Standard Register (NYSE: SR) today reported its fourth quarter

and total year 2010 results. For the quarter, the Company reported

revenue of $172.7 million and a net profit of $2.2 million, or

$0.08 per share. The current year fourth quarter 13-week results

compare to last year’s 14-week revenue of $184.9 million and a net

profit of $0.9 million, or $0.03 per share. For the year, the

Company reported revenue of $668.4 million and a net profit of $2.6

million, or $0.09 per share. The current year 52-week results

compare to last year’s 53-week revenue of $694.0 million and a net

loss of $12.4 million, or $0.43 per share.

“We have made great progress during the year to stabilize

revenue, improve profits and manage cash toward break-even,” stated

Joseph Morgan, president and chief executive officer. “As a result,

we are entering 2011 a financially stronger and more focused

organization that will take advantage of the emerging opportunities

in those markets in which we participate.”

Results of Operations

Revenue comparisons to the prior year are not consistent given

the extra week reported during the fourth quarter 2009. However,

during the quarter the Company continued to see expansion of its

customer base through new contracts and growth in priority

solutions even including the extra week from the prior year.

Gross margin as a percent of revenue was improved to 32.7 for

the quarter versus 31.9 in the prior year. For the year, gross

margin was at 32.0 percent of revenue versus 31.8 percent of

revenue in the prior year. Favorable LIFO inventory adjustments

were $1.2 million for the current quarter and $3.8 million for the

year. This compares to favorable LIFO adjustments of $1.9 million

and $4.9 million for the fourth quarter and total year 2009.

Continuous improvement initiatives allowed the Company to enhance

gross margin despite lower revenue units.

Selling, general and administrative expenses are also not

consistent given the extra week reported during the fourth quarter

2009. However, savings initiatives during the quarter continue to

offset planned investments in technology, materials science, and

key expertise to support our market development.

“All business units have shown great progress during the year in

improving their operating profits,” noted Morgan. “It is

encouraging to see that the investments we made previously to

support these businesses are now beginning to provide the returns

we had anticipated.”

Adjusting for pension loss amortization, pension settlement

losses and restructuring and impairment charges, non-GAAP adjusted

net income was $5.7 million, or $0.21 per share for the fourth

quarter of 2010, compared with non-GAAP adjusted net income of $3.2

million, or $0.11 per share for the fourth quarter of 2009. On a

year-to-date basis, adjusting for pension loss amortization,

pension settlement losses and restructuring and impairment charges,

non-GAAP adjusted net income was $15.5 million, or $0.54 per share

compared with non-GAAP adjusted net income of $16.4 million, or

$0.58 per share for the prior year.

Capital expenditures were $14.7 million for the year using a

combination of $8.4 million in cash and $6.3 million through

operating and capital lease agreements. In addition, the Company

purchased the assets of Fusion Graphics, Inc. for $2.5 million

during the second quarter. Pension funding was $24.0 million for

the year. Non-GAAP cash on a net debt basis was $5.9 million

negative for the year.

“We came short of our expectations for cash this year as our

year-end receivables balance grew $13 million from the previous

quarter,” commented Morgan. “On the upside, this has resulted in

strong positive cash flow for the start of 2011.”

Conference Call

Standard Register’s President and Chief Executive Officer Joseph

Morgan and Chief Financial Officer Bob Ginnan will host a

conference call at 10 a.m. EST on February 25, 2011, to review the

fourth quarter and year-end results. The call can be accessed via

an audio web cast which is accessible at:

http://www.standardregister.com/investorcenter.

Presentation of Information in This Press Release

This press release may contain information that is non-GAAP.

Generally, a non-GAAP financial measure is a numerical measure of a

company’s performance, financial position, or cash flows where

amounts are either excluded or included not in accordance with

generally accepted accounting principles. The presentation of

non-GAAP information is not meant to be considered in isolation or

as a substitute for results prepared in accordance with accounting

principles generally accepted in the United States. In particular,

because our outstanding debt is borrowed under a revolving credit

agreement which currently permits us to borrow and repay at will up

to a balance of $100 million (subject to limitations related to

receivable balances and letters of credit), we measure cash flow

performance prior to debt borrowing or repayment. In effect, we

evaluate cash flow as the change in net debt (total debt less cash

and cash equivalents).

About Standard Register

Standard Register is a premier document services provider,

trusted by companies to manage the critical documents they need to

thrive in today’s competitive climate. Employing nearly a century

of industry expertise, Lean Six Sigma methodologies and other

leading technologies, the company helps organizations increase

efficiency, reduce costs, mitigate risks, grow revenue and meet the

challenges of a changing business landscape. It offers document and

label solutions, technology solutions, consulting and print supply

chain services to help clients manage documents throughout their

enterprises. More information is available at

http://www.standardregister.com.

