- Record second-quarter net sales of $1.79 billion, up slightly

from the prior year

- Record second-quarter net income was $145.5 million, record

diluted EPS was $1.13, and record EBIT was $220.9 million

- Second-quarter adjusted diluted EPS of $1.22 increased 10.9%

over prior year and adjusted EBIT increased 10.4% to $236.9

million, both records

- All-time record quarterly cash provided by operating activities

of $408.6 million

- First-half fiscal 2024 cash provided by operating activities of

$767.8 million already larger than previous 12-month fiscal year

record

- Fiscal 2024 third-quarter outlook calls for flat sales and

adjusted EBIT growth of 25% to 35%

- Fiscal full-year 2024 outlook calls for revenue growth of

low-single digits and adjusted EBIT growth of low-double digits to

mid-teens

RPM International Inc. (NYSE: RPM), a world leader in specialty

coatings, sealants and building materials, today reported record

financial results for its fiscal 2024 second quarter ended November

30, 2023.

“For eight consecutive quarters, we have generated record sales

and adjusted EBIT, and we are making good progress toward achieving

our MAP 2025 profitability goals by becoming a more efficient and

collaborative organization. At our investor day last year, we

discussed two other key components of MAP 2025 – improving cash

flow conversion and investing to accelerate organic growth. We have

made great progress with cash flow, as our $767.8 million cash from

operating activities through the first six months of fiscal 2024

has already exceeded our previous 12-month fiscal year record. Our

organic growth investments are yielding successes, particularly in

high-performance buildings and turnkey flooring systems, where we

are gaining share,” said Frank C. Sullivan, RPM chairman and

CEO.

“Our Construction Products Group and Performance Coatings Group,

the segments focused on coatings and high-performance buildings,

led growth in the second quarter. They benefited from their focus

on maintenance and repair, as well as their positioning to sell

highly engineered solutions into growing end markets. Demand in DIY

and specialty OEM markets remained weak; however, we overcame these

challenges by successfully executing MAP 2025 initiatives to expand

gross margins by 320 basis points and generate double-digit

adjusted EBIT growth.”

Second-Quarter 2024 Consolidated Results

Consolidated

Three Months Ended

$ in 000s except per share data

November 30,

November 30,

2023

2022

$ Change

% Change

Net Sales

$

1,792,275

$

1,791,708

$

567

0.0

%

Net Income Attributable to RPM Stockholders

145,505

131,344

14,161

10.8

%

Diluted Earnings Per Share (EPS)

1.13

1.02

0.11

10.8

%

Income Before Income Taxes (IBT)

195,824

175,135

20,689

11.8

%

Earnings Before Interest and Taxes (EBIT)

220,883

196,202

24,681

12.6

%

Adjusted EBIT(1)

236,893

214,673

22,220

10.4

%

Adjusted Diluted EPS(1)

1.22

1.10

0.12

10.9

%

(1) Excludes certain items that are not indicative of RPM's

ongoing operations. See tables below titled Supplemental Segment

Information and Reconciliation of Reported to Adjusted Amounts for

details.

Fiscal 2024 sales were a second-quarter record and were in

addition to strong growth in the prior-year period when sales

increased 9.3%. Pricing was positive in all segments as they catch

up with cost inflation. Volume growth was strongest in businesses

that were positioned to serve solid demand for infrastructure,

reshoring and high-performance building projects with engineered

solutions, which was more than offset by lower DIY consumer

takeaway at retail stores and weak demand from specialty OEM end

markets.

Geographically, sales growth was strongest in markets outside

the U.S. A new management team and focused sales strategy in Europe

contributed to 8.9% growth, and Africa/Middle East and Asia/Pacific

benefited from improved coordination under PCG management that

resulted in 13.0% and 6.4% sales growth, respectively.

Sales included a 0.3% organic decline, a 0.2% decline from

divestitures net of acquisitions, and 0.5% growth from foreign

currency translation.

Selling, general and administrative expenses increased due to

incentives to sell higher-margin products and services; investments

to generate long-term growth; and inflation in compensation,

benefits and healthcare expenses. These increases were partially

offset by expense reduction actions taken in the fourth quarter of

fiscal 2023.

Fiscal 2024 second-quarter adjusted EBIT was a record and in

addition to strong growth in the prior-year period when adjusted

EBIT increased 36.4%. This growth was driven by gross margin

expansion of 320 basis points, aided by MAP 2025 initiatives,

including the commodity cycle, a positive mix from shifting toward

higher margin products and services, and improved fixed-cost

leverage at businesses with volume growth.

