Earnings Call to be held 7:30 am CT on

Thursday, February 22, 2024

Texas Pacific Land Corporation (NYSE: TPL) (the “Company” or

“TPL”) today announced its financial and operating results for the

fourth quarter and full year of 2023.

Fourth Quarter 2023 Highlights

- Net income of $113.1 million, or $14.73 per share

(diluted)

- Revenues of $166.7 million

- Adjusted EBITDA(1) of $150.9 million

- Free cash flow (1) of $116.3 million

- Royalty production of 26.3 thousand barrels of oil equivalent

per day, the highest quarterly royalty production level in TPL

history

- $10.2 million of common stock repurchases

- Quarterly cash dividend of $3.25 per share paid on December 15,

2023

- As of December 31, 2023, TPL’s royalty acreage had an estimated

4.5 net well permits, 9.7 net drilled but uncompleted wells, 2.8

net completed wells, and 67.2 net producing wells.

Full Year 2023 Highlights

- Net income of $405.6 million, or $52.77 per share

(diluted)

- Revenues of $631.6 million

- Adjusted EBITDA(1) of $541.4 million

- Free cash flow(1) of $415.5 million

- Royalty production of 23.5 thousand barrels of oil equivalent

per day

- $42.4 million of common stock repurchases

- $100.0 million of total cash dividends paid during 2023

(comprised of $13.00 per share in regular dividends)

(1) Reconciliations of Non-GAAP measures are provided in the

tables below.

“Fourth quarter 2023 capped off a strong year for TPL,” said

Tyler Glover, Chief Executive Officer of the Company. “Driven by

robust oil and gas royalty production and continued growth of our

water and surface businesses, total consolidated revenues and free

cash flow for this most recent quarter were the highest of any

quarter in 2023. For the full year 2023, TPL generated record

revenues from our Water segment, while revenues from our easements

and other surface-related income grew nearly 50% year-over-year.

This growth of our surface-related businesses helped to

substantially offset lower commodity prices. Looking ahead to 2024,

we continue to see strong activity on our royalty and surface

acreage. With an unmatched Permian asset footprint, high free cash

flow margins, a resilient business mix, and a large net cash

balance, TPL is well-positioned in 2024 to seize on opportunities

for value-added growth and shareholder return of capital.”

Financial Results for the Fourth Quarter of 2023

The Company reported net income of $113.1 million for the fourth

quarter of 2023 compared to net income of $99.7 million for the

fourth quarter of 2022.

Total revenues for the fourth quarter of 2023 were $166.7

million compared to $152.7 million for the fourth quarter of 2022.

The increase in revenue was principally due to a combined increase

of $10.1 million in water sales and produced water royalties and an

increase of $8.3 million in easements and other surface-related

income. Oil and gas royalty revenue increased $2.1 million due to

higher production volumes in the fourth quarter of 2023 compared to

the fourth quarter of 2022 partially offset by lower average

commodity prices over the same period. The Company’s share of

production was 26.3 thousand barrels of oil equivalent (“Boe”) per

day for the fourth quarter of 2023 versus 21.3 thousand Boe per day

for the same period of 2022. The average realized price was $42.81

per Boe in the fourth quarter of 2023 versus $51.57 per Boe in the

fourth quarter of 2022. TPL’s revenue streams are directly impacted

by commodity prices and development and operating decisions made by

our customers.

Total operating expenses of $32.8 million for the fourth quarter

of 2023 increased $4.3 million compared to the same period of 2022.

The change in operating expenses is principally related to an

increase in water service-related expenses resulting from increased

water sales activity during the fourth quarter of 2023 compared to

the same period of 2022.

Financial Results for the Year Ended December 31,

2023

The Company reported net income of $405.6 million for the year

ended December 31, 2023, a decrease of 9.1% compared to net income

of $446.4 million for the year ended December 31, 2022.

Total revenues decreased $35.8 million for the year ended

December 31, 2023 compared to the same period of 2022. Oil and gas

royalty revenue of $357.4 million for the year ended December 31,

2023 includes an $8.7 million recovery, as discussed below. As part

of an ongoing arbitration between TPL and an operator with respect

to underpayment of oil and gas royalties resulting from improper

deductions of post-production costs by the operator for production

periods before and through June 2023, the operator agreed to pay

$10.1 million to TPL, comprised of $8.7 million of unpaid oil and

gas royalties, $0.9 million of interest and $0.5 million of damages

(the "O&G Settlement"). Excluding the impact of the $8.7

million recovery, oil and gas royalty revenue decreased $103.7

million compared to the same period of 2022. The Company’s share of

production was approximately 23.5 thousand Boe per day for the year

ended December 31, 2023 versus 21.3 thousand Boe per day for the

same period of 2022. The average realized price was $42.58 per Boe

for the year ended December 31, 2023 versus $60.81 per Boe for the

same period of 2022. The decrease in oil and gas royalty revenue

was partially offset by a combined increase of $39.5 million in

water sales and produced water royalties and an increase of $22.9

million in easements and other surface-related income. TPL’s

revenue streams are directly impacted by commodity prices and

development and operating decisions made by our customers.

