Sonida Senior Living, Inc. (the “Company,” “we,” “our,” or “us”)

(NYSE: SNDA), a leading owner-operator and investor in communities

and services for seniors, today announced its results for the first

quarter ended March 31, 2024.

“We achieved strong across-the-board results during the first

quarter of 2024, executing on our key financial and operational

priorities with year-over-year occupancy, revenue and community net

operating income all demonstrating continued growth. With our

recent balance sheet and liquidity advancements, Sonida has

meaningfully positioned itself for strategic expansion and

continued momentum, with an eye on shareholder value creation into

the second quarter and beyond. I am truly proud of our team, as our

inherent focus on serving seniors with our signature programs and

services is clearly being reflected in the strength of our

performance,” said Brandon Ribar, President and CEO.

First Quarter Highlights

- Liquidity significantly improved in Q1 2024 with our private

placement transaction of 5,026,318 shares of common stock at $9.50

a share (the “Private Placement”) completed in February and March

of 2024 resulting in gross cash proceeds of $47.8 million.

- On April 1, 2024, the Company entered into an At-the-Market

Issuance Sales Agreement with Mizuho Securities USA LLC, whereby

the Company may sell, at its option, shares of its common stock up

to an aggregate offering price of $75,000,000 (“ATM Sales

Agreement”). An additional $10.3 million of net proceeds were

raised in April 2024 through our ATM Sales Agreement.

- Using proceeds from the Private Placement, purchased $74.4

million of the outstanding principal balance with Protective Life

(“Protective Life Loan Purchase”) for $40.2 million, resulting in a

decrease in notes payable of $49.6 million.

- Weighted average occupancy for the Company’s consolidated

portfolio increased 200 basis points to 85.9%, comparing Q1 2024 to

Q1 2023.

- Resident revenue increased $4.1 million, or 7.3%, comparing Q1

2024 to Q1 2023.

- Net income for the Q1 2024 was $27.0 million which includes a

$38.1 million gain on debt extinguishment in connection with the

Protective Life Loan Purchase.

- Q1 2024 Adjusted EBITDA, a non-GAAP measure, was $9.5 million

representing an increase of 21.5% year-over-year and 1.8% in

sequential quarters, driven primarily by continued improvement in

operations.

- Results for the Company’s consolidated portfolio of

communities:

- Q1 2024 vs. Q1 2023:

- Revenue Per Available Unit (“RevPAR”) increased 8.3% to

$3,557.

- Revenue Per Occupied Unit (“RevPOR”) increased 5.9% to

$4,140.

- Community Net Operating Income, a non-GAAP measure, increased

$1.5 million to $14.9 million. Adjusted Community Net Operating

Income, a non-GAAP measure, which excludes $2.0 million of state

grant revenue received in Q1 2023 (none received in Q1 2024) was

$14.9 million and $11.4 million for Q1 2024 and Q1 2023,

respectively.

- Community Net Operating Income Margin and Adjusted Community

Net Operating Income Margin (non-GAAP measures with the latter

adjusted for non-recurring state grant revenue) were 24.6% and

24.6%, for Q1 2024, respectively, and 23.7% and 20.8% for Q1 2023,

respectively.

- Q1 2024 vs. Q4 2023:

- RevPAR increased 2.5% to $3,557.

- RevPOR increased 2.4% to $4,140.

- Community Net Operating Income decreased $1.4 million to $14.9

million. There were no state grants received during these

periods.

- Community Net Operating Income Margin was 24.6% and 27.4% for

Q1 2024 and Q4 2023, respectively.

SONIDA SENIOR LIVING,

INC.