Second-Quarter 2024 Segment Sales and Earnings

Construction Products Group

Three Months Ended

$ in 000s

November 30,

November 30,

2023

2022

$ Change

% Change

Net Sales

$

661,750

$

612,443

$

49,307

8.1

%

Income Before Income Taxes

98,398

74,038

24,360

32.9

%

EBIT

98,953

77,834

21,119

27.1

%

Adjusted EBIT(1)

99,613

79,042

20,571

26.0

%

(1) Excludes certain items that are not indicative of RPM's

ongoing operations. See table below titled Supplemental Segment

Information for details.

CPG achieved record second-quarter sales with strength in

concrete admixtures and repair products as a result of increased

demand for engineered solutions serving infrastructure and

reshoring-related projects, as well as market share gains.

Businesses serving high-performance building construction and

renovation also performed well. Demand in markets outside the U.S.

was strong and was driven by infrastructure-related demand in Latin

America and a more focused sales strategy in Europe.

Sales included 6.1% organic growth, 0.6% growth from

acquisitions, and 1.4% growth from foreign currency

translation.

Record second-quarter adjusted EBIT was driven by the positive

impact of MAP 2025 initiatives, favorable mix, and improved

fixed-cost leverage from volume growth. Variable compensation

increased as a result of improved financial performance and was

partially offset by expense reduction actions implemented at the

end of fiscal 2023.

Performance Coatings Group

Three Months Ended

$ in 000s

November 30,

November 30,

2023

2022

$ Change

% Change

Net Sales

$

374,856

$

356,822

$

18,034

5.1

%

Income Before Income Taxes

61,502

46,709

14,793

31.7

%

EBIT

60,077

46,377

13,700

29.5

%

Adjusted EBIT(1)

60,870

47,568

13,302

28.0

%

(1) Excludes certain items that are not indicative of RPM's

ongoing operations. See table below titled Supplemental Segment

Information for details.

PCG generated record second-quarter sales, which were in

addition to strong results in the prior-year period, driven by

growth in engineered turnkey flooring systems serving reshoring

capital projects and market share gains. Strong growth in

Asia/Pacific and Africa/Middle East, which were all recently

aligned under PCG, also contributed to the record sales.

Sales included 5.6% organic growth, a 0.5% decline from

divestitures net of acquisitions, and no impact from foreign

currency translation.

All-time record adjusted EBIT was driven by sales growth,

favorable mix and improved fixed-cost leverage that was enhanced by

MAP 2025 initiatives. The adjusted EBIT growth was achieved in

addition to strong results in the prior-year period.

Specialty Products Group

Three Months Ended

$ in 000s

November 30,

November 30,

2023

2022

$ Change

% Change

Net Sales

$

176,982

$

212,084

$

(35,102

)

(16.6

%)

Income Before Income Taxes

10,145

27,431

(17,286

)

(63.0

%)

EBIT

10,041

27,438

(17,397

)

(63.4

%)

Adjusted EBIT(1)

16,920

29,953

(13,033

)

(43.5

%)

(1) Excludes certain items that are not indicative of RPM's

ongoing operations. See table below titled Supplemental Segment

Information for details.

SPG’s second-quarter sales decline was driven by weak demand in

specialty OEM end markets, particularly those with exposure to

residential housing. Sales were also negatively impacted by the

divestiture of the non-core furniture warranty business in the

third quarter of fiscal 2023 and challenging comparisons in the

prior-year period when the disaster restoration business had strong

results in response to Hurricane Ian. Higher selling prices

partially offset this sales decline.

Sales included a 14.6% organic decline, a 2.7% reduction from

divestitures, and 0.7% growth from foreign currency

translation.

Adjusted EBIT was negatively impacted by the sales decline and

unfavorable fixed-cost leverage. The divestiture of the non-core

furniture warranty business also contributed to the adjusted EBIT

decline. Investments in long-term growth initiatives weighed on

adjusted EBIT margins and were partially offset by

expense-reduction actions in the fourth quarter of fiscal 2023.

Adjusted EBIT excluded a $4.0 million expense related to an

adverse legal ruling for a divested business.