Total operating expenses of $145.5 million for the year ended

December 31, 2023 increased $40.4 million compared to the same

period of 2022. The change in operating expenses is principally

related to increases in legal and professional fees and water

service-related expenses during the year ended December 31, 2023

compared to the same period of 2022. During 2023, the Company made

the operational decision to incur higher water service-related

expenses in order to meet increased customer demand for water

within shorter time commitments. This decision, in turn, resulted

in higher water sales revenue and operating income during 2023 over

2022.

Quarterly Dividend Declared

On February 13, 2024, the Board declared a quarterly cash

dividend of $3.50 per share, payable on March 15, 2024 to

stockholders of record at the close of business on March 1,

2024.

Update on Consideration of Stockholder Proposal from the 2023

Annual Meeting

The Company also announced that on February 12, 2024, the

Nominating and Corporate Governance Committee recommended to the

full Board that the Board consider including in the 2024 proxy

materials a proposal granting stockholders the right to call a

special meeting for approval at the Company’s 2024 Annual Meeting.

Pursuant to the recommendation of the Nominating and Corporate

Governance Committee, the Company is currently evaluating the

appropriate parameters for such right, with the intent to make a

final recommendation to the full Board prior to the release of the

proxy materials for the Company’s 2024 Annual Meeting of

Stockholders.

Conference Call and Webcast Information

The Company will hold a conference call on Thursday, February

22, 2024 at 7:30 a.m. Central Time to discuss fourth quarter and

year end results. A live webcast of the conference call will be

available on the Investors section of the Company’s website at

http://www.TexasPacific.com. To listen to the live broadcast, go to

the site at least 15 minutes prior to the scheduled start time in

order to register and install any necessary audio software.

The conference call can also be accessed by dialing

1-877-407-4018 or 1-201-689-8471. The telephone replay can be

accessed by dialing 1-844-512-2921 or 1-412-317-6671 and providing

the conference ID# 13742748. The telephone replay will be available

starting shortly after the call through March 7, 2024.

About Texas Pacific Land Corporation

Texas Pacific Land Corporation is one of the largest landowners

in the State of Texas with approximately 868,000 acres of land in

West Texas, with the majority of its ownership concentrated in the

Permian Basin. The Company is not an oil and gas producer, but its

surface and royalty ownership provide revenue opportunities

throughout the life cycle of a well. These revenue opportunities

include fixed fee payments for use of our land, revenue for sales

of materials (caliche) used in the construction of infrastructure,

providing sourced water and/or treated produced water, revenue from

our oil and gas royalty interests, and revenues related to

saltwater disposal on our land. The Company also generates revenue

from pipeline, power line and utility easements, commercial leases

and temporary permits related to a variety of land uses including

midstream infrastructure projects and hydrocarbon processing

facilities.

Visit TPL at http://www.TexasPacific.com.

Cautionary Statement Regarding Forward-Looking

Statements

This news release may contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, that are based on TPL’s beliefs, as well as assumptions

made by, and information currently available to, TPL, and therefore

involve risks and uncertainties that are difficult to predict.

Generally, future or conditional verbs such as “will,” “would,”

“should,” “could,” or “may” and the words “believe,” “anticipate,”

“continue,” “intend,” “expect” and similar expressions identify

forward-looking statements. Forward-looking statements include, but

are not limited to, references to strategies, plans, objectives,

expectations, intentions, assumptions, future operations and

prospects and other statements that are not historical facts. You

should not place undue reliance on forward-looking statements.

