Standard Register (NYSE: SR) today announced its financial

results for the first quarter, which ended April 3, 2011. The

Company reported revenue of $164.9 million and a net income of $0.5

million, or $0.02 per share. The results compare to revenue of

$167.4 million and a net loss of $0.8 million, or $0.03 per share,

last year.

Results of Operations

Revenue was down slightly relative to the prior year. Increases

in core growth solutions were offset by expected declines in legacy

products in every segment but Industrial. Legacy products represent

the majority of the Company’s portfolio and provide a foundation of

stability, however the Company expects that future revenue growth

will be driven by increases in core solution sales throughout all

focus markets.

“Solutions that we call core are where the majority of our

investment and innovation will continue to take place,” said Joseph

Morgan, president and chief executive officer. “These core

solutions have been developed as the result of deep market

expertise in assisting our customers to solve problems, operate

more efficiently, build brand consistency, reduce risk and

ultimately advance their reputations. The ability to provide these

high-value solutions is a fundamental advantage that differentiates

Standard Register from our competitors.”

Gross margin as a percent of revenue improved to 32.5 for the

quarter versus 32.0 in the prior year. LIFO inventory adjustment

was negligible for the current quarter versus a favorable LIFO

adjustment of $1.7 million for the prior year. Selling, general and

administrative expenses, excluding pension loss amortization were

down $3.3 million from the prior year. Continuous improvement

initiatives allowed the Company to enhance its cost structure

which, allowed all three business units to show increases in their

operating profit over the prior year.

Adjusting for pension loss amortization and restructuring

charges, non-GAAP net income was $4.2 million, or $0.15 per share

for the current quarter compared with non-GAAP net income of $2.3

million, or $0.08 per share for the prior year quarter.

During the quarter, capital expenditures were $1.9 million and

are expected to be in the range of $18-21 million for the year, the

majority of which will support the advancement of our core growth

solutions. Pension funding contributions were $8.0 million during

the quarter and are expected to be approximately $30 million for

the year. Non-GAAP cash on a net debt basis was $5.8 million

positive for the quarter, driven by working capital improvements

previously predicted.

“Generating profit and positive cash flow during the quarter

demonstrates our progress toward a more enduring environment,”

noted Morgan. “However, we know that to be a sustainable

organization, we need to deliver growth on the top-line as well.

Driving revenue growth by advancing our core growth solutions is

the primary focus for this year.”

Dividend

On Thursday, April 28, 2011, Standard Register’s board of

directors declared a quarterly dividend of $0.05 per share to be

paid on June 10, 2011, to shareholders of record as of May 27,

2011. The board will consider future dividend payments on a

quarter-by-quarter basis in accordance with its normal

practice.

Conference Call

Standard Register’s President and Chief Executive Officer Joe

Morgan and Chief Financial Officer Bob Ginnan will host a

conference call at 10:00 a.m. EDT on April 29, 2011, to review the

first quarter results. The call can be accessed via an audio web

cast accessible at:

http://www.standardregister.com/investorcenter.

About Standard Register

Standard Register (NYSE:SR) is trusted by the world’s leading

companies to advance their reputations by aligning communications

with corporate standards and priorities. Providing market-specific

insights and a compelling portfolio of solutions to address the

changing business landscape in healthcare, commercial and

industrial markets, Standard Register is the recognized leader in

the management and execution of mission-critical communications.

More information is available at

http://www.standardregister.com.

Safe Harbor Statement

This report includes forward-looking statements covered by the

Private Securities Litigation Reform Act of 1995. Because such

statements deal with future events, they are subject to various

risks and uncertainties and actual results for fiscal year 2011 and

beyond could differ materially from the Company’s current

expectations. Forward-looking statements are identified by words

such as “anticipates,” “projects,” “expects,” “plans,” “intends,”

“believes,” “estimates,” “targets,” and other similar expressions

that indicate trends and future events.

