Quarterly Revenue Increases 9.4% to a Record

$82.0 million

Quarterly Net Income Increases 13.0% to

$12.1 million

Proto Labs, Inc. (NYSE: PRLB), a leading online and

technology-enabled, quick-turn, on-demand manufacturer, today

announced financial results for the second quarter ended June 30,

2017.

Second Quarter 2017 Highlights include:

- Revenue for the second quarter of 2017

was $82.0 million, 9.4 percent above revenue of $75.0 million in

the second quarter of 2016.

- The number of unique product developers

and engineers served totaled 16,174 in the second quarter of 2017,

an increase of 18.8 percent over the second quarter of 2016.

- Net income for the second quarter of

2017 was $12.1 million, or $0.45 per diluted share. Non-GAAP net

income, excluding the after-tax expense of stock compensation,

amortization of intangibles, legal settlements and unrealized

foreign currency gains, was $13.1 million, or $0.49 per diluted

share. See “Non-GAAP Financial Measures” below.

“We delivered record revenue this quarter with the Americas

leading the way with 14.5 percent year-over-year growth,” said

Vicki Holt, President and Chief Executive Officer. “Our revenue

growth was driven by an 18.8 percent growth in the number of unique

product developers we served this quarter, reflecting continued

penetration of our market opportunity.”

Additional Second Quarter 2017 Highlights include:

- Gross margin was 56.5 percent of

revenue for the second quarter of 2017 compared with 56.4 percent

for the second quarter of 2016.

- Operating margin was 20.0 percent of

revenue during the second quarter of 2017 compared to 19.8 percent

of revenue for the second quarter of 2016.

- The company generated $20.6 million in

cash from operations during the second quarter of 2017.

- Cash and investments balance increased

to $217.9 million at June 30, 2017.

“We continue to execute on our initiative to expand our product

envelope. Our recently launched on-demand manufacturing offering

tailors our injection molding service to address the specific needs

of the customer. This offering includes a suite of inspection

reports, including a digital inspection report option, a lifetime

mold guarantee and more competitive piece part pricing to the

on-demand manufacturing customer,” concluded Holt.

Non-GAAP Financial Measures

The company has included non-GAAP adjusted revenue growth that

excludes the impact of changes in foreign currency exchange rates

and non-GAAP adjusted revenue growth that excludes the impact of

discontinued businesses, discontinued manufacturing processes, and

unprofitable Alphaform 3D printing contracts in this press release

to provide investors with additional information regarding the

company’s financial results. Management believes these metrics are

useful in evaluating the underlying business trends and ongoing

operating performance of the company.

The company has also included non-GAAP operating margin,

adjusted for stock-based compensation expense, amortization

expense, impairment on assets and facilities-related charges

(collectively, “non-GAAP operating margin”), in this press release

to provide investors with additional information regarding the

company’s financial results.

The company has also included non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, impairment

on assets, facilities-related charges, legal settlement and

unrealized foreign currency activity (collectively, “non-GAAP net

income”), in this press release to provide investors with

additional information regarding the company’s financial

results.

The company has provided a reconciliation of GAAP to non-GAAP

net income, the most directly comparable measure calculated and

presented in accordance with GAAP. Non-GAAP net income is used by

the company’s management and board of directors to understand and

evaluate operating performance and trends and provide useful

measures for period-to-period comparisons of the company’s

business. Accordingly, the company believes that non-GAAP net

income provides useful information to investors and others in

understanding and evaluating operating results in the same manner

as our management and board of directors.

Conference Call

The company has scheduled a conference call to discuss its

second quarter 2017 financial results today, July 27, 2017 at 8:30

a.m. ET. To access the call in the U.S. please dial 877-709-8150.

Outside the U.S. please dial 201-689-8354. No participant code is

required. A simultaneous webcast of the call will be available via

the investor relations section of the Proto Labs website and the

following link:

http://edge.media-server.com/m/p/pcgxg5mm. A replay

will be available for 14 days following the call on the investor

relations section of Proto Labs’ website.

About Proto Labs, Inc.

Proto Labs is the world’s fastest digital manufacturing source

for custom prototypes and low-volume production parts. The

technology-enabled company uses advanced 3D printing, CNC machining

and injection molding technologies to produce parts within days.