Although TPL believes that plans, intentions and expectations

reflected in or suggested by any forward-looking statements made

herein are reasonable, TPL may be unable to achieve such plans,

intentions or expectations and actual results, and performance or

achievements may vary materially and adversely from those envisaged

in this news release due to a number of factors including, but not

limited to: the initiation or outcome of potential litigation; and

any changes in general economic and/or industry specific

conditions. These risks, as well as other risks associated with TPL

are also more fully discussed in our Annual Report on Form 10-K and

our Quarterly Reports on Form 10-Q. You can access TPL’s filings

with the SEC through the SEC website at http://www.sec.gov and TPL

strongly encourages you to do so. Except as required by applicable

law, TPL undertakes no obligation to update any forward-looking

statements or other statements herein for revisions or changes

after this communication is made.

FINANCIAL AND OPERATIONAL

RESULTS

(unaudited)

Three Months Ended

December 31,

Years Ended

December 31,

2023

2022

2023

2022

Company’s share of production volumes(1)

(2):

Oil (MBbls)

1,059

864

3,701

3,401

Natural gas (MMcf)

4,124

3,313

14,528

13,086

NGL (MBbls)

669

548

2,453

2,208

Equivalents (MBoe)

2,416

1,964

8,575

7,791

Equivalents per day (MBoe/d)

26.3

21.3

23.5

21.3

Oil and gas royalty revenue (in thousands)

(2):

Oil royalties

$

79,335

$

68,585

$

273,304

$

307,606

Natural gas royalties

6,705

14,679

29,915

74,866

NGL royalties

12,710

13,432

45,510

69,962

Total oil and gas royalties

$

98,750

$

96,696

$

348,729

$

452,434

Realized prices (1) (2):

Oil ($/Bbl)

$

78.46

$

83.16

$

77.33

$

94.69

Natural gas ($/Mcf)

$

1.76

$

4.79

$

2.23

$

6.19

NGL ($/Bbl)

$

20.53

$

26.51

$

20.05

$

34.25

Equivalents ($/Boe)

$

42.81

$

51.57

$

42.58

$

60.81

(1)

Term

Definition

Bbl

One stock tank barrel of 42 U.S. gallons

liquid volume used herein in reference to crude oil, condensate or

NGLs.

MBbls

One thousand barrels of crude oil,

condensate or NGLs.

MBoe

One thousand Boe.

MBoe/d

One thousand Boe per day.

Mcf

One thousand cubic feet of natural

gas.

MMcf

One million cubic feet of natural gas.

NGL

Natural gas liquids. Hydrocarbons found in

natural gas that may be extracted as liquefied petroleum gas and

natural gasoline.

(2)

The metrics provided exclude the impact of

the $8.7 million of oil and gas royalties from the O&G

Settlement discussed above.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except share and

per share amounts) (unaudited)

Three Months Ended

December 31,

Years Ended

December 31,

2023

2022

2023

2022

Revenues:

Oil and gas royalties

$

98,750

$

96,696

$

357,394

$

452,434

Water sales

26,404

19,207

112,203

84,725

Produced water royalties

22,436

19,566

84,260

72,234

Easements and other surface-related

income

19,067

10,746

70,932

48,057

Land sales and other operating revenue

—

6,491

6,806

9,972

Total revenues

166,657

152,706

631,595

667,422

Expenses:

Salaries and related employee expenses

10,696

11,732

43,384

41,402

Water service-related expenses

9,070

4,418

33,566

17,463

General and administrative expenses

4,141

3,524

14,928

13,285

Legal and professional fees

3,051

3,747

31,522

8,735

Ad valorem and other taxes

1,960

1,901

7,385

8,854

Depreciation, depletion and

amortization

3,876

3,153

14,757

15,376

Total operating expenses

32,794

28,475

145,542

105,115

Operating income

133,863

124,231

486,053

562,307

Other income, net

11,269

3,922

31,508

6,548

Income before income taxes

145,132

128,153

517,561

568,855

Income tax expense

32,022

28,422

111,916

122,493

Net income

$

113,110

$

99,731

$

405,645

$

446,362

Net income per share of common stock

Basic

$

14.74

$

12.95

$

52.81

$

57.80

Diluted

$

14.73

$

12.94

$

52.77

$

57.77

Weighted average number of shares of

common stock outstanding

Basic

7,671,773

7,698,487

7,681,435

7,721,957

Diluted

7,678,182

7,705,116

7,686,615

7,726,809

SEGMENT OPERATING

RESULTS

(dollars in thousands)

(unaudited)

Three Months Ended

December 31,

2023

2022

Revenues:

Land and resource management:

Oil and gas royalties

$

98,750

59

%

$

96,696

64

%

Easements and other surface-related

income

18,079

11

%

9,841

6

%

Land sales and other operating revenue

—

—

%

6,491

4

%

Total land and resource management

revenue

116,829

70

%

113,028

74

%

Water services and operations:

