Standard Register Reports 2005 First Quarter Results DAYTON, Ohio,

April 28 /PRNewswire-FirstCall/ -- Standard Register (NYSE:SR)

today reported financial results for the first quarter ended April

3, 2005. Results of Operations Total revenue on continuing

operations was $232.0 million, an increase of 5.3 percent over the

$220.3 million reported for the comparable quarter of 2004. Net

income was $2.4 million or $0.08 per share, compared with a net

loss of $6.5 million or $0.23 per share for the prior period.

"We've seen good progress on our sales initiatives," said Dennis

Rediker, president and chief executive officer of Standard

Register. "Our core Document and Label Systems and our

Print-On-Demand Services businesses each reported 4 percent revenue

growth, plus we had a significant revenue increase in our new

commercial print operation. During the quarter, we also received

several multi-year commitments from new customers that will

contribute to future revenue. The hard work of our associates is

clearly beginning to pay off." The continuing margin improvement

reflects our progress in recovering last year's three paper cost

hikes, plus the positive results from our company-wide cost

reduction and productivity improvement programs. The table below

isolates the effects of restructuring and the amortization of prior

years' pension losses on profitability. [$ Millions] Effect on

First Quarter Income Continuing Operations 1Q05 1Q04 Chg

Restructuring Expense -0.5 -3.3 2.8 Pension Loss Amortization -5.1

-4.5 -0.6 All Other Operations 9.5 -3.3 12.8 Pretax Income / (Loss)

3.9 -11.1 15.0 Income Tax 1.7 -4.3 6.0 Net Income / (Loss) 2.2 -6.8

9.0 Net Income / (Loss) on Discontinued Operations Operations 0.3

-0.3 Gain on Sale 0.2 0.2 Total 0.2 0.3 -0.1 Total Net Profit /

(Loss) 2.4 -6.5 8.9 Restructuring expense was $.5 million in the

current quarter, primarily residual lease facility costs related to

actions undertaken in previous periods. Pension loss amortization

was $5.1 million, originating in large part from weak stock market

returns in earlier years. All other operations contributed $9.5

million in the current period, versus a $3.3 million deficit in the

prior year -- the $12.8 million favorable swing was primarily

driven by higher revenue and lower fixed operating costs. The

Company recorded a $0.2 million change, net of tax, in estimated

reserves in connection with the gain from the fourth quarter 2004

sale of its equipment services business. Financial Condition The

Company continued to maintain its strong balance sheet. Net debt at

quarter-end was $42.8 million -- total debt of $71.3 million less

cash and cash equivalents of $28.5 million. The net borrowing

position represented 17% of total invested capital. Capital

expenditures were $6.1 million in the quarter, in-line with the

lower end of the $25 - $30 million expected range for the year, and

dividends paid were $0.23 per share or $6.6 million, consistent

with payments made in recent quarters. Net debt rose in the quarter

by $5.5 million, reflecting restructuring spending of $2.0 million

and the payment of annual sales management and other associate

incentives earned in 2004. Excluding spending for acquisitions,

divestitures, and restructuring related to reshaping the Company's

portfolio and cost structure, Standard Register has generated $19.0

million of positive net cash flow over the last four quarters --

after satisfying $24.1 million of capital expenditures and $26.4

million of dividends. Outlook "In line with previous guidance, we

expect our total year revenue to show modest growth on a 52-week

fiscal year basis (2004 contained 53 weeks) and for our margins to

continue to improve," said Rediker. "Our specific margin goal,

first announced in mid-2004, remains to achieve a five-point

improvement in pretax operating profit as a percent of revenue for

the second half 2005, compared to the first half 2004." The Company

expects to replace its existing $150 million revolving credit

agreement with a new $100 million secured revolving credit

agreement prior to the May 2005 expiration of the current

agreement. Dividend Standard Register's board of directors today

declared a quarterly dividend of $0.23 per share to be paid on June

10, 2005 to shareholders of record as of May 27, 2005. Presentation

of Information in This Press Release This press release presents

information that excludes restructuring and impairment expense, and

amortization of prior years' pension losses. These financial

measures are considered non-GAAP. Generally a non-GAAP financial

measure is a numerical measure of a company's performance,

financial position, or cash flows where amounts are either excluded

or included not in accordance with generally accepted accounting

principles. Standard Register believes that this information will

enhance an overall understanding of its financial performance due

to the non-operational nature in the above items and the

significant change from period to period. The presentation of

non-GAAP information is not meant to be considered in isolation or

as a substitute for results prepared in accordance with accounting

principles generally accepted in the United States. Conference Call

Standard Register president and chief executive officer Dennis L.

