DAYTON, Ohio, Feb. 23 /PRNewswire-FirstCall/ -- Standard Register

(NYSE:SR) today reported its financial results for the fourth

quarter and total year ended December 31, 2006. Results of

Operations Revenue on Continuing Operations for the fourth quarter

2006 was $228.1 million, up 3.6 percent over the comparable quarter

of 2005. Total year 2006 Revenue on Continuing Operations was

$894.9 million, compared to $890.7 million for the prior year.

Revenue growth for both the quarter and total year was driven by

strong performances in the Company's Print-On-Demand Services,

Commercial Print, and Document Systems business units, as indicated

below. Despite modest increases in label sales, the Document &

Label Solutions (DLS) business unit reported overall decreases of

4.9 percent and 3.5 percent for the quarter and total year,

reflecting a very competitive market for these traditional

products. Approximately 40 percent of the DLS decreases were

isolated to a single customer account. [$ Millions, rounded] 4th

Quarter Total Year Revenue by Business 2006 2005 %Chg 2006 2005

%Chg Unit Document & Label Solutions 141.3 148.7 -4.9% 575.3

596.2 -3.5% Print-On-Demand Services 70.3 57.9 21.4% 260.0 239.8

8.4% Commercial Print 9.9 7.5 31.1% 35.6 29.7 20.1% Document

Systems 5.9 4.7 25.4% 21.1 20.9 1.1% Digital Solutions 0.1 0.5

-78.2% 0.6 0.7 -15.9% Other 0.6 0.9 -37.9% 2.3 3.5 -34.3% Total

228.1 220.2 3.6% 894.9 890.7 0.5% Gross margins also improved for

both the quarter and total year 2006 periods as a result of the

overall revenue increases and continuing improvement in

manufacturing productivity. Depreciation and amortization expenses

were also lower, continuing the trend of recent years. Increased

investment in software development, higher sales and marketing

compensation, and increased fringe costs pushed selling, general

and administrative expense higher in both the quarter and total

year. In addition, higher expense for restructuring, impairment,

pension loss amortization, and pension settlement had a substantial

unfavorable effect on 2006 reported earnings, as indicated in the

table below. Excluding these expense items, Income from Continuing

Operations was $8.7 million for the fourth quarter 2006 versus $8.8

million for the comparable quarter of 2005; on the same basis, the

total year Income from Continuing Operations was $37.3 million in

2006 compared to $37.7 million for 2005. Including these expense

items and after Interest & Other Expenses and Income Taxes, the

Company reported a Net Loss on Continuing Operations for the fourth

quarter of $0.2 million or $0.01 per share, compared to a Net

Profit of $2.4 million or $0.08 per share in the prior year. For

the total year 2006, Net Income on Continuing Operations was $0.2

million or $0.01 per share, versus $7.1 million or $0.25 per share

in 2005. The Company sold its InSystems subsidiary in June 2006 and

classified the former business unit as a discontinued operation.

Total Net Income, including the results of InSystems operations and

its sale, was $1.1 million or $0.04 per share for the fourth

quarter compared to a break-even result in the fourth quarter 2005.

