Record Quarterly Revenue of $94.2 million,

an increase of 30.2% over 2016

Record Full Year 2017 Revenue of $344.5

million, an increase of 15.6% over 2016

Proto Labs, Inc. (NYSE: PRLB), a leading online and

technology-enabled, quick-turn, on-demand manufacturer, today

announced financial results for the fourth quarter and full year

ended December 31, 2017.

Fourth Quarter 2017 Highlights include:

- Revenue for the fourth quarter of 2017

was a record $94.2 million, representing a 30.2 percent increase

over revenue of $72.4 million in the fourth quarter of 2016.

- Fourth quarter revenue included $3.6

million revenue contribution from RAPID Manufacturing (“RAPID”),

the New Hampshire company acquired in the fourth quarter of 2017.

Excluding the revenue from RAPID and the impact of discontinued

services, revenue increased 26.1 percent compared with the prior

year’s fourth quarter. Adjusting for the positive impact on revenue

from foreign currency exchange rates, revenue growth was 28.3

percent. See “Non-GAAP Financial Measures” below.

- The number of unique product developers

and engineers served totaled 16,985 in the fourth quarter of 2017,

an increase of 20.9 percent over the fourth quarter of 2016.

- Net income for the fourth quarter of

2017 was a record $14.3 million, or $0.53 per diluted share.

- The Tax Cuts and Jobs Act of 2017 (the

“Tax Act”) resulted in a current period net benefit of $1.9

million, with a benefit from the revaluation of deferred tax

liabilities partially offset by deemed repatriation of foreign

earnings.

- Non-GAAP net income, excluding the

after-tax expense of stock compensation, amortization of

intangibles, acquisition costs, impairment on assets, unrealized

foreign currency gains and the net benefit in the current period

resulting from the Tax Act was $15.7 million, or $0.58 per diluted

share. See “Non-GAAP Financial Measures” below.

Additional Fourth Quarter 2017 Highlights include:

- Gross margin was 56.2 percent of

revenue for the fourth quarter of 2017, compared with 55.7 percent

for the fourth quarter of 2016.

- GAAP operating margin was 19.9 percent

of revenue during the fourth quarter of 2017, compared to 20.5

percent for the fourth quarter of 2016.

- Non-GAAP operating margin was 25.1

percent of revenue during the fourth quarter of 2017, compared to

23.1 percent for the fourth quarter of 2016. See “Non-GAAP

Financial Measures” below.

- The Company generated $22.7 million in

cash from operations during the fourth quarter of 2017.

- Cash and investments balance was $131.2

million at December 31, 2017.

“Proto Labs continues to demonstrate its ability to provide

solutions to our customers to help them accelerate product

development, reduce risk and optimize supply chains by delivering

custom parts at unprecedented speeds. The fourth quarter was a

strong ending to a great year,” said Vicki Holt, President and

Chief Executive Officer. “During the quarter, we delivered

double-digit revenue growth in each of our services and in each of

our regions on a constant currency basis. We were especially

pleased with the growth of revenue from our CNC business, up 37.6

percent organically. We continue to enhance our technology to

further expand the services that we can provide to our

customers.”

Full Year 2017 Highlights include:

- Revenue increased 15.6 percent to

$344.5 million compared with $298.1 million in 2016. Adjusting for

the $3.6 million revenue contribution from RAPID, and the impact of

discontinued services, adjusted revenue totaled $340.4 million, an

increase of 16.1 percent compared to 2016. See “Non-GAAP Financial

Measures” below.

- Net income for 2017 increased to $51.8

million, or $1.93 per diluted share compared with $42.7 million, or

$1.61 per diluted share in 2016.

- Non-GAAP net income, excluding the

after-tax expense of stock compensation, amortization of

intangibles, impairment of assets, acquisition costs, unrealized

foreign currency gains, legal settlement and the net benefit in the

current period resulting from the Tax Act was $57.4 million, or

$2.14 per diluted share. See “Non-GAAP Financial Measures”

below.

- Cash generated from operations during

the year totaled $81.7 million.

Additional 2017 Highlights include:

- Completion of our acquisition of RAPID

manufacturing in the fourth quarter.

- Expansion of our service offerings with

the launch of insert molding and on demand manufacturing in

injection molding and the addition of multi-jet fusion and Polyjet

to our 3D printing service.

- Served over 37,000 product developers

during the year, an increase of 18.5 percent.

