Third Quarter Highlights

- Acquired WorkflowOne in transaction

valued at $216.5 million

- Renewed and extended credit

facility

- Annual savings of $40 million expected

when integration is complete at end of 2015

- Pension accounting change to provide

greater transparency for investors; prior periods have been

restated

Standard Register (NYSE: SR) today announced its financial

results for the third quarter of 2013. The Company reported revenue

of $199.3 million and a net loss of $23.2 million or $3.92 per

diluted share. The results compare to third quarter 2012 revenue of

$145.7 million and net income of $2.5 million or $0.43 per diluted

share. Results for the third quarter and first three quarters of

2013 include two months of results from WorkflowOne, which Standard

Register acquired on August 1, 2013.

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization (Adjusted EBITDA), which excludes certain items as

detailed in the attached reconciliation, was $8.0 million compared

to $9.3 million for the third quarter of 2012.

“We continue to be challenged by revenue declines in certain

printed and transactional forms, however, we are encouraged by the

execution of key investments focused on growth solutions and

overall rapid pace of integrating WorkflowOne,” said Joseph P.

Morgan, Jr., president and chief executive officer. “The

acquisition has expanded both our customer base and portfolio of

solutions, and we are beginning to realize synergies, including

some initial cross-selling of each other’s capabilities. With

greater financial stability and flexibility, we are in a more

manageable position with our pension obligation and have more

resources for investment and executing our strategy. It is an

exciting transformational time for our company as we focus on the

evolving opportunities of applying workflow, content and analytics

to our customers’ communication needs.”

Third Quarter Results

Total revenue for the third quarter of 2013 was $199.3 million

compared to $145.7 million in the prior year quarter. Net loss for

the third quarter of 2013 was $23.2 million or $3.92 per diluted

share compared to net income of $2.5 million or $0.43 per diluted

share last year. The change in pension accounting had the effect of

adjusting net income for the third quarter of 2012 to $2.5 million

from a net loss of $2.6 million. The third quarter of 2013 includes

WorkflowOne revenue of $68.3 million and a net loss of $0.6

million, along with $18.5 million of acquisition, integration and

restructuring expenses.

Healthcare revenue was $62.9 million compared to $51.5 million

in the third quarter of 2012. Operating profit was $2.1 million

compared to $2.3 million in the prior year quarter.

Technology-enabled healthcare solutions were the primary drivers of

sales to new and existing customers, while volumes in clinical

documents continued to decline.

Business Solutions revenue was $136.5 million compared to $94.2

million in the third quarter last year. As previously reported,

reductions in revenue with a large financial services customer that

reorganized its distribution channels and restructured operations

are expected to total $18 to $20 million for the year. Revenue from

this customer declined $5.4 million during the third quarter. The

business unit posted an operating loss of $1.5 million compared to

operating profit of $2.3 million in the prior year third

quarter.

Gross margin as a percentage of revenue decreased to 26.9

percent from 28.8 percent for the same quarter last year. Gross

margin was affected by WorkflowOne transaction expenses, fair value

accounting treatment required for finished goods acquired in the

WorkflowOne transaction and the ramp-up of the new digital print

and distribution Center of Excellence in Jeffersonville, Indiana.

Pricing pressure, product mix and declines in volumes also

contributed to the decline in gross margin.

Selling, general and administrative (SG&A) expenses were

$54.4 million, including $18.9 million of SG&A of WorkflowOne,

compared to $37.7 million for the same quarter last year.

First Three Quarters Results

Total revenue was $477.8 million and the Company incurred a net

loss of $16.5 million or $2.79 per diluted share for the first

three quarters of 2013, compared to revenue of $458.4 million and

net income of $6.8 million or $1.16 per diluted share for the first

three quarters of 2012. The 2013 results include two months of

WorkflowOne. The change in pension accounting had the effect of

adjusting net income for the first three quarters of 2012 to $6.8

million from a net loss of $8.9 million.

Adjusted EBITDA, which excludes certain items as detailed in the

attached reconciliation, was $27.9 million compared to $31.3

million for the first three quarters of 2012.

Healthcare revenues were $160.6 million compared to $163.3

million in the first three quarters of 2012. Operating profit for

the first three quarters of 2013 was $6.0 million compared to $8.6

million for the prior year.

Business Solutions revenues were $317.2 million compared to

$295.1 million in the first three quarters of the prior year.

Operating profit was $2.3 million compared to $5.6 million for the

prior year.

Consolidated gross margin as a percent of revenue was 28.2

percent in the first three quarters of 2013 compared to 29.8

percent for the same period in 2012. SG&A expenses were $124.5

million, including $18.9 million of SG&A of WorkflowOne,

compared to $123.4 million in the prior year.

