Ranger Energy Services, Inc. (NYSE: RNGR) (“Ranger” or the

“Company”) announced today its results for the second quarter ended

June 30, 2023.

Second Quarter 2023 Highlights

- Revenue of $163.2 million, a 6% increase from $153.6 million in

second quarter 2022

- Net income of $6.1 million, or $0.24 per fully diluted share,

up from a net loss of $0.4 million, or $0.02 loss per share in

second quarter of 2022

- Adjusted EBITDA1 of $21.9 million, a 22% increase from $18.0

million in second quarter 2022 driven by increases in activity and

pricing across segments

- Returned $5.9 million of capital to shareholders through share

repurchases representing 37% of free cash flow during the

quarter.

- Ended the quarter with debt of $0.3 million, marking the

achievement of the Company’s stated goal of net debt zero.

- Initiating a quarterly dividend of $0.05 per share of common

stock, payable on September 8, 2023 to all stockholders of record

as of August 18, 2023

Year to Date 2023 Highlights

- Revenue of $320.7 million, a 16% increase from $277.2 million

in the prior year

- Net income of $12.3 million, a 302% increase from a net loss of

$6.1 million in the prior year

- Adjusted EBITDA of $42.0 million, a 52% increase from $27.6

million in the prior year driven by increases in activity and

pricing across segments

________________ 1

“Adjusted EBITDA” and “Free Cash Flow” are

not presented in accordance with generally accepted accounting

principles in the United States (“U.S. GAAP”). A Non-GAAP

supporting schedule is included with the statements and schedules

attached to this press release and can also be found on the

Company's website at: www.rangerenergy.com.

Comments

Stuart Bodden, Ranger’s Chief Executive Officer, commented, “We

are pleased to report another quarter of strong financial

performance. Despite facing commodity price and reduced activity

headwinds during the second quarter affecting the pace of our

planned growth for the year, our team's resilience and strategic

focus enabled us to achieve a 6% increase in revenue and an

impressive 22% increase in adjusted EBITDA compared to the same

period last year. While natural gas basins have remained under

pressure, our reputation for industry leading service quality has

allowed us to successfully reposition assets into oilier basins and

hold pricing steady. Although rig hours were generally flat through

the first half of the year, we are encouraged by the opportunity to

increase rig activity in the second half of the year and have

recently seen stabilization in the wireline market.

“Most notably during the quarter, we achieved our goal of

becoming net debt zero, having paid down over $56 million in debt

in the past twelve months. This tremendous accomplishment

highlights the effectiveness of our strategy and the superior cash

flow conversion that results from our business model. During the

second quarter, we repurchased approximately $6 million of Ranger

stock, equivalent to 37% of our second quarter free cash flow, and

will continue to actively repurchase our stock based on market

conditions. I am also pleased to announce that Ranger’s Board of

Directors has approved the payment of the Company’s first quarterly

dividend of $0.05 per share of common stock to be paid out in the

third quarter.

“Our continued strong operating and financial performance is a

testament to our exceptional people and the differentiated value of

our production cycle focus providing resiliency through cycle. We

are encouraged as we look to the second half of the year by several

customer discussions in flight that signal more revenue growth in

the future, and we expect seasonal trends to drive increased

activity in the third quarter. Taken together, we have confidence

in our business model and our strong cash flow conversion, which we

have demonstrated through our commitment to shareholder

returns.”

STRATEGIC UPDATE

Ranger’s four pillar strategy for creating shareholder value

are: maximizing cash flow, fortifying its balance sheet, growing

through acquisition, and returning meaningful capital to

shareholders. We made progress in each of these areas during the

second quarter of 2023.

- Maximizing Cash Flow: The Company’s focus on cash flow

generation is underpinned by a capital efficient business model

with strong operating leverage. The Company generated $16 million

of free cash flow during the second quarter and has generated $28

million of free cash flow on a year to date basis yielding a free

cash flow conversion rate of 67%. Initiatives are underway this

year to improve market penetration and operating efficiency across

all segments, along with efforts to diminish the impact of

seasonality in our wireline business.

- Fortifying the Balance Sheet: During the second quarter,

the Company reduced debt by $15.5 million and ended the quarter

essentially debt free. The Company believes that minimal debt

provides the ability to maximize shareholder returns through

opportunistic investment and capital returns to shareholders.