- Established a share repurchase

program.

“Our accomplishments in 2017, including the acquisition of RAPID

and the continued expansion of our services, will allow us to

provide more of a total solution to our customers. These

accomplishments have positioned us well for continued, sustainable

growth in both revenue and earnings. Our customer focus will

continue in 2018 as we continue to evolve our sales approach to

develop deeper customer relationships, further advance each of our

four service offerings, and increase the scale of our operations,

with an initial focus on integrating the RAPID acquisition.”

concluded Holt.

Non-GAAP Financial Measures

The company has included non-GAAP adjusted revenue growth that

excludes the impact of changes in foreign currency exchange rates

and non-GAAP adjusted revenue growth that excludes the impact of

acquired and discontinued businesses in this press release to

provide investors with additional information regarding the

company’s financial results. Management believes these metrics are

useful in evaluating the underlying business trends and ongoing

operating performance of the company.

The company has included non-GAAP operating margin, adjusted for

stock-based compensation expense, amortization expense, acquisition

costs, impairment on assets and facilities-related charges

(collectively, “non-GAAP operating margin”), in this press release

to provide investors with additional information regarding the

company’s financial results.

The company has included non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, impairment

on assets, facilities-related charges, acquisition costs,

unrealized foreign currency activity, legal settlement, provisional

charges related to the tax effect of deemed repatriation of foreign

earnings, and revaluation of net deferred tax assets associated

with the Tax Act (collectively, “non-GAAP net income”), in this

press release to provide investors with additional information

regarding the company’s financial results.

The company has provided below reconciliations of GAAP to

non-GAAP net income, operating margin and revenues, the most

directly comparable measures calculated and presented in accordance

with GAAP. These non-GAAP measures are used by the company’s

management and board of directors to understand and evaluate

operating performance and trends and provide useful measures for

period-to-period comparisons of the company’s business.

Accordingly, the company believes that these non-GAAP measures

provide useful information to investors and others in understanding

and evaluating operating results in the same manner as our

management and board of directors.

Conference Call

The company has scheduled a conference call to discuss its

fourth quarter and full year 2017 financial results today, February

8, 2018 at 8:30 a.m. ET. To access the call in the U.S. please dial

877-709-8150 or outside the U.S. dial 201-689-8354 at least five

minutes prior to the 8:30 a.m. start time. No participant code is

required. A simultaneous webcast of the call will be available via

the investor relations section of the Proto Labs website and the

following link: https://edge.media-server.com/m6/p/jrmdwby8. A

replay will be available for 14 days following the call on the

investor relations section of Proto Labs’ website.

About Proto Labs, Inc.

Proto Labs is the world's fastest digital manufacturing source

for rapid prototyping and on-demand production. The

technology-enabled company produces custom parts and assemblies in

as fast as 1 day with automated 3D printing, CNC machining, sheet

metal fabrication, and injection molding processes. Its digital

approach to manufacturing enables accelerated time to market,

reduces development and production costs, and minimizes risk

throughout the product life cycle. Visit protolabs.com for more

information.

Proto Labs, Inc. Condensed Consolidated Balance

Sheets (In thousands)

December 31, December 31,

2017 1

2016 (Unaudited) Assets Current

assets Cash and cash equivalents $ 36,707 $ 68,795 Short-term

marketable securities 57,424 39,477 Accounts receivable, net 51,503

34,060 Inventory 11,271 9,310 Income taxes receivable 461 445 Other

current assets 6,267 5,697 Total current

assets 163,633 157,784 Property and equipment, net 166,662

139,474 Long-term marketable securities 37,034 84,479 Goodwill

129,752 28,916 Other intangible assets, net 17,614 2,655 Other

long-term assets 2,672 933 Total assets $

517,367 $ 414,241

Liabilities and shareholders'

equity Current liabilities Accounts payable $ 15,876 $ 11,322

Accrued compensation 12,100 7,670 Accrued liabilities and other

8,408 4,435 Short-term debt obligations 5,000 - Income taxes

payable 1,000 - Total current liabilities

42,384 23,427 Long-term income taxes payable 2,181 -

Long-term deferred tax liabilities 6,966 7,003 Other long-term

liabilities 4,621 3,978 Shareholders' equity 461,215

379,833 Total liabilities and shareholders' equity $

517,367 $ 414,241 1The unaudited condensed

consolidated balance sheet at December 31, 2017 reflects the

preliminary allocation of RAPID’s purchase price to identifiable

tangible and intangible net assets acquired and the excess purchase

price to goodwill. A final determination of the fair value of the

assets acquired and liabilities assumed may differ materially from

the preliminary estimates.