SUMMARY OF CONSOLIDATED

FINANCIAL RESULTS

THREE MONTHS ENDED MARCH 31,

2024

(in thousands)

Three Months Ended March

31,

Three Months Ended December

31,

2024

2023

2023

Consolidated results

Resident revenue (1)

$

60,737

$

56,606

$

59,349

Management fees

594

505

586

Operating expenses

46,317

43,808

44,367

General and administrative expenses

7,211

7,063

9,946

Gain on extinguishment of debt, net

38,148

36,339

—

Other income (expense), net

(479

)

189

(480

)

Income (loss) before provision for income

taxes (1)

27,085

24,214

(14,581

)

Net income (loss) (1)

27,019

24,145

(14,629

)

Adjusted EBITDA (1) (2)

9,473

7,794

9,302

Community net operating income (NOI) (1)

(2)

14,915

13,402

16,260

Community net operating income margin (1)

(2)

24.6

%

23.7

%

27.4

%

Weighted average occupancy

85.9

%

83.9

%

85.9

%

(1) Includes $2.0 million of state grant

revenue received in Q1 2023. There were no such grant revenues in

Q1 2024 or Q4 2023.

(2) Adjusted EBITDA, Community Net

Operating Income, and Community Net Operating Income Margin are

financial measures that are not calculated in accordance with U.S.

Generally Accepted Accounting Principles (“GAAP”). See

“Reconciliation of Non-GAAP Financial Measures” for the Company's

definition of such measures, reconciliations to the most comparable

GAAP financial measures, and other information regarding the use of

the Company's non-GAAP financial measures.

Results of Operations

Three months ended March 31, 2024 as compared to three months

ended March 31, 2023

Revenues

Resident revenue for the three months ended March 31, 2024 was

$60.7 million as compared to $56.6 million for the three months

ended March 31, 2023, an increase of $4.1 million, or 7.3%. The

increase in revenue was primarily due to increased occupancy and

increased average rent rates. For the three months ended March 31,

2023, the Company received approximately $2.0 million, in various

relief funds received from state departments due to financial

distress impacts of COVID-19 (“State Relief Funds”). For the three

months ended March 31, 2024, the Company received no State Relief

Funds.

Expenses

Operating expenses for the three months ended March 31, 2024

were $46.3 million as compared to $43.8 million for the three

months ended March 31, 2023, an increase of $2.5 million, or 5.7%.

The increase is attributable to the increase in total labor over

this period.

General and administrative expenses for the three months ended

March 31, 2024 were $7.2 million as compared to $7.1 million for

the three months ended March 31, 2023, representing an increase of

$0.1 million. The increase was primarily a result of an increase in

labor and employee related expenses of $0.6 million, partially

offset by decreases in stock-based compensation of $0.3 million and

other expenses of $0.2 million.

Gain on extinguishment of debt for the three months ended March

31, 2024 was $38.1 million as compared to $36.3 million for three

months ended March 31, 2023. The 2024 gain relates to the

derecognition of notes payable and liabilities as a result of the

Protective Life Loan Purchase. The 2023 gain relates to the

derecognition of notes payable and liabilities as a result of the

transition of legal ownership of two communities to the Federal

National Mortgage Association (“Fannie Mae”).

As a result of the foregoing factors, the Company reported net

income of $27.0 million and $24.1 million for the three months

ended March 31, 2024 and March 31, 2023, respectively.

Adjusted EBITDA for the three months ended March 31, 2024 was

$9.5 million compared to $7.8 million for the three months ended

March 31, 2023, driven primarily by continued improvement in

operations. See “Reconciliation of Non-GAAP Financial Measures”

below.

Liquidity, Capital Resources, and

Subsequent Events

Liquidity

During 2023, the Company's liquidity conditions, including

operating losses and a net working capital deficit, raised

substantial doubt about the Company's ability to continue as a

going concern. As a result of increases in occupancy in 2023 and

2024, annual rental rate increases in March 2024 and the Private

Placement and Protective Life Loan Purchase, the Company has

substantially improved its liquidity position. In addition, $10.3

million of net proceeds were raised in April 2024 through our

at-the-market equity offering. See details below of the

transactions which have increased cash on hand significantly. Based

on these events, the Company concluded it has adequate cash to meet

its obligations as they become due for the 12-month period

following the date the March 31, 2024 financial statements are

issued.