- Exploring Growth Through Acquisition: Ranger has

demonstrated a successful track record of making attractive asset

acquisitions and consolidating businesses. During the second

quarter, the Company saw an increase in inquiries and continued to

evaluate opportunities. One such tuck-in opportunity was recently

signed for $7.25 million of pump down assets and support equipment

with payback of less than two years. Ranger is committed to

pursuing a disciplined acquisition strategy rooted in maximizing

long-term value.

- Initiating Capital Return Framework: The Company

previously announced a share repurchase and dividend framework that

it believes provides the best overall value creation potential for

investors with a commitment to return at least 25% of annual cash

flows. During the second quarter, the Company repurchased 508,700

shares of its Class A common stock at an average of $10.87 per

share, representing 2% of shares outstanding. The Company intends

to continue repurchasing shares in future quarters and is

continuing to evaluate the best mechanism to do so. In addition,

the Company will declare its first quarterly dividend of $0.05 per

share to holders of record in the third quarter.

PERFORMANCE SUMMARY

For the second quarter of 2023, revenue was $163.2 million, an

increase of 6% from $153.6 million in the prior year period. The

increase in revenue compared to the prior year primarily reflects

improvements across all lines of businesses. Year to date revenue

was $320.7 million, an increase of 16% from $277.2 million in the

prior year due to increasing operating activity and pricing

improvements in select service lines.

Cost of services for the second quarter of 2023 was $136.3

million, or 84% of revenue, compared to $130.0 million, or 85% of

revenue in the prior year period. The decrease in cost of services

as a percentage of revenue was primarily attributable to operating

leverage from incremental revenue, improved operating efficiency as

well as pricing improvement offset by higher employee medical

costs. On a year to date basis, cost of services totaled $267.2

million, which represented 83% of revenue as compared to $238.0

million, or 86% of revenue in 2022. Operating margins improved by

3% year over year due to strong operating leverage on incremental

revenue as well as improving pricing. Offsetting these

improvements, the Company experienced a $3.3 million year over year

increase in employee medical costs across segments with per

employee costs increasing by over 45% as compared to the prior

year. The Company believes that the a significant portion of these

increases are unusual in nature and should not be recurring.

General and administrative expenses were $7.3 million for the

second quarter of 2023 compared to $11.2 million in the prior year

period. The decrease in general and administrative expenses was

primarily due to a decrease in acquisition and integration costs

related to the Basic Asset Acquisition in the prior year period.

General and administrative expenses year to date totaled $15.7

million. This compares to general and administrative expenses of

$21.4 million in 2022.

Net income totaled $6.1 million for the second quarter of 2023

compared to a loss of $0.4 million for the second quarter of 2022.

The increase in net income relative to the prior year period is

primarily due to the increase in profit margins for both the High

Specification Rigs and Wireline Services segments of our business.

Net income, on a year to date basis, tripled year over year from a

loss of $6.1 million in 2022 to a net income of $12.3 million year

to date in 2023.

Fully diluted earnings per share was $0.24 for the second

quarter of 2023 compared to a loss per share of $0.02 in the prior

year period. Fully diluted earnings per share for year to date was

$0.49 compared to a diluted loss per share of $0.29 in the prior

year

Adjusted EBITDA of $21.9 million for the second quarter of 2023

increased $3.9 million when compared to the second quarter of 2022.

The increase in Adjusted EBITDA was primarily the result of

increased operating activity in certain service lines as well as

improved pricing and operating efficiency, offset by significantly

higher employee medical costs, some of which is expected to be

non-recurring. Year to date Adjusted EBITDA was $42.0 million on a

year to date basis in 2023, an increase of $14.4 million when

compared to the prior year to date period.

BUSINESS SEGMENT FINANCIAL RESULTS

High Specification Rigs

High Specification Rigs segment revenue was $77.6 million in the

second quarter, an increase of $1.6 million, or 2% relative to the

second quarter of 2022. Hourly rig rates were $687 per hour in the

second quarter as compared to $632 per hour in the second quarter

of 2022 reflecting an increase in pricing as well as reduced

downtime and heightened efficiency from better rig scheduling and

logistics management. Rig hours decreased to 113,200 rig hours in

the second quarter compared to 119,900 rig hours in the second

quarter of 2022. Segment revenue for year to date was $155.1, an

increase of $14.20, or 10% relative to year to date 2022. Rig hours

decreased by 3% from 232,400 for year to date 2022 to 225,700 for

year to date 2023. Hourly rig rates increased by 14% from $606 per

hour for the year to date 2022 to $688 per hour for year to date

2023.

