Triton International Limited (NYSE: TRTN) ("Triton")

today reported results for the first quarter ended March 31,

2017. On July 12, 2016 Triton Container International Limited

("TCIL") and TAL International Group, Inc. ("TAL") completed their

previously announced strategic combination and became wholly-owned

subsidiaries of Triton. In this press release, Triton has presented

its results based on U.S. GAAP as well as Non-GAAP selected

information for the three months ended March 31, 2017.

First Quarter and Recent

Highlights:

- Triton reported Net income attributable

to shareholders of $34.6 million and Income before income taxes of

$43.4 million for the first quarter of 2017.

- Triton reported Adjusted pre-tax income

of $42.7 million in the first quarter of 2017.

- Utilization averaged 95.3% for the

first quarter of 2017.

- Triton announced a quarterly dividend

of $0.45 per share payable on June 22, 2017 to shareholders of

record as of June 1, 2017.

Financial Results

The following table depicts Triton’s selected key financial

information for the first quarter of 2017, the fourth quarter of

2016, and the first quarter of 2016 (dollars in millions, except

per share data). Financial information for periods prior to July

12, 2016 is for TCIL (the accounting acquirer in the strategic

combination of TCIL and TAL) only.

Three Months Ended, March 31,

2017 December 31, 2016 March 31,

2016 Leasing revenues $265.6 $259.5 $163.0

Income

before income taxes $43.4 $31.1 $11.1

Net income

attributable to shareholders $34.6 $22.8 $8.7

Net income per

share - diluted $0.47 $0.31 $0.22

Adjusted pre-tax

income(1) $42.7 $19.0 $17.7

Adjusted net income(1) $35.4

$15.3 $16.0

(1) Adjusted pre-tax income and Adjusted net income are non-GAAP

financial measures that we believe are useful in evaluating our

operating performance. Triton's definition and calculation of

Adjusted pre-tax income and Adjusted net income, including

reconciliation of such non-GAAP financial measures to the most

directly comparable GAAP financial measures, are outlined in the

attached schedules.

Operating Performance

“We are very pleased with Triton’s solid start to 2017, in which

we clearly benefited from our market-leading scale, cost structure

and operational capabilities,” commented Brian M. Sondey, Chairman

and Chief Executive Officer of Triton. “The market recovery which

began toward the end of last year has continued into 2017, and our

operating and financial performance continue to rebound

nicely.”

“Throughout the first several months of 2017, market conditions

have remained favorable, especially for our dry container product

line. Global containerized trade growth remains moderately

positive, and a number of our customers have indicated their

volumes have been above expectations. The inventory of new

containers and depot stocks of used containers are currently very

low as we approach the traditional summer peak season for dry

containers. While Triton has supported the requirements of our

customers by ordering a high volume of new containers so far this

year, overall new container production has been constrained by the

financial challenges facing many shipping lines and leasing

companies. Despite a recent dip in steel prices in China, new dry

container prices remain near recent peak levels, and market leasing

rates are currently above the average lease rates in our portfolio.

Used container sale prices increased strongly in the first quarter,

after initially lagging the increase in new container prices and

market leasing rates.”

“Triton’s operating and financial performance rebounded quickly

in the first quarter. Container pick-up volumes and new container

lease transaction activity were high, despite the fact that the

first quarter is typically the weakest period for dry containers.

Our average container utilization increased 1.7% from the fourth

quarter of 2016 to the first quarter of 2017, and our utilization

currently stands at 96.4%. Triton generated $42.7 million of

Adjusted pre-tax income in the first quarter, which includes

approximately $6.2 million of net negative impacts from purchase

accounting. Our Adjusted pre-tax income increased over $20 million

from the fourth quarter of 2016, reflecting the significant

improvement in our key operating metrics.”

