Standard Register (NYSE: SR) today announced its financial

results for the second quarter of 2013. The Company reported

revenue of $136.8 million and a net loss of $4.8 million or $0.80

per share. The results compare to second quarter 2012 revenue of

$155.1 million and a net loss of $1.1 million or $0.19 per share.

The number of shares and net income/loss per share for prior

periods have been adjusted on a retroactive basis to reflect the

Company’s 1-for-5 reverse stock split, which was effective May 9,

2013.

Non-GAAP net income, after adjustments for pension loss

amortization, pension settlement, restructuring charges and related

tax effects, was $1.5 million or $0.25 per share compared to $3.8

million or $0.66 per share for the second quarter of 2012.

In a separate announcement this morning, Standard Register said

that it has acquired WorkflowOne, a printing and document

management firm with complementary business and market presence.

The announcement also contained information on Standard Register’s

renewal and expansion of its credit facility.

“Although we still face the volatility of a declining market for

our traditional printing products, the investments we have made in

technology-enabled solutions have created a portfolio with

increasing relevance in the market,” said Joseph P. Morgan, Jr.,

president and chief executive officer. “We are particularly

enthused with the near-term and long-term value creation benefits

of the acquisition announced this morning. Along with the increased

capabilities from combining our sales and operations with those of

WorkflowOne, we are looking to the future of our industry and

positioning our company for incremental growth opportunities by

utilizing the cash flow from our now larger manufacturing network

to invest in workflow, communications and analytics innovation.

This is a bold move at the right time with the right financial

structure. It makes our pension obligation more manageable, and

gives us additional resources to execute within our strategy.”

Second Quarter Results

Total revenue declined 11.8 percent to $136.8 million compared

to $155.1 million in the prior year quarter. The decline was

primarily the result of reduced volumes in printed clinical forms

and transactional documents.

Healthcare revenue declined 12.0 percent to $48.2 million

compared to $54.8 million in the second quarter of 2012. Operating

profit declined to $1.8 million from $3.8 million in the prior year

quarter. Healthcare technology-enabled solutions sales to both new

and existing customers continued to be strong during the quarter,

offsetting some of the volume decline in clinical documents and the

effect of large one-time projects in the first and second quarters

of 2012.

Business Solutions revenue declined 11.7 percent to $88.6

million from $100.3 million in the second quarter last year.

Approximately half of this decline is due to reductions in revenue

with a large financial services customer that reorganized its

distribution channels and restructured operations. Revenue from

this customer declined $6.0 million during the quarter. The decline

in revenue from this customer is expected to slow during the second

half of the year and to total $18 to $20 million for the year.

Lower volumes in printed documents also contributed to the revenue

decline. Operating profit declined to $0.9 million compared to $2.6

million last year.

Gross margin as a percentage of revenue decreased to 28.5

percent from 30.0 percent for the same quarter last year. Pricing

pressure and declines in volume contributed to the change. Selling,

general and administrative (SG&A) expenses declined 5.7 percent

in the quarter reflecting the realization of the restructuring and

cost reduction efforts.

First Half of Year Results

Total revenues declined 11.0 percent to $278.4 million and the

Company incurred a net loss of $6.8 million or $1.15 per share for

the first half of 2013, compared to revenue of $312.7 million and a

net loss of $6.2 million or $1.07 per share for the first half of

2012.

Non-GAAP net income, after adjustments for pension loss

amortization, pension settlement, restructuring charges and related

tax effects, was $4.8 million or $0.82 per share compared to $5.7

million or $0.98 per share for the first half of 2012.

Healthcare revenues declined 12.6 percent to $97.7 million from

$111.8 million in the first half of 2012. Operating profit for the

first half of 2013 was $3.9 million compared to $6.3 million for

the prior year.

Business Solutions revenues declined 10.1 percent to $180.7

million from $200.9 million in the first half of the prior year.

Operating profit increased by 16.5 percent to $3.8 million from

$3.3 million.

Consolidated gross margin as a percent of revenue was 29.1

percent in the first half of 2013 compared to 30.3 percent for the

same period in 2012. SG&A expense declined 10.7% in the first

half of 2013 to $85.4 million from $95.6 million in the prior

year.

Capital expenditures were $6.3 million compared to $1.2 million

in the first half of last year. The company continues to invest in

its Jeffersonville, Ind., digital print and distribution Center of

Excellence, which has begun operations. Investments were also made

in software technology and an upgrade to the SMARTworks® workflow

platform that was released during the quarter.