Consumer Group

Three Months Ended

$ in 000s

November 30,

November 30,

2023

2022

$ Change

% Change

Net Sales

$

578,687

$

610,359

$

(31,672

)

(5.2

%)

Income Before Income Taxes

98,066

93,873

4,193

4.5

%

EBIT

97,197

93,872

3,325

3.5

%

Adjusted EBIT(1)

96,395

94,214

2,181

2.3

%

(1) Excludes certain items that are not indicative of RPM's

ongoing operations. See table below titled Supplemental Segment

Information for details.

The Consumer Group’s second-quarter sales decline was driven by

reduced DIY takeaway at retail stores as housing turnover hit

multi-year lows and consumers focused their spending on travel and

entertainment, as well as certain retailers destocking inventories.

These pressures were partially offset by market share gains,

strength in international markets, and higher pricing to catch up

with inflation. The Consumer Group faced challenging comparisons to

the prior-year period when sales grew 15.3%.

Sales included a 5.1% organic decline, no impact from

acquisitions, and foreign currency translation headwinds of

0.1%.

Record second-quarter adjusted EBIT was driven by gross margin

expansion enabled by MAP 2025 initiatives and strength in

international markets. This growth was in addition to strong

prior-year results when adjusted EBIT increased 180.3%.

Cash Flow and Financial Position

During the first six months of fiscal 2024:

- Cash provided by operating activities was $767.8 million, which

exceeded the previous 12-month fiscal year record, compared to

$190.9 million during the prior-year period, and included an

all-time quarterly record of $408.6 million during the second

quarter of fiscal 2024. The increase was driven by increased

profitability and improved working capital management, including

MAP 2025 initiatives.

- Capital expenditures were $89.3 million compared to $113.5

million during the prior-year period, driven by the timing of

investments, including those related to MAP 2025 initiatives, which

are expected to accelerate in the second half of fiscal 2024.

- The company returned $138.3 million to stockholders through

cash dividends and share repurchases and achieved its 50th

consecutive year of dividend increases.

As of November 30, 2023:

- Total debt was $2.25 billion compared to $2.84 billion a year

ago, with the $592.4 million reduction driven by improved cash flow

being used to repay debt.

- Total liquidity, including cash and committed revolving credit

facilities, was $1.51 billion, compared to $880.0 million a year

ago.

Business Outlook

“We expect business conditions in the third quarter to generally

be similar to the second quarter, with strength in our CPG and PCG

segments, international markets, and market share gains offsetting

continued weakness in DIY and specialty OEM demand. Adjusted EBIT

growth is expected to accelerate, driven by less challenging

prior-year comparisons and MAP 2025 benefits, which should more

than offset lower volumes in certain businesses and investments we

are making to accelerate future growth and efficiencies,” Sullivan

added. “For the remainder of the year, we are leveraging our focus

on repair and maintenance; our strong position serving demand for

infrastructure, high performance buildings and reshoring projects;

and MAP 2025 to deliver another year of record sales and adjusted

EBIT.”

The company expects the following in the fiscal 2024 third

quarter:

- Consolidated sales to be flat compared to prior-year record

results.

- CPG sales to increase in the mid-single-digit percentage range

compared to prior-year record results.

- PCG sales to increase in the mid-single-digit percentage range

compared to prior-year record results.

- SPG sales to decrease in the mid-teen percentage range compared

to prior-year record results.

- Consumer Group sales to decrease in the low-single-digit

percentage range compared to prior-year record results.

- Consolidated adjusted EBIT to increase 25% to 35% compared to

prior-year record results.

The company expects the following in the full-year fiscal

2024:

- Consolidated sales to increase in the low-single-digit

percentage range compared to prior-year record results. The

previous outlook was for mid-single-digit percentage growth.

- Consolidated adjusted EBIT to increase in the low-double-digit

to mid-teen percentage range compared to prior-year record results.

This outlook is unchanged from the prior outlook.

Earnings Webcast and Conference Call Information

Management will host a conference call to discuss these results

beginning at 10:00 a.m. EST today. The call can be accessed via

webcast at www.RPMinc.com/Investors/Presentations-Webcasts or by

dialing 1-844-481-2915 or 1-412-317-0708 for international callers

and asking to join the RPM International call. Participants are

asked to call the assigned number approximately 10 minutes before

the conference call begins. The call, which will last approximately

one hour, will be open to the public, but only financial analysts

will be permitted to ask questions. The media and all other

participants will be in a listen-only mode.