Water sales

26,404

16

%

19,207

13

%

Produced water royalties

22,436

13

%

19,566

13

%

Easements and other surface-related

income

988

1

%

905

—

%

Total water services and operations

revenue

49,828

30

%

39,678

26

%

Total consolidated revenues

$

166,657

100

%

$

152,706

100

%

Net income:

Land and resource management

$

88,846

79

%

$

79,623

80

%

Water services and operations

24,264

21

%

20,108

20

%

Total consolidated net income

$

113,110

100

%

$

99,731

100

%

Years Ended

December 31,

2023

2022

Revenues:

Land and resource management:

Oil and gas royalties

$

357,394

57

%

$

452,434

68

%

Easements and other surface-related

income

67,905

11

%

44,569

7

%

Land sales and other operating revenue

6,806

1

%

9,972

1

%

Total land and resource management

revenue

432,105

69

%

506,975

76

%

Water services and operations:

Water sales

112,203

18

%

84,725

13

%

Produced water royalties

84,260

13

%

72,234

11

%

Easements and other surface-related

income

3,027

—

%

3,488

—

%

Total water services and operations

revenue

199,490

31

%

160,447

24

%

Total consolidated revenues

$

631,595

100

%

$

667,422

100

%

Net income:

Land and resource management

$

306,706

76

%

$

365,041

82

%

Water services and operations

98,939

24

%

81,321

18

%

Total consolidated net income

$

405,645

100

%

$

446,362

100

%

NON-GAAP PERFORMANCE MEASURES AND

DEFINITIONS

In addition to amounts presented in accordance with generally

accepted accounting principles in the United States of America

(“GAAP”), we also present certain supplemental non-GAAP performance

measurements. These measurements are not to be considered more

relevant or accurate than the measurements presented in accordance

with GAAP. In compliance with the requirements of the SEC, our

non-GAAP measurements are reconciled to net income, the most

directly comparable GAAP performance measure. For all non-GAAP

measurements, neither the SEC nor any other regulatory body has

passed judgment on these non-GAAP measurements.

EBITDA, Adjusted EBITDA and Free Cash Flow

EBITDA is a non-GAAP financial measurement of earnings before

interest, taxes, depreciation, depletion and amortization. Its

purpose is to highlight earnings without finance, taxes, and

depreciation, depletion and amortization expense, and its use is

limited to specialized analysis. We calculate Adjusted EBITDA as

EBITDA excluding employee share-based compensation. Its purpose is

to highlight earnings without non-cash activity such as share-based

compensation and/or other non-recurring or unusual items. We

calculate Free Cash Flow as Adjusted EBITDA less current income tax

expense and capital expenditures. Its purpose is to provide an

additional measure of operating performance. We have presented

EBITDA, Adjusted EBITDA and Free Cash Flow because we believe that

these metrics are useful supplements to net income in analyzing the

Company’s operating performance. Our definitions of Adjusted EBITDA

and Free Cash Flow may differ from computations of similarly titled

measures of other companies.

The following table presents a reconciliation of net income to

EBITDA, Adjusted EBITDA and Free Cash Flow for the three months and

years ended December 31, 2023 and 2022 (in thousands):

Three Months Ended

December 31,

Years Ended

December 31,

2023

2022

2023

2022

Net income

$

113,110

$

99,731

$

405,645

$

446,362

Add:

Income tax expense

32,022

28,422

111,916

122,493

Depreciation, depletion and

amortization

3,876

3,153

14,757

15,376

EBITDA

149,008

131,306

532,318

584,231

Add:

Employee share-based compensation

1,907

2,594

9,124

7,583

Adjusted EBITDA

150,915

133,900

541,442

591,814

Less:

Current income tax expense

(29,589

)

(26,319

)

(110,517

)

(121,230

)

Capital expenditures

(5,044

)

(6,812

)

(15,431

)

(18,967

)

Free Cash Flow

$

116,282

$

100,769

$

415,494

$

451,617

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221094108/en/

Investor Relations IR@TexasPacific.com

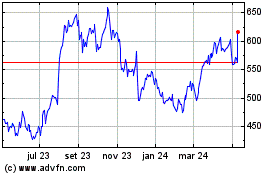

Texas Pacific Land (NYSE:TPL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

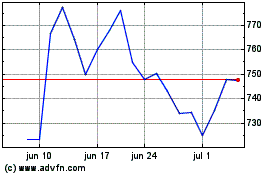

Texas Pacific Land (NYSE:TPL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025