Standard Register (NYSE: SR), a leader in critical

communications management solutions, today announced its financial

results for the third quarter and first nine months of 2012. The

Company reported third-quarter 2012 revenue of $145.7 million and a

net loss of $2.6 million or $0.09 per share. The results compare to

prior year third quarter revenue of $157.5 million and net income

of $8.4 million or $0.29 per share. The 2011 third quarter included

a $20.2 million ($12.2 million after tax) one-time benefit related

to termination of the Company’s postretirement healthcare plan, so

comparable results improved $1.2 million over the prior year

quarter.

Non-GAAP net income from operations after adjustments for

pension loss amortization, pension settlement, restructuring

charges, postretirement plan termination, tax effect of adjustments

and deferred tax valuation allowances was $2.5 million or $0.09 per

share for the third quarter of 2012, compared to break even for the

same period in 2011.

Through the first nine months of 2012, the Company reported

revenue of $458.4 million and a net loss of $8.9 million or $0.30

per share. The first nine months results compare to last year’s

revenue of $486.7 million and net income of $7.8 million or $0.27

per share for the same period of 2011. Non-GAAP adjusted net income

from operations for the first nine months of 2012 was $8.2 million

or $0.29 per share compared to non-GAAP adjusted net income of $6.8

million or $0.24 per share for the nine months of 2011.

The Company previously announced the loss of a portion of its

business with a large financial services customer due to the

customer’s restructuring. Revenue from this customer declined $10.6

million in the third quarter ($3.7 million in Core solutions and

$6.9 million in Legacy products) and $16.6 million in the first

nine months ($5.3 million in Core solutions and $11.3 million in

Legacy products). The Company has revised its expectation for 2012

to a loss of $24 to $25 million in revenue from this customer, $8

million in Core solutions and the balance in Legacy products.

“Underlying operating performance and our financial stability

continue to improve despite a revenue decline in the quarter

primarily related to the expected decreases in our Legacy products

and in business from one large customer,” said Joseph P. Morgan,

Jr., president and chief executive officer. “On a year-to-date

basis, revenue from Core growth solutions increased.”

Morgan continued, “Our transformation and the new solutions

we’re bringing to market resulted in another quarter of sales

momentum. In Healthcare, we signed more new contracts than in any

prior quarter since the business unit was established, and we are

seeing more subscriptions for our technology-oriented solutions,

with longer terms and better product mix. In Business Solutions,

customer communications and on-demand digital publishing are

growing, in part due to the investments in digital equipment we

made in 2011. Our challenges are the uncertainty of the economic

environment, our pension contribution expense and pricing pressures

that impact our margins. We are implementing our restructuring plan

ahead of schedule, making aggressive improvements in our sales,

delivery channel and customer service organizations, and managing

costs throughout the business. We are confident in our strategy and

can reaffirm that we expect to end 2012 with at least $5 million in

positive cash flow.”

Third Quarter Results

Total revenue declined 7 percent to $145.7 million in the third

quarter compared to $157.5 million in the third quarter of 2011.

Nearly all of the decline was attributable to the loss of business

from the large financial services customer. Core solutions, the

Company’s priority growth products and services, declined less than

1 percent; excluding the loss from the large financial services

customer, Core solutions grew 5 percent. Legacy products, generally

transactional documents and print materials, declined 12

percent.

Healthcare revenue declined 11 percent for the quarter, to $51.5

million compared to $57.7 million in the prior year quarter. The

decline was driven primarily by net unit decreases, with growth in

technology-related Core solutions offset by declines in Legacy

products. Operating income for the third quarter was $2.3 million

compared to $3.9 million for the same period in 2011. Excluding the

third quarter 2011 postretirement plan allocation of $1.9 million,

operating income improved over the prior year quarter. Dialog

Medical, a component of patient information solutions, was acquired

in July 2011 and incorporated into the Company’s reporting in the

third quarter of 2011.

Business Solutions revenue for the third quarter was $94.2

million, a decrease of 6 percent compared to third quarter 2011

revenue of $99.8 million. Excluding the loss of business from the

large financial services customer, revenue increased $5.0 million

over the prior year. Core solutions growth, particularly in

customer communications and on-demand publishing, was partially

offset by net unit decreases in Legacy transactional products.

Operating income for the third quarter was $2.3 million compared to

$2.0 million in the third quarter last year. Excluding the

postretirement plan allocation of $3.2 million, year over year

operating income improved significantly.

Consolidated gross margin as a percent of revenue was 29.0

percent, unchanged from the third quarter of 2011. Some new

business at lower margins and declining sales in higher margin

products were offset by savings from ongoing restructuring

activities and other cost-saving initiatives. Selling, general and

administrative (SG&A) expenses declined 16 percent in the

quarter.