Proto Labs,

Inc. Condensed Consolidated Statements of Operations

(In thousands, except share and per share amounts)

(Unaudited)

Three Months Ended Year Ended

December 31, December 31,

2017

2016

2017

2016

Revenue Injection Molding $ 50,245 $ 41,598 $ 194,432 $ 175,974 CNC

Machining 30,421 20,897 103,739 81,407 3D Printing 11,268 9,788

43,329 37,847 Sheet Metal 1,767 - 1,767 - Other

477 70 1,223

2,827 Total revenue 94,178 72,353 344,490

298,055 Cost of revenue

41,290

32,041 150,648

131,118 Gross profit 52,888 40,312 193,842 166,937

Operating expenses Marketing and sales 15,393 11,949 56,856

46,131 Research and development 5,776 5,278 23,560 22,388 General

and administrative

12,944

8,254 41,200

36,651 Total operating expenses

34,113 25,481

121,616 105,170 Income from

operations 18,775 14,831 72,226 61,767 Other income, net

430 112 2,209

2,454 Income before income taxes 19,205 14,943

74,435 64,221 Provision for income taxes

4,933

5,571 22,657

21,514 Net income

$ 14,272

$ 9,372 $

51,778 $ 42,707 Net

income per share: Basic

$ 0.53

$ 0.35 $ 1.94

$ 1.62 Diluted

$

0.53 $ 0.35 $

1.93 $ 1.61 Shares

used to compute net income per share: Basic 26,705,909 26,457,302

26,647,610 26,365,173 Diluted 27,009,017 26,609,929 26,845,071

26,564,639

Proto Labs, Inc. Condensed Consolidated

Statements of Cash Flows (In thousands)

(Unaudited) Year Ended

December 31, 2017 2016 Operating

activities Net income $ 51,778 $ 42,707 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 18,474 17,485 Stock-based

compensation expense 8,558 6,775 Deferred taxes 90 2,780

Amortization of held-to-maturity securities 1,063 1,173 Loss on

impairment of assets 513 455 Other (153 ) (1,541 ) Changes in

operating assets and liabilities

1,425

7,665 Net cash provided by operating

activities

81,748

77,499 Investing activities

Purchases of property and equipment (32,635 ) (33,616 ) Cash used

for acquisitions, net of cash acquired (110,533 ) - Purchases of

marketable securities (20,037 ) (89,315 ) Proceeds from maturities

of marketable securities 47,972 62,176 Purchases of other assets

and investments

(8,742 )

- Net cash used in investing activities

(123,975 ) (60,755

) Financing activities Proceeds from

issuance of debt 5,000 - Acquisition-related contingent

consideration - (400 ) Proceeds from exercises of stock options and

other 8,602 5,715 Repurchases of common stock

(4,410 ) - Net

cash provided by financing activities

9,192

5,315 Effect of exchange rate

changes on cash and cash equivalents

947

(917 ) Net (decrease) increase

in cash and cash equivalents (32,088 ) 21,142

Cash and cash

equivalents, beginning of period 68,795

47,653 Cash and cash

equivalents, end of period $ 36,707

$ 68,795

Proto Labs, Inc. Reconciliation of GAAP to

Non-GAAP Net Income per Share (In thousands, except share

and per share amounts) (Unaudited)

Three Months Ended

Year Ended December 31,

December 31,

2017

2016

2017

2016

Non-GAAP net income, adjusted for

stock-based compensation expense, amortization expense, impairment

on assets, acquisition costs, unrealized (gain) loss on foreign

currency, charges related to the exit of facilities and legal

settlement

GAAP net income $ 14,272 $ 9,372 $ 51,778 $ 42,707 Add back:

Stock-based compensation expense 2,400 1,515 8,558 6,775

Amortization expense 107 163 501 683 Impairment on assets 513 - 513

455 Acquisition costs 1,875 - 1,875 - Unrealized (gain) loss on

foreign currency (102 ) 217 (185 ) (1,243 ) Facilities-related

charges - 222 - 1,373 Legal settlement

-

- (417

) - Total adjustments 1

4,793 2,117

10,845 8,043

Provisional charges related to the tax effect of deemed

repatriation of foreign earnings 2,400 - 2,400 - Revaluation of net

deferred tax assets and liabilities (4,262 ) - (4,262 ) - Income

tax benefits on adjustments 2

(1,520

) (646 )