Outlook

Mr. Sondey concluded, “In general, we expect market conditions

to remain favorable for at least the next several quarters. We

expect the supply / demand balance for containers to remain tight,

and that our key operating metrics will continue to improve. We

also anticipate that we will achieve sequential growth in our

Adjusted pre-tax income from the first quarter to the second

quarter of 2017, reflecting further improvement in our operating

performance and reduced impacts from purchase accounting. We also

expect that our Adjusted pre-tax income will increase from its

second quarter level through the end of the year, if market

conditions remain strong.”

Dividend

Triton’s Board of Directors has approved and declared a $0.45

per share quarterly cash dividend on its issued and outstanding

common shares, payable on June 22, 2017 to shareholders of record

at the close of business on June 1, 2017.

Investors’ Webcast

Triton will hold a Webcast at 9 a.m. (New York time) on Friday,

May 12, 2017 to discuss its first quarter results. To

participate by phone, please dial 1-877-418-5277 (domestic) or

1-412-717-9592 (international) approximately 15 minutes prior to

the start time and reference the Triton International Limited

conference call. To access the live Webcast or archive, please

visit Triton's website at http://www.trtn.com. An archive of the

Webcast will be available one hour after the live call through

Friday, June 23, 2017.

About Triton International

Limited

Triton International Limited is the parent of Triton Container

International Limited and TAL International Group, Inc., each of

which merged under Triton on July 12, 2016 to create the world’s

largest lessor of intermodal freight containers and chassis. With a

container fleet of over five million twenty-foot equivalent units

("TEU"), Triton’s global operations include acquisition, leasing,

re-leasing and subsequent sale of multiple types of intermodal

containers and chassis.

The following table sets forth the combined equipment fleet

utilization(a) for TCIL and TAL as of and for the periods

indicated:

Quarter Ended March 31,

2017 December 31, 2016

September 30, 2016 June 30, 2016

March 31, 2016 Average Utilization

95.3% 93.6% 92.4% 93.3% 94.0%

March 31, 2017

December 31, 2016 September 30, 2016

June 30, 2016 March 31, 2016 Ending

Utilization 95.8% 94.8% 92.6% 93.7% 93.5%

(a) Utilization is computed by dividing total units on lease (in

cost equivalent units, or "CEUs") by the total units in fleet (in

CEUs), excluding new units not yet leased and off-hire units

designated for sale. For the utilization calculation, units on

lease to Hanjin were treated as off-lease effective August 1,

2016.

The following table provides the composition of the combined

equipment fleet as of March 31, 2017, December 31, 2016,

and March 31, 2016 (in units, TEUs and CEUs):

Equipment Fleet in Units

Equipment Fleet in TEU March 31, 2017

December 31, 2016

March 31, 2016 March 31, 2017

December 31, 2016

March 31, 2016 Dry 2,835,075 2,747,497

2,636,095 4,604,595 4,443,935 4,232,676

Refrigerated 220,158

217,564 202,337 422,922 417,634 387,267

Special 82,867

84,077 87,305 145,410 147,217 152,477

Tank 11,958 11,961

11,422 11,958 11,961 11,422

Chassis 21,116 21,172 21,806

38,220 38,321 39,395

Equipment leasing fleet 3,171,174

3,082,271 2,958,965 5,223,105 5,059,068 4,823,237

Equipment

trading fleet 20,280 15,927 19,874 31,290 26,276 33,423

Total 3,191,454 3,098,198 2,978,839 5,254,395 5,085,344

4,856,660

Equipment in CEU

March 31, 2017

December 31, 2016

March 31, 2016

Operating leases

6,295,201

6,126,320

5,912,651

Finance leases

360,869

368,468

250,874

Equipment trading fleet

74,638

72,646

98,041

Total

6,730,708

6,567,434

6,261,566

Important Cautionary Information Regarding Forward-Looking

Statements

Certain statements in this release, other than purely historical

information, are "forward-looking statements" within the meaning of

the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Statements that

include the words "expect," "intend," "plan," "believe," "project,"

"anticipate," "will," "may," "would" and similar statements of a

future or forward-looking nature may be used to identify

forward-looking statements. All forward-looking statements address

matters that involve risks and uncertainties, many of which are

beyond Triton's control. Accordingly, there are or will be

important factors that could cause actual results to differ

materially from those indicated in such statements and, therefore,

you should not place undue reliance on any such statements.