For those unable to listen to the live call, a replay will be

available from January 4, 2024, until January 11, 2024. The replay

can be accessed by dialing 1-877-344-7529 or 1-412-317-0088 for

international callers. The access code is 4125009. The call also

will be available for replay and as a written transcript via the

RPM website at www.RPMinc.com.

About RPM

RPM International Inc. owns subsidiaries that are world leaders

in specialty coatings, sealants, building materials and related

services. The company operates across four reportable segments:

consumer, construction products, performance coatings and specialty

products. RPM has a diverse portfolio of market-leading brands,

including Rust-Oleum, DAP, Zinsser, Varathane, DayGlo, Legend

Brands, Stonhard, Carboline, Tremco and Dryvit. From homes and

workplaces, to infrastructure and precious landmarks, RPM’s brands

are trusted by consumers and professionals alike to help build a

better world. The company employs approximately 17,300 individuals

worldwide. Visit www.RPMinc.com to learn more.

For more information, contact Matt Schlarb, Senior Director of

Investor Relations, at 330-220-6064 or mschlarb@rpminc.com.

Use of Non-GAAP Financial Information

To supplement the financial information presented in accordance

with Generally Accepted Accounting Principles in the United States

(“GAAP”) in this earnings release, we use EBIT, adjusted EBIT and

adjusted earnings per share, which are all non-GAAP financial

measures. EBIT is defined as earnings (loss) before interest and

taxes, with adjusted EBIT and adjusted earnings per share provided

for the purpose of adjusting for one-off items impacting revenues

and/or expenses that are not considered by management to be

indicative of ongoing operations. We evaluate the profit

performance of our segments based on income before income taxes,

but also look to EBIT as a performance evaluation measure because

interest income (expense), net is essentially related to corporate

functions, as opposed to segment operations. For that reason, we

believe EBIT is also useful to investors as a metric in their

investment decisions. EBIT should not be considered an alternative

to, or more meaningful than, income before income taxes as

determined in accordance with GAAP, since EBIT omits the impact of

interest and investment income or expense in determining operating

performance, which represent items necessary to our continued

operations, given our level of indebtedness. Nonetheless, EBIT is a

key measure expected by and useful to our fixed income investors,

rating agencies and the banking community all of whom believe, and

we concur, that this measure is critical to the capital markets’

analysis of our segments’ core operating performance. We also

evaluate EBIT because it is clear that movements in EBIT impact our

ability to attract financing. Our underwriters and bankers

consistently require inclusion of this measure in offering

memoranda in conjunction with any debt underwriting or bank

financing. EBIT may not be indicative of our historical operating

results, nor is it meant to be predictive of potential future

results. See the financial statement section of this earnings

release for a reconciliation of EBIT and adjusted EBIT to income

before income taxes, and adjusted earnings per share to earnings

per share. We have not provided a reconciliation of our

third-quarter fiscal 2024 or full-year fiscal 2024 adjusted EBIT

guidance because material terms that impact such measure are not in

our control and/or cannot be reasonably predicted, and therefore a

reconciliation of such measure is not available without

unreasonable effort.

Forward-Looking Statements

This press release contains “forward-looking statements”

relating to our business. These forward-looking statements, or

other statements made by us, are made based on our expectations and

beliefs concerning future events impacting us and are subject to

uncertainties and factors (including those specified below), which

are difficult to predict and, in many instances, are beyond our

control. As a result, our actual results could differ materially

from those expressed in or implied by any such forward-looking

statements. These uncertainties and factors include (a) global

markets and general economic conditions, including uncertainties

surrounding the volatility in financial markets, the availability

of capital, and the viability of banks and other financial

institutions; (b) the prices, supply and availability of raw

materials, including assorted pigments, resins, solvents, and other

natural gas- and oil-based materials; packaging, including plastic

and metal containers; and transportation services, including fuel

surcharges; (c) continued growth in demand for our products; (d)

legal, environmental and litigation risks inherent in our

businesses and risks related to the adequacy of our insurance

coverage for such matters; (e) the effect of changes in interest

rates; (f) the effect of fluctuations in currency exchange rates

upon our foreign operations; (g) the effect of non-currency risks

of investing in and conducting operations in foreign countries,

including those relating to domestic and international political,

social, economic and regulatory factors; (h) risks and

uncertainties associated with our ongoing acquisition and

divestiture activities; (i) the timing of and the realization of

anticipated cost savings from restructuring initiatives and the

ability to identify additional cost savings opportunities; (j)

risks related to the adequacy of our contingent liability reserves;