(3,344 ) (3,139

) Non-GAAP net income

$

15,683 $ 10,843

$ 57,417 $

47,611 Non-GAAP net income per

share: Basic

$ 0.59 $

0.41 $ 2.16

$ 1.81 Diluted

$

0.58 $ 0.41

$ 2.14 $

1.79 Shares used to compute non-GAAP net

income per share: Basic 26,705,909 26,457,302 26,647,610 26,365,173

Diluted 27,009,017 26,609,929 26,845,071 26,564,639 1

Stock-based compensation expense, amortization expense, impairment

on assets, acquisition costs, unrealized (gain) loss on foreign

currency, facilities-related charges and legal settlement were

included in the following GAAP consolidated statement of operations

categories:

Three Months Ended Year Ended

December 31, December 31,

2017

2016

2017

2016

Cost of revenue $ 273 $ 318 $ 970 $ 1,318 Marketing and sales 405

234 1,429 974 Research and development 295 312 1,091 1,396 General

and administrative 3,922 1,036 7,957 5,598 Other income, net

(102 ) 217

(602 ) (1,243

) Total adjustments

$ 4,793

$ 2,117 $

10,845 $ 8,043

2 For the three months and year ended December 31, 2017 and

2016, income tax effects were calculated using the effective tax

rate for the relevant jurisdictions. Our non-GAAP tax rates differ

from our GAAP tax rates due primarily to the mix of activity

incurred in domestic and foreign tax jurisdictions.

Proto Labs, Inc. Reconciliation of GAAP to Non-GAAP

Operating Margin (In thousands) (Unaudited)

Three

Months Ended Year Ended December 31,

December 31,

2017

2016

2017

2016

Revenue $ 94,178 $ 72,353 $ 344,490 $ 298,055 Income from

operations

18,775

14,831 72,226

61,767 GAAP operating margin 19.9 % 20.5 % 21.0

% 20.7 % Add back: Stock-based compensation expense 2,400 1,515

8,558 6,775 Amortization expense 107 163 501 683 Acquisition Costs

1,875 - 1,875 - Impairment on assets 513 - 513 455

Facilities-related charges

-

222 -

1,373 Total adjustments

4,895 1,900

11,447 9,286

Non-GAAP income from operations adjusted

for stock-based compensation expense, amortization expense,

acquisition costs, impairment on assets and facilities-related

charges

$ 23,670 $

16,731 $ 83,673

$ 71,053 Non-GAAP operating

margin 25.1 % 23.1 % 24.3 % 23.8 %

Proto Labs, Inc. Comparison of GAAP to

Non-GAAP Revenue Growth (In thousands)

(Unaudited)

Three Months Ended

Three Months EndedDecember 31,

2017

December31,2016

%

% ChangeConstant

GAAP

Adjustments1

Non-GAAP

GAAP

Change2

Currencies3

Revenues United States $ 72,067 $ - $ 72,067 $ 54,566 32.1 % 32.1 %

Europe 18,930 (1,427 ) 17,503 14,847 27.5 % 17.9 % Japan

3,181 106

3,287 2,940

8.2 % 11.8

% Total Revenue

$ 94,178

$ (1,321 ) $

92,857 $ 72,353 30.2 % 28.3

%

Year Ended

Year

EndedDecember 31, 2017

December31,

2016

%

% ChangeConstant

GAAP

Adjustments1

Non-GAAP

GAAP

Change2

Currencies3 Revenues United

States $ 263,086 $ - $ 263,086 $ 223,930 17.5 % 17.5 % Europe

70,154 (282 ) 69,872 63,365 10.7 % 10.3 % Japan

11,250 361

11,611 10,760

4.6 % 7.9

% Total Revenue

$ 344,490

$ 79 $

344,569 $ 298,055 15.6 %

15.6 % 1 Revenue growth for the three month and year ended

periods ended December 31, 2017 has been recalculated using 2016

foreign currency exchange rates in effect during comparable periods

to provide information useful in evaluating the underlying business

trends excluding the impact of changes in foreign currency exchange

rates. 2 This column presents the percentage change from GAAP

revenue growth for the three month and year ended periods ended

December 31, 2016 to GAAP revenue growth for the three month and

year ended periods ended December 31, 2017. 3 This column presents

the percentage change from GAAP revenue growth for the three month

and year ended periods ended December 31, 2016 (calculated using

the foreign currency exchange rates in effect during those periods)

to non-GAAP revenue growth for the three month and year ended

periods ended December 31, 2017 (as recalculated using 2016 foreign

currency exchange rates in order to provide a constant currency

comparison).

