Standard Register (NYSE: SR) today reported its financial

results for the first quarter ended March 29, 2009.

Results of Operations

Revenue for the first quarter was $174.6 million, down 15.7

percent compared with $207.2 million recorded for the comparable

quarter of 2008. Gross margin as a percent of revenue was 31.1

percent compared with 31.3 percent in the prior year. �Despite the

revenue shortfall, our gross margin as a percent of revenue

remained even with last year due to the successful execution of

cost reduction initiatives implemented in 2007 and 2008,� said Joe

Morgan, president and chief executive officer. �We have added to

our customer base in the quarter and have not experienced any

significant customer losses. Our top line has mainly been impacted

by the reduction in corporate spending by many of our customers

combined with a continued technology trend that impacts many legacy

products.�

Net income from continuing operations was a loss of $11.0

million or $0.38 per share compared with income of $2.5 million or

$0.09 per share last year. The loss was primarily due to

considerable pension settlement charges representing $19.7 million

on a pre-tax basis or $0.41 per share. SG&A expenses were $51.8

million compared with $59.5 million in the comparable quarter of

2008. These expenses included non-cash pension loss amortization of

$4.7 million vs. $5.2 million in the prior year and are a result of

prior years� pension losses as well as declining interest rates.

Non-cash pension settlement charges were significant and were

related to lump sum payments made to retirees. No pension

settlement charges were recorded in the prior year. SG&A

expenses, excluding pension loss amortization, decreased in the

quarter by $7.3 million. This represented the seventh consecutive

quarter of year over year lower SG&A expenses excluding pension

amortization. In late 2008, the Company announced plans to reduce

annualized costs by $33 million. This was in addition to

successfully achieving $40 million from cost-savings measures

introduced in mid 2007. �One of our key areas of focus is the

relentless pursuit of cost reduction,� added Morgan. �This will

continue to receive our full attention throughout 2009.�

Cash flow on a net debt basis was negative due primarily to

unusually large payments in the Company�s non-qualified plans and

the $0.23 per share dividend paid to shareholders in the

quarter.

The Company completed its organizational transformation

initiatives by aligning sales, marketing, client satisfaction and

in some cases, manufacturing by the major vertical markets of

healthcare, industrial products and commercial, a business unit

comprised of specific market sectors including financial,

government and retail. This targeted approach resulted in the

signing of 43 multi-year contracts during the quarter. These

contracts represent over $11.0 million in new business on an

annualized basis and support the Company�s strategy that focusing

on a concentrated number of vertical markets will lead to growth in

revenue and earnings over the long term.

Dividend

Standard Register�s board of directors today declared a

quarterly dividend of $0.05 per share to be paid on June 5, 2009,

to shareholders of record as of May 22, 2009. The board will

consider future dividend payments on a quarter-by-quarter basis in

accordance with its normal practice.

Conference Call

Standard Register�s president and chief executive officer Joe

Morgan and chief financial officer Bob Ginnan will host a

conference call at 10 a.m. EDT on April 24, 2009, to review the

first quarter results. The call can be accessed via an audio web

cast which is accessible at:

http://www.standardregister.com/investorcenter.

Presentation of Information in This Press Release

This press release may contain information that is non-GAAP.

Generally, a non-GAAP financial measure is a numerical measure of a

company�s performance, financial position, or cash flows where

amounts are either excluded or included not in accordance with

generally accepted accounting principles. The presentation of

non-GAAP information is not meant to be considered in isolation or

as a substitute for results prepared in accordance with accounting

principles generally accepted in the United States. In particular,

we will segregate and highlight cash flows related to restructuring

and contributions to our qualified pension plan, both of which are

carefully monitored by management and have a significant and

variable impact on cash flow. In addition, because our outstanding

debt is borrowed under a revolving credit agreement which currently

permits us to borrow and repay at will up to a balance of $100

million (subject to limitations related to receivable balances and

letters of credit), we measure cash flow performance prior to debt

borrowing or repayment. In effect, we evaluate cash flow as the

change in net debt (total debt less cash and cash equivalents).

About Standard Register

Standard Register is a premier document services provider,

trusted by companies to manage the critical documents they need to

thrive in today�s competitive climate. Employing nearly a century

of industry expertise, Lean Six Sigma methodologies and other

leading technologies, the company helps organizations increase

efficiency, reduce costs, mitigate risks, grow revenue and meet the

challenges of a changing business landscape.

It offers document and label solutions, technology solutions,

consulting and print supply chain services to help clients manage

documents throughout their enterprises. More information is

available at http://www.standardregister.com.

