Standard Register Reports First Quarter 2008 Financial Results

25 Abril 2008 - 9:00AM

Business Wire

Standard Register (NYSE: SR) today reported its financial results

for the first quarter ended March 30, 2008. Results of Operations

Net Income for the first quarter was $2.5 million or $0.09 per

share, compared to a net loss of $0.8 million or $0.03 per share in

the prior year. First quarter revenue was $207.2 million versus

$227.4 million in 2007. �Despite the lower revenue, our operating

earnings improved in the quarter and we had very strong cash flow,�

said Dennis Rediker, president and CEO of Standard Register.

Operating income before pension loss amortization, restructuring,

and impairment was $10.4 million this quarter, up 10.6 percent

compared to the comparable $9.4 million result a year earlier. The

reconciliation of these operating results to the GAAP results

appears later in this release. Net cash flow was a positive $9.7

million in the quarter, after funding $5.0 million in pension

contributions, $3.2 million in capital expenditures, and $6.7

million in dividends. Net debt ended the quarter at $41.6 million,

representing just 26.5 percent of total capital. The Company has

generated $9.3 million in positive net cash flow over the trailing

four quarters. About one-third of our revenue decline was from a

single customer who ended purchases after the first quarter of

2007. The balance of the business was off 6.0 percent. �The economy

definitely played a role in our manufacturing market, where we saw

decreased units. The impetus for our customers to continue to

aggressively pursue cost reductions was to some degree also likely

reinforced by economic conditions,� said Rediker. The Company�s

mid-year 2007 cost reduction plan contributed significantly to the

improved operating performance. This was evident in the percentage

gross margin, which remained nearly identical to last year despite

the lower revenue. In addition, SG&A expenses were $8.0 million

lower in the quarter, excluding the pension loss amortization.

Earlier this week, the Company announced a benefit freeze to its

pension plan participants, which comprise about one-third of

employees. Affected employees will become eligible for enhanced

401K benefits in line with other employees that do not participate

in the traditional pension plan. The table below reconciles the

operating earnings cited earlier to our net earnings in accordance

with GAAP. [$ Millions, rounded] � Effect on 1Q Income CONTINUING

OPERATIONS 2008 � 2007 � Chg Operations before Restructuring,

Impairment � � � � � Amortization of Past Pension Losses &�the

Pension Settlement Charge 10.4 � 9.4 � 1.0 � � Reconciliation to

Net Income / (Loss): Restructuring Expense 0.0 -2.4 2.4 Impairment

Expense -0.2 0.4 -0.6 Amortization of Past Pension Losses -5.2 �

-7.0 � 1.8 Income / (Loss) on Continuing Operations 5.1 0.4 4.7 �

Interest & Other Income / (Expense) -0.7 � -0.7 � 0.0 Pretax

Income / (Loss) 4.4 -0.4 4.7 � Income Taxes 1.9 � -0.2 � 2.1 Net

Income / (Loss) on Continuing Operations 2.5 � -0.2 � 2.7 �

DISCONTINUED OPERATIONS 0.0 -0.6 0.6 � � � � � TOTAL NET INCOME /

(LOSS) 2.5 � -0.8 � 3.3 � Earnings Per Share on Continuing

Operations 0.09 � -0.01 � 0.09 Restructuring & Impairment

Expenses 0.00 -0.04 0.04 Pension Loss Amortization & Pension

Settlement -0.11 -0.15 0.04 All Other Continuing Operations 0.20 �

0.18 � 0.02 � Discontinued Operations 0.00 � -0.02 � 0.02 Total

Earnings Per Share 0.09 � -0.03 � 0.11 Dividend Standard Register�s

board of directors declared on April 24, 2008 a quarterly dividend

of $0.23 per share to be paid on June 6, 2008, to shareholders of

record as of May 23, 2008. Chief Operating Officer The board of

directors yesterday named Joseph P. Morgan, Jr. as chief operating

officer reporting to Dennis L. Rediker. In this position, Mr.

Morgan will have responsibility for all operations of the Company.

Prior to this he was vice president, chief technology officer and

general manager, On Demand Solutions Group. He has served as an

officer of the Company since 2003. Board of Directors At the

Company�s Annual Meeting held April 24, 2008, shareholders approved

setting the number of directors at eight, as well as electing five

incumbent directors and three new directors including David P.

Bailis, Michael E. Kohlsdorf and R. Eric McCarthey. Conference Call

Standard Register president and chief executive officer Dennis L.

Rediker and chief financial officer Craig J. Brown will host a

conference call at 10 a.m. EDT on April 25, 2008, to review the

first quarter results. The call can be accessed via an audio web

cast which is accessible at:

http://www.standardregister.com/investorcenter. Presentation of

Information in This Press Release This press release presents

information that excludes restructuring, impairment charges, and

amortization of past pension losses. These financial measures are

considered non-GAAP. Generally, a non-GAAP financial measure is a

numerical measure of a company�s performance, financial position,

or cash flows where amounts are either excluded or included not in

accordance with generally accepted accounting principles (GAAP).