Increase in Authorized Shares of Common Stock

On March 21, 2024, following receipt of stockholder approval at

the Special Meeting of the Company’s stockholders held on March 21,

2024, the Company filed an amendment to the Company’s Amended and

Restated Certificate of Incorporation, as amended, with the

Delaware Secretary of State to increase the number of authorized

shares of the Company’s common stock from 15,000,000 shares to

30,000,000 shares. The charter amendment became effective upon

filing.

Securities Purchase Agreement

On February 1, 2024, the Company entered into a securities

purchase agreement (the “Securities Purchase Agreement”) with

affiliates of Conversant Capital and several other shareholders

(together, the “Investors”), pursuant to which the Investors agreed

to purchase from the Company, and the Company agreed to sell to the

Investors, in a private placement transaction pursuant to Section

4(a)(2) of the Securities Act of 1933, as amended, an aggregate of

5,026,318 shares of the Company’s Common Stock at a price of $9.50

per share.

The Private Placement occurred in two closings. The Company

issued and sold an aggregate of 3,350,878 shares to the Investors

and received gross cash proceeds of $31.8 million at the first

closing, which was completed on February 1, 2024. The Company

issued the remaining 1,675,440 shares to the Investors and received

additional gross cash proceeds of $15.9 million at the second

closing, which occurred on March 22, 2024. The Company intends to

use this new capital for working capital, continued investments in

community improvements, potential acquisitions of new communities,

broader community programming and other general corporate

purposes.

Protective Life Loan Purchase

On February 2, 2024, the Company completed the Protective Life

Loan Purchase of the total outstanding principal balance of $74.4

million from Protective Life Insurance Company (“Protective Life”)

that was secured by seven of the Company’s senior living

communities for a purchase price of $40.2 million. In addition to

aggregate deposits of $1.5 million made in December 2023 and

January 2024, the Company funded the remaining cash portion of the

purchase price (including one-time closing costs) with $15.4

million of net proceeds from the sale of the shares at the first

closing of the Private Placement. The Company obtained additional

debt proceeds through its existing loan facility with Ally Bank for

the remaining portion of the purchase price, as described below.

The Company terminated these loans after completion of the loan

purchase from Protective Life.

Ally Term Loan Expansion

On February 2, 2024, in connection with the Protective Life Loan

Purchase, the Company expanded its outstanding term loan with Ally

Bank by $24.8 million, which was secured by six of the Company’s

senior living communities within the Protective Life Loan Purchase.

As part of the loan amendment with Ally, the Company also increased

its interest rate cap coverage to include the additional borrowings

at a cost of $0.6 million.

Cash flows

The table below presents a summary of the Company’s net cash

provided by (used in) operating, investing, and financing

activities (in thousands):

Three months ended March

31,

2024

2023

$ Change

Net cash provided by (used in) operating

activities

$

(4,105

)

$

3,249

$

(7,354

)

Net cash used in investing activities

(5,131

)

(5,086

)

(45

)

Net cash provided by (used in) financing

activities

29,149

(3,759

)

32,908

Increase (decrease) in cash and cash

equivalents

$

19,913

$

(5,596

)

$

25,509

In addition to $24.2 million of unrestricted cash on hand as of

March 31, 2024, our future liquidity will depend in part upon our

operating performance, which will be affected by prevailing

economic conditions, and financial, business and other factors,

some of which are beyond our control. Principal sources of

liquidity are expected to be cash flows from operations, proceeds

from equity offerings, proceeds from debt refinancings or loan

modifications, and proceeds from the sale of owned assets.

In addition to the Private Placement and Ally term loan

expansion on April 1, 2024, the Company entered into the

At-the-Market Issuance Sales Agreement with Mizuho Securities USA

LLC, whereby the Company may sell, at its option, shares of its

common stock up to an aggregate offering price of $75,000,000. On

April 5, 2024, the Company sold 382,000 shares pursuant to the ATM

Sales Agreement at $27.50 per share for net proceeds of $10.3

million, inclusive of $0.2 million in commission paid to Mizuho.

These transactions are expected to provide additional financial

flexibility to the Company and increase our liquidity position.