Factors that could cause the Company’s results to differ

materially from those expressed in forward-looking statements

include, without limitation, variation in demand and acceptance of

the Company’s products and services, the frequency, magnitude and

timing of paper and other raw-material-price changes, general

business and economic conditions beyond the Company’s control,

timing of the completion and integration of acquisitions, the

consequences of competitive factors in the marketplace including

the ability to attract and retain customers, results of continuous

improvement and other cost-containment strategies, and the

Company’s success in attracting and retaining key personnel. The

Company undertakes no obligation to revise or update

forward-looking statements as a result of new information since

these statements may no longer be accurate or timely.

Non-GAAP Measures Presented in This Press Release

The Company reports its results in accordance with Generally

Accepted Accounting Principles in the United States (GAAP).

However, we believe that certain non-GAAP measures found in this

press release, when presented in conjunction with comparable GAAP

measures, are useful for investors. Generally, a non-GAAP financial

measure is a numerical measure of a company’s performance,

financial position, or cash flows where amounts are either excluded

or included, not in accordance with generally accepted accounting

principles. We discuss several measures of operating performance

including non-GAAP net income and earnings per share and cash flow

on a net debt basis which are not calculated in accordance with

GAAP. These non-GAAP measures should not be considered as

substitutes for, or superior to, results determined in accordance

with GAAP.

Management evaluates the Company’s results excluding pension

loss amortization, pension settlements, restructuring charges, and

asset impairments. We believe that this non-GAAP financial measure

is useful to investors because it provides a more complete

understanding of our current underlying operating performance, a

clearer comparison of current period results with past reports of

financial performance, and greater transparency regarding

information used by management in its decision making. Internally,

management and our Board of Directors use this non-GAAP measure to

evaluate our business performance.

In addition, because our credit facility is borrowed under a

revolving credit agreement, which currently permits us to borrow

and repay at will up to a balance of $100 million (subject to

limitations related to receivables, inventories, and letters of

credit), we take the measure of cash flow performance prior to

borrowing or repayment of the credit facility. In effect, we

evaluate cash flow as the change in net debt (credit facility debt

less cash and cash equivalents).

The table below provides a reconciliation of these non-GAAP

measures to their most comparable measure calculated in accordance

with GAAP.

THE STANDARD REGISTER COMPANY STATEMENT OF OPERATIONS

(Dollars in thousands, except per share amounts)

Y-T-D 13 Weeks Ended 13 Weeks Ended

3-Apr-11 4-Apr-10 TOTAL REVENUE

$ 164,889 $ 167,423

COST OF SALES

111,257 113,814

GROSS MARGIN 53,632 53,609

COSTS AND

EXPENSES Selling, general and administrative

52,303

54,145 Restructuring and other exit costs

74

432

TOTAL COSTS AND EXPENSES

52,377 54,577

INCOME (LOSS) FROM OPERATIONS 1,255 (968 )

OTHER INCOME (EXPENSE) Interest expense

(572 )

(390 ) Other income

5 2

Total other expense (567 ) (388 )

INCOME (LOSS) BEFORE INCOME TAXES 688 (1,356 )

Income Tax Expense (Benefit)

153

(543 )

NET INCOME (LOSS) $ 535

$ (813 ) Average Number of

Shares Outstanding - Basic

28,976 28,875 Average Number of

Shares Outstanding - Diluted

28,997 28,875

BASIC

AND DILUTED INCOME (LOSS) PER SHARE $ 0.02 $

(0.03 ) Dividends per share declared for the period

$

0.05 $ 0.05 MEMO: Depreciation and amortization

$ 5,350 $ 6,087 Pension loss amortization

$

6,073 $ 4,668

SEGMENT OPERATING

RESULTS** (Dollars in thousands)