Safe Harbor Statement

This report includes forward-looking statements covered by the

Private Securities Litigation Reform Act of 1995. Because such

statements deal with future events, they are subject to various

risks and uncertainties and actual results for fiscal year 2011 and

beyond could differ materially from the Company’s current

expectations. Forward-looking statements are identified by words

such as “anticipates,” “projects,” “expects,” “plans,” “intends,”

“believes,” “estimates,” “targets,” and other similar expressions

that indicate trends and future events.

Factors that could cause the Company’s results to differ

materially from those expressed in forward-looking statements

include, without limitation, variation in demand and acceptance of

the Company’s products and services, the frequency, magnitude and

timing of paper and other raw-material-price changes, general

business and economic conditions beyond the Company’s control,

timing of the completion and integration of acquisitions, the

consequences of competitive factors in the marketplace, results of

continuous improvement and other cost-containment strategies, and

the Company’s success in attracting and retaining key personnel.

Additional information concerning factors that could cause actual

results to differ materially from those projected is contained in

the Company’s filing with The Securities and Exchange Commission,

including its report on Form 10-K that will be filed for the year

ended January 2, 2011. The Company undertakes no obligation to

revise or update forward-looking statements as a result of new

information since these statements may no longer be accurate or

timely.

THE STANDARD REGISTER COMPANY STATEMENT OF OPERATIONS

(Dollars in thousands, except per share amounts)

Fourth

Quarter Y-T-D 13 Weeks Ended

14 Weeks Ended 52 Weeks Ended 53 Weeks

Ended 2-Jan-11 3-Jan-10 2-Jan-11

3-Jan-10 $ 172,684 $ 184,853

TOTAL REVENUE $ 668,377 $ 694,016

116,207 125,863

COST

OF SALES 454,796 473,446

56,477 58,990

GROSS MARGIN

213,581 220,570

COSTS AND EXPENSES

50,684 54,270 Selling, general and administrative

204,613 205,270

370 - Pension settlement losses

370 20,412

- 2,407 Environmental remediation

(803 ) 2,513

- 326 Asset impairments

-

1,176

243 748

Restructuring and other exit costs

1,733

11,513

51,297

57,751

TOTAL COSTS AND EXPENSES

205,913 240,884

5,180 1,239

INCOME (LOSS) FROM OPERATIONS

7,668 (20,314 )

OTHER INCOME (EXPENSE)

(572 ) (273 ) Interest expense

(2,189 )

(1,197 )

(536 ) 35 Other

(expense) income

(333 ) 390

(1,108 ) (238 )

Total other expense

(2,522 ) (807 )

4,072 1,001

INCOME

(LOSS) BEFORE INCOME TAXES 5,146 (21,121 )

1,887 129 Income Tax

Expense (Benefit)

2,503 (8,724 )

$ 2,185 $ 872

NET

INCOME (LOSS) $ 2,643 $ (12,397 )

28,948 28,859 Average Number of Shares

Outstanding - Basic

28,917 28,836

28,955 28,914

Average Number of Shares Outstanding - Diluted

28,944 28,836

$ 0.08 $ 0.03

BASIC AND DILUTED INCOME

(LOSS) PER SHARE $ 0.09 $ (0.43 )

$

0.05 $ 0.05 Dividends per share declared for the period

$ 0.20 $ 0.20 MEMO:

$ 5,507 $

6,901 Depreciation and amortization

$ 23,255 $ 25,044

$ 4,668 $ 2,844 Pension loss amortization

$

18,672 $ 14,598

SEGMENT OPERATING

RESULTS (Dollars in thousands)

Fourth Quarter

Y-T-D 13 Weeks Ended 14 Weeks Ended 52

Weeks Ended 53 Weeks Ended 2-Jan-11

3-Jan-10 2-Jan-11 3-Jan-10

REVENUE $ 43,892 $ 50,857 Financial Services

$ 175,677 $ 193,203

43,644

46,227 Commercial Markets

165,888 170,107

87,536

97,084 Total Commercial

341,565 363,310

66,315

70,357 Healthcare

250,963 265,850

18,833

17,412 Industrial

75,849

64,856

$ 172,684

$ 184,853 Total Revenue

$ 668,377

$ 694,016

GROSS MARGIN $

13,105 $ 14,791 Financial Services

$ 52,244 $

56,184

11,276 11,088

Commercial Markets

42,963 44,971

24,381 25,879 Total Commercial

95,207 101,155

24,771 26,230 Healthcare

91,926 96,475

6,112 4,950 Industrial

22,675 18,024

1,213 1,931 LIFO adjustment

3,773 4,916

$

56,477 $ 58,990 Total Gross Margin

$ 213,581 $ 220,570

NET INCOME (LOSS) BEFORE TAXES $ 2,438 $ 1,851

Financial Services

$ 7,361 $ 7,914

(502

) (2,090 ) Commercial Markets

(4,011 ) (3,981 )