The Company, from time to time, considers and evaluates

financial and capital raising transactions related to its

portfolio, including debt refinancings, purchases and sales of

assets and other transactions. There can be no assurance that the

Company will continue to generate cash flows at or above current

levels, or that the Company will be able to obtain the capital

necessary to meet the Company’s short and long-term capital

requirements.

Recent changes in the current economic environment, and other

future changes, could result in decreases in the fair value of

assets, slowing of transactions, and the tightening of liquidity

and credit markets. These impacts could make securing debt or

refinancings for the Company or buyers of the Company’s properties

more difficult or on terms not acceptable to the Company. The

Company’s actual liquidity and capital funding requirements depend

on numerous factors, including its operating results, its capital

expenditures for community investment, and general economic

conditions, as well as other factors described in “Item 1A. Risk

Factors” of our Annual Report on Form 10-K for the fiscal year

ended December 31, 2023, filed with the SEC on March 27, 2024.

Conference Call

Information

The Company will host a conference call with senior management

to discuss the Company’s financial results for the three months

ended March 31, 2024, on Friday May 10, 2024, at 12:30 p.m. Eastern

Time. To participate, dial 877-407-0989 (no passcode required). A

link to the simultaneous webcast of the teleconference will be

available at:

https://www.webcast-eqs.com/register/sonidaseniorliving_q12024_en/en.

For the convenience of the Company’s shareholders and the

public, the conference call will be recorded and available for

replay starting May 11, 2024 through May 24, 2024. To access the

conference call replay, call 877-660-6853, passcode 13743707. A

transcript of the call will be posted in the Investor Relations

section of the Company’s website.

About the Company

Dallas, Texas-based Sonida Senior Living, Inc. is a leading

owner-operator and investor in independent living, assisted living

and memory care communities and services for senior adults. As of

March 31, 2024, the Company operated 71 senior housing communities

in 18 states with an aggregate capacity of approximately 8,000

residents, including 61 communities which the Company owns and 10

communities that the Company third-party manages, which provide

compassionate, resident-centric services and care as well as

engaging programming. For more information, visit

www.sonidaseniorliving.com or connect with the Company on Facebook,

Twitter or LinkedIn.

Definitions of RevPAR and

RevPOR

RevPAR, or average monthly revenue per available unit, is

defined by the Company as resident revenue for the period, divided

by the weighted average number of available units in the

corresponding portfolio for the period, divided by the number of

months in the period.

RevPOR, or average monthly revenue per occupied unit, is defined

by the Company as resident revenue for the period, divided by the

weighted average number of occupied units in the corresponding

portfolio for the period, divided by the number of months in the

period.

Safe Harbor

This release contains forward-looking statements which are

subject to certain risks and uncertainties that could cause our

actual results and financial condition of Sonida Senior Living,

Inc. (the “Company,” “we,” “our” or “us”) to differ materially from

those indicated in the forward-looking statements, including, among

others, the risks, uncertainties and factors set forth under “Item.

