Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

14 Maio 2019 - 5:35PM

Edgar (US Regulatory)

Free Writing Prospectus Filed Pursuant to Rule 433

To Prospectus dated May 14, 2019

Preliminary Prospectus Supplement dated May 14, 2019

Registration Statement File

No. 333-231443

Spire Inc.

10,000,000

Depositary Shares

Each Representing a 1/1,000th Interest in a Share of

5.90% Series A Cumulative Redeemable Perpetual Preferred Stock

(Liquidation Preference Equivalent to $25.00 per Depositary Share)

Pricing Term Sheet

May 14, 2019

|

|

|

|

|

Issuer:

|

|

Spire Inc.

|

|

|

|

|

Security:

|

|

Depositary Shares (“Depositary Shares”), each representing a 1/1,000th interest in a share of Issuer’s 5.90% Series A Cumulative Redeemable Perpetual Preferred Stock (“Preferred Stock”)

|

|

|

|

|

Liquidation Preference:

|

|

$25,000 per share of Preferred Stock (equivalent to $25.00 per Depositary Share) plus accumulated and unpaid dividends

|

|

|

|

|

Ratings (Moody’s / S&P)*:

|

|

Ba1 (stable) / BBB (stable)

|

|

|

|

|

Trade Date:

|

|

May 14, 2019

|

|

|

|

|

Settlement Date:

|

|

May 21, 2019 (T+5)

|

|

|

|

|

Size:

|

|

$250,000,000 (10,000,000 Depositary Shares)

|

|

|

|

|

Term:

|

|

Perpetual

|

|

|

|

|

Dividend Rate (Cumulative):

|

|

5.90%

|

|

|

|

|

Dividend Payment Dates:

|

|

Quarterly in arrears on February 15, May 15, August 15 and November 15 and of each year, commencing August 15, 2019

|

|

|

|

|

Optional Redemption:

|

|

Issuer may, at its option, redeem the Preferred Stock:

|

|

|

|

|

Ratings Event Call:

|

|

• at any time prior to August 15, 2024, within 120 days after the

conclusion of any review or appeal process instituted by Issuer, if any, following the occurrence of a Ratings Event (as defined in Issuer’s Preliminary Prospectus Supplement dated May 14, 2019), in whole, but not in part, at a redemption

price in cash equal to $25,500 per share of Preferred Stock (equivalent to $25.50 per Depositary Share); or

|

|

|

|

|

|

|

|

|

Par Call:

|

|

• on or after August 15, 2024, at any time and from time to time, in

whole or in part, at a redemption price in cash equal to $25,000 per share of Preferred Stock (equivalent to $25.00 per Depositary Share)

|

|

|

|

|

|

|

plus, in each case, an amount equal to all accumulated and unpaid dividends thereon (whether or not declared) to, but excluding, the redemption date

|

|

|

|

|

Public Offering Price:

|

|

100% ($25.00 per Depositary Share)

|

|

|

|

|

Underwriting Discount:

|

|

$0.7875 per Depositary Share for retail investors ($5,073,075.00)

$0.5000 per Depositary Share for institutional investors ($1,779,000.00)

|

|

|

|

|

Net Proceeds to Issuer, before Expenses:

|

|

$243,147,925.00

|

|

|

|

|

Listing:

|

|

Issuer intends to apply to list the Depositary Shares on the New York Stock Exchange and, if the application is approved, expects trading to begin within 30 days of the initial issuance thereof

|

|

|

|

|

Joint Book-Running Managers:

|

|

Morgan Stanley & Co. LLC

BofA

Securities, Inc.

Wells Fargo Securities, LLC

|

|

|

|

|

Joint Lead Manager:

|

|

J.P. Morgan Securities LLC

|

|

|

|

|

Co-Managers:

|

|

Stifel, Nicolaus & Company, Incorporated

TD Securities (USA) LLC

|

|

|

|

|

CUSIP / ISIN:

|

|

84857L 309 / US84857L3096

|

|

*

|

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision, suspension or withdrawal at any time. Each credit rating should be evaluated independently of any other credit rating.

|

Issuer has filed a registration statement (including a preliminary prospectus supplement and prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus supplement for this offering, the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about Issuer and

this offering. You may get these documents for free by searching the SEC online data base (EDGAR) on the SEC web site at

www.sec.gov

. Alternatively, Issuer, any underwriter or any dealer participating in this offering will arrange to send you

the prospectus supplement and prospectus if you request it by calling Morgan Stanley & Co. LLC, toll-free at

866-718-1649,

BofA Securities, Inc., toll-free at

800-294-1322

or Wells Fargo Securities, LLC, toll-free at

800-645-3751.

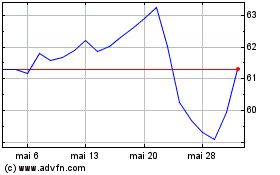

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

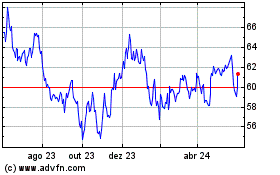

Spire (NYSE:SR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024