(k) risks relating to a public health crisis similar to the Covid

pandemic; (l) risks related to acts of war similar to the Russian

invasion of Ukraine; (m) risks related to the transition or

physical impacts of climate change and other natural disasters or

meeting sustainability-related voluntary goals or regulatory

requirements; (n) risks related to our use of technology,

artificial intelligence, data breaches and data privacy violations;

and (o) other risks detailed in our filings with the Securities and

Exchange Commission, including the risk factors set forth in our

Form 10-K for the year ended May 31, 2023, as the same may be

updated from time to time. We do not undertake any obligation to

publicly update or revise any forward-looking statements to reflect

future events, information or circumstances that arise after the

filing date of this release.

CONSOLIDATED STATEMENTS OF INCOME IN THOUSANDS, EXCEPT PER

SHARE DATA (Unaudited)

Three Months Ended

Six Months Ended

November 30,

November 30,

November 30,

November 30,

2023

2022

2023

2022

Net Sales

$

1,792,275

$

1,791,708

$

3,804,132

$

3,724,028

Cost of Sales

1,044,047

1,101,317

2,227,287

2,289,166

Gross Profit

748,228

690,391

1,576,845

1,434,862

Selling, General & Administrative Expenses

523,289

490,607

1,054,321

975,812

Restructuring Expense

1,239

1,272

7,737

2,626

Interest Expense

30,348

27,918

62,166

54,629

Investment (Income), Net

(5,289

)

(6,851

)

(17,728

)

(3,187

)

Other Expense, Net

2,817

2,310

5,371

4,726

Income Before Income Taxes

195,824

175,135

464,978

400,256

Provision for Income Taxes

50,009

43,593

117,850

99,435

Net Income

145,815

131,542

347,128

300,821

Less: Net Income Attributable to Noncontrolling Interests

310

198

541

464

Net Income Attributable to RPM International Inc.

Stockholders

$

145,505

$

131,344

$

346,587

$

300,357

Earnings per share of common stock attributable to

RPM International Inc. Stockholders: Basic

$

1.13

$

1.02

$

2.70

$

2.34

Diluted

$

1.13

$

1.02

$

2.69

$

2.33

Average shares of common stock outstanding - basic

127,758

127,585

127,816

127,600

Average shares of common stock outstanding - diluted

128,249

128,911

128,312

128,887

SUPPLEMENTAL SEGMENT INFORMATION IN THOUSANDS (Unaudited)

Three Months Ended

Six Months Ended

November 30,

November 30,

November 30,

November 30,

2023

2022

2023

2022

Net Sales: CPG Segment

$

661,750

$

612,443

$

1,444,539

$

1,318,856

PCG Segment

374,856

356,822

753,369

720,540

SPG Segment

176,982

212,084

357,933

414,781

Consumer Segment

578,687

610,359

1,248,291

1,269,851

Total

$

1,792,275

$

1,791,708

$

3,804,132

$

3,724,028

Income Before Income Taxes: CPG Segment Income Before

Income Taxes (a)

$

98,398

$

74,038

$

238,850

$

180,793

Interest (Expense), Net (b)

(555

)

(3,796

)

(3,951

)

(4,576

)

EBIT (c)

98,953

77,834

242,801

185,369

MAP initiatives (d)

660

1,208

1,409

2,389

Adjusted EBIT

$

99,613

$

79,042

$

244,210

$

187,758

PCG Segment Income Before Income Taxes (a)

$

61,502

$

46,709

$

106,323

$

96,110

Interest Income, Net (b)

1,425

332

2,549

526

EBIT (c)

60,077

46,377

103,774

95,584

MAP initiatives (d)

793

1,191

16,147

2,293

Adjusted EBIT

$

60,870

$

47,568

$

119,921

$

97,877

SPG Segment Income Before Income Taxes (a)

$

10,145

$

27,431

$

26,542

$

55,316

Interest Income (Expense), Net (b)

104

(7

)

203

(5

)

EBIT (c)

10,041

27,438

26,339

55,321

MAP initiatives (d)

2,926

2,515

5,645

4,281

(Gain) on sale of a business (e)

-

-

(1,123

)

-

Legal contingency adjustment on a divested business (g)

3,953

-

3,953

-

Adjusted EBIT

$

16,920

$

29,953

$

34,814

$

59,602

Consumer Segment Income Before Income Taxes (a)

