point impact year over year with the remaining

difference driven by capacity additions and business mix.

- GAAP operating margin was 27.1 percent

of revenue during the second quarter of 2015 compared to 30.2

percent for the second quarter of 2014.

- Cash generated from operations during

the second quarter totaled $12.4 million. Cash, cash equivalents

and investments were $142.0 million at June 30, 2015 compared with

$137.2 million at March 31, 2015.

“We continue to focus on our priorities – to enhance our

targeted sales and marketing efforts worldwide, expand our envelope

of manufacturing services and continually improve customer service.

We are making progress on each of these initiatives. In the second

half of the year, we anticipate growing demand for our recently

introduced materials and processes, including lathe-turned parts in

North America and Europe, the full launch of additive manufacturing

in Europe in the third quarter and the introduction of the lathe

process in Japan later in 2015. Our expanded sales and marketing

focus is beginning to gain traction. While there is much work

ahead, we remain committed to our continued execution and believe

our success will result in strong, consistent revenue growth and

profitability,” concluded Ms. Holt.

Non-GAAP Financial Measures

The company has included non-GAAP adjusted revenue growth that

excludes the impact of changes in foreign currency exchange rates

from total revenues in this press release to provide investors with

additional information regarding the company’s financial results.

Management believes this metric is useful in evaluating the

underlying business trends and ongoing operating performance of the

company.

The company has also included non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, and

non-cash unrealized foreign currency activity (collectively,

“non-GAAP net income”), in this press release to provide investors

with additional information regarding the company’s financial

results. The company has provided below a reconciliation of

non-GAAP net income to net income, the most directly comparable

measure calculated and presented in accordance with GAAP. Non-GAAP

net income is used by the company’s management and board of

directors to understand and evaluate operating performance and

trends and provides a useful measure for period-to-period

comparisons of the company’s business. Accordingly, the company

believes that non-GAAP net income provides useful information to

investors and others in understanding and evaluating operating

results in the same manner as our management and board of

directors.

Conference Call

The company has scheduled a conference call to discuss its

second quarter financial results today, July 23, 2015 at 8:30 a.m.

ET. To access the call in the U.S. please dial 877-709-8150.

Outside the U.S. please dial 201-689-8354. No participant code is

required. A simultaneous webcast of the call will be available via

the investor relations section of the Proto Labs website and the

following link: http://edge.media-server.com/m/p/waibd344/lan/en.

An audio replay will be available for 14 days following the call on

the investor relations section of Proto Labs’ website.

About Proto Labs, Inc.

Proto Labs is the world's fastest digital manufacturing source

for custom prototypes and low-volume production parts. The

technology-enabled company uses advanced 3D printing, CNC machining

and injection molding technologies to produce parts within days.

The result is an unprecedented speed-to-market value for product

designers and engineers worldwide. Visit protolabs.com for more

information.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical or current facts are “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements involve known and unknown

risks, uncertainties and other factors which may cause the results

of Proto Labs to be materially different than those expressed or

implied in such statements. Certain of these risk factors and

others are described in the “Risk Factors” section within reports

filed with the SEC. Other unknown or unpredictable factors also

could have material adverse effects on Proto Labs’ future results.

The forward-looking statements included in this press release are

made only as of the date hereof. Proto Labs cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, Proto Labs expressly disclaims

any intent or obligation to update any forward-looking statements

to reflect subsequent events or circumstances.

Proto Labs, Inc.

Condensed Consolidated Balance

Sheets

(In thousands)

June 30,

December 31,

2015

2014

(Unaudited)