Cash flow on a net debt basis was negative by $6.6 million for

the first three quarters of 2013 compared to positive cash flow of

$4.0 million for the first three quarters of 2012.

Capital expenditures were $9.1 million compared to $2.4 million

in the first three quarters of last year. The Company continues to

invest in infrastructure at its digital and distribution Center of

Excellence in Jeffersonville, Indiana. Investments were also made

in software technology, workflow and digital manufacturing

capability.

The Company contributed $18.8 million to its qualified pension

plan in the first three quarters of 2013 compared to $18.7 million

in the first three quarters of 2012. Total pension contributions

for 2013 are expected to be $24.7 million compared to $22.7 million

of contributions made in 2012. The Company is encouraged by the

recent rise in long-term interest rates. If rates hold at their

present level, the Company’s pension liability would be reduced at

the end of 2013 by an actuarial gain.

Pension Accounting Change

The Company changed its method of accounting for its pension

plans to a more preferable method to recognize actuarial gains and

losses in the income statement in the year incurred rather than

amortizing them over time. Under the new method permitted under

Generally Accepted Accounting Principles (GAAP), certain asset

investment gains and losses and liability actuarial gains and

losses in excess of a recognition corridor (10 percent of the

greater of plan assets or benefit obligations) will be recognized

in the fourth quarter of each year. All historical financial

information has been retrospectively adjusted to reflect this

pension accounting change, increasing net income by $13.5 million

for the first two quarters of 2013 and $15.6 million for the first

three quarters of last year. The new method of accounting will

provide greater transparency and permit investors to more clearly

evaluate and compare the company’s operating performance. The

change has no impact on benefits to participants, the Company’s

pension liability or pension funding obligations.

Acquisition of WorkflowOne

On August 1, 2013, Standard Register announced that it acquired

WorkflowOne in a transaction valued at $216.5 million, financed by

assuming $210 million of long-term debt and the issuance of

warrants with an estimated value of $6.5 million. Standard Register

expects to achieve $40 million in annual savings when the

integration of the two companies is complete.

On September 26, 2013, the Company’s Board of Directors approved

a new strategic restructuring program in connection with the

acquisition of WorkflowOne and the integration of the two

companies. Total costs of the restructuring program, which is

expected to continue through the end of the calendar year 2015,

will be approximately $29.8 million. Except for $0.5 million of

inventory impairment, the balance of the restructuring charges will

be cash expenditures. The Company also expects to incur

approximately $8.5 million in integration costs in connection with

the acquisition.

Renewal and Expansion of Credit Facility

During the third quarter, Standard Register announced that it

completed an early renewal and an expansion of its credit facility.

The Company entered into a five-year $125 million senior-secured

asset-based credit facility that provides additional liquidity and

the ability to capitalize on opportunities for growth aligned with

its strategic objectives. The new facility amends and extends its

existing credit facility, which was due to mature on March 31,

2014. The facility is secured by the Company’s existing and future

working capital assets.

Conference Call

Standard Register’s President and Chief Executive Officer Joseph

P. Morgan, Jr., and Chief Financial Officer Robert Ginnan will host

a conference call at 10:00 a.m. EDT on Friday, October 25, 2013, to

review the third quarter results. The call can be accessed via an

audio webcast accessible at

http://www.standardregister.com/investor.

About Standard Register

Standard Register (NYSE:SR), is trusted by the world’s leading

companies to advance their reputations and add value to their

operations by aligning communications with corporate brand

standards. Standard Register’s business is Connectication:

leveraging traditional printing and technology-enhanced

communications solutions to amplify the effectiveness of connected

communications. Providing market-specific insights and a compelling

portfolio of workflow, content and analytics solutions to address

the changing business landscape in healthcare, financial services,

manufacturing and retail markets, Standard Register is the

recognized leader in the management and execution of

mission-critical communications. More information is available at

http://www.standardregister.com.

Safe Harbor Statement

This press release contains forward-looking statements covered

by the Private Securities Litigation Reform Act of 1995. Because

such statements deal with future events, they are subject to

various risks and uncertainties and actual results could differ

materially from the Company’s current expectations.

Factors that could cause the Company’s results to differ

materially from those expressed in forward-looking statements

include, without limitation, our ability to successfully integrate

the acquired assets or achieve the expected synergies of the

WorkflowOne acquisition, access to capital for expanding in our

solutions, the pace at which digital technologies and electronic

health records (EHR) adoption erode the demand for certain products

and services, the success of our plans to deal with the threats and

opportunities brought by digital technology, results of cost

containment strategies and restructuring programs, our ability to

attract and retain key personnel, variation in demand and

acceptance of the Company’s products and services, frequency,

magnitude and timing of paper and other raw material price changes,

the timing of the completion and integration of acquisitions,

general business and economic conditions beyond the Company’s

control, and the consequences of competitive factors in the

marketplace, including the ability to attract and retain customers.