The Company contributed $10.5 million to its qualified pension

plan in the first half of 2013 compared to $13.5 million in the

first half of 2012. Total pension contributions for 2013 are

expected to be $24.8 million compared to $22.7 million of

contributions made in 2012. The Company is encouraged by the recent

rise in long-term interest rates. If rates hold at their present

level, the Company’s pension liability would be reduced at the end

of 2013 by an actuarial gain.

Cash flow on a net debt basis was positive by $1.2 million for

the first half of 2013 compared to negative cash flow of $0.7

million for the first half of 2012.

Acquisition of WorkflowOne

Standard Register announced today that it has acquired

WorkflowOne in a transaction valued at $218 million, financed by

assuming $210 million of long-term debt and the issuance of

warrants with an estimated value of $8 million. The transaction

advances Standard Register’s revenue position, enhances its product

and solutions portfolio, broadens its customer base, improves its

cost structure and provides greater financial flexibility and

stability.

Standard Register expects to achieve $1 billion in annual

revenue and $40 million in annual savings when the integration of

the two companies is complete. The acquisition is expected to

deliver value creation benefits immediately from combined sales and

operating capabilities and to improve 2013 EBITDA (a non-GAAP

measure of earnings before interest, taxes, depreciation and

amortization). The Company will go to market under the Standard

Register corporate umbrella and will rapidly integrate its

operations. WorkflowOne will initially operate as a subsidiary of

Standard Register. Joseph P. Morgan, Jr., president and chief

executive officer of Standard Register, will lead the combined

company. Timothy A. Tatman, former president and chief executive

officer of WorkflowOne, will serve in an advisory capacity through

the integration.

Renewal and Expansion of Credit Facility

Standard Register announced today that it has completed an early

renewal and an expansion of its credit facility. The Company

entered into a five-year $125 million senior-secured asset-based

credit facility that provides additional liquidity and the ability

to capitalize on opportunities for growth aligned with its

strategic objectives. The new facility amends and extends its

existing credit facility, which was due to mature on March 31,

2014. The facility is secured by the Company’s existing and future

working capital assets. Proceeds from the new credit facility will

be used for financing working capital, expanding investment and for

general corporate purposes for the newly combined company. Bank of

America, N.A. is the Lead Arranger for the credit facility.

Adjustment of Earnings Per Share due to Reverse Split

All references to shares of common stock and per share data for

all periods presented in the accompanying unaudited financial

statements have been adjusted to reflect the reverse stock split on

a retroactive basis.

Conference Call

Standard Register’s President and Chief Executive Officer Joseph

P. Morgan, Jr., and Chief Financial Officer Robert Ginnan will host

a conference call at 10:00 a.m. EDT on Thursday, August 1, 2013, to

review the second quarter results and the transaction announced

this morning. The call can be accessed via an audio webcast

accessible at http://www.standardregister.com/investorcenter.

About Standard Register

Standard Register (NYSE:SR), is trusted by the world’s leading

companies to advance their reputations and add value to their

operations by aligning communications with corporate standards and

priorities. Providing market-specific insights and a compelling

portfolio of workflow, communications and analytics solutions to

address the changing business landscape in healthcare, financial

services, manufacturing and retail markets, Standard Register is

the recognized leader in the management and execution of

mission-critical communications. More information is available at

http://www.standardregister.com.

Safe Harbor Statement

This press release contains forward-looking statements covered

by the Private Securities Litigation Reform Act of 1995. Because

such statements deal with future events, they are subject to

various risks and uncertainties and actual results could differ

materially from the Company’s current expectations.

Factors that could cause the Company’s results to differ

materially from those expressed in forward-looking statements

include, without limitation, our ability to successfully integrate

the acquired assets or achieve the expected synergies of the

WorkflowOne acquisition, access to capital for expanding in our

solutions, the pace at which digital technologies and electronic

health records (EHR) adoption erode the demand for certain products

and services, the success of our plans to deal with the threats and

opportunities brought by digital technology, results of cost

containment strategies and restructuring programs, our ability to

attract and retain key personnel, variation in demand and

acceptance of the Company’s products and services, frequency,

magnitude and timing of paper and other raw material price changes,

the timing of the completion and integration of acquisitions,

general business and economic conditions beyond the Company’s

control, and the consequences of competitive factors in the

marketplace, including the ability to attract and retain customers.