The result is an unprecedented speed-to-market value for product

designers and engineers worldwide. Visit protolabs.com for more

information.

Forward-Looking Statements

Statements contained in this press release regarding matters

that are not historical or current facts are “forward-looking

statements” within the meaning of The Private Securities Litigation

Reform Act of 1995. These statements involve known and unknown

risks, uncertainties and other factors which may cause the results

of Proto Labs to be materially different than those expressed or

implied in such statements. Certain of these risk factors and

others are described in the “Risk Factors” section within reports

filed with the SEC. Other unknown or unpredictable factors also

could have material adverse effects on Proto Labs’ future results.

The forward-looking statements included in this press release are

made only as of the date hereof. Proto Labs cannot guarantee future

results, levels of activity, performance or achievements.

Accordingly, you should not place undue reliance on these

forward-looking statements. Finally, Proto Labs expressly disclaims

any intent or obligation to update any forward-looking statements

to reflect subsequent events or circumstances.

Proto Labs, Inc. Condensed Consolidated Balance

Sheets (In thousands)

June 30, December 31, 2017

2016 (Unaudited)

Assets Current assets Cash and cash equivalents $ 99,196 $

68,795 Short-term marketable securities 48,272 39,477 Accounts

receivable, net 42,211 34,060 Inventory 9,327 9,310 Income taxes

receivable - 445 Other current assets 5,915 5,697

Total current assets 204,921 157,784 Property and equipment,

net 146,364 139,474 Long-term marketable securities 69,435 84,479

Goodwill 28,916 28,916 Other intangible assets, net 2,367 2,655

Other long-term assets 2,650 933 Total assets $

454,653 $ 414,241

Liabilities and shareholders'

equity Current liabilities Accounts payable $ 14,147 $ 11,322

Accrued compensation 10,990 7,670 Accrued liabilities and other

4,530 4,435 Income taxes payable 1,383 - Total

current liabilities 31,050 23,427 Long-term deferred tax

liabilities 8,613 7,003 Other long-term liabilities 4,186 3,978

Shareholders' equity 410,804 379,833 Total

liabilities and shareholders' equity $ 454,653 $ 414,241

Proto Labs, Inc. Condensed Consolidated Statements

of Operations (In thousands, except share and per share

amounts) (Unaudited)

Three Months Ended Six Months

Ended June 30, June 30,

2017

2016

2017

2016

Revenue Injection Molding $ 46,792 $ 44,762 $ 94,708 $ 87,931 CNC

Machining 24,180 19,854 46,152 38,729 3D Printing 10,873 9,099

20,958 18,209 Other

195

1,246 389

2,660 Total revenue 82,040 74,961 162,207 147,529

Cost of revenue

35,671

32,715 70,565

65,629 Gross profit 46,369 42,246 91,642 81,900

Operating expenses Marketing and sales 14,630 11,453 27,617 22,395

Research and development 6,084 5,816 11,907 11,134 General and

administrative

9,253 10,126

18,034 18,377 Total

operating expenses

29,967

27,395 57,558

51,906 Income from operations 16,402 14,851 34,084

29,994 Other income, net

1,173

1,092 1,488

1,717 Income before income taxes 17,575 15,943 35,572

31,711 Provision for income taxes

5,489

5,252 11,286

10,358 Net income

$ 12,086

$ 10,691 $

24,286 $ 21,353 Net

income per share: Basic

$ 0.46

$ 0.41 $ 0.91

$ 0.81 Diluted

$

0.45 $ 0.40 $

0.91 $ 0.80 Shares

used to compute net income per share: Basic 26,541,978 26,368,001

26,554,262 26,295,074 Diluted 26,649,152 26,561,148 26,710,217

26,526,629

Proto Labs, Inc. Condensed Consolidated

Statements of Cash Flows (In thousands)

(Unaudited) Six Months

Ended June 30, 2017 2016 Operating

activities Net income $ 24,286 $ 21,353 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 8,700 8,147 Stock-based compensation

expense 3,958 3,541 Deferred taxes 1,608 403 Amortization of

held-to-maturity securities 592 590 Loss on impairment of assets -

455 Other 77 (1,095 ) Changes in operating assets and liabilities

206 5,084 Net

cash provided by operating activities

39,427

38,478 Investing

activities Purchases of property and equipment (13,301 )

