SilverBow Resources, Inc. (NYSE: SBOW) (“SilverBow” or the

“Company”) today announced that Institutional Shareholder Services

(“ISS”) and Glass Lewis & Co. (“Glass Lewis”), two leading

independent proxy advisory firms, have both recommended that

SilverBow shareholders vote “FOR” the re-election of SilverBow’s

three highly qualified and independent director nominees on the

WHITE proxy card in connection

with the Company’s 2024 Annual Meeting of Shareholders (the “2024

Annual Meeting”) on May 21, 2024.

In their respective May 9, 2024 reports, ISS and Glass Lewis

stated1:

- “Given that it does not appear that change on the board is

needed at this time, votes for management nominees Ellisor,

McAllister, and Wampler, as well as withholds against dissident

nominees Brooks, Fox, and Minyard, are warranted on the management

(WHITE) card.” (ISS)

- “In each of the dissident’s three approaches of the [Company]

since 2022, the board appears to have responded appropriately. The

board’s reasons for a failure to consummate a transaction include a

failure of the parties to reach a consensus regarding valuation

(2022 and 2024), and the failure of the dissident to secure

financing (2023).” (ISS)

- “We do not see that Kimmeridge substantively addresses [the

substantial contraction in value for the Laredo Assets] in its

materials, including by acknowledging the possibility that the

board's acceptance of Kimmeridge's August 23, 2022 term sheet could

have been materially value destructive for SilverBow shareholders.”

(Glass Lewis)

- “The most evident hurdle to Kimmeridge's platform, in our view,

is that SilverBow very recently demonstrated strong strategic and

financial execution in the wake of large-scale M&A, disclosure

of which has correlated with a substantial increase in shareholder

value.” (Glass Lewis)

- “Coupled with perspectives relating to SilverBow's recent

performance, including the Company's first full quarter of

execution following SilverBow's largest Eagle Ford acquisition to

date, we do not find there exists a sufficiently compelling case to

suggest board change is warranted as an extension of the Company's

recent M&A activity, or, more broadly, prevailing market

impressions of SilverBow's operational and financial execution and

updated guidance.” (Glass Lewis)

- “[…] we believe available materials suggest the board made

reasonable effort to engage around an array of potential

alternatives, including by executing multiple NDAs, submitting

counterproposals and, at one point, agreeing on specific buyout

terms which were subsequently abandoned by Kimmeridge (a

development which, again and for the avoidance of doubt, we do not

believe is particularly well addressed in the Dissident's

materials).” (Glass Lewis)

Commenting on the recommendations, SilverBow issued the

following statement:

The support of both ISS and Glass Lewis for

the re-election of SilverBow’s highly qualified and independent

director nominees and recommendations of “WITHHOLD” against the

election of each of Kimmeridge’s nominees is further evidence that

the SilverBow Board is acting in the best interests of our

shareholders.

ISS and Glass Lewis recognize that SilverBow

has the right Board and the right strategy to continue to deliver

enhanced value for shareholders. The Company has a track record of

successfully executing its plan, and our first quarter results and

increased 2024 outlook demonstrate that we have strong

momentum.

The SilverBow Board remains committed to

acting in the best interests of the Company and ALL SilverBow

shareholders.

SilverBow strongly urges shareholders to

follow ISS and Glass Lewis’s recommendations and vote “FOR” the

re-election of SilverBow’s three highly qualified director nominees

– Gabriel L. Ellisor, Kathleen McAllister and Charles W. Wampler –

on the WHITE proxy card today.

Your

Vote Is Important!

Please vote on the WHITE

proxy card “FOR” the Company’s three nominees, “WITHHOLD” on

Kimmeridge’s nominees, and “FOR” ALL other Company proposals using

one of the following options:

- Follow the instructions set

forth on the WHITE proxy card to vote via the internet,

- Follow the instructions set

forth on the WHITE proxy card to vote by telephone, or

- Mark, sign and date the

WHITE proxy card and return it in the postage-paid

envelope.

Remember, please discard and do

not sign any gold Kimmeridge proxy card.

If you have already voted using a

gold proxy card, you may cancel that vote

simply by voting again using the

Company’s WHITE proxy card.

Only your latest-dated vote will

count!

If you have any questions about

how to vote your shares,

please call the firm assisting us

with the solicitation of proxies:

INNISFREE M&A

INCORPORATED

Shareholders may call:

1 (877) 825-8793 (toll-free from

the U.S. and Canada) or

+1 (412) 232-3651 (from other

countries)

ABOUT SILVERBOW RESOURCES, INC.

SilverBow Resources, Inc. (NYSE: SBOW) is a Houston-based energy

company actively engaged in the exploration, development and

production of oil and gas in the Eagle Ford Shale and Austin Chalk

in South Texas. With over 30 years of history operating in South

Texas, the Company possesses a significant understanding of

regional reservoirs that it leverages to assemble high quality

drilling inventory while continuously enhancing its operations to

maximize returns on capital invested.

FORWARD-LOOKING STATEMENTS

This communication includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. These forward-looking statements represent management’s

expectations or beliefs concerning future events, and it is

possible that the results described in this communication will not

be achieved. These forward-looking statements are based on current

expectations and assumptions and are subject to a number of risks

and uncertainties, many of which are beyond our control. All

statements, other than statements of historical fact included in

this communication, including those regarding our strategy, the

benefits of the acquisitions, future operations, guidance and

outlook, financial position, prospects, plans and objectives of

management are forward-looking statements. When used in this

communication, words such as “will,” “could,” “believe,”

“anticipate,” “intend,” “estimate,” “budgeted,” “guidance,”

“expect,” “may,” “continue,” “potential,” “plan,” “project,”

“positioned,” “should” and similar expressions are intended to

identify forward-looking statements, although not all

forward-looking statements contain such identifying words.