These factors include, without limitation, economic, business,

competitive, market and regulatory conditions and the following:

failure to realize the anticipated benefits of the combination of

TCIL and TAL, including as a result of a delay or difficulty in

integrating the businesses of TCIL and TAL; uncertainty as to the

long-term value of Triton's common shares; the expected amount and

timing of cost savings and operating synergies resulting from the

transaction; decreases in the demand for leased containers;

decreases in market leasing rates for containers; difficulties in

re-leasing containers after their initial fixed-term leases; their

customers' decisions to buy rather than lease containers; their

dependence on a limited number of customers for a substantial

portion of their revenues; customer defaults; decreases in the

selling prices of used containers; extensive competition in the

container leasing industry; difficulties stemming from the

international nature of their businesses; decreases in the demand

for international trade; disruption to their operations resulting

from the political and economic policies of foreign countries,

particularly China; disruption to their operations from failures of

or attacks on their information technology systems; their

compliance with laws and regulations related to security,

anti-terrorism, environmental protection and corruption; their

ability to obtain sufficient capital to support their growth;

restrictions on their businesses imposed by the terms of their debt

agreements; and other risks and uncertainties, including those risk

factors set forth in the section entitled "Risk Factors" contained

in our Annual Report on Form 10-K filed with the SEC, on

March 17, 2017.

The foregoing list of important factors should not be construed

as exhaustive and should be read in conjunction with the other

cautionary statements that are included herein and elsewhere. Any

forward-looking statements made herein are qualified in their

entirety by these cautionary statements, and there can be no

assurance that the actual results or developments anticipated by us

will be realized or, even if substantially realized, that they will

have the expected consequences to, or effects on Triton or its

business or operations. Except to the extent required by applicable

law, we undertake no obligation to update publicly or revise any

forward-looking statement, whether as a result of new information,

future developments or otherwise.

TRITON INTERNATIONAL LIMITED Consolidated

Balance Sheets (Dollars in thousands, except share data)

(Unaudited) March 31, 2017 December

31, 2016 ASSETS: Leasing equipment, net of

accumulated depreciation of $1,887,657 and $1,787,505 $ 7,605,903 $

7,370,519 Net investment in finance leases, net of allowances of

$527 and $527 335,253 346,810 Equipment held for sale 104,954

99,863

Revenue earning assets 8,046,110 7,817,192

Cash and cash equivalents 135,442 113,198 Restricted cash 57,628

50,294 Accounts receivable, net of allowances of $27,884 and

$28,082 167,720 173,585 Goodwill 236,665 236,665 Lease intangibles,

net of accumulated amortization of $80,225 and $56,159 222,532

246,598 Insurance receivables 32,310 17,170 Other assets 53,750

53,126 Fair value of derivative instruments 7,902 5,743

Total assets $ 8,960,059 $ 8,713,571

LIABILITIES

AND SHAREHOLDERS' EQUITY: Equipment purchases payable $ 200,728

$ 83,567 Fair value of derivative instruments 6,206 9,404 Accounts

payable and other accrued expenses 143,459 143,098 Net deferred

income tax liability 317,841 317,316 Debt, net of unamortized

deferred financing costs of $26,005 and $19,999 6,478,602

6,353,449

Total liabilities 7,146,836 6,906,834

Shareholders' equity:

