Current Report Filing (8-k)

28 Abril 2023 - 5:41PM

Edgar (US Regulatory)

000009144012/30false00000914402023-04-272023-04-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 27, 2023

Snap-on Incorporated

(Exact name of registrant as specified in its charter) | | | | | | | | | | | | | | |

| Delaware | | 001-07724 | | 39-0622040 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 2801 80th Street, | Kenosha, | Wisconsin | 53143-5656 |

| (Address of Principal Executive Offices, and Zip Code) |

(262) 656-5200

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | SNA | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

| | | | | |

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On April 27, 2023, the Board of Directors of Snap-on Incorporated (the “Company”) approved the amendments to, and the restatement of, the Company’s Bylaws, effective immediately. The amendments included the adoption of proxy access and certain other changes, which are described below.

Section 2.10 of the Bylaws now provides for proxy access for director nominations. Pursuant to Section 2.10, a stockholder, or a group of up to 20 stockholders, owning 3% or more of the Company’s outstanding common stock continuously for at least three years may nominate, and the Company will include in its proxy materials for any annual meeting of stockholders, nominees for director constituting up to 20% of the Board (rounded down to the nearest whole number, but not less than two individuals). To nominate an individual for director under Section 2.10, an eligible stockholder’s notice must be received by the Secretary of the Company at the Company’s principal executive offices not less than 120 days nor more than 150 days prior to the first anniversary of the date that the Company distributed its proxy statement to stockholders for the previous year’s annual meeting. The stockholder(s) and the nominee(s) are also required to satisfy the other requirements specified in Section 2.10 of the Bylaws. Former Section 2.10, which covers voting procedures and inspectors of elections, was re-numbered as Section 2.11.

The advance notice provisions related to stockholder nominations and proposals in Section 2.9 of the Bylaws were primarily amended to address matters related to the universal proxy rules in Rule 14a-19 of the Securities Exchange Act of 1934 (the “Exchange Act”), to require additional information from stockholders submitting nominations or proposals (including certain information related to securities ownership) and from any nominee, and to modify the advance notice window for stockholders submitting director nominations (other than those under new Section 2.10) and proposals (other than proposals pursuant to Rule 14a-8 under the Exchange Act). To be timely, a stockholder’s notice must be received at the Company’s principal executive offices not less than 90 days nor more than 120 days prior to the anniversary of the previous year’s annual meeting of stockholders. Further, any stockholder directly or indirectly soliciting proxies from other stockholders must use a proxy card color other than white, with the white proxy card reserved for exclusive use by the Company’s Board of Directors.

As a result of the amendments discussed above, the window for the submission of any proxy access nominees in accordance with Section 2.10 of the Bylaws for the Company’s 2024 Annual Meeting of Shareholders is between October 12, 2023, and November 11, 2023. The advance notice window for other stockholder nominations and proposals under Section 2.9 for the 2024 Annual Meeting of Shareholders is now between December 29, 2023, and January 28, 2024.

Section 2.6 of the Bylaws was amended to conform to recent changes to the Delaware General Corporation Law, which eliminated the requirement to make a list of stockholders available during each stockholder meeting, and provisions related to the previously completed phased declassification of the Board in Section 3.1 were deleted.

The amendments also include certain conforming, clarifying, administrative and non-substantive changes to the Bylaws.

The foregoing description of the amendments to the Bylaws is qualified in its entirety by reference to the full text of the Bylaws, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and incorporated by reference herein.

| | | | | |

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

The Company held its 2023 Annual Meeting of Shareholders on April 27, 2023 (the “2023 Annual Meeting”). At the 2023 Annual Meeting, the Company’s shareholders: (i) elected 10 members of the Company’s Board of Directors to each serve a one-year term ending at the Annual Meeting of Shareholders to be held in 2024; (ii) ratified the Audit Committee’s selection of Deloitte & Touche LLP (“Deloitte”) as the Company’s independent registered public accounting firm for fiscal 2023; (iii) approved, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in the proxy statement for the 2023 Annual Meeting (the “2023 Proxy Statement”); and (iv) approved, on an advisory basis, the holding of future advisory votes to approve named executive officer compensation annually. There were 53,128,822 shares of the Company’s common stock outstanding and eligible to vote as of the close of business on February 28, 2023, the record date for the 2023 Annual Meeting.