Rediker, and chief financial officer Craig J. Brown, will host a

conference call at 10 a.m. EDT on April 29, 2005, to review the

first quarter results. The call can be accessed via an audio

webcast which is accessible at:

http://www.standardregister.com/investorcenter . About Standard

Register Standard Register (NYSE:SR) is a leading information

solutions company, with more than 90 years of innovation in

improving the way business gets done in healthcare, financial

services, manufacturing and other industries. The company helps

organizations increase efficiency, reduce costs, enhance security

and grow revenue by effectively capturing, managing and using

information. Its offerings range from document and label solutions

to e- business solutions to consulting and managed services. More

information is available at http://www.standardregister.com/ . Safe

Harbor Statement This report includes forward-looking statements

covered by the Private Securities Litigation Reform Act of 1995.

Because such statements deal with future events, they are subject

to various risks and uncertainties and actual results for fiscal

year 2005 and beyond could differ materially from the Company's

current expectations. Forward-looking statements are identified by

words such as "anticipates," "projects," "expects," "plans,"

"intends," "believes," "estimates," "targets," and other similar

expressions that indicate trends and future events. Factors that

could cause the Company's results to differ materially from those

expressed in forward-looking statements include, without

limitation, variation in demand and acceptance of the Company's

products and services, the frequency, magnitude and timing of paper

and other raw-material-price changes, general business and economic

conditions beyond the Company's control, timing of the completion

and integration of acquisitions, the consequences of competitive

factors in the marketplace, cost-containment strategies, and the

Company's success in attracting and retaining key personnel.

Additional information concerning factors that could cause actual

results to differ materially from those projected is contained in

the Company's filing with The Securities and Exchange Commission,

including its report on Form 10-K for the year ended January 2,

2005. The Company undertakes no obligation to revise or update

forward-looking statements as a result of new information since

these statements may no longer be accurate or timely. THE STANDARD

REGISTER COMPANY STATEMENT OF OPERATIONS Y-T-D (In Thousands,

except Per Share Amounts) 13 Weeks Ended 13 Weeks Ended 03-Apr-05

28-Mar-04 TOTAL REVENUE $231,979 $220,276 COST OF SALES 147,870

137,307 GROSS MARGIN 84,109 82,969 COSTS AND EXPENSES Research and

Development 2,666 3,605 Selling, General and Administrative 66,277

75,837 Depreciation and Amortization 10,173 10,619 Restructuring

528 3,341 TOTAL COSTS AND EXPENSES 79,644 93,402 INCOME (LOSS) FROM

CONTINUING OPERATIONS 4,465 (10,433) OTHER INCOME (EXPENSE)

Interest Expense (666) (690) Investment and Other Income 99 50

Total Other Expense (567) (640) INCOME (LOSS) FROM CONTINUING

OPERATIONS BEFORE INCOME TAXES 3,898 (11,073) Income Tax Expense

(Benefit) 1,690 (4,267) NET INCOME (LOSS) FROM CONTINUING

OPERATIONS 2,208 (6,806) DISCONTINUED OPERATIONS Income from

discontinued operations, net of taxes - 307 Gain on sale of

discontinued operations, net of taxes 146 - NET INCOME (LOSS)

$2,354 ($6,499) Average Number of Shares Outstanding - Basic 28,544

28,483 Average Number of Shares Outstanding - Diluted 28,565 28,483

BASIC AND DILUTED EARNINGS (LOSS) PER SHARE Income (loss) from

continuing operations $0.08 ($0.24) Income from discontinued

operations - 0.01 Gain on sale of discontinued operations - - Net

income (loss) per share $0.08 ($0.23) Dividends Paid Per Share

$0.23 $0.23 BALANCE SHEET (In Thousands) 03-Apr-05 02-Jan-05 ASSETS

Cash & Short Term Investments $28,529 $44,088 Accounts

Receivable 124,181 128,396 Inventories 50,160 51,796 Other Current

Assets 28,930 27,960 Total Current Assets 231,800 252,240 Plant and

Equipment 144,072 147,160 Goodwill and Intangible Assets 19,026

19,746 Deferred Taxes 84,595 86,505 Other Assets 35,351 37,322

Total Assets $514,844 $542,973 LIABILITIES AND SHAREHOLDERS' EQUITY

Current Portion Long-Term Debt $70,552 $80,549 Current Liabilities

86,505 108,475 Deferred Compensation 14,758 16,832 Long-Term Debt

728 867 Retiree Healthcare 46,581 46,826 Pension Liability 86,157

83,273 Other Long-Term Liabilities 646 746 Shareholders' Equity

208,917 205,405 Total Liabilities and Shareholders' Equity $514,844

$542,973 DATASOURCE: Standard Register CONTACT: News media, Julie

McEwan, +1-937-221-1845, or , or Investors, Robert J. Cestelli,

+1-937-221-1304, or , both of Standard Register Web site:

http://www.standardregister.com/

http://www.standardregister.com/investorcenter

Copyright

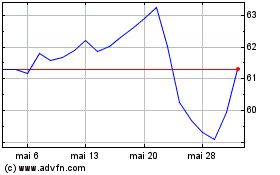

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

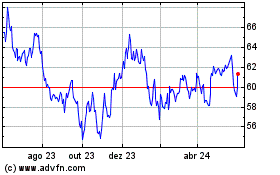

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024