Common shares, $0.01 par value,

294,000,000 shares authorized 74,497,727 and 74,376,025shares

issued, respectively

745 744 Undesignated shares $0.01 par value, 6,000,000 shares

authorized, no shares issued and outstanding — — Additional paid-in

capital 691,536 690,418 Accumulated earnings 952,947 945,313

Accumulated other comprehensive income 27,697 26,758

Total shareholders' equity 1,672,925 1,663,233

Non-controlling interests 140,298 143,504

Total

equity 1,813,223 1,806,737

Total liabilities and

shareholders' equity $ 8,960,059 $ 8,713,571

TRITON INTERNATIONAL LIMITED Consolidated

Statements of Operations (Dollars and shares in thousands,

except per share amounts) (Unaudited) Three

Months Ended March 31, 2017 2016 Leasing

revenues: Operating leases $ 259,585 $ 160,995 Finance leases 6,017

2,030

Total leasing revenues 265,602

163,025 Equipment trading revenues 5,484 — Equipment

trading expenses (5,092 ) —

Trading margin 392

— Net gain (loss) on sale of leasing equipment 5,161

(1,837 )

Operating expenses: Depreciation and

amortization 117,880 79,144 Direct operating expenses 21,954 14,467

Administrative expenses 22,967 14,513 Transaction and other costsA

2,472 3,411 Provision (reversal) for doubtful accounts 574

(119 ) Total operating expenses 165,847 111,416

Operating income 105,308 49,772

Other expenses: Interest and

debt expense 63,504 33,698 Realized loss on derivative instruments,

net 599 654 Unrealized (gain) loss on derivative instruments, net

(1,498 ) 4,596 Other (income), net (742 ) (233 )

Total other

expenses 61,863 38,715 Income before income taxes

43,445 11,057 Income tax expense 7,142 992

Net

income $ 36,303 $ 10,065 Less: income attributable to

noncontrolling interest 1,692 1,323 Net income

attributable to shareholders $ 34,611 $ 8,742 Net

income per common share—Basic $ 0.47 $ 0.22 Net income per common

share—Diluted $ 0.47 $ 0.22 Cash dividends paid per common share $

0.45 $ — Weighted average number of common shares

outstanding—Basic 73,741 40,429 Dilutive share options and

restricted shares 292 — Weighted average number of common

shares outstanding—Diluted 74,033 40,429

(A) See definitions

TRITON INTERNATIONAL LIMITED Consolidated

Statements of Cash Flows (Dollars in thousands)

(Unaudited) Three Months Ended March 31,

2017 2016 Cash flows from operating

activities: Net income $ 36,303 $ 10,065 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 117,880 79,144 Amortization of

deferred financing costs and other debt related amortization 2,490

1,265 Amortization of lease premiums 24,138 — Share compensation

expense 1,057 1,358 Net (gain) loss on sale of leasing equipment

(5,161 ) 1,837 Unrealized (gain) loss on derivative instruments

(1,498 ) 4,596 Deferred income taxes 6,593 265 Changes in operating

assets and liabilities, net of acquired assets and liabilities:

Decrease in accounts receivable 3,353 1,661 (Decrease) increase in

accounts payable and other accrued expenses (3,978 ) 3,522 Net

equipment (purchased) for resale activity (8,893 ) — Other changes

in operating assets and liabilities (9,343 ) 3,055

Net

cash provided by operating activities 162,941 106,768

Cash flows from investing activities: Purchases of

leasing equipment and investments in finance leases (265,706 )

(43,092 ) Proceeds from sale of equipment, net of selling costs

34,988 32,468 Cash collections on finance lease receivables, net of

income earned 15,580 3,869 Other (405 ) (356 )

Net cash used in

investing activities (215,543 ) (7,111 )

Cash flows from

financing activities: Financing fees paid under debt facilities

(7,517 ) (188 ) Borrowings under debt facilities 388,253 7,500

Payments under debt facilities and capital lease obligations

(260,475 ) (106,962 ) (Increase) decrease in restricted cash (7,334

) 734 Common share dividends paid (33,183 ) — Distributions to

noncontrolling interest (4,898 ) (6,960 )

Net cash provided by

(used in) financing activities 74,846 (105,876 )