For the whole of 2006, the Company reported a loss of $11.7 million

or $0.41 per share, versus a profit of $1.4 million or $0.05 per

share in the prior year. [$ Millions, rounded] Effect on 4Q Income

Effect on Annual Income CONTINUING OPERATIONS 2006 2005 Chg 2006

2005 Chg Income from Continuing Operations Before Restructuring,

Impairment, Pension Loss Amortization, & the Pension Settlement

Charge 8.7 8.8 -0.1 37.3 37.7 -0.4 Restructuring Expense -0.3 -0.2

-0.1 -2.7 -1.0 -1.7 Impairment Expense -1.1 -0.1 -1.0 -2.7 -0.3

-2.4 Amortization of Past Pension Losses -6.5 -4.7 -1.8 -25.6 -19.0

-6.6 Pension Settlement Charge 0.0 0.0 0.0 -1.6 0.0 -1.6 Income /

(Loss) on Continuing Operations 0.8 3.7 -0.1 4.7 17.4 -12.8

Interest & Other Income / (Expense) -0.6 -0.1 -0.6 -2.1 -2.0

-0.1 Pretax Income / (Loss) 0.2 3.6 -3.5 2.6 15.5 -12.8 Income Tax

Adjustments -0.1 0.2 -0.4 -1.4 -2.2 0.8 Income Taxes -0.2 -1.5 1.3

-1.0 -6.1 5.1 Net Income / (Loss) on Continuing Operations -0.2 2.4

-2.6 0.2 7.1 0.0 DISCONTINUED OPERATIONS 1.3 -2.4 3.7 -11.9 -5.7

-6.1 CUMULATIVE EFFECT OF CHANGE IN ACCOUNTING PRINCIPLE 0.1 TOTAL

NET INCOME / (LOSS) 1.1 0.0 1.1 -11.7 1.4 -13.1 "Despite

challenging industry conditions for traditional printed documents,

we believe there is good business and cash flow in this industry

segment if we continue our market focus and improvements in

productivity. We were pleased to see the increases in revenue and

gross margin in our other business units, which underscores our

shifting mix and our long-term growth opportunity," said Dennis L.

Rediker, Standard Register's president and chief executive officer.

Cash flow was a negative $19.5 million, primarily a result of

higher year- end accounts receivable and 2006 pension contributions

of $25 million that were twice the level of the prior two years'

average. The higher receivables related to the timing of payments

at a few large accounts and an increase in December's revenue. The

balance sheet remained strong with a 25.7 percent ratio of net debt

(total debt less cash and short-term investments) to total capital.

Outlook "Looking forward to 2007, we expect revenue for the total

year to increase in the low-to-mid single digit range overall with

a continuation of the strategic mix change we witnessed in 2006.

Capital spending is expected to step up in 2007 to the $25 - $28

million range in order to support expected growth in the

Print-On-Demand Services business, while contributions to the

pension plan are expected to fall back to $20 million," added

Rediker. Presentation of Information in This Press Release This

press release presents information that excludes restructuring,

impairment charges, pension settlement charges and amortization of

past pension losses. These financial measures are considered

non-GAAP. Generally, a non-GAAP financial measure is a numerical

measure of a company's performance, financial position, or cash

flows where amounts are either excluded or included not in

accordance with generally accepted accounting principles (GAAP).

This information is intended to enhance an overall understanding of

the financial performance due to the non-operational nature of

these items and the significant change from period to period. This

presentation is consistent with the manner in which the Board of

Directors internally evaluates performance. The presentation of

non-GAAP information is not meant to be considered in isolation or

as a substitute for results prepared in accordance with principles

generally accepted in the United States. Conference Call Standard

Register president and chief executive officer Dennis L. Rediker

and chief financial officer Craig J. Brown will host a conference

call at 10 a.m. EST on February 23, 2007, to review the fourth

quarter and full-year results. The call can be accessed via an

audio webcast which is accessible at:

http://www.standardregister.com/investorcenter. About Standard

Register Standard Register is a premier document services provider,

trusted by companies to manage the critical documents they need to

thrive in today's competitive climate. Relying on nearly 100 years

of industry expertise, Lean Six Sigma methodologies and leading

technologies, the company helps organizations increase efficiency,

reduce costs, mitigate risks, grow revenue and meet the challenges

of a changing business landscape. It offers document and label

solutions, e-business solutions, consulting and print supply chain

services to help clients manage documents across their enterprise.

More information is available at http://www.standardregister.com/.

Safe Harbor Statement This report includes forward-looking

statements covered by the Private Securities Litigation Reform Act

of 1995. Because such statements deal with future events, they are

subject to various risks and uncertainties and actual results for

fiscal year 2007 and beyond could differ materially from the

Company's current expectations. Forward-looking statements are

identified by words such as "anticipates," "projects," "expects,"

"plans," "intends," "believes," "estimates," "targets," and other

similar expressions that indicate trends and future events. Factors

that could cause the Company's results to differ materially from

those expressed in forward-looking statements include, without

limitation, variation in demand and acceptance of the Company's

products and services, the frequency, magnitude and timing of paper

and other raw-material-price changes, general business and economic

conditions beyond the Company's control, timing of the completion

and integration of acquisitions, the consequences of competitive

factors in the marketplace, cost-containment strategies, and the

Company's success in attracting and retaining key personnel.