Operating income was $11.5 million in the second quarter, an

increase of $5.4 million, or 89% relative to $6.1 million in the

second quarter of 2022. Adjusted EBITDA was $15.6 million in the

second quarter, up from $14.2 million in the second quarter of

2022. Operating income was $23.4 million for year to date 2023, an

increase of 9.6, or 70% relative to $13.8 million for year to date

2022. Adjusted EBITDA was $33.0 million for year to date 2023, up

from $28.3 million in year to date 2022. The increase in operating

income and Adjusted EBITDA was largely the result of improved

pricing and rig efficiency.

Wireline Services

Wireline Services segment revenue was $54.5 million, up $5.0

million, or 10% in the second quarter, from $49.5 million in the

second quarter of 2022. The increase in revenue reflects an

increase in operating activity in certain operating geographies as

well as improved pricing on a year over year basis. Year to date

segment revenue was $104.4 million, up $16.3 million or 19% year to

date 2023 compared to $88.1 million for the comparable period in

2022. Completed stage counts decreased by 10% from 15,400 for the

2022 year to date period, compared to 13,800 for the year to date

2023 period. The increase in revenue and decrease in stage count is

indicative of improvements made in pricing levels and pricing terms

with customers.

Operating income was $2.8 million, up $1.3 million, or 87% in

the second quarter, from $1.5 million in the second quarter of

2022. Adjusted EBITDA was $5.7 million in the second quarter, up

from $4.3 million in the prior year period. Operating income was

$4.6 million, up $7.6 million, or 253% for year to date 2023, from

an operating loss of $3.0 million for year to date 2022. Adjusted

EBITDA was $9.9 million for year to date 2023, up from $2.5 million

for year to date 2022. Improved profitability in this segment is

driven by both an increase in stage count pricing on a year over

year basis as well as a series of cost savings initiatives that

were put into place.

Processing Solutions and Ancillary Services

Processing Solutions and Ancillary Services segment revenue was

$31.1 million in the second quarter, up $3.0 million, or 11% from

$28.1 million in the second quarter of 2022. Segment revenue was

$61.2 million for year to date 2023, up $13.0 million, or 27% from

$48.2 million for year to date 2022. The increase in revenue was

attributable to the increase in operational activity across all

lines of business including coil tubing, processing solutions,

rentals and fishing, and plug and abandonment services.

Operating income was $4.2 million in the second quarter, down

from $5.1 million in the prior year period. Adjusted EBITDA was

$5.6 million in the second quarter, compared to $5.1 million in the

second quarter of 2021. Operating income was $7.6 million for year

to date 2023, up from $6.4 million in the prior year period.

Adjusted EBITDA was $10.6 million for year to date 2023, compared

to $8.4 million in the prior year period. This segment has seen

profitability improvement year over year due to increased activity

levels across the various service lines.

BALANCE SHEET, CASH FLOW AND LIQUIDITY

As of June 30, 2023, the Company had $69.1 million of liquidity,

consisting of $62.7 million of capacity on its revolving credit

facility and $6.4 million of cash on hand. This compares favorably

to the prior year period end of June 30, 2022 when the Company had

$28.3 million of liquidity, consisting of $23.2 million of capacity

on its revolving credit facility and $5.1 million of cash on

hand.

The Company had total debt of $0.3 million compared to total

debt of $18.4 million at December 31, 2022, a reduction of 98%.

Year to date Cash from Operating Activities was $40.9 million,

compared to $7.8 million over the same period in 2022. The

Company’s free cash flow(1) improved significantly to $28.0 million

on a year to date basis compared to free cash flow(1) of $2.1

million in the prior year. On a year to date basis, the Company had

capital expenditures of $12.9 million with proceeds from asset

sales of $4.7 million.