(22,416 ) Purchases of marketable securities (20,037 ) (38,304 )

Proceeds from maturities of marketable securities 25,194 28,759

Purchases of other investments

(514

) - Net cash used in

investing activities

(8,658 )

(31,961 ) Financing

activities Acquisition-related contingent consideration - (400

) Proceeds from exercises of stock options and other 3,791 3,729

Repurchases of common stock

(4,410

) - Net cash provided by

(used in) financing activities

(619

) 3,329 Effect of exchange

rate changes on cash and cash equivalents

251

(168 ) Net increase in

cash and cash equivalents 30,401 9,678

Cash and cash

equivalents, beginning of period 68,795

47,653 Cash and cash

equivalents, end of period $ 99,196

$ 57,331

Proto Labs, Inc. Reconciliation of GAAP to

Non-GAAP Net Income per Share (In thousands, except share

and per share amounts) (Unaudited)

Three Months Ended Six

Months Ended June 30, June

30,

2017

2016

2017

2016

Non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, unrealized

gain on foreign currency, legal settlement, impairment on assets

and charges related to the exit of facilities

GAAP net income $ 12,086 $ 10,691 $ 24,286 $ 21,353 Add back:

Stock-based compensation expense 2,242 1,809 3,958 3,541

Amortization expense 125 171 288 357 Impairment on assets - 455 -

455 Facilities-related charges - 418 - 418 Unrealized gain on

foreign currency (412 ) (806 ) (349 ) (1,130 ) Legal settlement

(417 ) -

(417 )

- Total adjustments 1

1,538

2,047 3,480

3,641 Income tax benefits on

adjustments 2

(501 )

(773 ) (1,079

) (1,310 ) Non-GAAP

net income

$ 13,123 $

11,965 $ 26,687

$ 23,684

Non-GAAP net income per share: Basic

$

0.49 $ 0.45

$ 1.01 $

0.90 Diluted

$ 0.49

$ 0.45 $

1.00 $ 0.89

Shares used to compute non-GAAP net income per share: Basic

26,541,978 26,368,001 26,554,262 26,295,074 Diluted 26,649,152

26,561,148 26,710,217 26,526,629

1

Stock-based compensation expense, amortization expense, impairment

on assets, facilities-related charges, unrealized gain on foreign

currency and legal settlement were included in the following GAAP

consolidated statement of operations categories:

Three

Months Ended Six Months Ended June

30, June 30,

2017

2016

2017

2016

Cost of revenue $ 237 $ 268 $ 434 $ 398 Marketing and sales 339 213

607 491 Research and development 279 480 501 774 General and

administrative 1,512 1,892 2,704 3,108 Other income, net

(829 ) (806

) (766 )

(1,130 ) Total adjustments

$

1,538 $ 2,047

$ 3,480 $

3,641 2 For the three months ended June

30, 2017 and 2016, income tax effects were calculated reflecting an

effective GAAP tax rate of 31.2% and 32.9%, respectively, and an

effective non-GAAP tax rate of 31.3% and 33.5%, respectively. For

the six months ended June 30, 2017 and 2016, income tax effects

were calculated reflecting an effective GAAP tax rate of 31.7% and

32.7%, respectively, and an effective non-GAAP tax rate of 31.7%

and 33.0%, respectively. Our GAAP tax rates for the three and six

months ended June 30, 2017 and 2016 differ from our non-GAAP tax

rates for the same periods due primarily to the mix of activity

incurred in domestic and foreign tax jurisdictions.