The Company undertakes no obligation to revise or update

forward-looking statements as a result of new information, since

these statements may no longer be accurate or timely. For more

information, see the Company’s most recent Form 10-K and other

filings with the Securities and Exchange Commission.

Non-GAAP Measure Presented in This Press Release

The Company reports its results in accordance with Generally

Accepted Accounting Principles in the United States (GAAP).

However, we believe that certain non-GAAP measures found in this

press release, when presented in conjunction with comparable GAAP

measures, are useful for investors. Generally, a non-GAAP financial

measure is a numerical measure of a company’s performance,

financial position, or cash flows where amounts are either excluded

or included, not in accordance with generally accepted accounting

principles. We discuss several measures of operating performance

including non-GAAP net income and earnings per share and cash flow

on a net debt basis, which are not calculated in accordance with

GAAP. These non-GAAP measures should not be considered as

substitutes for, or superior to, results determined in accordance

with GAAP.

Management evaluates the Company’s results, excluding pension

loss amortization, pension settlements, restructuring charges and

certain adjustments to the deferred tax valuation allowance. We

believe this non-GAAP financial measure is useful to investors

because it provides a more complete understanding of our current

underlying operating performance, a clearer comparison of current

period results with past reports of financial performance, and

greater transparency regarding information used by management in

its decision-making. Internally, management and our Board of

Directors use this non-GAAP measure to evaluate our business

performance.

In addition, because our credit facility is borrowed under a

revolving credit agreement, which currently permits us to borrow

and repay at will up to a balance of $100 million (subject to

limitations related to receivables, inventories, and letters of

credit), we take the measure of cash flow performance prior to

borrowing or repayment of the credit facility. In effect, we

evaluate cash flow as the change in net debt (credit facility debt

less cash and cash equivalents).

The table below provides a reconciliation of these non-GAAP

measures to their most comparable measure calculated in accordance

with GAAP.

THE STANDARD REGISTER COMPANY CONSOLIDATED

STATEMENTS OF OPERATIONS (In thousands, except per share

amounts) (Unaudited)

Second Quarter

Y-T-D

13 Weeks Ended

13 Weeks Ended

26 Weeks Ended 26 Weeks Ended Jun 30,

2013 Jul 1, 2012 Jun 30, 2013 Jul 1,

2012 $ 136,817 $ 155,067

TOTAL

REVENUE $ 278,437 $ 312,716

97,762

108,473

COST OF SALES 197,462

217,921

39,055 46,594

GROSS

MARGIN 80,975 94,795

OPERATING EXPENSES

42,794 45,380 Selling, general and administrative

85,386 95,595

— — Pension settlement

— 983

193 1,490 Restructuring and other exit

costs

819 2,612

42,987

46,870

TOTAL OPERATING EXPENSES

86,205 99,190

(3,932

) (276 )

LOSS FROM OPERATIONS (5,230 )

(4,395 )

OTHER INCOME (EXPENSE) (530 )

(685 ) Interest expense

(1,154 ) (1,389 )

59

23 Other income

58 39

(471 ) (662 )

Total other expense

(1,096 ) (1,350 )

(4,403 ) (938

)

LOSS BEFORE INCOME TAXES (6,326 ) (5,745 )

307 197 Income tax expense

434 502

$ (4,710

) $ (1,135 )

NET LOSS $ (6,760

) $ (6,247 )

5,925 5,840 Average Number

of Shares Outstanding - Basic

5,898 5,831

5,925 5,840

Average Number of Shares Outstanding - Diluted

5,898 5,831

$ (0.80 ) $ (0.19 )

BASIC AND

DILUTED LOSS PER SHARE $ (1.15 ) $ (1.07 )

$ — $ — Dividends per share declared for the

period

$ — $ 0.25 MEMO:

$ 4,938

$ 6,148 Depreciation and amortization

$ 10,004 $

11,970

$ 6,898 $ 5,773 Pension loss amortization

$ 13,796 $ 11,558

SEGMENT OPERATING

RESULTS (In thousands) (Unaudited)

13 Weeks Ended

13 Weeks Ended 26 Weeks Ended 26

Weeks Ended Jun 30, 2013 Jul 1, 2012

Jun 30, 2013 Jul 1, 2012 REVENUE

$ 48,176 $ 54,763 Healthcare

$ 97,671 $

111,813

88,641 100,304 Business

Solutions

180,766 200,903

$ 136,817 $ 155,067 Total

Revenue

$ 278,437 $ 312,716

NET (LOSS) INCOME BEFORE TAXES $ 1,769

$ 3,774 Healthcare

$ 3,905 $ 6,342

894 2,613

Business Solutions

3,828 3,285

(7,066 )