Assets

Current assets Cash and cash equivalents $ 56,324 $ 43,329

Short-term marketable securities 31,190 30,706 Accounts receivable,

net 29,493 24,226 Inventory 6,828 6,194 Income taxes receivable

2,931 - Other current assets 4,399 3,889 Total

current assets 131,165 108,344 Property and equipment, net

100,921 91,626 Long-term marketable securities 54,482 54,318

Goodwill 28,916 28,916 Other intangible assets, net 3,710 4,083

Other long-term assets 197 227 Total assets $ 319,391

$ 287,514

Liabilities and shareholders'

equity

Current liabilities Accounts payable $ 11,334 $ 7,882 Accrued

compensation 8,264 6,067 Accrued liabilities and other 1,779 2,718

Income taxes payable - 1,953 Current portion of long-term debt

obligations 71 139 Total current liabilities 21,448

18,759 Long-term deferred tax liabilities 2,423 1,846

Long-term debt obligations - 10 Other long-term liabilities 1,533

1,360 Shareholders' equity 293,987 265,539

Total liabilities and shareholders' equity $ 319,391 $ 287,514

Proto Labs, Inc. Condensed Consolidated

Statements of Operations (In thousands, except share and per

share amounts) (Unaudited)

Three Months Ended Six Months Ended June

30, June 30,

2015

2014

2015

2014

Revenue Protomold $ 39,932 $ 36,255 $ 77,550 $ 68,949 Firstcut

18,585 14,478 34,955 27,858 Fineline

5,452

2,133 10,000

2,133 Total revenue 63,969 52,866

122,505 98,940 Cost of revenue

26,419

20,183 49,701

37,233 Gross profit 37,550 32,683 72,804

61,707 Operating expenses Marketing and sales 9,502 7,261

18,356 13,678 Research and development 4,397 3,914 8,711 7,370

General and administrative

6,304

5,534 12,549

10,237 Total operating expenses

20,203 16,709

39,616 31,285 Income from

operations 17,347 15,974 33,188 30,422 Other income (expense), net

(36 ) (66

) (493 )

37 Income before income taxes 17,311 15,908 32,695

30,459 Provision for income taxes

5,625

4,952 10,556

9,401 Net income

$

11,686 $ 10,956

$ 22,139 $

21,058 Net income per share: Basic

$ 0.45 $

0.43 $ 0.86

$ 0.82 Diluted

$

0.44 $ 0.42

$ 0.84 $

0.81 Shares used to compute net income per

share: Basic 25,921,111 25,620,005 25,885,888 25,597,055 Diluted

26,277,503 26,146,848 26,245,135 26,132,265

Proto

Labs, Inc. Condensed Consolidated Statements of Cash

Flows (In thousands) (Unaudited)

Six Months Ended June 30, 2015 2014

Operating activities

Net income $ 22,139 $ 21,058 Adjustments to reconcile net income to

net cash provided by operating activities: Depreciation and

amortization 6,940 4,683 Stock-based compensation expense 2,909

2,248 Deferred taxes 620 107 Excess tax benefit from stock-based

compensation (989 ) (1,623 ) Amortization of held-to-maturity

securities 632 854 Changes in operating assets and liabilities

(4,418 )

(1,310 ) Net cash provided by operating

activities

27,833

26,017 Investing activities

Purchases of property and equipment (15,717 ) (31,625 )

Acquisitions, net of cash acquired

-

(33,864 ) Purchases of marketable securities (25,389 ) (38,463 )

Proceeds from sales and maturities of marketable securities

24,109 55,441 Net

cash used in investing activities

(16,997

) (48,511 )

Financing activities Payments on debt (77 ) (954 )

Acquisition-related contingent consideration (1,000 ) (400 )

Proceeds from exercises of stock options and other 2,207 1,806

Excess tax benefit from stock-based compensation

989 1,623 Net cash

provided by financing activities

2,119

2,075 Effect of exchange rate changes on

cash and cash equivalents

40

234

Net increase (decrease) in cash and

cash equivalents

12,995 (20,185 )

Cash and cash equivalents, beginning of

period

43,329 43,039

Cash and cash equivalents, end of

period

$ 56,324 $

22,854 Proto Labs, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measure (In

thousands, except share and per share amounts)

(Unaudited) Three Months

Ended Six Months Ended June 30,

June 30,

2015

2014

2015

2014

Non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense and

unrealized loss (gain) on foreign currency:

GAAP net income $ 11,686 $ 10,956 $ 22,139 $ 21,058 Add back:

Stock-based compensation expense Cost of revenue 132 97 243 179

Marketing and sales 271 240 507 435 Research and development 336

268 630 483 General and administrative

828

645 1,529

1,151 Total stock-based

compensation expense 1,567 1,250 2,909 2,248 Income tax benefits on

stock-based compensation expense

(479

) (398 )

(884 ) (710

) Non-GAAP net income adjusted for stock-based

compensation expense

12,774

11,808 24,164

22,596 Add back: Amortization expense General

and administrative 186 124 373 124 Income tax benefits on

amortization expense

(65 )

(43 ) (131

) (43 )

Non-GAAP net income adjusted for

stock-based compensation and amortization expenses

12,895 11,889

24,406 22,677

Add back: Unrealized loss (gain) on foreign currency Other income

(expense), net 165 140 618 127 Income tax benefits on unrealized

loss (gain) on foreign currency

(30

) (25 )

(128 ) (21

)

Non-GAAP net income adjusted for

stock-based compensation expense, amortization expense and

unrealized loss (gain) on foreign currency

$ 13,030 $

12,004 $ 24,896

$ 22,783

Non-GAAP net income per share: Basic

$

0.50 $ 0.47

$ 0.96 $

0.89 Diluted

$ 0.50

$ 0.46 $

0.95 $ 0.87

Shares used to compute non-GAAP net income per share: Basic

25,921,111 25,620,005 25,885,888 25,597,055 Diluted 26,277,503

26,146,848 26,245,135 26,132,265

Proto Labs,

Inc. Comparison of GAAP to Non-GAAP Revenue Growth

(In thousands) (Unaudited) Three

Months Ended % Change Six Months

Ended % Change June

30, % Constant June

30, % Constant

2015

2014

Change

Currencies1

2015

2014

Change

Currencies1 Revenues United

States $ 52,270 $ 42,434 23.2% 23.2% $ 99,699 $ 77,418 28.8% 28.8%

Europe 10,083 8,985 12.2% 33.5% 18,864 18,190 3.7% 20.5% Japan

1,616 1,447 11.6%

33.0% 3,942 3,332

18.3% 38.9% Total Revenue

$

63,969 $ 52,866 21.0%

25.2% $ 122,505 $ 98,940

23.8% 27.8%

1 Revenue growth for the three- and

six-month periods ended June 30, 2015 has been recalculated using

2014 foreign currency exchange rates in effect during comparable

periods to provide information useful in evaluating the underlying

business trends excluding the impact of changes in foreign currency

exchange rates.

Proto Labs, Inc. Revenue by Geography -

Based on Shipping Location (In thousands)

(Unaudited) Three Months

Ended Six Months Ended June 30,

June 30,

2015

2014

2015

2014

Revenues Domestic United States $ 49,298 $ 39,966 $ 94,143 $ 72,988

International Europe 10,083 8,985 18,864 18,190 Japan 1,616 1,447

3,942 3,332 United States

2,972

2,468 5,556

4,430 Total international

14,671

12,900 28,362

25,952 Total revenue

$

63,969 $ 52,866

$ 122,505 $

98,940

Proto Labs, Inc. Product

Developer Information (Unaudited)

Three Months Ended Six Months Ended June

30, June 30, 2015 2014 2015

2014 Unique product developers and engineers served

11,822 9,234 17,194

13,115

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150723005439/en/

For Proto Labs, Inc.Investor Relations:John Way,

763-479-7726john.way@protolabs.comorJenifer Kirtland,

408-656-9496jkirtland@evcgroup.comorMedia Relations:Bill

Dietrick, 763-479-7664bill.dietrick@protolabs.com

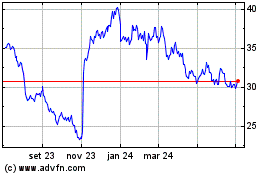

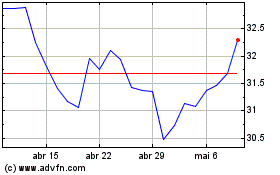

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024