1A. Risk Factors” in our Annual Report on Form 10-K for the fiscal

year ended December 31, 2023, filed with the Securities and

Exchange Commission (the “SEC”) on March 27, 2024, and also include

the following: the Company’s ability to generate sufficient cash

flows from operations, proceeds from equity issuances and debt

financings, and proceeds from the sale of assets to satisfy its

short- and long-term debt obligations and to fund the Company’s

acquisitions and capital improvement projects to expand, redevelop,

and/or reposition its senior living communities; increases in

market interest rates that increase the cost of certain of our debt

obligations; increased competition for, or a shortage of, skilled

workers, including due to general labor market conditions, along

with wage pressures resulting from such increased competition, low

unemployment levels, use of contract labor, minimum wage increases

and/or changes in overtime laws; the Company’s ability to obtain

additional capital on terms acceptable to it; the Company’s ability

to extend or refinance its existing debt as such debt matures; the

Company’s compliance with its debt agreements, including certain

financial covenants, and the risk of cross-default in the event

such non-compliance occurs; the Company’s ability to complete

acquisitions and dispositions upon favorable terms or at all; the

risk of oversupply and increased competition in the markets which

the Company operates; the Company’s ability to improve and maintain

controls over financial reporting and remediate the identified

material weakness discussed in its recent Quarterly and Annual

Reports filed with the SEC; the cost and difficulty of complying

with applicable licensure, legislative oversight, or regulatory

changes; risks associated with current global economic conditions

and general economic factors such as inflation, the consumer price

index, commodity costs, fuel and other energy costs, competition in

the labor market, costs of salaries, wages, benefits, and

insurance, interest rates, and tax rates; the impact from or the

potential emergence and effects of a future epidemic, pandemic,

outbreak of infectious disease or other health crisis; and changes

in accounting principles and interpretations.

For information about Sonida Senior Living, visit

www.sonidaseniorliving.com or connect with the Company on Facebook,

Twitter or LinkedIn.

Sonida Senior Living,

Inc.

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except per

share data)

Three Months Ended

March 31,

2024

2023

Revenues:

Resident revenue

$

60,737

$

56,606

Management fees

594

505

Managed community reimbursement

revenue

6,107

4,962

Total revenues

67,438

62,073

Expenses:

Operating expense

46,317

43,808

General and administrative expense

7,211

7,063

Depreciation and amortization expense

9,935

9,881

Managed community reimbursement

expense

6,107

4,962

Total expenses

69,570

65,714

Other income (expense):

Interest income

139

194

Interest expense

(8,591

)

(8,867

)

Gain on extinguishment of debt, net

38,148

36,339

Other income (expense), net

(479

)

189

Income before provision for income

taxes

27,085

24,214

Provision for income taxes

(66

)

(69

)

Net income

27,019

24,145

Undeclared dividends on Series A

convertible preferred stock

(1,335

)

(1,198

)

Undistributed net income allocated to

participating securities

(2,849

)

(3,182

)

Net income attributable to common

stockholders

$

22,835

$

19,765

Weighted average common shares outstanding

— basic

9,861

6,855

Weighted average common shares outstanding

— diluted

10,562

7,168

Basic net income per common share

$

2.32

$

2.88

Diluted net income per common share

$

2.16

$

2.76

Sonida Senior Living,

Inc.

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands, except per

share amounts)

March 31, 2024

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

24,211

$

4,082

Restricted cash

13,452

13,668

Accounts receivable, net

10,346

8,017

Prepaid expenses and other assets

3,412

4,475

Derivative assets

2,130

2,103

Total current assets

53,551

32,345

Property and equipment, net

581,902

588,179

Other assets, net

824

936

Total assets

$

636,277

$

621,460

Liabilities and Equity

Current liabilities:

Accounts payable

$

4,864

$

11,375

Accrued expenses

39,747

42,388

Current portion of notes payable, net of

deferred loan costs

6,831

42,323

Deferred income

4,255

4,041

Federal and state income taxes payable

288

215

Other current liabilities

512

519

Total current liabilities

56,497

100,861

Notes payable, net of deferred loan costs

and current portion

571,267

587,099

Other long-term liabilities

40

49

Total liabilities

627,804

688,009

Commitments and contingencies

Redeemable preferred stock:

Series A convertible preferred stock,

$0.01 par value; 41 shares authorized, 41 shares issued and

outstanding as of March 31, 2024 and December 31, 2023

49,877

48,542

Shareholders’ deficit:

Authorized shares - 15,000 as of March 31,

2024 and December 31, 2023; none issued or outstanding, except

Series A convertible preferred stock as noted above

—

—

Authorized shares - 30,000 and $15,000 as

of March 31, 2024 and December 31, 2023, respectively; 13,197 and

8,178 shares issued and outstanding as of March 31, 2024 and

December 31, 2023, respectively

132

82

Additional paid-in capital

349,610

302,992

Retained deficit

(391,146

)

(418,165

)

Total shareholders’ deficit

(41,404

)

(115,091

)

