Quarterly Revenue Increases 17 Percent Year

over Year to Record $75.0 Million

Proto Labs, Inc. (NYSE:PRLB), a leading online and

technology-enabled, quick-turn, on-demand manufacturer, today

announced financial results for the second quarter ended June 30,

2016.

Second Quarter 2016 Highlights include:

- Revenue for the second quarter of 2016

was $75.0 million, 17 percent above revenue of $64.0 million in the

second quarter of 2015. Alphaform, the German company acquired in

the fourth quarter of 2015, contributed $4.8 million in revenue in

the second quarter. Excluding this contribution, legacy revenue

totaled $70.2 million, an increase of 10 percent compared with the

second quarter of 2015.

- Revenue from 3D printing totaled $9.1

million. Excluding Alphaform’s $2.1 million in 3D printing revenue,

legacy 3D printing revenue was $7.0 million, an increase of 29

percent from the 2015 second quarter.

- The number of unique product developers

and engineers served increased 14 percent to 13,519 from 11,822 in

the second quarter of 2015.

- Net income for the second quarter of

2016 was $10.7 million, or $0.40 per diluted share. Non-GAAP net

income, excluding the after-tax expense of stock compensation,

amortization of intangibles, nonrecurring expenses and unrealized

foreign currency gains, was $12.0 million, or $0.45 per diluted

share. See “Non-GAAP Financial Measures” below.

“Revenue growth was solid in the second quarter, driven by

continued strong growth in 3D printing, strength in our European

markets, and the contribution from Alphaform,” said Vicki Holt,

President and Chief Executive Officer. “We were also pleased with

the legacy growth in Europe in the quarter, which grew 24 percent

and we saw an improved performance in Japan with a revenue increase

of 46 percent year over year. In the Americas, we experienced

slower than expected growth in injection molding and CNC machining.

This was primarily due to a slowdown in the US industrial economy

as well as attrition in sales leadership.

“During the quarter, we improved our gross margins in both our

legacy operations as well as in our Alphaform business. We are also

beginning to see traction from our expanded sales and marketing

efforts of 3D printing in Europe and anticipate this business will

continue to grow throughout the year.”

Additional Second Quarter 2016 Highlights include:

- Gross margin was 56.4 percent of

revenue for the second quarter compared with 58.7 percent for the

second quarter of 2015 and 54.6 in the first quarter of 2016.

Alphaform had a 310 basis point negative impact on gross margin in

the second quarter of 2016.

- GAAP operating margin was 19.8 percent

of revenue during the second quarter of 2016 compared to 27.1

percent for the second quarter of 2015. On a non-GAAP basis,

operating margin was 23.6 percent. See “Non-GAAP Financial

Measures” below.

- Cash generated from operations during

the second quarter was $19.9 million. Cash and investments

increased $7.1 million during the quarter to $164.3 million at June

30, 2016.

“Over the next several quarters, we will be focused on driving

actions to improve our sales performance and efficiency through our

operations and we expect to see improvement in sales growth,

especially in the Americas, over time. We remain confident in the

fundamentals in our business - our market size, differentiated

proposition and excellent customer experience,” Ms. Holt

concluded.

Non-GAAP Financial Measures

The company has included non-GAAP adjusted revenue growth that

excludes the impact of changes in foreign currency exchange rates

and legacy revenue excluding the revenue contribution from

Alphaform from total revenues in this press release to provide

investors with additional information regarding the company’s

financial results. Management believes these metrics are useful in

evaluating the underlying business trends and ongoing operating

performance of the company.

The company has also included non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, unrealized

foreign currency activity, impairment on assets and charges related

to the exit of facilities (collectively, “non-GAAP net income”), in

this press release to provide investors with additional information

regarding the company’s financial results.