First Nine Months Results

Total revenue declined 6 percent to $458.4 million compared to

$486.7 million for the first nine months of 2011. Of the decline,

$16.6 million was from the loss of business at the large financial

services customer and the remainder was primarily a result of

Legacy product unit volumes declining more rapidly than growth in

Core solutions sales. In the first nine months of 2012, Core

solutions grew 2 percent (4.9% excluding the loss of business at

the large financial services customer). Legacy products declined 11

percent. At the end of the first nine months of 2012, Core

solutions accounted for 43 percent of revenue, compared to 40

percent at the end of the third quarter last year. Legacy products

correspondingly declined to 57 percent from 60 percent for the same

periods.

Healthcare revenue declined 8 percent to $163.3 million from

$177.4 million in the first nine months of 2011. Operating income

for the first nine months of 2012 was $8.6 million compared to

$12.4 million for the prior year ($10.5 million after excluding the

postretirement plan allocation of $1.9 million).

Business Solutions revenue declined to $295.1 million from

$309.3 million in the first nine months of the prior year and

nearly all of the 5 percent decline was from the loss of business

at the large financial services customer. Operating income

increased by 19 percent to $5.6 million from $4.8 million (or $1.6

million excluding the postretirement plan allocation of $3.2

million).

Consolidated gross margin as a percent of revenue was 30 percent

in the first nine months of 2012, compared to 31 percent for the

same period in 2011. SG&A expense declined 11 percent in the

first nine months of 2012, to $138.6 million from $155.5 million in

the prior year. SG&A expense for the first nine months of 2011

included a credit of $3.3 million from amortization of prior

service credits before the termination of the postretirement

healthcare benefits plan.

Cash flow on a net debt basis was positive by $4.0 million

year-to-date in 2012 compared to a negative $5.8 million at the end

of the first three quarters of 2011.

Capital Expenditures, Restructuring and Pension Contribution

Updates

Through the first nine months of 2012, capital expenditures were

$2.4 million. Expected capital expenditures for the full year 2012

are in the range of $7 million to $11 million. The Company

continues to invest at a prudent level to support Core technology

solutions growth and to increase efficiencies with management

reporting systems and customer service. Restructuring efforts have

more clearly defined investments that will produce the best

return.

In January 2012, the Company announced a two-year strategic

restructuring plan to better align its resources in support of the

growing Core solutions business and reduce costs to offset the

impact of declining revenues in Legacy products. The Company has

identified additional savings initiatives and currently expects

annual savings of approximately $60 million by the end of 2013.

Costs associated with the restructuring program are expected to be

approximately $11.5 million by the end of 2013.

Standard Register has contributed $18.7 million to the Company’s

qualified pension plan in the first nine months of 2012 and expects

to contribute at least another $2 million in the fourth quarter.

Based on provisions of the highway reauthorization legislation

signed into law in July, the Company updated pension-funding

expectations for 2012 and 2013, which were previously expected to

total $53 million. With relief provided by the Moving Ahead for

Progress in the 21st Century Act (MAPS-21), commonly called the

highway bill, the contribution for 2012 is expected to be $20.7

million and $26.8 million in 2013, a decrease of $5.5 million from

the earlier estimate. Currently, the Company expects contributions

to total $42 million in 2014.

Conference Call

Standard Register’s President and Chief Executive Officer Joseph

P. Morgan, Jr. and Chief Financial Officer Robert Ginnan will host

a conference call at 10:00 a.m. EDT on Friday, October 26, 2012, to

review the third quarter results. The call can be accessed via an

audio webcast accessible at

http://www.standardregister.com/investorcenter.

About Standard Register

Standard Register (NYSE:SR), celebrating 100 years of

innovation, is trusted by the world’s leading companies to advance

their reputations by aligning communications with corporate

standards and priorities. Providing market-specific insights and a

compelling portfolio of solutions to address the changing business

landscape in healthcare, financial services, commercial and

industrial markets, Standard Register is the recognized leader in

the management and execution of mission-critical communications.

More information is available at

http://www.standardregister.com.

Safe Harbor Statement

This press release contains forward-looking statements covered

by the Private Securities Litigation Reform Act of 1995. Because

such statements deal with future events, they are subject to

various risks and uncertainties and actual results could differ

materially from the Company’s current expectations.

