Avery Dennison: 1Q Earnings Beat - Analyst Blog

24 Abril 2013 - 8:04AM

Zacks

Avery Dennison

Corporation (AVY) reported adjusted earnings of 59 cents

per share in the first-quarter 2013, up 37% from the 43 cents per

share in the year-ago quarter and ahead of the Zacks Consensus

Estimate of 57 cents. Including restructuring costs and other

items, earnings from continuing operations were 66 cents per share

in the quarter compared with 42 cents in the year-ago quarter.

Total revenue increased 4% to $1.499 billion from $1.443 billion in

the prior-year quarter, but way short of the Zacks Consensus

Estimate of $1.53 billion. On an organic basis, revenues increased

approximately 4%.

Cost of sales in the reported quarter rose 3% to $1.1 billion.

Gross profit increased 7% to $4028 million from $377 million in the

prior-year quarter. Gross margin expanded 70 basis points to

26.8%.

Marketing, general & administrative expenses were $301 million

versus $289 million in the year-ago quarter. Adjusted operating

profit increased 14% to $101 million. Adjusted operating margin

improved 60 basis points to 6.7%.

Segmental Performance

Total revenue in the Pressure-sensitive Materials segment increased

3% to $1.1 billion. Label and Packaging Materials sales increased

in low-single digits while sales for Graphics, Reflective, and

Performance Tapes increased slightly. Adjusted operating profit

increased 6% to $108.5 million in the quarter. Adjusted operating

margin expanded 30 basis points to 9.9%, driven by benefit of

productivity initiatives and higher volume which helped mitigate

changes in product mix and higher employee-related expenses.

Total revenue from Retail Branding and Information Solutions

increased 6% to $382.7 million from $360.1 million in the

year-earlier quarter. The improvement was driven by increased

demand from U.S. and European retailers and brands. The segment’s

adjusted operating income rose 59% to $17.6 million with adjusted

operating margin expanding 150 basis points to 4.6% on productivity

initiatives, higher volumes, partially offset by employee related

expenses.

Other specialty converting businesses segment reported net sales of

$18.2 million, up 2% from $18 million in the year-ago quarter. The

segment reported an operating loss of $2.7 million, narrower than

the year ago quarter’s loss of $3.2 million.

Financial Position

As of Mar 31, 2013, Avery Dennison had cash and cash equivalents of

$208 million versus $191 million as of Mar 31, 2012. Long-term debt

was at $702 million as of Mar 31, 2013 compared with $703.7 million

as of Mar 31, 2012. Cash flow from operating activities was a usage

of $65.7 million during the quarter compared with an inflow of 10.7

million in the prior year quarter. Avery repurchased 1.5 million

shares during the quarter for $62 million.

Cost Reduction Actions

The company had initiated a restructuring program in the first half

of 2012 to trim down costs across all its segments. In this regard,

the company has incurred restructuring costs of approximately $56

million in 2012, and expects to incur $25 million in 2013. In the

first quarter of 2013, Avery incurred restructuring costs, net of

gain on sale of assets, of approximately $7 million. Avery expects

to realize more than $100 million in annualized savings from this

program by mid-2013.

Fiscal 2013 Outlook

The company expects adjusted earnings in the range of $2.40 to

$2.75 per share. Free cash flow from continuing operations is

expected between $275 million and $315 million in 2013.

Sale of Businesses

In the fourth quarter, Avery announced that it has entered into an

agreement with CCL Industries Inc., a global leader in specialty

packaging solutions to divest its Office and Consumer Products and

Designed and Engineered Solutions businesses, for $500 million in

cash. The businesses have been classified as discontinued

operations in the first quarter earnings results. Avery has

received all regulatory clearances for the sale and expects it to

be completed by mid 2013. The net proceeds of approximately $400

million will be utilized to repurchase shares and make an

additional pension contribution.

Avery continues to deliver healthy organic growth in both the core

segments - Pressure-Sensitive Materials and Retail Branding and

Information Solutions. Now, with the divestiture of the

underperforming Office and Consumer Products unit, the company will

be able to focus on these core segments and increase its growth

profile. Avery currently retains a short-term Zacks Rank #2

(Buy).

Pasadena, California-based Avery Dennison manufactures

pressure-sensitive materials, and tickets, tags, labels other

converted products. Avery has over 200 manufacturing and

distribution facilities encompassing more than 60 countries.

Peer Performance

An Avery Dennison peer, United Stationers Inc.

(USTR) reported first quarter earnings of 56 cents, up 24% from 45

cents earned in the year-ago quarter but way short of the Zacks

Consensus Estimate of 77 cents. Among other peers, The

Standard Register Company (SR) and ACCO Brands

Corporation (ACCO) are yet to announce their first quarter

results.

ACCO BRANDS CP (ACCO): Free Stock Analysis Report

AVERY DENNISON (AVY): Free Stock Analysis Report

STANDARD REGIST (SR): Free Stock Analysis Report

UTD STATIONERS (USTR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

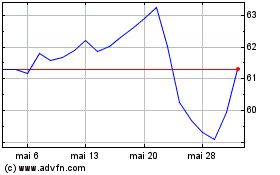

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

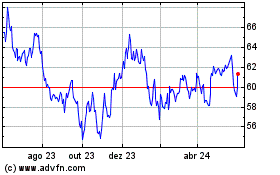

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024