The company has also included a reconciliation of non-GAAP

condensed consolidated statement of operations to GAAP condensed

consolidated statement of operations. The non-GAAP condensed

consolidated statement of operations provides non-GAAP operating

income and non-GAAP net income, which are used by the company’s

management and board of directors to understand and evaluate

operating performance and trends and provide useful measures for

period-to-period comparisons of the company’s business.

Accordingly, the company believes that non-GAAP operating income

and non-GAAP net income provide useful information to investors and

others in understanding and evaluating operating results in the

same manner as our management and board of directors.

Conference Call

The company has scheduled a conference call to discuss its

second quarter financial results today, July 28, 2016 at 8:30 a.m.

ET. To access the call in the U.S. please dial 877-709-8150.

Outside the U.S. please dial 201-689-8354. No participant code is

required. A simultaneous webcast of the call will be available via

the investor relations section of the Proto Labs website and the

following link:

http://edge.media-server.com/m/p/dwf9w9tm/lan/en. A replay

will be available for 14 days following the call on the investor

relations section of Proto Labs’ website.

About Proto Labs, Inc.

Proto Labs is the world’s fastest digital manufacturing source

for custom prototypes and low-volume production parts. The

technology-enabled company uses advanced 3D printing, CNC machining

and injection molding technologies to produce parts within days.

The result is an unprecedented speed-to-market value for product

designers and engineers worldwide. Visit protolabs.com for more

information.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical or current facts are “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements involve known and unknown

risks, uncertainties and other factors which may cause the results

of Proto Labs to be materially different than those expressed or

implied in such statements. Certain of these risk factors and

others are described in the “Risk Factors” section within reports

filed with the SEC. Other unknown or unpredictable factors also

could have material adverse effects on Proto Labs’ future results.

The forward-looking statements included in this press release are

made only as of the date hereof. Proto Labs cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, Proto Labs expressly disclaims

any intent or obligation to update any forward-looking statements

to reflect subsequent events or circumstances.

Proto Labs, Inc.

Condensed Consolidated Balance Sheets (In thousands)

June 30, December 31, 2016

2015 (Unaudited)

Assets Current assets Cash and cash equivalents $ 57,331 $

47,653 Short-term marketable securities 39,216 33,201 Accounts

receivable, net 34,486 36,125 Inventory 9,901 9,771 Income taxes

receivable 2,005 6,028 Other current assets 5,468

5,224 Total current assets 148,407 138,002 Property and

equipment, net 138,685 125,475 Long-term marketable securities

67,730 64,789 Goodwill 28,916 28,916 Other intangible assets, net

2,980 3,337 Other long-term assets 1,305 517 Total

assets $ 388,023 $ 361,036

Liabilities and shareholders'

equity Current liabilities Accounts payable $ 11,435 $ 13,643

Accrued compensation 9,753 9,993

Accrued liabilities and other

2,491

2,626

Total current liabilities 23,679 26,262 Long-term deferred

tax liabilities 4,632 4,240 Other long-term liabilities 2,928 2,889

Shareholders' equity 356,784 327,645 Total

liabilities and shareholders' equity $ 388,023 $ 361,036

Proto Labs, Inc.

Condensed Consolidated Statements of Operations (In

thousands, except share and per share amounts)