Factors that could cause the Company’s results to differ

materially from those expressed in forward-looking statements

include, without limitation, our access to capital for expanding in

Core solutions, the pace at which digital technologies erode the

demand for certain legacy products, the success of our plans to

deal with the threats and opportunities brought by digital

technology, results of cost containment strategies and

restructuring programs, our ability to attract and retain key

personnel, variation in demand and acceptance of the Company’s

products and services, frequency, magnitude and timing of paper and

other raw material price changes, the timing of the completion and

integration of acquisitions, general business and economic

conditions beyond the Company’s control, and the consequences of

competitive factors in the marketplace, including the ability to

attract and retain customers. The Company undertakes no obligation

to revise or update forward-looking statements as a result of new

information, since these statements may no longer be accurate or

timely. For more information, see the Company’s most recent Form

10-K and other filings with the Securities and Exchange

Commission.

Non-GAAP Measure Presented in This Press Release

The Company reports its results in accordance with Generally

Accepted Accounting Principles in the United States (GAAP).

However, we believe that certain non-GAAP measures found in this

press release, when presented in conjunction with comparable GAAP

measures, are useful for investors. Generally, a non-GAAP financial

measure is a numerical measure of a company’s performance,

financial position, or cash flows where amounts are either excluded

or included, not in accordance with generally accepted accounting

principles. We discuss several measures operating performance

including non-GAAP net income and earnings per share and cash flow

on a net debt basis, which are not calculated in accordance with

GAAP. These non-GAAP measures should not be considered as

substitutes for, or superior to, results determined in accordance

with GAAP.

Management evaluates the Company’s results, excluding pension

loss amortization, pension settlements, restructuring charges, and

deferred tax valuation allowances. We believe this non-GAAP

financial measure is useful to investors because it provides a more

complete understanding of our current underlying operating

performance, a clearer comparison of current period results with

past reports of financial performance, and greater transparency

regarding information used by management in its decision-making.

Internally, management and our Board of Directors use this non-GAAP

measure to evaluate our business performance.

In addition, because our credit facility is borrowed under a

revolving credit agreement, which currently permits us to borrow

and repay at will up to a balance of $100 million (subject to

limitations related to receivables, inventories, and letters of

credit), we take the measure of cash flow performance prior to

borrowing or repayment of the credit facility. In effect, we

evaluate cash flow as the change in net debt (credit facility debt

less cash and cash equivalents).

The table below provides a reconciliation of these non-GAAP

measures to their most comparable measure calculated in accordance

with GAAP.

THE STANDARD REGISTER COMPANY CONSOLIDATED STATEMENTS OF

OPERATIONS (Dollars in thousands, except per share amounts)

(Unaudited)

13 Weeks

Ended 13 Weeks Ended 39 Weeks Ended 39 Weeks

Ended 30-Sep-12 2-Oct-11 30-Sep-12

2-Oct-11 $ 145,722 $ 157,543

TOTAL REVENUE $ 458,438 $ 486,717

103,690 111,392

COST

OF SALES 321,611 336,351

42,032 46,151

GROSS MARGIN

136,827 150,366

COSTS AND EXPENSES

43,053 51,140 Selling, general and administrative

138,648 155,473

- (20,239 ) Pension settlement and

postretirement plan amendment

983 (19,786 )

733 112 Restructuring and other

exit costs

3,345 (65 )

43,786 31,013

TOTAL

COSTS AND EXPENSES 142,976

135,622

(1,754 ) 15,138

(LOSS)

INCOME FROM OPERATIONS (6,149 ) 14,744

OTHER INCOME (EXPENSE) (670 ) (630 ) Interest

expense

(2,059 ) (1,774 )

10

60 Other income

49

558

(660 ) (570 )

Total other

expense (2,010 ) (1,216 )

(2,414

) 14,568

(LOSS) INCOME BEFORE INCOME TAXES

(8,159 ) 13,528

202

6,214 Income tax expense

704

5,742

$ (2,616

) $ 8,354

NET (LOSS) INCOME $

(8,863 ) $ 7,786

29,232 29,048 Average Number of Shares Outstanding - Basic

29,182 29,035

29,232 29,204 Average Number of Shares

Outstanding - Diluted

29,182 29,199

$

(0.09 ) $ 0.29

BASIC AND DILUTED (LOSS) INCOME PER

SHARE $ (0.30 ) $ 0.27

$

- $ 0.05 Dividends per share declared for the period

$ 0.05 $ 0.15 MEMO:

$ 4,896 $

5,264 Depreciation and amortization

$ 16,866 $ 15,884

$ 5,773 $ 6,070 Pension loss amortization

$

17,331 $ 18,212

SEGMENT OPERATING

RESULTS (Dollars in thousands) (Unaudited)