Safe Harbor Statement

This report includes forward-looking statements covered by the

Private Securities Litigation Reform Act of 1995. Because such

statements deal with future events, they are subject to various

risks and uncertainties and actual results for fiscal year 2009 and

beyond could differ materially from the Company�s current

expectations. Forward-looking statements are identified by words

such as �anticipates,� �projects,� �expects,� �plans,� �intends,�

�believes,� �estimates,� �targets,� and other similar expressions

that indicate trends and future events.

Factors that could cause the Company�s results to differ

materially from those expressed in forward-looking statements

include, without limitation, variation in demand and acceptance of

the Company�s products and services, the frequency, magnitude and

timing of paper and other raw-material-price changes, general

business and economic conditions beyond the Company�s control,

timing of the completion and integration of acquisitions, the

consequences of competitive factors in the marketplace,

cost-containment strategies, and the Company�s success in

attracting and retaining key personnel. Additional information

concerning factors that could cause actual results to differ

materially from those projected is contained in the Company�s

filing with The Securities and Exchange Commission, including its

report on Form 10-K for the year ended December 28, 2008. The

Company undertakes no obligation to revise or update

forward-looking statements as a result of new information since

these statements may no longer be accurate or timely.

� �

THE STANDARD REGISTER COMPANY � �

STATEMENT OF

OPERATIONS Y-T-D (In Thousands, except Per Share

Amounts)

13 Weeks Ended 13 Weeks Ended

29-Mar-09 �

30-Mar-08 �

TOTAL REVENUE

$174,620 $207,185 �

COST OF SALES

120,385 � �

142,400 � �

GROSS MARGIN

54,235 64,785 �

COSTS AND EXPENSES Selling,

General and Administrative

51,787 59,561 Pension

settlement losses

19,747 - Asset Impairment

-

164 Restructuring

601 � �

9 � �

TOTAL COSTS

AND EXPENSES 72,135 � �

59,734 � �

(LOSS)

INCOME FROM CONTINUING OPERATIONS (17,900 )

5,051 �

OTHER INCOME (EXPENSE) Interest Expense

(303 ) (761 ) Other income

48 �

�

82 �

Total Other Expense (255 )

(679 ) � �

(LOSS) INCOME FROM CONTINUING

OPERATIONS BEFORE INCOME TAXES

(18,155 ) 4,372 � Income Tax (Benefit) Expense

(7,179 ) �

1,878 � �

NET (LOSS) INCOME FROM

CONTINUING OPERATIONS (10,976 ) 2,494 �

DISCONTINUED OPERATIONS Gain on sale of discontinued

operations, net of taxes

- � �

2 � �

NET(LOSS)

INCOME (10,976 ) �

2,496 � � � Average

Number of Shares Outstanding - Basic

28,792 28,744

Average Number of Shares Outstanding - Diluted

28,792

28,744 �

BASIC AND DILUTED (LOSS) INCOME PER SHARE

($0.38 ) $0.09 � Dividends Paid Per Share

$0.23 $0.23 � � �

BALANCE SHEET (In Thousands)

29-Mar-09 � 28-Dec-08 �

ASSETS Cash & Short Term

Investments

$367 $282 Accounts Receivable

101,757

112,810 Inventories

38,982 38,718 Other Current Assets

22,066 � � 22,060 � Total Current Assets

163,172

173,870 � Plant and Equipment

99,405 102,071 Goodwill and

Intangible Assets

7,725 7,752 Deferred Taxes

105,146

114,121 Other Assets

15,625 � � 15,563 � Total Assets

$391,073 � � $413,377 � �

LIABILITIES AND SHAREHOLDERS'

EQUITY Current Portion Long-Term Debt

$159 $159 Current

Liabilities

71,713 87,296 Deferred Compensation

7,056

8,362 Long-Term Debt

41,359 33,840 Retiree Healthcare

7,932 8,063 Pension Liability

208,740 235,457 Other

Long-Term Liabilities

5,286 5,231 Shareholders' Equity

48,828 � � 34,969 � Total Liabilities and Shareholders'

Equity

$391,073 � � $413,377 �

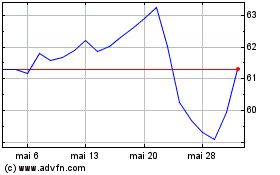

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

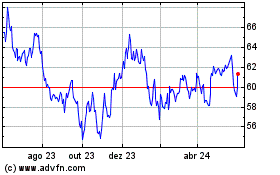

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024