The Company undertakes no obligation to revise or update

forward-looking statements as a result of new information, since

these statements may no longer be accurate or timely. For more

information, see the Company’s most recent Form 10-K and other

filings with the Securities and Exchange Commission.

Non-GAAP Measures Presented in This Press Release

The Company reports its results in accordance with Generally

Accepted Accounting Principles in the United States (GAAP).

However, we believe that certain non-GAAP measures found in this

press release, when presented in conjunction with comparable GAAP

measures, are useful for investors. Generally, a non-GAAP financial

measure is a numerical measure of a company’s performance,

financial position, or cash flows where amounts are either excluded

or included, not in accordance with generally accepted accounting

principles. We discuss several measures of operating performance

including non-GAAP adjusted earnings before interest, taxes,

depreciation and amortization (Adjusted EBITDA) and cash flow on a

net debt basis, which are not calculated in accordance with GAAP.

These non-GAAP measures should not be considered as substitutes

for, or superior to, results determined in accordance with

GAAP.

Management uses Adjusted EBITDA, which excludes pension benefit

cost, restructuring and impairment charges, acquisition and

integration expense and certain fair value adjustments to evaluate

the Company’s results. We believe this non-GAAP financial measure

is useful to investors because it provides a more complete

understanding of our current underlying operating performance, a

clearer comparison of current period results with past reports of

financial performance, and greater transparency regarding

information used by management in its decision-making. Internally,

management and our Board of Directors use this non-GAAP measure to

evaluate our business performance. The Company’s debt covenants are

also based on the Adjusted EBITDA calculations, although other

items are excluded.

In addition, because our credit facility is borrowed under a

revolving credit agreement, which currently permits us to borrow

and repay at will up to a balance of $125 million (subject to

limitations related to receivables, inventories, and letters of

credit), we take the measure of cash flow performance prior to

borrowing or repayment of the credit facility. In effect, we

evaluate cash flow as the change in net debt (credit facility debt

less cash and cash equivalents).

The table below provides a reconciliation of these non-GAAP

measures to their most comparable measure calculated in accordance

with GAAP.

THE STANDARD REGISTER COMPANY

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except

per share amounts) (Unaudited)

Third Quarter Y-T-D

13 Weeks Ended 13 Weeks Ended 39 Weeks Ended

39 Weeks Ended Sep 29, 2013 Sep 30,

2012 Sep 29, 2013 Sep 30, 2012

$ 199,339 $ 145,722

TOTAL REVENUE $

477,776 $ 458,438

145,687

103,690

COST OF SALES

343,149

321,611

53,652 42,032

GROSS

MARGIN 134,627 136,827

OPERATING EXPENSES

54,384 37,683 Selling, general and administrative

124,486 123,377

6,216 254 Acquisition and integration

costs

8,002

608

1,262 — Asset impairments

1,262 —

11,055

733 Restructuring and other exit costs

11,874 3,345

72,917

38,670

TOTAL OPERATING EXPENSES

145,624 127,330

(19,265

) 3,362

(LOSS) INCOME FROM OPERATIONS (10,997

) 9,497

OTHER INCOME (EXPENSE) (3,713

) (670 ) Interest expense

(4,867 ) (2,059 )

7 10 Other income

65

49

(3,706 ) (660 )

Total other

expense (4,802 ) (2,010 )

(22,971

) 2,702

(LOSS) INCOME BEFORE INCOME TAXES

(15,799 ) 7,487

252 202

Income tax expense

686 704

$ (23,223 ) $ 2,500

NET (LOSS) INCOME $ (16,485 ) $

6,783

5,931 5,846 Average Number of Shares

Outstanding - Basic

5,909 5,836

5,931 5,846 Average

Number of Shares Outstanding - Diluted

5,909 5,854

$ (3.92 ) $ 0.43

BASIC (LOSS) INCOME PER

SHARE $ (2.79 ) $ 1.16

$

(3.92 ) $ 0.43

DILUTED( LOSS) INCOME PER SHARE

$ (2.79 ) $ 1.16

$ — $ —

Dividends per share declared for the period

$ — $

0.25 MEMO:

$ 7,848 $ 4,896 Depreciation and

amortization

$ 17,852 $ 16,866

SEGMENT OPERATING RESULTS (In thousands) (Unaudited)