Total liabilities, redeemable preferred

stock and shareholders’ deficit

$

636,277

$

621,460

Sonida Senior Living,

Inc.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(in thousands)

Three Months Ended March

31,

2024

2023

Cash flows from operating

activities:

Net income

$

27,019

$

24,145

Adjustments to reconcile net income to net

cash provided by (used in) operating activities:

Depreciation and amortization

9,935

9,881

Amortization of deferred loan costs

324

366

Gain on sale of assets, net

(192

)

(251

)

Loss on derivative instruments, net

527

572

Gain on extinguishment of debt

(38,148

)

(36,339

)

Provision for bad debt

397

237

Non-cash stock-based compensation

expense

575

902

Other non-cash items

(3

)

(1

)

Changes in operating assets and

liabilities:

Accounts receivable, net

(2,726

)

(48

)

Prepaid expenses and other assets

1,063

1,159

Other assets, net

(41

)

62

Accounts payable and accrued expense

(3,123

)

1,828

Federal and state income taxes payable

73

260

Deferred income

214

438

Other current liabilities

1

38

Net cash provided by (used in)

operating activities

(4,105

)

3,249

Cash flows from investing

activities:

Capital expenditures

(5,762

)

(5,429

)

Proceeds from sale of assets

631

343

Net cash used in investing

activities

(5,131

)

(5,086

)

Cash flows from financing

activities:

Proceeds from notes payable

24,830

—

Repayments of notes payable

(41,999

)

(3,714

)

Proceeds from issuance of common stock,

net

47,641

—

Purchase of interest rate cap

(554

)

—

Deferred loan costs paid

(549

)

—

Other financing costs

(220

)

(45

)

Net cash provided by (used in)

financing activities

29,149

(3,759

)

Increase (decrease) in cash and cash

equivalents and restricted cash

19,913

(5,596

)

Cash, cash equivalents, and restricted

cash at beginning of period

17,750

30,742

Cash, cash equivalents, and restricted

cash at end of period

$

37,663

$

25,146

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES (UNAUDITED)

This earnings release contains the financial measures (1)

Community Net Operating Income and Adjusted Community Net Operating

Income, (2) Community Net Operating Income Margin and Adjusted

Community Net Operating Income Margin, (3) Adjusted EBITDA, (4)

Revenue per Occupied Unit (RevPOR) and (5) Revenue per Available

Unit (RevPAR), all of which are not calculated in accordance with

U.S. GAAP. Presentations of these non-GAAP financial measures are

intended to aid investors in better understanding the factors and

trends affecting the Company’s performance and liquidity. However,

investors should not consider these non-GAAP financial measures as

a substitute for financial measures determined in accordance with

GAAP, including net income (loss), income (loss) from operations,

net cash provided by (used in) operating activities, or revenue.

Investors are cautioned that amounts presented in accordance with

the Company’s definitions of these non-GAAP financial measures may

not be comparable to similar measures disclosed by other companies

because not all companies calculate non-GAAP measures in the same

manner. Investors are urged to review the following reconciliations

of these non-GAAP financial measures from the most comparable

financial measures determined in accordance with GAAP.

Community Net Operating Income and Community Net Operating

Income Margin are non-GAAP performance measures for the Company’s

consolidated owned portfolio of communities that the Company

defines as net income (loss) excluding: general and administrative

expenses (inclusive of stock-based compensation expense), interest

income, interest expense, other income/expense, provision for

income taxes, settlement fees and expenses, revenue and operating

expenses from the Company’s disposed properties; and further

adjusted to exclude income/expense associated with non-cash,

non-operational, transactional, or organizational restructuring

items that management does not consider as part of the Company’s

underlying core operating performance and impacts the comparability

of performance between periods. For the periods presented herein,

such other items include depreciation and amortization expense,

gain(loss) on extinguishment of debt, gain(loss) on disposition of

assets, long-lived asset impairment, and loss on non-recurring

settlements with third parties. The Community Net Operating Income

Margin is calculated by dividing Community Net Operating Income by

resident revenue. Adjusted Community Net Operating Income and

Adjusted Community Net Operating Income Margin are further adjusted

to exclude the impact from non-recurring state grant funds

received.