FINANCIAL GUIDANCE

Based on the most recent forecasts, the Company believes that

its Adjusted EBITDA and Free Cash Flow guidance remain achievable

at the lower end of the published ranges. Guidance ranges have been

narrowed and adjusted accordingly. The third quarter is anticipated

to be similar to the prior year and the fourth quarter is

anticipated to be improved from the prior year barring any extreme

weather events. The Company continues to expect full-year 2023 free

cash flow conversion to be approximately 60%. A summary of Company

guidance follows representing current views which are subject to

change.

($ in Millions)

FY 2022 Actual

FY 2023 Forecast

Updated

FY 2023 Forecast

Revenue

$608.5

$685 - $715

$660 - $680

Adjusted EBITDA

$79.5

$95 - $105

$92 - $97

Free Cash Flow

$30.7

$55 - $70

$55 - $65

Capital Expenditures and Leases

$19.1

$25 - $35

$25 - $35

Conference Call

The Company will host a conference call to discuss its results

from the second quarter of 2023 on Tuesday, August 8, 2023, at 9:00

a.m. Central Time (10:00 a.m. Eastern Time). To join the conference

call from within the United States, participants may dial

1-833-255-2829. To join the conference call from outside of the

United States, participants may dial 1-412-902-6710. When

instructed, please ask the operator to join the Ranger Energy

Services, Inc. call. Participants are encouraged to login to the

webcast or dial in to the conference call approximately ten minutes

prior to the start time. To listen via live webcast, please visit

the Investor Relations section of the Company’s website,

http://www.rangerenergy.com.

An audio replay of the conference call will be available shortly

after the conclusion of the call and will remain available for

approximately seven days. The replay will also be available in the

Investor Resources section of the Company’s website shortly after

the conclusion of the call and will remain available for

approximately seven days.

About Ranger Energy Services, Inc.

Ranger is one of the largest providers of high specification

mobile rig well services, cased hole wireline services, and

ancillary services in the U.S. oil and gas industry. Our services

facilitate operations throughout the lifecycle of a well, including

the completion, production, maintenance, intervention, workover and

abandonment phases.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements contained in this press release constitute

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. These forward-looking statements represent

Ranger’s expectations or beliefs concerning future events, and it

is possible that the results described in this press release will

not be achieved. These forward-looking statements are subject to

risks, uncertainties and other factors, many of which are outside

of Ranger’s control that could cause actual results to differ

materially from the results discussed in the forward-looking

statements.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, Ranger does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise. New factors emerge from time to time, and it is not

possible for Ranger to predict all such factors. When considering

these forward-looking statements, you should keep in mind the risk

factors and other cautionary statements in our filings with the

Securities and Exchange Commission. The risk factors and other

factors noted in Ranger’s filings with the SEC could cause its

actual results to differ materially from those contained in any

forward-looking statement.

RANGER ENERGY SERVICES,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except share and

per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Revenue

High specification rigs

$

77.6

$

76.0

$

155.1

$

140.9

Wireline services

54.5

49.5

104.4

88.1

Processing solutions and ancillary

services

31.1

28.1

61.2

48.2

Total revenue

163.2

153.6

320.7

277.2

Operating expenses

Cost of services (exclusive of

depreciation and amortization):

High specification rigs

62.0

61.8

122.1

112.6

Wireline services

48.8

45.2

94.5

85.6

Processing solutions and ancillary

services

25.5

23.0

50.6

39.8

Total cost of services

136.3

130.0

267.2

238.0

General and administrative

7.3

11.2

15.7

21.4

Depreciation and amortization

8.7

11.4

18.7

23.0

Impairment of fixed assets

—

1.1

—

1.1

(Gain) loss on sale of assets

(0.5

)

2.1

(1.5

)

1.1

Total operating expenses

151.8

155.8

300.1

284.6

Operating income (loss)

11.4

(2.2

)

20.6

(7.4

)

Other (income) expenses

Interest expense, net

0.9

1.8

2.1

3.9

Loss on debt retirement

2.4

—

2.4

—

Gain on bargain purchase, net of tax

—

(2.8

)

—

(2.8

)

Total other (income) expenses, net

3.3

(1.0

)

4.5

1.1

Income (loss) before income tax expense

(benefit)

8.1

(1.2

)

16.1

(8.5

)

Income tax expense (benefit)

2.0

(0.8

)

3.8

(2.4

)

Net income (loss)

6.1

(0.4

)

12.3

(6.1

)

Income (loss) per common share:

Basic

$

0.25

$

(0.02

)

$

0.49

$

(0.29

)

Diluted

$

0.24

$

(0.02

)

$

0.49

$

(0.29

)

Weighted average common shares

outstanding

Basic

24,840,569

23,581,466

24,890,178

21,041,300

Diluted

25,188,123

23,581,466

25,249,026

21,041,300

RANGER ENERGY SERVICES,

INC.

