Rayonier to Split Stock 3 for 2, Increase Dividend 13.7 Percent

14 Setembro 2005 - 2:44PM

Business Wire

Rayonier (NYSE:RYN) announced today that its Board of Directors has

approved a three-for-two stock split and a 13.7 percent increase in

the quarterly cash dividend to 47 cents per share on a post-split

basis. The split will be effected in the form of a stock dividend

by issuing one-half additional share for each share held. The

additional shares will be distributed October 17, 2005, to

shareholders of record on October 3, 2005. The 47 cents per share

fourth quarter dividend will be paid on December 30, 2005, to

shareholders of record on December 9, 2005. The previously

announced third quarter pre-split dividend of 62 cents per share

will be paid on September 30, 2005, to shareholders of record on

September 9, 2005. Lee Nutter, Chairman, President and CEO, said:

"The stock split recognizes the appreciation in value of Rayonier's

common shares since our last split in June 2003 and should further

improve liquidity and trading volume. The increased dividend

reflects our continued strong operating performance and positive

outlook for the coming year, despite higher energy costs and slight

short-term effects of Hurricane Katrina. "Further value creation is

expected as TerraPointe, our real estate subsidiary, implements

strategic growth plans to maximize the asset value of our 200,000

acres of higher-and-better use properties in coastal Southeast

Georgia and Northeast Florida. Also, our significant cash balances

and low debt-to-capital ratio provide continuing strategic

flexibility," Nutter said. Rayonier has 2.2 million acres of

timberland and real estate in the U.S. and New Zealand. The company

is also the world's leading producer of high performance specialty

cellulose fibers and has customers in more than 50 countries.

Certain statements herein relating to future financial performance

and the expected impact of the stock split and dividend increase

are made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995. The following important

factors, among others, could cause actual results to differ

materially from those expressed in the forward-looking statements:

changes in global market trends and world events; interest rate and

currency movements; fluctuations in demand for, or supply of,

cellulose specialties, absorbent materials, timber, wood products

or real estate and entry of new competitors into these markets;

adverse weather conditions affecting production, timber

availability, sales and distribution; changes in production costs

for wood products or performance fibers, particularly for raw

materials such as wood, energy and chemicals; changes in law or

policy that might limit or restrict the development of real estate,

particularly in the Southeast U.S.; the ability of the company to

identify and complete timberland and higher-value real estate

acquisitions; the company's ability to satisfy requirements in

order to qualify as a REIT; the availability of tax deductions and

the ability of the company to complete tax-efficient exchanges of

real estate; implementation or revision of governmental policies

and regulations affecting the environment, endangered species,

import and export controls or taxes; and the ability to complete

the previously announced transactions relating to our New Zealand

timberland assets. Further, the Company's future results could be

impacted by those additional factors described in the Company's

most recent Form 10-K on file with the Securities and Exchange

Commission. For further information, visit the company's website at

http://www.rayonier.com. Complimentary copies of Rayonier press

releases and other financial documents are also available by mail

or fax by calling 1-800-RYN-7611.

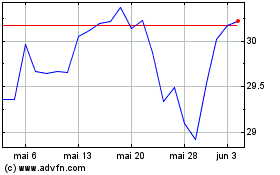

Rayonier (NYSE:RYN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rayonier (NYSE:RYN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024