$

98,066

$

93,873

$

229,895

$

210,562

Interest Income, Net (b)

869

1

1,619

27

EBIT (c)

97,197

93,872

228,276

210,535

MAP initiatives (d)

34

342

414

749

Business interruption insurance recovery (f)

(836

)

-

(11,128

)

-

Adjusted EBIT

$

96,395

$

94,214

$

217,562

$

211,284

Corporate/Other (Loss) Before Income Taxes (a)

$

(72,287

)

$

(66,916

)

$

(136,632

)

$

(142,525

)

Interest (Expense), Net (b)

(26,902

)

(17,597

)

(44,858

)

(47,414

)

EBIT (c)

(45,385

)

(49,319

)

(91,774

)

(95,111

)

MAP initiatives (d)

8,480

13,215

21,174

28,528

Adjusted EBIT

$

(36,905

)

$

(36,104

)

$

(70,600

)

$

(66,583

)

TOTAL CONSOLIDATED Income Before Income Taxes (a)

$

195,824

$

175,135

$

464,978

$

400,256

Interest (Expense)

(30,348

)

(27,918

)

(62,166

)

(54,629

)

Investment Income, Net

5,289

6,851

17,728

3,187

EBIT (c)

220,883

196,202

509,416

451,698

MAP initiatives (d)

12,893

18,471

44,789

38,240

(Gain) on sale of a business (e)

-

-

(1,123

)

-

Business interruption insurance recovery (f)

(836

)

-

(11,128

)

-

Legal contingency adjustment on a divested business (g)

3,953

-

3,953

-

Adjusted EBIT

$

236,893

$

214,673

$

545,907

$

489,938

(a)

The presentation includes a reconciliation of Income (Loss) Before

Income Taxes, a measure defined by Generally Accepted Accounting

Principles in the United States (GAAP), to EBIT and Adjusted EBIT.

(b)

Interest Income (Expense), Net includes the combination of Interest

Income (Expense) and Investment Income (Expense), Net.

(c)

EBIT is defined as earnings (loss) before interest and taxes, with

Adjusted EBIT provided for the purpose of adjusting for items

impacting earnings that are not considered by management to be

indicative of ongoing operations. We evaluate the profit

performance of our segments based on income before income taxes,

but also look to EBIT, or adjusted EBIT, as a performance

evaluation measure because Interest Income (Expense), Net is

essentially related to corporate functions, as opposed to segment

operations. For that reason, we believe EBIT is also useful to

investors as a metric in their investment decisions. EBIT should

not be considered an alternative to, or more meaningful than,

income before income taxes as determined in accordance with GAAP,

since EBIT omits the impact of interest and investment income or

expense in determining operating performance, which represent items

necessary to our continued operations, given our level of

indebtedness. Nonetheless, EBIT is a key measure expected by and

useful to our fixed income investors, rating agencies and the

banking community all of whom believe, and we concur, that this

measure is critical to the capital markets' analysis of our

segments' core operating performance. We also evaluate EBIT because

it is clear that movements in EBIT impact our ability to attract

financing. Our underwriters and bankers consistently require

inclusion of this measure in offering memoranda in conjunction with

any debt underwriting or bank financing. EBIT may not be indicative

of our historical operating results, nor is it meant to be

predictive of potential future results.

(d)

Reflects restructuring and other charges, which have been incurred

in relation to our Margin Acceleration Plan ("MAP to Growth") and

our Margin Achievement Plan ("MAP 2025"), together MAP initiatives,

as follows:"Inventory-related charges," & "Accelerated expense

- other," and inventory write-offs related to the discontinuation

of certain product lines ("Discontinued product lines") partially

offset by the sale of inventory that had previously been reserved

for as a result of prior product line rationalization initiatives

at PCG, which have been recorded in

Cost of Sales;"Headcount

reductions, impairments, closures of facilities and related costs

as well as the loss on the divestiture of a non-core service

business within our PCG segment," which have been recorded in

Restructuring Expense;"Accelerated expense - other,"

"Receivable write-offs," "ERP consolidation plan," &

"Professional fees," which have been recorded in

Selling,

General & Administrative Expenses.

(e)

Reflects the gain associated with post-closing adjustments for the

sale of the furniture warranty business in the SPG segment which

has been recorded in

Selling, General & Administrative

Expenses.

(f)

Business interruption insurance recovery at our Consumer segment

related to lost sales and incremental costs incurred during fiscal

2021 and 2022 as a result of an explosion at the plant of a

significant alkyd resin supplier, which has been recorded in

Selling, General & Administrative Expenses.