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

(in millions, except share and

per share amounts)

June 30, 2023

December 31, 2022

Assets

Cash and cash equivalents

$

6.4

$

3.7

Accounts receivable, net

74.9

91.2

Contract assets

31.1

26.9

Inventory

7.5

5.9

Prepaid expenses

7.2

9.2

Assets held for sale

1.0

3.2

Total current assets

128.1

140.1

Property and equipment, net

218.8

221.6

Intangible assets, net

6.7

7.1

Operating leases, right-of-use assets

10.0

11.2

Other assets

1.2

1.6

Total assets

$

364.8

$

381.6

Liabilities and Stockholders'

Equity

Accounts payable

22.0

24.3

Accrued expenses

31.1

36.1

Other financing liability, current

portion

0.6

0.7

Long-term debt, current portion

0.3

6.8

Other current liabilities

6.3

6.6

Total current liabilities

60.3

74.5

Operating leases, right-of-use

obligations

8.4

9.6

Other financing liability

11.3

11.6

Long-term debt, net

—

11.6

Other long-term liabilities

10.8

8.1

Total liabilities

$

90.8

$

115.4

Commitments and contingencies

Stockholders' equity

Preferred stock, $0.01 per share;

50,000,000 shares authorized; no shares issued and outstanding as

of June 30, 2023 and December 31, 2022

—

—

Class A Common Stock, $0.01 par value,

100,000,000 shares authorized; 25,689,807 shares issued and

24,589,879 shares outstanding as of June 30, 2023; 25,446,292

shares issued and 24,894,464 shares outstanding as of December 31,

2022

0.3

0.3

Class B Common Stock, $0.01 par value,

100,000,000 shares authorized; no shares issued or outstanding as

of June 30, 2023 and December 31, 2022

—

—

Less: Class A Common Stock held in

treasury at cost; 1,099,928 treasury shares as of June 30, 2023 and

551,828 treasury shares as of December 31, 2022

(9.7

)

(3.8

)

Retained earnings

19.5

7.1

Additional paid-in capital

263.9

262.6

Total controlling stockholders' equity

274.0

266.2

Total liabilities and stockholders'

equity

$

364.8

$

381.6

RANGER ENERGY SERVICES,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS

(in millions)

Six Months Ended June

30,

2023

2022

Cash Flows from Operating

Activities

Net income (loss)

$

12.3

$

(6.1

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

18.7

23.0

Equity based compensation

2.4

1.7

(Gain) loss on disposal of property and

equipment

(1.5

)

1.1

Impairment of fixed assets

—

1.1

Gain on bargain purchase, net of tax

—

(2.8

)

Deferred income tax expense

3.8

—

Loss on debt retirement

2.4

—

Other expense, net

0.9

0.6

Changes in operating assets and

liabilities

Accounts receivable

15.8

(3.7

)

Contract assets

(4.2

)

(14.5

)

Inventory

(1.8

)

(1.7

)

Prepaid expenses and other current

assets

2.0

5.0

Other assets

0.9

(1.2

)

Accounts payable

(2.3

)

6.2

Accrued expenses

(7.2

)

—

Other current liabilities

(0.1

)

(0.2

)

Other long-term liabilities

(1.2

)

(0.7

)

Net cash provided by operating

activities

40.9

7.8

Cash Flows from Investing

Activities

Purchase of property and equipment

(12.9

)

(5.7

)

Proceeds from disposal of property and

equipment

4.7

13.9

Net cash provided by (used in)

investing activities

(8.2

)

8.2

Cash Flows from Financing

Activities

Borrowings under Credit Facility

298.6

283.3

Principal payments on Credit Facility

(301.1

)

(276.4

)

Principal payments on Eclipse M&E Term

Loan

(10.4

)

(0.8

)

Principal payments under Eclipse Term Loan

B

—

(9.4

)

Principal payments on Secured Promissory

Note

(6.2

)