The Company believes that presentation of Community Net

Operating Income, Community Net Operating Income Margin, Adjusted

Community Net Operating Income, and Adjusted Community Net

Operating Income Margin as performance measures are useful to

investors because (i) they are one of the metrics used by the

Company’s management to evaluate the performance of our core

consolidated owed portfolio of communities, to review the Company’s

comparable historic and prospective core operating performance of

the consolidated owned communities, and to make day-to-day

operating decisions; (ii) they provide an assessment of operational

factors that management can impact in the short-term, namely

revenues and the controllable cost structure of the organization,

by eliminating items related to the Company’s financing and capital

structure and other items that management does not consider as part

of the Company’s underlying core operating performance, and impacts

the comparability of performance between periods.

Community Net Operating Income, Net Community Operating Income

Margin, Adjusted Community Net Operating Income, and Adjusted

Community Net Operating Income Margin have material limitations as

a performance measure, including: (i) excluded general and

administrative expenses are necessary to operate the Company and

oversee its communities; (ii) excluded interest is necessary to

operate the Company’s business under its current financing and

capital structure; (iii) excluded depreciation, amortization, and

impairment charges may represent the wear and tear and/or reduction

in value of the Company’s communities, and other assets and may be

indicative of future needs for capital expenditures; and (iv) the

Company may incur income/expense similar to those for which

adjustments are made, such as gain (loss) on debt extinguishment,

gain(loss) on disposition of assets, loss on settlements, non-cash

stock-based compensation expense, and transaction and other costs,

and such income/expense may significantly affect the Company’s

operating results.

(Dollars in thousands)

Three Months Ended

March 31,

Three Months Ended December

31,

2024

2023

2023

Community Net Operating Income

Net income (loss)

$

27,019

$

24,145

$

(14,629

)

General and administrative expense

7,211

7,063

9,946

Depreciation and amortization expense

9,935

9,881

10,137

Interest income

(139

)

(194

)

(87

)

Interest expense

8,591

8,867

9,673

Gain on extinguishment of debt

(38,148

)

(36,339

)

—

Other (income) expense, net

479

(189

)

480

Provision for income taxes

66

69

48

Settlement (income) fees and expense, net

(1)

(99

)

99

692

Community net operating income

14,915

13,402

16,260

Resident revenue

$

60,737

$

56,606

$

59,349

Community net operating income

margin

24.6

%

23.7

%

27.4

%

COVID-19 state relief grants (2)

—

2,037

—

Adjusted resident revenue

60,737

54,569

59,349

Adjusted community net operating

income

$

14,915

$

11,365

$

16,260

Adjusted community net operating income

margin

24.6

%

20.8

%

27.4

%

(1) Settlement fees and expenses relate to

non-recurring settlements with third parties for contract

terminations, insurance claims, and related fees.

(2) COVID-19 relief revenue are grants and

other funding received from third parties to aid in the COVID-19

response and includes State Relief Funds received.

ADJUSTED EBITDA (UNAUDITED)

Adjusted EBITDA is a non-GAAP performance measures that the

Company defines as net income (loss) excluding: depreciation and

amortization expense, interest income, interest expense, other

expense/income, provision for income taxes; and further adjusted to

exclude income/expense associated with non-cash, non-operational,

transactional, or organizational restructuring items that

management does not consider as part of the Company’s underlying

core operating performance and impacts the comparability of

performance between periods. For the periods presented herein, such

other items include stock-based compensation expense, provision for

bad debts, gain (loss) on extinguishment of debt, gain on sale of

assets, long-lived asset impairment, casualty losses, and

transaction and conversion costs.

The Company believes that presentation of Adjusted EBITDA’s

impact as a performance measure is useful to investors because it

provides an assessment of operational factors that management can

impact in the short-term, namely revenues and the controllable cost

structure of the organization, by eliminating items related to the

Company’s financing and capital structure and other items that

management does not consider as part of the Company’s underlying

core operating performance and that management believes impact the

comparability of performance between periods.