Proto Labs, Inc. Reconciliation of GAAP to

Non-GAAP Operating Margin (In thousands)

(Unaudited)

Three Months Ended Six Months Ended

June 30, June 30,

2017

2016

2017

2016

Revenue $ 82,040 $ 74,961 $ 162,207 $ 147,529 Income from

operations

16,402

14,851 34,084

29,994 GAAP operating margin 20.0 % 19.8 % 21.0

% 20.3 % Add back: Stock-based compensation expense 2,242 1,809

3,958 3,541 Amortization expense 125 171 288 357 Impairment on

assets - 455 - 455 Facilities-related charges

-

418 -

418 Total adjustments

2,367 2,853

4,246 4,771

Non-GAAP income from operations adjusted

for stock-based compensation expense, amortization expense,

impairment on assets and facilities-related charges

$ 18,769 $

17,704 $ 38,330

$ 34,765 Non-GAAP operating

margin 22.9 % 23.6 % 23.6 % 23.6 %

Proto

Labs, Inc. Comparison of GAAP to Non-GAAP Revenue Growth

(In thousands) (Unaudited)

Three Months Ended

% Change

Six Months Ended % Change June

30, % Constant June

30, % Constant

2017

2016

Change

Currencies1

2017

2016

Change

Currencies1

Revenues United States $ 63,353 $ 55,323 14.5 % 14.5 % $ 123,529 $

109,791 12.5 % 12.5 % Europe 16,131 17,276 -6.6 % -1.9 % 33,130

32,907 0.7 % 6.1 % Japan

2,556

2,362 8.2 %

11.5 % 5,548

4,831 14.8 %

15.8 % Total Revenue

$

82,040 $ 74,961

9.4 % 10.6 %

$ 162,207 $

147,529 9.9 %

11.2 % 1 Revenue growth for the

three- and six-month periods ended June 30, 2017 has been

recalculated using 2016 foreign currency exchange rates in effect

during comparable periods to provide information useful in

evaluating the underlying business trends excluding the impact of

changes in foreign currency exchange rates.

Three

Months Ended Six Months Ended June

30,

%

June 30,

%

2017

2016

Change(2)

2017

2016

Change(2)

Revenues Injection Molding $ 46,792 $ 44,219 5.8 % $ 94,158 $

86,612 8.7 % CNC Machining 24,180 19,854 21.8 % 46,152 38,729 19.2

% 3D Printing 10,873 9,019 20.6 % 20,958 18,036 16.2 % Other

195 401 -51.4

% 389 876

-55.6 % Total Revenue

$

82,040 $ 73,493

11.6 % $

161,657 $ 144,253

12.1 % 2 Revenue growth for the

three- and six-month periods ended June 30, 2017 and 2016 has been

recalculated to exclude revenue earned from two discontinued

manufacturing processes, Metal Injection Molding (MIM) and

Magnesium Thixomolding (Thixo), discontinued non-core resin resale

business and unprofitable Alphaform 3D Printing contracts.

Proto Labs, Inc. Revenue by Geography (In

thousands) (Unaudited)

Three Months Ended Six Months

Ended June 30, June 30,

2017

2016

2017

2016

Revenue: United States $ 63,353 $ 55,323 $ 123,529 $ 109,791

Europe 16,131 17,276 33,130 32,907 Japan

2,556

2,362 5,548

4,831 Total Revenue

$ 82,040

$ 74,961 $

162,207 $ 147,529

Proto Labs, Inc. Product Developer

Information (Unaudited)

Three Months Ended Six Months

Ended June 30, June 30, 2017 2016

2017 2016 Unique product developers and engineers

served

16,174 13,612 24,255

20,333 Note: the information above includes

unique product developers and engineers who purchased our 3D

Printed products in the United States and Europe through our

web-based customer interface. The information does not include 3D

Printing and Injection Molding customers resulting from the

Alphaform acquisition who do not utilize our web-based customer

interface.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170727005251/en/

Proto Labs, Inc.Investor Relations:Daniel Schumacher,

763-479-7240daniel.schumacher@protolabs.comorJohn Way,

763-479-7726john.way@protolabs.comorMedia Relations:Bill Dietrick,

763-479-7664bill.dietrick@protolabs.com

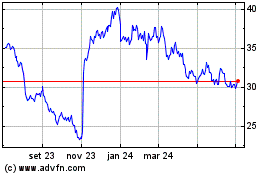

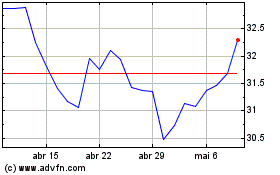

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024