1,936 (239 )

Total Commercial

3,350 3,933

6,676 6,027

Healthcare

19,575 22,553

660 (355 ) Industrial

239 (1,304 )

(5,200 )

(4,432 ) Unallocated

(18,018 )

(46,303 )

$ 4,072 $ 1,001 Total

Net Income (Loss) Before Taxes

$ 5,146

$ (21,121 )

BALANCE SHEET (Dollars in

thousands)

2-Jan-11 3-Jan-10

ASSETS Cash and cash equivalents

$ 531 $ 2,404

Accounts and notes receivable

122,308 108,524 Inventories

29,253 33,625 Other current assets

20,953

24,504 Total current assets

173,045 169,057 Plant and equipment

74,149

85,740 Goodwill and intangible assets

8,822 6,557 Deferred

taxes

102,996 104,691 Other assets

10,819 13,676

Total assets

$ 369,831

$ 379,721

LIABILITIES AND SHAREHOLDERS'

EQUITY Current portion long-term debt

$ 1,467 $

35,868 Other current liabilities

77,296 77,349 Deferred

compensation

6,306 7,699 Long-term debt

42,926 -

Retiree healthcare obligation

4,931 7,425 Pension benefit

obligation

185,174 202,146 Other long-term liabilities

6,883 7,080 Shareholders' equity

44,848 42,154

Total liabilities and shareholders' equity

$

369,831 $ 379,721

CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in thousands)

52 Weeks Ended 53 Weeks Ended

2-Jan-11 3-Jan-10 Net income (loss)

plus non-cash items

$ 48,128 $ 54,369 Working capital

(4,112 ) 3,618 Restructuring payments

(5,409

) (9,872 ) Contributions to qualified pension plan

(24,000 ) (20,600 ) Other

(2,819

) (8,341 ) Net cash provided by operating

activities

11,788 19,174

Capital expenditures, net

(8,403 ) (8,844 )

Acquisition

(2,464 ) - Proceeds from sale of

equipment

359 634 Net

cash used in investing activities

(10,508 )

(8,210 ) Net change in borrowings under credit

facility

4,019 2,010 Principal payments on long-term debt

(1,477 ) (159 ) Dividends paid

(5,807 )

(11,026 ) Other

153 201

Net cash used in financing activities

(3,112 )

(8,974 ) Effect of exchange rate

(41

) 132 Net change in cash

$

(1,873 ) $ 2,122

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (Dollars in

thousands, except per share amounts)

Fourth Quarter Y-T-D 13 Weeks Ended 14

Weeks Ended 52 Weeks Ended 53 Weeks Ended

2-Jan-11 3-Jan-10 2-Jan-11

3-Jan-10 $ 2,185 $ 872 GAAP Net Income

(Loss)

$ 2,643 $ (12,397 ) Adjustments:

4,668 2,844 Pension loss amortization

18,672 14,598

370 - Pension settlement losses

370 20,412

758

1,074 Restructuring and impairment charges*

2,248 12,689

(2,302 ) (1,556 ) Tax effect of adjustments (at

statutory tax rates)

(8,454 ) (18,941 )

$ 5,679 $

3,234 Non-GAAP Net Income

$ 15,479

$ 16,361

$ 0.08 $ 0.03

GAAP Income (Loss) Per Share

$ 0.09 $ (0.43 )

Adjustments, net of tax:

0.10 0.06 Pension loss

amortization

0.39 0.31

0.01 - Pension settlement

losses

0.01 0.43

0.02 0.02 Restructuring and

impairment charges*

0.05 0.27

$ 0.21 $ 0.11

Non-GAAP Income Per Share

$ 0.54 $ 0.58

GAAP Net Cash Flow

$ (1,873

) $ 2,122 Adjustments: Credit facility borrowed

(4,019 ) (2,010 ) Non-GAAP Net

Cash Flow

$ (5,892 ) $

112 *includes impairment recorded in other

income

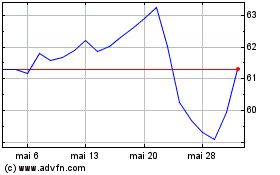

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

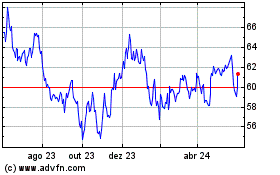

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024