(Unaudited) Three Months Ended Six Months

Ended June 30, June 30,

2016

2015

2016

2015

Revenue Injection Molding (Protomold) $ 44,762 $ 39,932 $ 87,931 $

77,550 CNC Machining (Firstcut) 19,854 18,585 38,729 34,955 3D

Printing (Fineline) 9,099 5,452 18,209 10,000 Other

1,246 -

2,660 - Total revenue

74,961 63,969 147,529 122,505 Cost of revenue

32,715 26,419

65,629 49,701 Gross profit

42,246 37,550 81,900 72,804 Operating expenses Marketing and

sales 11,453 9,502 22,395 18,356 Research and development 5,816

4,397 11,134 8,711 General and administrative

10,126 6,304

18,377 12,549 Total

operating expenses

27,395

20,203 51,906

39,616 Income from operations 14,851 17,347

29,994 33,188 Other income (expense), net

1,092

(36 ) 1,717

(493 ) Income before income taxes

15,943 17,311 31,711 32,695 Provision for income taxes

5,252 5,625

10,358 10,556 Net income

$ 10,691 $

11,686 $ 21,353

$ 22,139 Net income per

share: Basic

$ 0.41 $

0.45 $ 0.81

$ 0.86 Diluted

$

0.40 $ 0.44

$ 0.80 $ 0.84

Shares used to compute net income per share: Basic

26,368,001 25,921,111 26,295,074 25,885,888 Diluted 26,561,148

26,277,503 26,526,629 26,245,135

Proto Labs, Inc. Condensed Consolidated Statements

of Cash Flows (In thousands) (Unaudited)

Six Months Ended June 30, 2016 2015

Operating activities Net income $ 21,353 $ 22,139

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 8,147 6,940

Stock-based compensation expense 3,541 2,909 Deferred taxes 403 620

Excess tax benefit from stock-based compensation (1,916 ) (989 )

Amortization of held-to-maturity securities 590 632 Loss on

impairment of assets 455 - Other (1,095 ) - Changes in operating

assets and liabilities

5,084

(4,418 ) Net cash provided by operating

activities

36,562

27,833 Investing activities

Purchases of property and equipment (22,416 ) (15,717 ) Purchases

of marketable securities (38,304 ) (25,389 ) Proceeds from sales

and maturities of marketable securities

28,759

24,109 Net cash used in investing

activities

(31,961 )

(16,997 ) Financing

activities Payments on debt - (77 ) Acquisition-related

contingent consideration (400 ) (1,000 ) Proceeds from exercises of

stock options and other 3,729 2,207 Excess tax benefit from

stock-based compensation

1,916

989 Net cash provided by financing activities

5,245 2,119

Effect of exchange rate changes on cash and cash equivalents

(168 ) 40

Net increase in cash and cash equivalents 9,678 12,995

Cash and cash equivalents, beginning of period

47,653 43,329

Cash and cash equivalents, end of period $

57,331 $ 56,324

Proto Labs, Inc. Reconciliation of GAAP to

Non-GAAP Condensed Consolidated Statements of Operations (In

thousands, except share and per share amounts)

(Unaudited) Three Months Ended Three Months

Ended June 30, 2016 June 30,

2015

GAAP

Adjustments

Non-GAAP

GAAP

Adjustments

Non-GAAP

Revenue Injection Molding (Protomold) $ 44,762 $ - $ 44,762 $

39,932 $ - $ 39,932 CNC Machining (Firstcut) 19,854 - 19,854 18,585

- 18,585 3D Printing (Fineline) 9,099 - 9,099 5,452 - 5,452 Other

1,246 - 1,246 - -

- Total revenue 74,961 - 74,961 63,969 - 63,969

Cost of revenue

32,715

(268 ) 32,447

26,419 (131 )

26,288 Gross profit 42,246 268 42,514 37,550

131 37,681 Operating expenses Marketing and sales 11,453

(213 ) 11,240 9,502 (271 ) 9,231 Research and development 5,816

(480 ) 5,336 4,397 (336 ) 4,061 General and administrative

10,126 (1,892 )

8,234 6,304

(1,015 ) 5,289 Total

operating expenses

27,395

(2,585 ) 24,810

20,203 (1,622

) 18,581 Income from operations

14,851 2,853 17,704 17,347 1,753 19,100 Other income (expense), net

1,092 (806 )

286 (36 )