Three Months EndedDecember

31, 2017

Three Months EndedDecember

31, 2016

%

% ChangeAdjusted

GAAP

Adjustments4

Non-GAAP

GAAP

Adjustments4

Non-GAAP

Change Revenue Revenues

Injection Molding $ 50,245 $ - $ 50,245 $ 41,598 $ (485 ) $ 41,113

20.8 % 22.2 % CNC Machining 30,421 (1,657 ) 28,764 $ 20,897 -

20,897 45.6 % 37.6 % 3D Printing 11,268 - 11,268 9,788 - 9,788 15.1

% 15.1 % Sheet Metal 1,767 (1,767 ) 0 - - - * * Other

477 (155 )

322 70 -

70 * *

Total Revenue

$ 94,178 $

(3,579 ) $

90,599 $ 72,353

$ (485 ) $

71,868 30.2 % 26.1 % *Percentage change

not meaningful.

Year Ended Year Ended % Change

December 31, 2017 December 31,

2016 % Adjusted

GAAP

Adjustments4

Non-GAAP

GAAP

Adjustments4

Non-GAAP

Change Revenue Revenues

Injection Molding $ 194,432 $ (550 ) $ 193,882 $ 175,974 $ (2,904 )

$ 173,070 10.5 % 12.0 % CNC Machining 103,739 (1,657 ) 102,082

81,407 - 81,407 27.4 % 25.4 % 3D Printing 43,329 - 43,329 37,847

(242 ) 37,605 14.5 % 15.2 % Sheet Metal 1,767 (1,767 ) 0 - - - * *

Other

1,223 (155

) 1,068 2,827

(1,784 ) 1,043

* * Total Revenue

$

344,490 $ (4,129

) $ 340,361 $

298,055 $ (4,930

) $ 293,125 15.6 %

16.1 % *Percentage change not meaningful. 4 Revenue

growth for the three month and year periods ended December 31, 2017

and 2016 has been recalculated to exclude revenue earned from the

acquisition of Rapid and two discontinued manufacturing processes,

Metal Injection Molding (MIM) and Magnesium Thixomolding (Thixo),

discontinued non-core resin resale business and unprofitable

Alphaform 3D Printing contracts.

Proto Labs,

Inc. Revenue by Geography (In thousands)

(Unaudited)

Three Months Ended Year Ended

December 31, December 31,

2017

2016

2017

2016

Revenue: United States $ 72,067 $ 54,566 $ 263,086 $ 223,930

Europe 18,930 14,847 70,154 63,365 Japan

3,181

2,940 11,250

10,760 Total Revenue

$

94,178 $ 72,353

$ 344,490 $

298,055 Proto Labs, Inc.

Product Developer Information (Unaudited)

Three Months

Ended Year Ended December 31, December 31,

2017 2016 2017 2016 Unique product

developers and engineers served

16,985

14,046 37,267 31,457

Note: the information above includes unique product developers and

engineers who purchased our 3D Printed products in the United

States and Europe through our web-based customer interface. The

information does not include 3D Printing, Injection Molding and

Sheet Metal customers resulting from the Alphaform and RAPID

acquisitions who do not utilize our web-based customer interface.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180208005245/en/

Investor Relations Contact:Proto Labs, Inc.Dan

Schumacher, 763-479-7240Director of Investor Relationsdaniel.schumacher@protolabs.comorMedia

Contact:Padilla for Proto LabsTim Nelson,

612-455-1789tim.nelson@padillaco.com

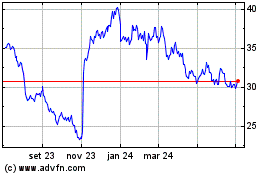

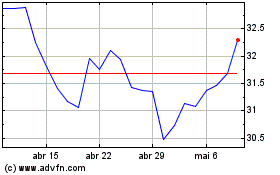

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Proto Labs (NYSE:PRLB)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024