(7,325 ) Unallocated

(14,059

)

(15,372

)

$ (4,403 ) $ (938 ) Total Net Loss

Before Taxes

$ (6,326

)

$

(5,745

)

CONSOLIDATED BALANCE SHEETS (In thousands)

(Unaudited)

Jun 30, 2013 Dec 30,

2012 ASSETS Cash and cash equivalents

$

481

$ 1,012 Accounts receivable

99,423 104,513 Inventories

41,930 44,281 Other current assets

10,398

9,248 Total current assets

152,232 159,054 Plant and equipment

56,310

58,923 Goodwill and intangible assets

12,909 13,389 Deferred

taxes

22,765 22,765 Other assets

5,384

5,773 Total assets

$

249,600

$ 259,904

LIABILITIES AND

SHAREHOLDERS' DEFICIT Current liabilities

$

73,001

$ 74,832 Deferred compensation

2,907 3,498 Long-term debt

46,244 49,159 Pension benefit liability

239,410

252,665 Other long-term liabilities

6,901 6,610

Shareholders' deficit

(118,863 ) (126,860 )

Total liabilities and shareholders' deficit

$

249,600

$ 259,904

CONSOLIDATED STATEMENTS OF

CASHFLOWS (In thousands) (Unaudited)

Y-T-D 26

Weeks Ended 26 Weeks Ended Jun 30, 2013

Jul 1, 2012 Net loss plus non-cash items

$

17,761

$ 21,290 Working capital

5,516 4,168 Restructuring payments

(1,329 ) (3,646 ) Contributions to qualified pension

plan

(10,521 ) (13,500 ) Other

(2,608

) (5,104 ) Net cash provided by operating

activities

8,819 3,208 Capital expenditures

(6,301 ) (1,239 ) Proceeds from sale of equipment

88 64 Net cash used in

investing activities

(6,213 ) (1,175 ) Net

change in borrowings under credit facility

(1,729 )

(55 ) Principal payments on long-term debt

(1,193 )

(1,352 ) Dividends paid

— (1,500 ) Other

(200

) (5 ) Net cash used in financing activities

(3,122 ) (2,912 ) Effect

of exchange rate

(15 ) 66

Net change in cash

$

(531

) $ (813 )

RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (In thousands, except per share amounts)

(Unaudited)

13 Weeks Ended 13 Weeks

Ended 26 Weeks Ended 26 Weeks

Ended Jun 30, 2013 Jul 1, 2012 Jun 30,

2013 Jul 1, 2012 $ (4,710 )

$ (1,135 ) GAAP Net Loss

$ (6,760 ) $ (6,247 )

Adjustments:

6,898 5,773 Pension loss amortization

13,796 11,558

— — Pension settlement

— 983

193 1,490 Restructuring charges

819 2,612

(2,795 ) (2,865 ) Tax effect of adjustments (at

statutory tax rates)

(5,760 ) (5,978 )

1,912

564 Deferred tax valuation allowance

2,746 2,796

$ 1,498

$ 3,827 Non-GAAP Net Income

$

4,841 $ 5,724

$

(0.80 ) $ (0.19 ) GAAP Loss Per Share

$

(1.15 ) $ (1.07 ) Adjustments, net of tax:

0.71 0.60 Pension loss amortization

1.42 1.20

— — Pension settlement

— 0.10

0.02 0.15

Restructuring charges

0.08 0.27

0.32

0.10 Deferred tax valuation allowance

0.47

0.48

$ 0.25 $ 0.66

Non-GAAP Income Per Share

$ 0.82 $ 0.98

GAAP Net Cash Flow

$ (531 ) $

(813 ) Adjustments: Credit facility paid (borrowed)

1,729

55 Non-GAAP Net Cash Flow

$

1,198 $ (758 )

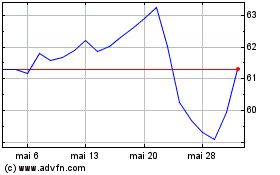

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

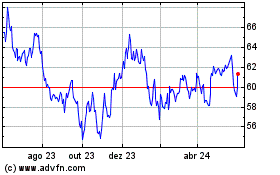

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024