Y-T-D 13 Weeks

Ended 13 Weeks Ended 3-Apr-11

4-Apr-10 REVENUE Financial Services

$

43,306 $ 44,714 Commercial Markets

40,331

41,651 Total Commercial

83,637

86,365 Healthcare

60,672 64,261 Industrial

20,580 16,797 Total Revenue

$ 164,889 $ 167,423

GROSS MARGIN Financial Services

$ 13,143 $

13,344 Commercial Markets

11,187

10,332 Total Commercial

24,330 23,676

Healthcare

22,572 23,541 Industrial

6,552 4,734 LIFO

adjustment

178 1,658

Total Gross Margin

$ 53,632 $ 53,609

NET INCOME (LOSS) BEFORE TAXES Financial

Services

$ 1,691 $ 1,097 Commercial Markets

(293 ) (2,139 ) Total Commercial

1,398 (1,042 ) Healthcare

4,683 3,962

Industrial

789 (874 ) Unallocated

(6,182

) (3,402 ) Total Net Income (Loss) Before

Taxes

$ 688 $ (1,356 ) **Prior

year data has been revised to reflect the reclassification of

certain customers between segments

BALANCE SHEET

(Dollars in thousands)

3-Apr-11 2-Jan-11

ASSETS Cash and cash equivalents

$ 557

$ 531 Accounts and notes receivable

110,612 122,308

Inventories

29,455 29,253 Other current assets

20,639 20,953 Total current

assets

161,263 173,045 Plant and equipment

70,694 74,149 Goodwill and intangible assets

8,779

8,822 Deferred taxes

100,820 102,996 Other assets

11,086 10,819 Total assets

$

352,642 $ 369,831

LIABILITIES

AND SHAREHOLDERS' EQUITY Current portion long-term debt

$ 1,490 $ 1,467 Other current liabilities

72,570 77,296 Deferred compensation

6,278 6,306

Long-term debt

36,817 42,926 Retiree healthcare obligation

4,921 4,931 Pension benefit obligation

174,935

185,174 Other long-term liabilities

6,877 6,883

Shareholders' equity

48,754 44,848

Total liabilities and shareholders' equity

$ 352,642

$ 369,831

CONSOLIDATED

STATEMENTS OF CASH FLOWS (Dollars in thousands)

13

Weeks Ended 13 Weeks Ended 3-Apr-11

4-Apr-10 Net income (loss) plus non-cash items

$ 11,540 $ 9,389 Working capital

8,662 7,757

Restructuring payments

(683 ) (2,407 ) Contributions

to qualified pension plan

(8,000 ) (7,000 ) Other

(2,068 ) (2,144 ) Net cash

provided by operating activities

9,451

5,595 Capital expenditures, net

(1,879

) (2,073 ) Proceeds from sale of equipment

-

19 Net cash used in investing

activities

(1,879 ) (2,054 ) Net

change in borrowings under credit facility

(5,728 )

(4,119 ) Principal payments on long-term debt

(357 )

(199 ) Dividends paid

(1,459 ) (1,456 ) Other

(15 ) 10 Net cash used in

financing activities

(7,559 )

(5,764 ) Effect of exchange rate

13

12 Net change in cash

$ 26

$ (2,211 )

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (Dollars in thousands, except per share

amounts)

Y-T-D 13 Weeks Ended 13 Weeks Ended

3-Apr-11 4-Apr-10 GAAP Net Income

(Loss)

$ 535 $ (813 ) Adjustments: Pension

loss amortization

6,073 4,668 Restructuring charges

74 432 Tax effect of adjustments (at statutory tax rates)

(2,441 ) (2,025 ) Non-GAAP Net

Income

$ 4,241 $ 2,262

GAAP Income (Loss) Per Share

$ 0.02 $ (0.03 )

Adjustments, net of tax: Pension loss amortization

0.13 0.10 Restructuring charges

- 0.01

Non-GAAP Income Per Share

$ 0.15

$ 0.08 GAAP Net Cash Flow

$ 26 $

(2,211 ) Adjustments: Credit facility paid

5,728

4,119 Non-GAAP Net Cash Flow

$

5,754 $ 1,908

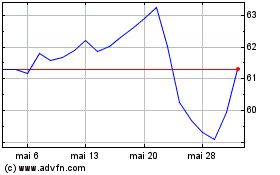

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

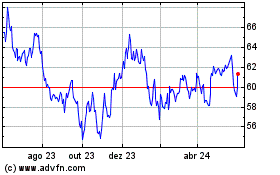

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024