Important factors that could cause actual results to differ

materially from our expectations include, but are not limited to,

the following risks and uncertainties: further actions by the

members of the Organization of the Petroleum Exporting Countries,

Russia and other allied producing countries with respect to oil

production levels and announcements of potential changes in such

levels; risks related to recently completed acquisitions and

integration of these acquisitions; volatility in natural gas, oil

and natural gas liquids prices; ability to obtain permits and

government approvals; our borrowing capacity, future covenant

compliance; cash flow and liquidity, including our ability to

satisfy our short- or long-term liquidity needs; asset disposition

efforts or the timing or outcome thereof; ongoing and prospective

joint ventures, their structures and substance, and the likelihood

of their finalization or the timing thereof; the amount, nature and

timing of capital expenditures, including future development costs;

timing, cost and amount of future production of oil and natural

gas; availability of drilling and production equipment or

availability of oil field labor; availability, cost and terms of

capital; timing and successful drilling and completion of wells;

availability and cost for transportation and storage capacity of

oil and natural gas; costs of exploiting and developing our

properties and conducting other operations; competition in the oil

and natural gas industry; general economic and political

conditions, including inflationary pressures, further increases in

interest rates, a general economic slowdown or recession,

instability in financial institutions, political tensions and war

(including future developments in the ongoing conflicts in Ukraine

and the Middle East); the severity and duration of world health

events, including health crises and pandemics and related economic

repercussions, including disruptions in the oil and gas industry,

supply chain disruptions, and operational challenges; opportunities

to monetize assets; our ability to execute on strategic

initiatives, including acquisitions; effectiveness of our risk

management activities, including hedging strategy; counterparty and

credit market risk; the impact of shareholder activism and any

changes in composition of the Company’s board of directors; pending

legal and environmental matters, including potential impacts on our

business related to climate change and related regulations; actions

by third parties, including customers, service providers and

shareholders; current and future governmental regulation and

taxation of the oil and natural gas industry; developments in world

oil and natural gas markets and in oil and natural gas-producing

countries; uncertainty regarding our future operating results; and

other risks and uncertainties discussed in the Company’s reports

filed with the U.S. Securities and Exchange Commission (“SEC”),

including its Annual Report on Form 10-K for the year ended

December 31, 2023, and subsequent quarterly reports on Form 10-Q

and current reports on Form 8-K.

All forward-looking statements speak only as of the date of this

communication. You should not place undue reliance on these

forward-looking statements. The Company’s capital budget, operating

plan, service cost outlook and development plans are subject to

change at any time. Although we believe that our plans, intentions

and expectations reflected in or suggested by the forward-looking

statements we make in this communication are reasonable, we can

give no assurance that these plans, intentions or expectations will

be achieved. The risk factors and other factors noted herein and in

the Company’s SEC filings could cause its actual results to differ

materially from those contained in any forward-looking statement.

These cautionary statements qualify all forward-looking statements

attributable to us or persons acting on our behalf.

All subsequent written and oral forward-looking statements

attributable to us or to persons acting on our behalf are expressly

qualified in their entirety by the foregoing. We undertake no

obligation to publicly release the results of any revisions to any

such forward-looking statements that may be made to reflect events

or circumstances after the date of this communication or to reflect

the occurrence of unanticipated events, except as required by

law.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

The Company, its directors and certain of its executive officers

and employees are or will be participants in the solicitation of

proxies from shareholders in connection with the 2024 Annual

Meeting. The Company has filed the Definitive Proxy Statement with

the SEC on April 9, 2024 in connection with the solicitation of

proxies for the 2024 Annual Meeting, together with a WHITE proxy

card.

The identity of the participants, their direct or indirect

interests, by security holdings or otherwise, and other information

relating to the participants are available in the Definitive Proxy

Statement (available here) in the section entitled “Security

Ownership of Board of Directors and Management” and Appendix F. To

the extent holdings of the Company’s securities by the Company’s

directors and executive officers changes from the information

included in this communication, such information will be reflected

on Statements of Change in Ownership on Forms 3, 4 or 5 filed with

the SEC. These documents are available free of charge as described

below.

SHAREHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT

AND ANY OTHER DOCUMENTS TO BE FILED BY THE COMPANY WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION. Shareholders are able to obtain,

free of charge, copies of all of the foregoing documents, any

amendments or supplements thereto at the SEC’s website

(http://www.sec.gov). Copies of the foregoing documents, any

amendments or supplements thereto are also available, free of

charge, at the “Investor Relations” section of the Company’s

website (https://www.sbow.com/investor-relations).

1

Permission to use quotes neither sought

nor received.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509479221/en/

INVESTOR: ir@sbow.com (281) 874-2700, (888) 991-SBOW

MEDIA: Adam Pollack / Jed Repko Joele Frank, Wilkinson

Brimmer Katcher (212) 355-4449

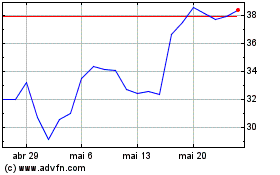

SilverBow Resources (NYSE:SBOW)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

SilverBow Resources (NYSE:SBOW)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025