165 129 Income

before income taxes 15,943 2,047 17,990 17,311 1,918 19,229

Provision for income taxes

5,252

773 6,025

5,625 574

6,199 Net income

$ 10,691

$ 1,274 $

11,965 $ 11,686

$ 1,344 $

13,030 Net income per share: Basic

$ 0.41 $ 0.04

$ 0.45 $

0.45 $ 0.05

$ 0.50 Diluted

$

0.40 $ 0.05

$ 0.45 $ 0.44

$ 0.06 $

0.50 Shares used to compute net income per

share: Basic 26,368,001 26,368,001 26,368,001 25,921,111 25,921,111

25,921,111 Diluted 26,561,148 26,561,148 26,561,148 26,277,503

26,277,503 26,277,503

Proto Labs, Inc. Reconciliation of GAAP to

Non-GAAP Condensed Consolidated Statements of Operations (In

thousands, except share and per share amounts)

(Unaudited) Six Months Ended Six Months

Ended June 30, 2016 June 30,

2015

GAAP

Adjustments

Non-GAAP

GAAP

Adjustments

Non-GAAP

Revenue Injection Molding (Protomold) $ 87,931 $ - $ 87,931 $

77,550 $ - $ 77,550 CNC Machining (Firstcut) 38,729 - 38,729 34,955

- 34,955 3D Printing (Fineline) 18,209 - 18,209 10,000 - 10,000

Other 2,660 - 2,660 -

- - Total revenue 147,529 - 147,529 122,505 -

122,505 Cost of revenue

65,629

(398 ) 65,231

49,701 (243 )

49,458 Gross profit 81,900 398 82,298 72,804

243 73,047 Operating expenses Marketing and sales 22,395

(491 ) 21,904 18,356 (507 ) 17,849 Research and development 11,134

(774 ) 10,360 8,711 (630 ) 8,081 General and administrative

18,377 (3,108 )

15,269 12,549

(1,902 ) 10,647 Total

operating expenses

51,906

(4,373 ) 47,533

39,616 (3,039

) 36,577 Income from operations

29,994 4,771 34,765 33,188 3,282 36,470 Other income (expense), net

1,717 (1,130 )

587 (493 )

618 125 Income

before income taxes 31,711 3,641 35,352 32,695 3,900 36,595

Provision for income taxes

10,358

1,310 11,668

10,556 1,143

11,699 Net income

$ 21,353

$ 2,331 $

23,684 $ 22,139

$ 2,757 $

24,896 Net income per share: Basic

$ 0.81 $ 0.09

$ 0.90 $

0.86 $ 0.10

$ 0.96 Diluted

$

0.80 $ 0.09

$ 0.89 $ 0.84

$ 0.11 $

0.95 Shares used to compute net income per

share: Basic 26,295,074 26,295,074 26,295,074 25,885,888 25,885,888

25,885,888 Diluted 26,526,629 26,526,629 26,526,629 26,245,135

26,245,135 26,245,135

Proto Labs, Inc. Reconciliation of GAAP to Non-GAAP Net

Income per Share (In thousands, except share and per share

amounts) (Unaudited) Three Months Ended

Six Months Ended June 30, June

30,

2016

2015

2016

2015

Non-GAAP net income, adjusted for stock-based compensation expense,

amortization expense, unrealized (gain) loss on foreign currency,

impairment on assets and charges related to the exit of facilities

GAAP net income $ 10,691 $ 11,686 $ 21,353 $ 22,139 Add back:

Stock-based compensation expense 1,809 1,567 3,541 2,909

Amortization expense 171 186 357 373 Impairment on assets 455 - 455

- Facilities-related charges 418 - 418 - Unrealized (gain) loss on

foreign currency

(806 )

165 (1,130 )

618 Total adjustments

2,047 1,918

3,641 3,900 Income

tax benefits on adjustments

(773 )