Additional information concerning factors that could cause actual

results to differ materially from those projected is contained in

the Company's filing with The Securities and Exchange Commission,

including its report on Form 10-K for the year ended December 31,

2006. The Company undertakes no obligation to revise or update

forward-looking statements as a result of new information since

these statements may no longer be accurate or timely. THE STANDARD

REGISTER COMPANY Fourth Quarter STATEMENT OF OPERATIONS Y-T-D 13

Weeks 13 Weeks (In Thousands, except Per Share 52 Weeks 52 Weeks

Ended Ended Amounts) Ended Ended 31-Dec-06 01-Jan-06 31-Dec-06

01-Jan-06 $228,122 $220,226 TOTAL REVENUE $894,904 $890,740 151,336

146,814 COST OF SALES 587,712 588,675 76,786 73,412 GROSS MARGIN

307,192 302,065 COSTS AND EXPENSES Selling, General and 68,041

61,438 Administrative 268,311 249,481 6,535 7,921 Depreciation and

Amortization 28,786 33,848 1,146 146 Asset Impairment 2,738 303 274

208 Restructuring 2,671 998 75,996 69,713 TOTAL COSTS AND EXPENSES

302,506 284,630 INCOME FROM CONTINUING 790 3,699 OPERATIONS 4,686

17,435 OTHER INCOME (EXPENSE) (693) (590) Interest Expense (2,285)

(2,465) Investment and Other Income 54 519 (Expense) 228 499 (639)

(71) Total Other Expense (2,057) (1,966) INCOME FROM CONTINUING

OPERATIONS BEFORE 151 3,628 INCOME TAXES 2,629 15,469 340 1,255

Income Tax Expense 2,475 8,323 NET (LOSS) INCOME FROM (189) 2,373

CONTINUING OPERATIONS 154 7,146 DISCONTINUED OPERATIONS Income

(Loss) from discontinued 556 (2,399) operations, net of taxes

(1,849) (6,297) Gain (loss) on sale of discontinued operations, net

711 (3) of taxes (10,044) 550 NET INCOME (LOSS) BEFORE CUMULATIVE

EFFECT OF A 1,078 (29) CHANGE IN ACCOUNTING PRINCIPLE (11,739)

1,399 Cumulative effect of a change in accounting principle, net of

- - taxes 78 - $1,078 ($29) NET INCOME (LOSS) (11,661) $1,399

Average Number of Shares 28,616 28,829 Outstanding - Basic 28,543

28,738 Average Number of Shares 28,635 28,829 Outstanding - Diluted

28,579 28,766 BASIC AND DILUTED EARNINGS (LOSS) PER SHARE Income

(loss) from continuing ($0.01) $0.08 operations $0.01 $0.25 Income

(Loss) from discontinued $0.02 (0.08) operations (0.07) (0.22) Gain

(Loss) on sale of 0.03 - discontinued operations (0.35) 0.02 $0.04

($0.00) Net income (loss) per share (0.41) $0.05 $0.23 $0.23

Dividends Paid Per Share $0.92 $0.92 BALANCE SHEET (In Thousands)

31-Dec-06 01-Jan-06 ASSETS Cash & Short Term Investments $488

$13,609 Accounts Receivable 135,839 120,491 Inventories 49,242

47,033 Assets of Discontinued Operations - 25,706 Other Current

Assets 32,201 28,692 Total Current Assets 217,770 235,531 Plant and

Equipment 119,339 128,601 Goodwill and Intangible Assets 8,168

8,115 Deferred Taxes 86,710 80,599 Other Assets 20,092 23,066 Total

Assets $452,079 $475,912 LIABILITIES AND SHAREHOLDERS' EQUITY

Current Portion Long-Term Debt $358 $611 Liabilities of

Discontinued Operations $0 $5,756 Current Liabilities 100,956

94,236 Deferred Compensation 17,190 16,357 Long-Term Debt 41,021

34,379 Retiree Healthcare 20,398 43,885 Pension Liability 153,953

107,236 Other Long-Term Liabilities 36 - Shareholders' Equity

118,167 173,452 Total Liabilities and Shareholders' Equity $452,079

$475,912 DATASOURCE: Standard Register CONTACT: Lesley Sprigg

+1-937-221-1825, or , or Robert J. Cestelli +1-937-221-1304, or ,

both of Standard Register Web site:

http://www.standardregister.com/

http://www.standardregister.com/investorcenter

Copyright

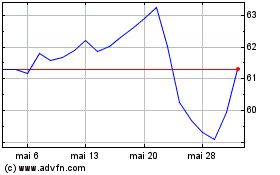

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

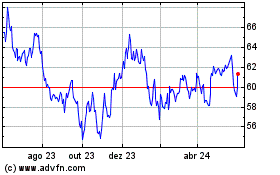

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024