Quarterly operating earnings before restructuring and impairment

rise over the prior year for the seventh consecutive quarter; net

debt drops below 10 percent of capital DAYTON, Ohio, July 27

/PRNewswire-FirstCall/ -- Standard Register (NYSE:SR) today

reported its financial results for the second quarter ended July 2,

2006. Results of Operations The results for the quarter reflected

the impact of several major strategic elements that are reshaping

the Company. - The Print-on-Demand (POD) Services segment reported

a jump in operating margin, fueled by a 9.4 percent revenue

increase and improved production costs. - Gross margins in the

Document and Label Solutions (DLS) segment remained steady despite

the competitive pricing climate and reduced unit sales that pushed

the quarter's revenue 4.0 percent lower, as the Company continued

its program of cost reductions and productivity improvements. - All

other segments, including Commercial Print Services and Document

Systems, that emphasize software and service offerings showed 6.3

percent revenue growth overall. - The Digital Solutions segment,

which offers cost effective data capture solutions based on

innovative digital writing technology, continued to report positive

new developments and a growing pipeline of opportunities. Revenue

in this emerging market has been modest thus far, however, and this

segment reported an operating loss of $1.4 million in the quarter.

- As previously reported, the Company sold its unprofitable

InSystems business unit during the second quarter. This business

did not fit with the Company's strategy. Proceeds were $8.5 million

plus the return of certain cash balances. The Company reported a

loss on the sale of $9.2 million after tax. InSystems results and

its sale are reported as discontinued operations. - The Company

continued to maintain a strong balance sheet with net debt just 9.3

percent of total capital. Total revenue for the quarter was $222.8

million, up slightly from last year's $222.5 million, reflecting

the lower DLS revenue offset by the growth in POD Services and

other segments. Revenue for the first half was $451.5 million

versus $451.9 million in the prior year. The gross margin improved

by 1.7 and 1.3 percentage points in relation to revenue for the

quarter and year-to-date periods, respectively. The Company has

made good progress in recovering recent paper cost increases and

benefited from lower production costs and higher POD Services

volume. Operating expenses were higher in both the quarter and

year-to-date periods, impacted by higher restructuring, asset

impairment, and the amortization of past pension losses. The table

below isolates these effects on the Company's earnings. [$

Millions, rounded] Effect on 2Q Income Effect on YTD Income 2006

2005 Chg 2006 2005 Chg CONTINUING OPERATIONS Operations before

Restructuring, Impairment & Amortization of Past Pension Losses

10.9 8.4 2.5 23.8 19.9 3.9 Reconciliation to Net Income / (Loss):

Restructuring Expense -0.8 -0.3 -0.4 -1.9 -0.9 -1.0 Impairment

Expense 0.2 0.0 0.2 -1.5 0.0 -1.5 Amortization of Past Pension

Losses -6.7 -4.4 -2.3 -12.7 -9.5 -3.2 Income / (Loss) on Operations

3.6 3.7 -0.1 7.7 9.6 -1.9 Interest & Other Income / (Expense)

-0.4 -0.7 0.2 -0.9 -1.2 0.3 Pretax Income / (Loss) 3.2 3.0 0.1 6.8

8.3 -1.5 Ohio Statutory Tax Rate Adjustment -2.9 2.9 -2.9 2.9

Income Taxes -1.2 -1.3 0.1 -2.8 -3.5 0.8 Net Income / (Loss) on

Continuing Operations 1.9 -1.1 3.0 4.0 1.9 2.1 DISCONTINUED

OPERATIONS -10.4 -1.2 -9.2 -11.1 -1.9 -9.2 CUMULATIVE EFFECT OF

CHANGE IN ACCOUNTING PRINCIPLE 0.1 0.1 TOTAL NET INCOME / (LOSS)

-8.5 -2.3 -6.2 -7.0 0.1 -7.1 Continuing operations before

restructuring, impairment, and amortization of past pension losses

was $10.9 million and $23.8 million for the quarter and

year-to-date periods, up 30 percent and 20 percent, respectively.