Adjusted EBITDA has material limitations as a performance

measure, including: (i) excluded interest is necessary to operate

the Company’s business under its current financing and capital

structure; (ii) excluded depreciation, amortization and impairment

charges may represent the wear and tear and/or reduction in value

of the Company’s communities and other assets and may be indicative

of future needs for capital expenditures; and (iii) the Company may

incur income/expense similar to those for which adjustments are

made, such as bad debts, gain(loss) on sale of assets, or

gain(loss) on debt extinguishment, non-cash stock-based

compensation expense and transaction and other costs, and such

income/expense may significantly affect the Company’s operating

results.

(In thousands)

Three Months Ended

March 31,

Three Months Ended

December 31,

2024

2023

2023

Adjusted EBITDA

Net income (loss)

$

27,019

$

24,145

$

(14,629

)

Depreciation and amortization expense

9,935

9,881

10,137

Stock-based compensation expense, net

575

902

605

Provision for bad debt

398

238

568

Interest income

(139

)

(194

)

(87

)

Interest expense

8,591

8,867

9,673

Gain on extinguishment of debt, net

(38,148

)

(36,339

)

—

Other (income) expense, net

479

(189

)

480

Provision for income taxes

66

69

48

Casualty losses (1)

298

—

348

Transaction and conversion costs (2)

399

414

2,159

Adjusted EBITDA

$

9,473

$

7,794

$

9,302

(1) Casualty losses relate to

non-recurring insured claims for unexpected events.

(2) Transaction and conversion costs

relate to legal and professional fees incurred for transactions,

restructure activities, or related projects.

SUPPLEMENTAL

INFORMATION

First Quarter

(Dollars in thousands)

2024

2023

Increase (decrease)

Fourth Quarter 2023

Sequential increase

(decrease)

Selected Operating Results

I. Consolidated community

portfolio

Number of communities

61

62

(1)

61

—

Unit capacity

5,692

5,747

(55)

5,700

(8)

Weighted average occupancy (1)

85.9%

83.9%

2.0%

85.9%

—%

RevPAR

$3,557

$3,283

$274

$3,470

$87

RevPOR

$4,140

$3,911

$229

$4,042

$98

Consolidated community net operating

income

$14,915

$13,402

$1,513

$16,260

$(1,345)

Consolidated community net operating

income margin (3)

24.6%

23.7%

0.9%

27.4%

(2.8)%

Consolidated community net operating

income, net of general and administrative expenses (2)

$7,704

$6,339

$1,365

$6,314

$1,390

Consolidated community net operating

income margin, net of general and administrative expenses (2)

12.7%

11.2%

1.5%

10.6%

2.1%

II. Consolidated Debt

Information

(Excludes insurance premium

financing)

Total variable rate mortgage debt

$162,114

$137,453

N/A

$137,320

N/A

Total fixed rate debt

$418,275

$500,721

N/A

$492,998

N/A

(1) Weighted average occupancy represents

actual days occupied divided by total number of available days

during the quarter.

(2) General and administrative expenses

exclude stock-based compensation expense in order to remove the

fluctuation in fair value measurement due to market volatility.

(3) Includes $2.0 million of state grant

revenue received in Q1 2023. There were no such grant revenues in

Q1 2024 or Q4 2023. Excluding the grant revenue, Q1 2023

consolidated community NOI margin was 20.8%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240510173742/en/

Investor Relations Jason Finkelstein Ignition Investor

Relations ir@sonidaliving.com

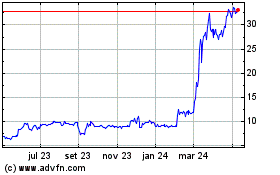

Sonida Senior Living (NYSE:SNDA)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

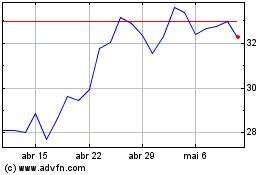

Sonida Senior Living (NYSE:SNDA)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024