The directors elected to the Company’s Board of Directors for terms expiring at the Annual Meeting of Shareholders to be held in 2024, and the number of votes cast for and against, as well as abstentions and broker non-votes with respect to, each individual, are set forth below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | For | | Against | | Abstentions | | Broker Non-Votes |

| David C. Adams | | 33,503,133 | | 9,872,068 | | 67,753 | | 4,006,174 |

| Karen L. Daniel | | 40,062,961 | | 3,321,403 | | 58,591 | | 4,006,174 |

| Ruth Ann M. Gillis | | 42,838,911 | | 538,889 | | 65,155 | | 4,006,174 |

| James P. Holden | | 38,991,272 | | 4,384,715 | | 66,967 | | 4,006,174 |

| Nathan J. Jones | | 40,927,599 | | 2,440,674 | | 74,682 | | 4,006,174 |

| Henry W. Knueppel | | 39,802,383 | | 3,575,376 | | 65,195 | | 4,006,174 |

| W. Dudley Lehman | | 40,108,675 | | 3,270,502 | | 63,778 | | 4,006,174 |

| Nicholas T. Pinchuk | | 39,319,938 | | 4,003,495 | | 119,522 | | 4,006,174 |

| Gregg M. Sherrill | | 41,014,006 | | 2,350,880 | | 78,069 | | 4,006,174 |

| Donald J. Stebbins | | 42,838,063 | | 535,446 | | 69,446 | | 4,006,174 |

The proposal to ratify the Audit Committee’s selection of Deloitte as the Company’s independent registered public accounting firm for fiscal 2023 received the following votes:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Votes for approval: | | 43,289,895 | | Votes against: | | 4,090,857 | | Abstentions: | | 68,377 |

| Broker non-votes: | | 0 | | | | | | | | |

The advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in “Compensation Discussion and Analysis” and “Executive Compensation Information” in the 2023 Proxy Statement, received the following votes:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Votes for approval: | | 40,208,921 | | Votes against: | | 3,105,077 | | Abstentions: | | 128,957 |

| Broker non-votes: | | 4,006,174 | | | | | | | | |

The advisory vote related to the frequency of future advisory votes to approve named executive officer compensation received the following votes:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 Year: | | 41,934,907 | | 2 Years: | | 122,216 | | 3 Years: | | 1,292,322 |

| Abstentions: | | 93,509 | | Broker non-votes: | | 4,006,174 | | | | |

Based on the results of the advisory vote related to the frequency of future advisory votes to approve named executive officer compensation and other factors, the Company’s Board determined that it will continue to hold future advisory votes to approve executive compensation annually until the next required shareholder vote on the frequency of these votes.

As noted in Item 5.03 above, as a result of the amendments to the Bylaws, the window for the submission of any proxy access nominees in accordance with Section 2.10 of the Bylaws for the Company’s 2024 Annual Meeting of Shareholders is between October 12, 2023, and November 11, 2023. The advance notice window for other stockholder nominations and proposals under Section 2.9 for the 2024 Annual Meeting of Shareholders is now between December 29, 2023, and January 28, 2024. In addition to satisfying the requirements under the Bylaws, to comply with the universal proxy rules, shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must also provide notice that sets forth the information required by Rule 14a-19 no later than January 28, 2024. The Corporate Secretary must receive a shareholder proposal under Rule 14a-8 no later than November 11, 2023, for the proposal to be considered for inclusion in the Company’s proxy materials for the 2024 Annual Meeting of Shareholders.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | Description | |

| Bylaws of Snap-on Incorporated (as amended and restated as of April, 27, 2023) |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Snap-on Incorporated has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | SNAP-ON INCORPORATED |

| | | |

Date: April 28, 2023 | | | | By: | | /s/ Richard T. Miller |

| | | | | | Richard T. Miller |

| | | | | | Vice President, General Counsel and Secretary |

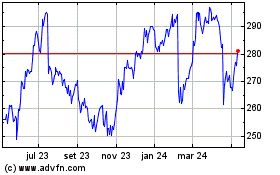

Snap on (NYSE:SNA)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

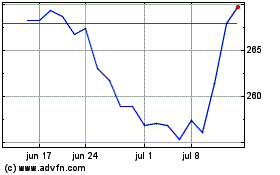

Snap on (NYSE:SNA)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024