Current year earnings were helped by an accrual adjustment for

unclaimed funds, but were penalized by unusually high health care

claims; the net positive effect on earnings from these two items

was approximately $0.7 million. Including the loss on the sale of

InSystems, the Company reported a second quarter net loss of $8.5

million or $0.29 per share, compared to a loss of $2.3 million and

$0.08 per share last year. For the first six months, the net loss

was $7.0 million or $0.24 per share versus a breakeven result for

the comparable period of 2005. Net debt was $16.3 million at the

end of June, down $15.6 million during the quarter. Setting aside

$8.5 million from the sale of InSystems, cash flow for the quarter

was a positive $7.1 million -- after satisfying the operating needs

plus capital spending of $4.5 million, pension funding of $6.0

million and dividends of $6.7 million. Outlook "We continue to

expect modest revenue growth for the whole of 2006 with the fourth

quarter seasonally stronger," said Dennis Rediker, Standard

Register's president and chief executive officer. "Despite a very

price competitive market for certain of our traditional print

products, we believe that our strategic initiatives are beginning

to show results that will lead to meaningful growth in our earnings

over the next several years," added Rediker. Dividend Standard

Register's board of directors today declared a quarterly dividend

of $ 0.23 per share to be paid on Sept. 8, 2006, to shareholders of

record as of Aug. 25, 2006. Presentation of Information in This

Press Release This press release presents information that excludes

restructuring, impairment charges, and amortization of past pension

losses. These financial measures are considered non-GAAP.

Generally, a non-GAAP financial measure is a numerical measure of a

company's performance, financial position, or cash flows where

amounts are either excluded or included not in accordance with

generally accepted accounting principles (GAAP). This information

is intended to enhance an overall understanding of the financial

performance due to the non-operational nature of these items and

the significant change from period to period. This presentation is

consistent with the manner in which the Board of Directors

internally evaluates performance. The presentation of non-GAAP

information is not meant to be considered in isolation or as a

substitute for results prepared in accordance with principles

generally accepted in the United States. Conference Call Standard

Register president and chief executive officer Dennis L. Rediker

and chief financial officer Craig Brown will host a conference call

at 10 a.m. EDT on July 28, 2006, to review the second quarter

results. The call can be accessed via an audio webcast which is

accessible at: http://www.standardregister.com/investorcenter.

About Standard Register Standard Register is a premier document

services provider, trusted by companies to manage the critical

documents they need to thrive in today's competitive climate.

Relying on nearly 100 years of industry expertise, Lean Six Sigma

methodologies and leading technologies, we help organizations

increase efficiency, reduce costs, mitigate risks, grow revenue and

meet the challenges of a changing business landscape. It offers

document and label solutions, e-business solutions, consulting, and

print supply chain services to help clients manage documents across

their enterprise. More information is available at

http://www.standardregister.com/. Safe Harbor Statement This report

includes forward-looking statements covered by the Private

Securities Litigation Reform Act of 1995. Because such statements

deal with future events, they are subject to various risks and

uncertainties and actual results for fiscal year 2006 and beyond

could differ materially from the Company's current expectations.

Forward-looking statements are identified by words such as

"anticipates," "projects," "expects," "plans," "intends,"

"believes," "estimates," "targets," and other similar expressions

that indicate trends and future events. Factors that could cause

the Company's results to differ materially from those expressed in

forward-looking statements include, without limitation, variation

in demand and acceptance of the Company's products and services,

the frequency, magnitude and timing of paper and other

raw-material-price changes, general business and economic

conditions beyond the Company's control, timing of the completion

and integration of acquisitions, the consequences of competitive

factors in the marketplace, cost-containment strategies, and the

Company's success in attracting and retaining key personnel.