This information is intended to enhance an overall understanding of

the financial performance due to the non-operational nature of

these items and the significant change from period to period. This

presentation is consistent with the manner in which the Board of

Directors internally evaluates performance. The presentation of

non-GAAP information is not meant to be considered in isolation or

as a substitute for results prepared in accordance with principles

generally accepted in the United States. About Standard Register

Standard Register is a premier document services provider, trusted

by companies to manage the critical documents they need to thrive

in today�s competitive climate. Employing nearly a century of

industry expertise, Lean Six Sigma methodologies and other leading

technologies, the company helps organizations increase efficiency,

reduce costs, mitigate risks, grow revenue and meet the challenges

of a changing business landscape. It offers document and label

solutions, technology solutions, consulting and print supply chain

services to help clients manage documents throughout their

enterprises. More information is available at

http://www.standardregister.com. Safe Harbor Statement This report

includes forward-looking statements covered by the Private

Securities Litigation Reform Act of 1995. Because such statements

deal with future events, they are subject to various risks and

uncertainties and actual results for fiscal year 2008 and beyond

could differ materially from the Company�s current expectations.

Forward-looking statements are identified by words such as

�anticipates,� �projects,� �expects,� �plans,� �intends,�

�believes,� �estimates,� �targets,� and other similar expressions

that indicate trends and future events. Factors that could cause

the Company�s results to differ materially from those expressed in

forward-looking statements include, without limitation, variation

in demand and acceptance of the Company�s products and services,

the frequency, magnitude and timing of paper and other

raw-material-price changes, general business and economic

conditions beyond the Company�s control, timing of the completion

and integration of acquisitions, the consequences of competitive

factors in the marketplace, cost-containment strategies, and the

Company�s success in attracting and retaining key personnel.

Additional information concerning factors that could cause actual

results to differ materially from those projected is contained in

the Company�s filing with The Securities and Exchange Commission,

including its report on Form 10-K for the year ended December 30,

2007. The Company undertakes no obligation to revise or update

forward-looking statements as a result of new information since

these statements may no longer be accurate or timely. THE STANDARD

REGISTER COMPANY � � � STATEMENT OF OPERATIONS Y-T-D (In Thousands,

except Per Share Amounts) 13 Weeks Ended 13 Weeks Ended 30-Mar-08 �

1-Apr-07 � TOTAL REVENUE $207,185 $227,431 � COST OF SALES 138,164

� � 151,496 � � GROSS MARGIN 69,021 75,935 � COSTS AND EXPENSES

Selling, General and Administrative 56,966 66,918 Depreciation and

Amortization 6,831 6,655 Asset Impairment 164 (409 ) Restructuring

9 � � 2,406 � � TOTAL COSTS AND EXPENSES 63,970 � � 75,570 � �

INCOME FROM CONTINUING OPERATIONS 5,051 365 � OTHER INCOME

(EXPENSE) Interest Expense (761 ) (797 ) Other income 82 � � 68 �

Total Other Expense (679 ) (729 ) � � INCOME (LOSS) FROM CONTINUING

OPERATIONS BEFORE INCOME TAXES 4,372 (364 ) � � Income Tax Expense

(Benefit) 1,878 � � (175 ) � NET INCOME (LOSS) FROM CONTINUING

OPERATIONS 2,494 (189 ) � DISCONTINUED OPERATIONS Gain on sale of

discontinued operations, net of taxes 2 - Loss from discontinued

operations, net of taxes - (639 ) � � � � NET INCOME (LOSS) 2,496 �

� ($828 ) � � Average Number of Shares Outstanding - Basic 28,736

28,635 Average Number of Shares Outstanding - Diluted 28,744 28,635

� BASIC AND DILUTED INCOME (LOSS) PER SHARE Income (Loss) from

continuing operations $0.09 ($0.01 ) Loss from discontinued

operations - � � (0.02 ) Net Income (Loss) per share $0.09 � �

($0.03 ) � Dividends Paid Per Share $0.23 $0.23 � � � BALANCE SHEET

(In Thousands) 30-Mar-08 � 30-Dec-07 � ASSETS Cash & Short Term

Investments $3,412 $697 Accounts Receivable 117,147 130,212

Inventories 43,605 45,351 Other Current Assets 22,963 � � 22,523 �

Total Current Assets 187,127 198,783 � Plant and Equipment 107,283

110,975 Goodwill and Intangible Assets 7,834 7,861 Deferred Taxes

77,120 80,852 Other Assets 19,712 21,075 � � � Total Assets

$399,076 � � $419,546 � � LIABILITIES AND SHAREHOLDERS' EQUITY

Current Portion Long-Term Debt $0 $21 Current Liabilities 74,229

87,342 Deferred Compensation 10,521 12,010 Long-Term Debt 45,000

51,988 Retiree Healthcare 19,445 19,496 Pension Liability 129,357

133,647 Other Long-Term Liabilities 5,036 5,083 Shareholders'

Equity 115,488 109,959 � � � Total Liabilities and Shareholders'

Equity $399,076 � � $419,546 �

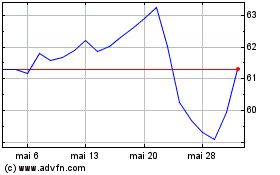

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

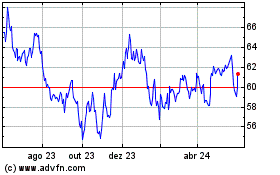

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024