(2.7

)

Principal payments on financing lease

obligations

(2.7

)

(2.3

)

Principal payments on other financing

liabilities

(0.5

)

(1.8

)

Shares withheld on equity transactions

(0.9

)

(1.2

)

Payments on Installment Purchases

(0.2

)

(0.2

)

Repurchase of Class A Common Stock

(5.9

)

—

Deferred financing costs on Wells

Fargo

(0.7

)

—

Net cash used in financing

activities

(30.0

)

(11.5

)

Increase in cash and cash

equivalents

2.7

4.5

Cash and cash equivalents, Beginning of

Period

3.7

0.6

Cash and cash equivalents, End of

Period

$

6.4

$

5.1

Supplemental Cash Flow

Information

Interest paid

$

0.6

$

0.6

Supplemental Disclosure of Non-cash

Investing and Financing Activities

Additions to fixed assets through

installment purchases and financing leases

$

(3.4

)

$

(2.0

)

Additions to fixed assets through asset

trades

$

(1.1

)

$

—

RANGER ENERGY SERVICES, INC.

SUPPLEMENTAL NON-GAAP FINANCIAL MEASURES

(UNAUDITED)

Note Regarding Non‑GAAP Financial Measure

The Company utilizes certain non-GAAP financial measures that

management believes to be insightful in understanding the Company’s

financial results. These financial measures, which include Adjusted

EBITDA and Free Cash Flow, should not be construed as being more

important than, or as an alternative for, comparable U.S. GAAP

financial measures. Detailed reconciliations of these Non-GAAP

financial measures to comparable U.S. GAAP financial measures have

been included below and are available in the Investor Relations

sections of our website at www.rangerenergy.com. Our presentation

of Adjusted EBITDA and Free Cash Flow should not be construed as an

indication that our results will be unaffected by the items

excluded from the reconciliations. Our computations of these

Non-GAAP financial measures may not be identical to other similarly

titled measures of other companies.

Adjusted EBITDA

We believe Adjusted EBITDA is a useful performance measure

because it allows for an effective evaluation of our operating

performance when compared to our peers, without regard to our

financing methods or capital structure. We exclude the items listed

below from net income or loss in arriving at Adjusted EBITDA

because these amounts can vary substantially within our industry

depending upon accounting methods, book values of assets, capital

structures and the method by which the assets were acquired.

Certain items excluded from Adjusted EBITDA are significant

components in understanding and assessing a company’s financial

performance, such as a company’s cost of capital and tax structure,

as well as the historic costs of depreciable assets, none of which

are reflected in Adjusted EBITDA.

We define Adjusted EBITDA as net income or loss before net

interest expense, income tax provision or benefit, depreciation and

amortization, equity‑based compensation, acquisition-related,

severance and reorganization costs, gain or loss on disposal of

assets, and certain other non-cash items that we do not view as

indicative of our ongoing performance.

The following tables are a reconciliation of net income or loss

to Adjusted EBITDA for the respective periods:

High Specification

Rigs

Wireline Services

Processing Solutions and

Ancillary Services

Other

Total

Three Months Ended June 30,

2023

Net income (loss)

$

11.5

$

2.8

$

4.2

$

(12.4

)

$

6.1

Interest expense, net

—

—

—

0.9

0.9

Income tax expense

—

—

—

2.0

2.0

Depreciation and amortization

4.1

2.9

1.4

0.3

8.7

EBITDA

15.6

5.7

5.6

(9.2

)

17.7

Equity based compensation

—

—

—

1.2

1.2

Loss on retirement of debt

—

—

—

2.4

2.4

Gain on disposal of property and

equipment

—

—

—

(0.5

)

(0.5

)

Severance and reorganization costs

—

—

—

0.2

0.2

Acquisition related costs

—

—

—

0.9

0.9

Adjusted EBITDA

$

15.6

$

5.7

$

5.6

$

(5.0

)

$

21.9

High Specification

Rigs

Wireline Services

Processing Solutions and

Ancillary Services

Other

Total

Three Months Ended June 30,

2022

Net income (loss)

$

6.1

$

1.5

$

5.1

$

(13.1

)

$

(0.4

)

Interest expense, net

—

—

—

1.8

1.8

Income tax benefit

—

—

—

(0.8

)

(0.8

)