(g)

Represents incremental expense related to an adverse legal ruling

from a case associated with a business that was divested in the

prior year. We strongly disagree with the legal ruling and have

filed an appeal.

SUPPLEMENTAL INFORMATION RECONCILIATION

OF "REPORTED" TO "ADJUSTED" AMOUNTS (Unaudited)

Three Months Ended

Six Months Ended

November 30,

November 30,

November 30,

November 30,

2023

2022

2023

2022

Reconciliation of Reported Earnings

per Diluted Share to Adjusted Earnings per Diluted Share

(All amounts presented after-tax):

Reported Earnings per Diluted Share

$

1.13

$

1.02

$

2.69

$

2.33

MAP initiatives (d)

0.07

0.11

0.27

0.23

(Gain) on sale of a business (e)

-

-

(0.01

)

-

Business interruption insurance recovery (f)

-

-

(0.07

)

-

Legal contingency adjustment on a divested business (g)

0.02

-

0.02

-

Investment returns (h)

-

(0.03

)

(0.04

)

0.02

Adjusted Earnings per Diluted Share (i)

$

1.22

$

1.10

$

2.86

$

2.58

(d)

Reflects restructuring and other charges, which have been incurred

in relation to our Margin Acceleration Plan ("MAP to Growth") and

our Margin Achievement Plan ("MAP 2025"), together MAP initiatives,

as follows:"Inventory-related charges," & "Accelerated expense

- other," and inventory write-offs related to the discontinuation

of certain product lines ("Discontinued product lines") partially

offset by the sale of inventory that had previously been reserved

for as a result of prior product line rationalization initiatives

at PCG, which have been recorded in

Cost of Sales;"Headcount

reductions, impairments, closures of facilities and related costs

as well as the loss on the divestiture of a non-core service

business within our PCG segment," which have been recorded in

Restructuring Expense;"Accelerated expense - other,"

"Receivable write-offs," "ERP consolidation plan," &

"Professional fees," which have been recorded in

Selling,

General & Administrative Expenses.

(e)

Reflects the gain associated with post-closing adjustments for the

sale of the furniture warranty business in the SPG segment which

has been recorded in

Selling, General & Administrative

Expenses.

(f)

Business interruption insurance recovery at our Consumer segment

related to lost sales and incremental costs incurred during fiscal

2021 and 2022 as a result of an explosion at the plant of a

significant alkyd resin supplier, which has been recorded in

Selling, General & Administrative Expenses.

(g)

Represents incremental expense related to an adverse legal ruling

from a case associated with a business that was divested in the

prior year. We strongly disagree with the legal ruling and have

filed an appeal.

(h)

Investment returns include realized net gains and losses on sales

of investments and unrealized net gains and losses on equity

securities, which are adjusted due to their inherent volatility.

Management does not consider these gains and losses, which cannot

be predicted with any level of certainty, to be reflective of the

Company's core business operations.

(i)

Adjusted Diluted EPS is provided for the purpose of adjusting

diluted earnings per share for items impacting earnings that are

not considered by management to be indicative of ongoing

operations.

CONSOLIDATED BALANCE SHEETS IN THOUSANDS

(Unaudited)

November 30, 2023

November 30, 2022

May 31, 2023

Assets Current Assets Cash and cash equivalents

$

262,746

$

232,118

$

215,787

Trade accounts receivable

1,290,788

1,388,168

1,552,522

Allowance for doubtful accounts

(57,448

)

(48,041

)

(49,482

)

Net trade accounts receivable

1,233,340

1,340,127

1,503,040

Inventories

1,102,815

1,389,591

1,135,496

Prepaid expenses and other current assets

320,106

355,024

329,845

Total current assets

2,919,007

3,316,860

3,184,168

Property, Plant and Equipment, at Cost

2,407,579

2,187,570

2,332,916

Allowance for depreciation

(1,154,468

)

(1,061,701

)

(1,093,440

)