Net

increase (decrease) in unrestricted cash and cash equivalents $

22,244 $ (6,219 ) Unrestricted cash and cash equivalents, beginning

of period 113,198 56,689

Unrestricted cash and

cash equivalents, end of period $ 135,442 $ 50,470

Supplemental non-cash investing activities: Equipment

purchases payable $ 200,728 $ 17,483

A Transaction costs associated with the merger of TCIL and TAL

and other costs for the three months ended March 31, 2017 and

2016 were as follows:

Three Months Ended March 31,

2017 2016 Employee compensation costs $ 2,463

$ 2,346 Professional fees — 434 Legal expenses 9 631 Total $

2,472 $ 3,411

Employee compensation costs include costs to maintain and retain

key employees, severance expenses, and certain stock compensation

expense, including retention and stock compensation expense

pursuant to plans established as part of TCIL's 2011

re-capitalization. Professional fees and legal expenses include

costs paid for services directly related to the closing of the

merger and include legal fees, accounting fees and transaction and

advisory fees.

Non-GAAP Financial Measures

We use the terms "Adjusted pre-tax income" and "Adjusted net

income" throughout this press release.

Adjusted pre-tax income is defined as income before income taxes

as further adjusted for certain items which are described in more

detail below, which management believes are not representative of

our operating performance. Adjusted pre-tax income excludes gains

and losses on interest rate swaps, the write-off of deferred

financing costs, transaction and other costs, and noncontrolling

interest. Adjusted net income is defined as net income further

adjusted for the items discussed above, net of income tax.

Adjusted pre-tax income and Adjusted net income are not

presentations made in accordance with U.S. GAAP. Adjusted pre-tax

income and Adjusted net income should not be considered as

alternatives to, or more meaningful than, amounts determined in

accordance with U.S. GAAP, including net income.

We believe that Adjusted pre-tax income and Adjusted net income

are useful to an investor in evaluating our operating performance

because these measures:

- are widely used by securities analysts

and investors to measure a company’s operating performance;

- help investors to more meaningfully

evaluate and compare the results of our operations from period to

period by removing the impact of our capital structure, our asset

base and certain non-routine events which we do not expect to occur

in the future; and

- are used by our management for various

purposes, including as measures of operating performance and

liquidity, to assist in comparing performance from period to period

on a consistent basis, in presentations to our board of directors

concerning our financial performance and as a basis for strategic

planning and forecasting.

We have provided reconciliations of Net income before income

taxes and Net income attributable to shareholders, the most

directly comparable U.S. GAAP measures, to Adjusted pre-tax income

and Adjusted net income in the tables below for the three months

ended March 31, 2017, the three months ended December 31,

2016, and the three months ended March 31, 2016.

TRITON INTERNATIONAL LIMITED Non-GAAP

Reconciliations of Adjusted Pre-tax Income and Adjusted Net

Income (Dollars in Thousands)

Three Months Ended,

March 31, 2017

December 31, 2016

March 31, 2016

Income before income taxes $ 43,445 $ 31,113 $ 11,057 Add:

Unrealized (gain) loss on derivative instruments, net (1,498 )

(9,648 ) 4,596 Transaction and other costs 2,472 399 3,411 Less:

Income attributable to noncontrolling interest 1,692 2,846

1,323 Adjusted pre-tax income $ 42,727 $ 19,018

$ 17,741

Three Months Ended,

March 31, 2017

December 31, 2016

March 31, 2016

Net income attributable to shareholders $ 34,611 $ 22,778 $ 8,742

Add: Unrealized (gain) loss on derivative instruments, net (1,252 )

(7,775 ) 4,184 Transaction and other costs 2,066 322

3,105 Adjusted net income $ 35,425 $ 15,325 $ 16,031

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170511006454/en/

Triton International LimitedAndrew Greenberg, 914-697-2900Senior

Vice PresidentFinance & Investor Relations

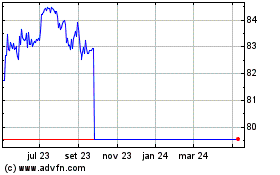

Triton (NYSE:TRTN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Triton (NYSE:TRTN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024