Depreciation and amortization

8.1

2.8

—

0.5

11.4

EBITDA

14.2

4.3

5.1

(11.6

)

12.0

Impairment of fixed assets

—

—

—

1.1

1.1

Equity based compensation

—

—

—

0.9

0.9

Gain on disposal of property and

equipment

—

—

—

2.1

2.1

Bargain purchase gain, net of tax

—

—

—

(2.8

)

(2.8

)

Severance and reorganization costs

—

—

—

0.5

0.5

Acquisition related costs

—

—

—

3.3

3.3

Legal fees and settlements

—

—

—

0.9

0.9

Adjusted EBITDA

$

14.2

$

4.3

$

5.1

$

(5.6

)

$

18.0

High Specification

Rigs

Wireline Services

Processing Solutions and

Ancillary Services

Other

Total

Six Months Ended June 30,

2023

Net income (loss)

$

23.4

$

4.6

$

7.6

$

(23.3

)

$

12.3

Interest expense, net

—

—

—

2.1

2.1

Income tax expense

—

—

—

3.8

3.8

Depreciation and amortization

9.6

5.3

3.0

0.8

18.7

EBITDA

33.0

9.9

10.6

(16.6

)

36.9

Equity based compensation

—

—

—

2.3

2.3

Loss on retirement of debt

—

—

—

2.4

2.4

Gain on disposal of property and

equipment

—

—

—

(1.5

)

(1.5

)

Severance and reorganization costs

—

—

—

0.4

0.4

Acquisition related costs

—

—

—

1.5

1.5

Adjusted EBITDA

$

33.0

$

9.9

$

10.6

$

(11.5

)

$

42.0

High Specification

Rigs

Wireline Services

Processing Solutions and

Ancillary Services

Other

Total

Six Months Ended June 30,

2022

Net income (loss)

$

13.8

$

(3.0

)

$

6.4

$

(23.3

)

$

(6.1

)

Interest expense, net

—

—

—

3.9

3.9

Income tax benefit

—

—

—

(2.4

)

(2.4

)

Depreciation and amortization

14.5

5.5

2.0

1.0

23.0

EBITDA

28.3

2.5

8.4

(20.8

)

18.4

Impairment of fixed assets

—

—

—

1.1

1.1

Equity based compensation

—

—

—

1.7

1.7

Loss on disposal of property and

equipment

—

—

—

1.1

1.1

Bargain purchase gain, net of tax

—

—

—

(2.8

)

(2.8

)

Severance and reorganization costs

—

—

—

0.5

0.5

Acquisition related costs

—

—

—

6.5

6.5

Legal fees and settlements

—

—

—

1.1

1.1

Adjusted EBITDA

$

28.3

$

2.5

$

8.4

$

(11.6

)

$

27.6

Free Cash Flow

We believe free cash flow is an important financial measure for

use in evaluating the Company’s financial performance, as it

measures our ability to generate additional cash from our business

operations. Free cash flow should be considered in addition to,

rather than as a substitute for, net income as a measure of our

performance or net cash provided by operating activities as a

measure of our liquidity. Additionally, our definition of free cash

flow is limited and does not represent residual cash flows

available for discretionary expenditures due to the fact that the

measure does not deduct the payments required for debt service and

other obligations or payments made for business acquisitions.

Therefore, we believe it is important to view free cash flow as

supplemental to our entire statement of cash flows.

The following table is a reconciliation of consolidated

operating cash flows to Free Cash Flow for the six months ended

June 30, 2023 and 2022, in millions:

Six Months Ended

June 30, 2023

June 30, 2022

Net cash provided by operating

activities

$

40.9

$

7.8

Purchase of property and equipment

(12.9

)

(5.7

)

Free cash Flow

$

28.0

$

2.1

EBITDA

$

42.0

$

27.6

Free cash flow conversion - Free cash

flow as a percentage of EBITDA

67

%

8

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230807816492/en/

Melissa Cougle Chief Financial Officer (713) 935-8900

InvestorRelations@rangerenergy.com

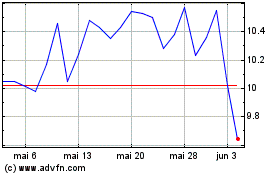

Ranger Energy Services (NYSE:RNGR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Ranger Energy Services (NYSE:RNGR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024