Additional information concerning factors that could cause actual

results to differ materially from those projected is contained in

the Company's filing with The Securities and Exchange Commission,

including its report on Form 10-K for the year ended January 1,

2006. The Company undertakes no obligation to revise or update

forward-looking statements as a result of new information since

these statements may no longer be accurate or timely. THE STANDARD

REGISTER COMPANY STATEMENT OF OPERATIONS Second Quarter (In

Thousands, except Y-T-D 13 Weeks 13 Weeks Per Share Amounts) 26

Weeks 26 Weeks Ended Ended Ended Ended 02-Jul-06 03-Jul-05

02-Jul-06 03-Jul-05 $222,832 $222,495 TOTAL REVENUE $451,455

$451,871 144,883 148,365 COST OF SALES 291,637 297,620 77,949

74,130 GROSS MARGIN 159,818 154,251 COSTS AND EXPENSES 2,780 1,730

Research and Development 5,115 3,672 Selling, General and 63,484

59,078 Administrative 128,637 121,967 Depreciation and 7,483 9,268

Amortization 14,975 18,194 (155) - Asset Impairment 1,539 - 774 338

Restructuring 1,864 866 74,366 70,414 TOTAL COSTS AND EXPENSES

152,130 144,699 INCOME FROM CONTINUING 3,583 3,716 OPERATIONS 7,688

9,552 OTHER INCOME (EXPENSE) (523) (636) Interest Expense (1,037)

(1,292) Investment and Other 97 (38) Income (Expense) 134 49 (426)

(674) Total Other Expense (903) (1,243) INCOME (LOSS) FROM

CONTINUING OPERATIONS 3,157 3,042 BEFORE INCOME TAXES 6,785 8,309

1,228 4,148 Income Tax Expense 2,786 6,393 NET INCOME (LOSS) FROM

1,929 (1,106) CONTINUING OPERATIONS 3,999 1,916 DISCONTINUED

OPERATIONS Loss from discontinued (1,273) (1,608) operations, net

of taxes (1,923) (2,422) Gain (loss) on sale of discontinued

operations, (9,168) 406 net of taxes (9,168) 552 NET INCOME BEFORE

CUMULATIVE EFFECT OF A CHANGE IN (8,512) (2,308) ACCOUNTING

PRINCIPLE (7,092) 46 Cumulative effect of a change in accounting -

- principle 78 - ($8,512) ($2,308) NET INCOME (LOSS) (7,014) $46

Average Number of Shares 28,934 28,771 Outstanding - Basic 28,907

28,657 Average Number of Shares 28,952 28,771 Outstanding - Diluted

28,970 28,668 BASIC AND DILUTED EARNINGS (LOSS) PER SHARE Income

(loss) from $0.07 ($0.04) continuing operations $0.14 $0.06 Loss

from discontinued (0.04) (0.05) operations (0.06) (0.08) (Loss)

Gain on sale of (0.32) 0.01 discontinued operations (0.32) 0.02

($0.29) ($0.08) Net income (loss) per share ($0.24) $0.00 $0.23

$0.23 Dividends Paid Per Share $0.46 $0.46 BALANCE SHEET (In

Thousands) 2-Jul-06 01-Jan-06 ASSETS Cash & Short Term

Investments $2,426 $13,609 Accounts Receivable 121,573 123,006

Inventories 46,407 47,033 Other Current Assets 30,467 30,255 Total

Current Assets 200,873 213,903 Plant and Equipment 121,375 129,989

Goodwill and Intangible Assets 7,924 16,866 Deferred Taxes 80,079

83,937 Other Assets 22,319 31,217 Total Assets $432,570 $475,912

LIABILITIES AND SHAREHOLDERS' EQUITY Current Portion Long-Term Debt

$619 $611 Current Liabilities 84,341 99,437 Deferred Compensation

16,292 16,357 Long-Term Debt 18,068 34,379 Retiree Healthcare

41,994 43,885 Pension Liability 112,267 107,236 Other Long-Term

Liabilities 75 555 Shareholders' Equity 158,914 173,452 Total

Liabilities and Shareholders' Equity $432,570 $475,912 DATASOURCE:

Standard Register CONTACT: News media, Julie McEwan,

+1-937-221-1825, or , or Investors, Robert J. Cestelli,

+1-937-221-1304, or , both of Standard Register

Copyright

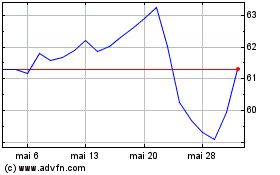

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

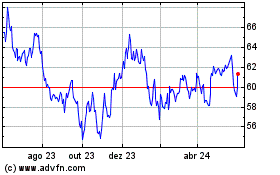

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024