(574 ) (1,310

) (1,143 ) Non-GAAP

net income

$ 11,965 $

13,030 $ 23,684

$ 24,896

Non-GAAP net income per share: Basic

$

0.45 $ 0.50

$ 0.90 $

0.96 Diluted

$ 0.45

$ 0.50 $

0.89 $ 0.95

Shares used to compute non-GAAP net income per share: Basic

26,368,001 25,921,111 26,295,074 25,885,888 Diluted 26,561,148

26,277,503 26,526,629 26,245,135

Proto Labs, Inc. Comparison of GAAP to Non-GAAP

Revenue Growth (In thousands) (Unaudited)

Three Months Ended % Change Six Months Ended

% Change June 30, %

Constant June 30, %

Constant

2016

2015

Change

Currencies1

2016

2015

Change

Currencies1

Revenues United States $ 55,323 $ 52,270 5.8 % 5.8 % $ 109,791 $

99,699 10.1 % 10.1 % Europe 17,277 10,083 71.3 % 73.5 % 32,907

18,864 74.4 % 78.2 % Japan

2,361

1,616 46.1 %

29.4 % 4,831

3,942 22.6 %

13.5 % Total Revenue

$

74,961 $ 63,969

17.2 % 17.1 %

$ 147,529 $

122,505 20.4 %

20.7 %

1 Revenue growth for the

three- and six-month periods ended June 30, 2016 has been

recalculated using 2015 foreign currency exchange rates in effect

during comparable periods to provide information useful in

evaluating the underlying business trends excluding the impact of

changes in foreign currency exchange rates.

Three Months Ended % Change Six Months Ended

% Change June 30, %

Constant June 30, %

Constant

2016

2015

Change2

Currencies2

2016

2015

Change2

Currencies2 Revenues United

States $ 55,323 $ 52,270 5.8 % 5.8 % $ 109,791 $ 99,699 10.1 % 10.1

% Europe 12,503 10,083 24.0 % 26.3 % 23,242 18,864 23.2 % 27.1 %

Japan

2,361 1,616

46.1 % 29.4 %

4,831 3,942

22.6 % 13.5 %

Total Revenue

$ 70,187 $

63,969 9.7 %

9.6 % $ 137,864

$ 122,505 12.5

% 12.8 %

2

Revenue growth for the three- and six-month periods ended June 30,

2016 has been recalculated to exclude revenue earned from our

acquisition of Alphaform, and using 2015 foreign currency exchange

rates in effect during comparable periods to provide information

useful in evaluating the underlying business trends excluding the

impact of changes in foreign currency exchange rates.

Proto Labs, Inc.

Revenue by Geography - Based on Shipping Location (In

thousands) (Unaudited) Three Months Ended

Six Months Ended June 30, June

30,

2016

2015

2016

2015

Revenues Domestic United States $ 51,852 $ 49,298 $ 102,419 $

94,143 International Europe 17,277 10,083 32,907 18,864 Japan 2,361

1,616 4,831 3,942 United States

3,471

2,972 7,372

5,556 Total international

23,109

14,671 45,110

28,362 Total revenue

$

74,961 $ 63,969

$ 147,529 $

122,505

Proto Labs, Inc. Product Developer

Information (Unaudited) Three Months Ended

Six Months Ended June 30, June 30, 2016

2015 2016 2015 Unique product developers and

engineers served

13,519 11,822

20,240 17,194

Note: the data above does

not include product developers and engineers who purchased products

attributable to our acquisition of Alphaform during the periods

presented.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160728005539/en/

Proto Labs, Inc.Investor Relations:John Way,

763-479-7726john.way@protolabs.comorJenifer Kirtland,

408-656-9496jkirtland@evcgroup.comorMedia Relations:Bill Dietrick,

763-479-7664bill.dietrick@protolabs.com

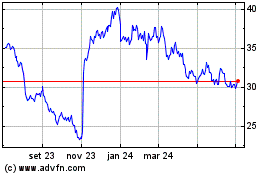

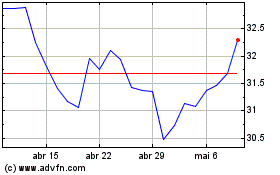

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024