Property, plant and equipment, net

1,253,111

1,125,869

1,239,476

Other Assets Goodwill

1,311,653

1,341,580

1,293,588

Other intangible assets, net of amortization

533,659

581,909

554,991

Operating lease right-of-use assets

324,272

295,384

329,582

Deferred income taxes

25,201

16,201

15,470

Other

170,474

171,710

164,729

Total other assets

2,365,259

2,406,784

2,358,360

Total Assets

$

6,537,377

$

6,849,513

$

6,782,004

Liabilities and Stockholders' Equity Current

Liabilities Accounts payable

$

650,771

$

679,596

$

680,938

Current portion of long-term debt

5,548

3,713

178,588

Accrued compensation and benefits

204,921

197,266

257,328

Accrued losses

34,881

25,795

26,470

Other accrued liabilities

358,234

383,664

347,477

Total current liabilities

1,254,355

1,290,034

1,490,801

Long-Term Liabilities Long-term debt, less current

maturities

2,246,834

2,841,066

2,505,221

Operating lease liabilities

278,028

254,217

285,524

Other long-term liabilities

298,257

292,101

267,111

Deferred income taxes

97,349

80,010

90,347

Total long-term liabilities

2,920,468

3,467,394

3,148,203

Total liabilities

4,174,823

4,757,428

4,639,004

Stockholders' Equity Preferred stock; none issued

-

-

-

Common stock (outstanding 128,872; 129,090; 128,766)

1,289

1,291

1,288

Paid-in capital

1,141,970

1,113,025

1,124,825

Treasury stock, at cost

(830,402

)

(756,872

)

(784,463

)

Accumulated other comprehensive (loss)

(589,690

)

(601,046

)

(604,935

)

Retained earnings

2,637,387

2,334,063

2,404,125

Total RPM International Inc. stockholders' equity

2,360,554

2,090,461

2,140,840

Noncontrolling interest

2,000

1,624

2,160

Total equity

2,362,554

2,092,085

2,143,000

Total Liabilities and Stockholders' Equity

$

6,537,377

$

6,849,513

$

6,782,004

CONSOLIDATED STATEMENTS OF CASH FLOWS IN THOUSANDS

(Unaudited)

Six Months Ended

November 30,

November 30,

2023

2022

Cash Flows From Operating Activities: Net

income

$

347,128

$

300,821

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization

84,177

76,750

Deferred income taxes

(5,574

)

(4,196

)

Stock-based compensation expense

17,147

16,877

Net (gain) loss on marketable securities

(6,226

)

2,812

Net loss on sales of assets and businesses

3,623

-

Other

4,007

(104

)

Changes in assets and liabilities, net of effect from purchases and

sales of businesses: Decrease in receivables

272,262

72,931

Decrease (increase) in inventory

37,243

(189,487

)

Decrease (increase) in prepaid expenses and other

21,260

(23,025

)

current and long-term assets (Decrease) in accounts payable

(11,806

)

(95,502

)

(Decrease) in accrued compensation and benefits

(53,980

)

(62,724

)

Increase in accrued losses

8,332

1,465

Increase in other accrued liabilities

50,188

94,297

Cash Provided By Operating Activities

767,781

190,915

Cash Flows From Investing Activities: Capital expenditures

(89,300

)

(113,463

)

Acquisition of businesses, net of cash acquired

(15,404

)

(47,542

)

Purchase of marketable securities

(22,057

)

(10,309

)

Proceeds from sales of marketable securities

13,796

7,071

Other

1,326

236

Cash (Used For) Investing Activities

(111,639

)

(164,007

)

Cash Flows From Financing Activities: Additions to long-term

and short-term debt

-

517,785

Reductions of long-term and short-term debt

(449,485

)

(351,795

)

Cash dividends

(113,325

)

(105,640

)

Repurchases of common stock

(25,000

)

(25,000

)

Shares of common stock returned for taxes

(20,689

)

(14,825

)

Payments of acquisition-related contingent consideration

(1,082

)

(3,705

)

Other

(713

)

(2,627

)

Cash (Used For) Provided By Financing Activities

(610,294

)

14,193

Effect of Exchange Rate Changes on Cash and Cash

Equivalents

1,111

(10,655

)

Net Change in Cash and Cash Equivalents

46,959

30,446

Cash and Cash Equivalents at Beginning of Period

215,787

201,672

Cash and Cash Equivalents at End of Period

$

262,746

$

232,118

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240104575029/en/

Matt Schlarb, 330-220-6064 Senior Director of Investor Relations

mschlarb@rpminc.com

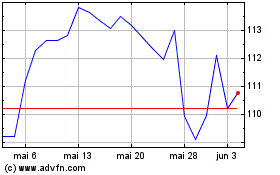

RPM (NYSE:RPM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

RPM (NYSE:RPM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025