13 Weeks

Ended 13 Weeks Ended 39 Weeks Ended 39 Weeks

Ended 30-Sep-12 2-Oct-11 30-Sep-12

2-Oct-11 REVENUE $ 51,535 $

57,717 Healthcare

$ 163,348 $ 177,440

94,187 99,826 Business Solutions

295,090 309,277

$

145,722 $ 157,543 Total Revenue

$ 458,438 $ 486,717

NET (LOSS) INCOME BEFORE TAXES $ 2,222 $ 3,858

Healthcare

$ 8,564 $ 12,365

2,365 1,993

Business Solutions

5,650 4,808

(7,001 )

8,717 Unallocated

(22,373

) (3,645 )

$ (2,414 )

$ 14,568 Total Net (Loss) Income Before Taxes

$ (8,159 ) $ 13,528

CONSOLIDATED BALANCE SHEETS (Dollars in thousands)

(Unaudited)

30-Sep-12 1-Jan-12

ASSETS Cash and cash equivalents

$ 1,175 $

1,569 Accounts receivable

106,519 113,403 Inventories

46,752 48,822 Other current assets

10,051

9,058 Total current assets

164,497 172,852 Plant and equipment

$

60,277 $ 73,950 Goodwill and intangible assets

13,662

14,479 Deferred taxes

23,991 23,996 Other assets

5,982 8,584 Total assets

$ 268,409 $ 293,861

LIABILITIES AND SHAREHOLDERS' DEFICIT Current liabilities

79,320 83,443 Deferred compensation

3,567 5,777

Long-term debt

54,158 60,149 Pension benefit obligation

212,530 236,206 Other long-term liabilities

6,992

7,339 Shareholders' deficit

(88,158 )

(99,053 ) Total liabilities and shareholders' deficit

$ 268,409 $ 293,861

CONSOLIDATED STATEMENTS OF CASH FLOWS (Dollars in

thousands) (Unaudited)

39 Weeks Ended 39 Weeks Ended

30-Sep-12 2-Oct-11 Net income (loss)

plus non-cash items

$ 30,591 $ 25,472 Working capital

10,541 12,371 Restructuring payments

(7,550 )

(1,103 ) Contributions to qualified pension plan

(18,703

) (20,000 ) Other

(4,727 )

(130 ) Net cash provided by operating activities

10,152 16,610

Capital expenditures, net

(2,441 ) (12,022 ) Proceeds

from sale of equipment

104 40 Acquisition, net of cash

received

- (4,905 ) Net cash

used in investing activities

(2,337 )

(16,887 ) Net change in borrowings

under credit facility

(4,364 ) 5,772 Principal

payments on long-term debt

(1,914 ) (1,091 )

Dividends paid

(1,500 ) (4,380 ) Other

(613 ) 78 Net cash (used in)

provided by financing activities

(8,391 )

379 Effect of exchange rate

182 (119 ) Net change in cash

$

(394 ) $ (17 )

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (Dollars in

thousands, except per share amounts) (Unaudited)

13 Weeks

Ended 13 Weeks Ended 39 Weeks Ended 39 Weeks

Ended 30-Sep-12 2-Oct-11 30-Sep-12

2-Oct-11 $ (2,616 ) $

8,354 GAAP Net Income (Loss)

$ (8,863 ) $

7,786 Adjustments:

5,773 6,070 Pension loss

amortization

17,331 18,212

- (20,239 ) Pension

settlement and postretirement plan amendment

983 (19,786 )

733 112 Restructuring charges

3,345 (65 )

(2,567 ) 5,582 Tax effect of adjustments (at

statutory tax rates)

(8,544 ) 651

1,194

- Deferred tax valuation allowance

3,990 -

$

2,517 $ (121 ) Non-GAAP Net Income

$

8,242 $ 6,798

$

(0.09 ) $ 0.29 GAAP Income (Loss) Per Share

$

(0.30 ) $ 0.27 Adjustments, net of tax:

0.12 0.13 Pension loss amortization

0.36 0.38

- (0.42 ) Pension settlement and postretirement plan

amendment

0.02 (0.41 )

0.02 - Restructuring charges

0.07 -

0.04 -

Deferred tax valuation allowance

0.14

-

$ 0.09 $ -

Non-GAAP Income (Loss) Per Share

$ 0.29

$ 0.24 GAAP Net Cash Flow

$ (394

) $ (17 ) Adjustments: Credit facility paid

4,364 (5,772 ) Non-GAAP Net Cash Flow

$ 3,970 $ (5,789 )

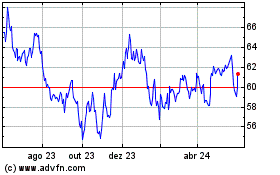

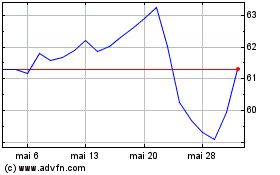

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024