13

Weeks Ended 13 Weeks Ended 39 Weeks Ended 39

Weeks Ended Sep 29, 2013 Sep 30, 2012

Sep 29, 2013 Sep 30, 2012 REVENUE

$ 62,908 $ 51,535 Healthcare

$ 160,579

$ 163,348

136,431 94,187 Business

Solutions

317,197 295,090

$

199,339 $ 145,722 Total Revenue

$ 477,776 $ 458,438

NET (LOSS) INCOME BEFORE TAXES $ 2,063 $ 2,222

Healthcare

$ 5,968 $ 8,564

(1,452 )

2,365 Business Solutions

2,376 5,650

(23,582 )

(1,885 ) Unallocated

(44,795 ) (6,727 )

$ (22,971 ) $ 2,702 Total Net

(Loss) Income Before Taxes

$ (15,799 )

$ 7,487

CONSOLIDATED BALANCE

SHEETS (In thousands) (Unaudited)

Sep 29, 2013

Dec 30, 2012 ASSETS Cash and cash equivalents

$ 2,804 $ 1,012 Accounts receivable

155,019

104,513 Inventories

65,995 44,281 Other current assets

16,940 9,248 Total current assets

240,758 159,054 Plant and equipment

94,765

58,923 Goodwill and intangible assets

140,661 13,389

Deferred taxes

22,765 22,765 Other assets

8,718

5,773 Total assets

$ 507,667

$ 259,904

LIABILITIES AND

SHAREHOLDERS' DEFICIT Current liabilities

$

135,952 $ 74,832 Deferred compensation

3,068 3,498

Long-term debt

266,048 49,159 Pension benefit liability

230,575 252,665 Other long-term liabilities

7,256

6,610 Shareholders' deficit

(135,232 )

(126,860 ) Total liabilities and shareholders' deficit

$

507,667 $ 259,904

CONSOLIDATED STATEMENTS OF CASHFLOWS (In thousands)

(Unaudited)

Y-T-D 39 Weeks Ended 39 Weeks

Ended Sep 29, 2013 Sep 30, 2012 Net

loss plus non-cash items

$ 15,914 $ 30,591 Working

capital

15,427 10,541 Restructuring payments

(3,982

) (7,550 ) Contributions to qualified pension plan

(18,766 ) (18,703 ) Other

(3,323 )

(4,727 ) Net cash provided by operating activities

5,270 10,152 Acquisition cash acquired

1,665 —

Additions to plant and equipment

(9,065 ) (2,441 )

Proceeds from sale of equipment

171 104

Net cash used in investing activities

(7,229 ) (2,337

) Net change in borrowings under credit facility

8,371 (4,364 ) Debt issuance costs

(2,357 ) —

Principal payments on long-term debt

(1,840 ) (1,914

) Dividends paid

— (1,500 ) Other

(398 )

(613 ) Net cash provided by (used in) financing activities

3,776 (8,391 ) Effect of exchange rate

(25 ) 182 Net change in cash

$

1,792 $ (394 )

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (In

thousands) (Unaudited)

13 Weeks Ended 13 Weeks Ended

39 Weeks Ended 39 Weeks Ended Sep 29, 2013

Sep 30, 2012 Sep 29, 2013 Sep 30,

2012 $ (23,223 ) $ 2,500 GAAP Net (Loss)

Income

$ (16,485 ) $ 6,783 Adjustments:

252 202 Income taxes

686 704

3,713 670

Interest

4,867 2,059

7,848 4,896

Depreciation and amortization

17,852 16,866

$ (11,410 ) $ 8,268

EBITDA

$ 6,920 $ 26,412

Adjustments:

12,317 733 Restructuring and impairment

13,136 3,345

6,216 254 Acquisition and integration

costs

8,002 608

(506 ) 60 Pension expense

(benefit)

(1,519 ) 890

1,392 —

Fair value adjustments

1,392 —

$ 8,009 $ 9,315 Adjusted EBITDA

$ 27,931 $ 31,255 GAAP

Net Cash Flow

$ 1,792 $ (394 ) Adjustments: Credit

facility paid (borrowed)

(8,371 ) 4,364

Non-GAAP Net Cash Flow

$ (6,579 ) $

3,970

Standard RegisterInvestor and media contact:Carol Merry,

614-383-1624carol.merry@fahlgren.comwww.standardregister.com

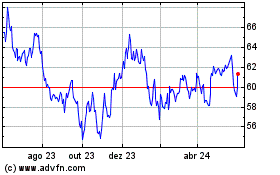

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

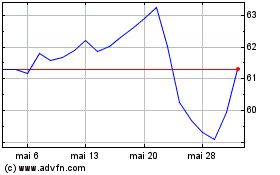

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024