Triton International Limited Announces Public Offering of Common Shares

05 Setembro 2017 - 5:17PM

Business Wire

Triton International Limited (NYSE:TRTN) (the “Company” or

“Triton”) today announced the commencement of a public offering of

$200,000,000 of the Company’s common shares, including $175,000,000

of common shares to be sold by the Company and $25,000,000 of

common shares to be sold by certain affiliates of Warburg Pincus

LLC (the “Selling Shareholders”). The underwriters have been

granted a 30-day option to purchase up to an additional $26,250,000

and $3,750,000 of common shares from the Company and the Selling

Shareholders, respectively. The offering is subject to market and

other conditions, and there can be no assurance as to whether or

when the offering may be completed, or as to the actual size or

terms of the offering.

The Company intends to use the net proceeds from this offering

for general corporate purposes, including the purchase of

containers. The Company will not receive any proceeds from the sale

of shares to be offered by the Selling Shareholders.

BofA Merrill Lynch, Wells Fargo Securities and RBC Capital

Markets are acting as joint book-running managers for the offering.

The offering will be made pursuant to an existing effective

registration statement, previously filed with the Securities and

Exchange Commission (the “SEC”). The offering will be made only by

means of a prospectus and a related prospectus supplement, copies

of which may be obtained on the SEC’s website at www.sec.gov.

Copies of the prospectus and prospectus supplement may also be

obtained from BofA Merrill Lynch, NC1-004-03-43, 200 North College

Street, 3rd floor, Charlotte NC 28255-0001, Attention: Prospectus

Department, or e-mail dg.prospectus_requests@baml.com; Wells Fargo

Securities, Attention: Equity Syndicate Department, 375 Park

Avenue, New York, NY, 10152, at (800) 326-5897 or email a request

to cmclientsupport@wellsfargo.com; and RBC Capital Markets, LLC,

200 Vesey Street, 8th Floor, New York, NY 10281-8098; Attention:

Equity Syndicate; Tel: (877) 822-4089; email:

equityprospectus@rbccm.com.

This press release shall not constitute an offer to sell or the

solicitation of any offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

Important Cautionary Information Regarding Forward-Looking

Statements

Certain statements in this release, other than purely historical

information, are “forward-looking statements” within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Statements

that include the words “expect,” “intend,” “plan,” “believe,”

“project,” “anticipate,” “will,” “may,” “would” and similar

statements of a future or forward-looking nature may be used to

identify forward-looking statements. All forward-looking statements

address matters that involve risks and uncertainties, many of which

are beyond Triton’s control. Accordingly, there are or will be

important factors that could cause actual results to differ

materially from those indicated in such statements and, therefore,

you should not place undue reliance on any such statements.

These factors include, without limitation, economic, business,

competitive, market and regulatory conditions and the following:

failure to realize the anticipated benefits of the combination of

Triton Container International Limited (“TCIL”) and TAL

International Group, Inc. (“TAL”), decreases in the demand for

leased containers; decreases in market leasing rates for

containers; difficulties in re-leasing containers after their

initial fixed-term leases; customers’ decisions to buy rather than

lease containers; dependence on a limited number of customers for a

substantial portion of its revenues; customer defaults; decreases

in the selling prices of used containers; extensive competition in

the container leasing industry; difficulties stemming from the

international nature of its businesses; decreases in demand for

international trade; disruption to its operations resulting from

political and economic policies of foreign countries, particularly

China; disruption to its operations from failures of or attacks on

its information technology systems; compliance with laws and

regulations related to security, anti-terrorism, environmental

protection and corruption; ability to obtain sufficient capital to

support its growth; restrictions on its businesses imposed by the

terms of its debt agreements; and other risks and uncertainties,

including those risk factors listed under the caption “Risk

Factors” in our Annual Report on Form 10-K for the year ended

December 31, 2016 filed with the SEC on March 17, 2017 and our

preliminary prospectus supplement and accompanying prospectus

related to the public offering filed with the SEC on September 5,

2017.

The foregoing list of important factors should not be construed

as exhaustive and should be read in conjunction with the other

cautionary statements that are included herein and elsewhere. Any

forward-looking statements made herein are qualified in their

entirety by these cautionary statements, and there can be no

assurance that the actual results or developments anticipated by us

will be realized or, even if substantially realized, that they will

have the expected consequences to, or effects on, Triton or its

businesses or operations. Except to the extent required by

applicable law, we undertake no obligation to update publicly or

revise any forward-looking statement, whether as a result of new

information, future developments or otherwise.

About Triton International Limited

Triton International Limited is the parent of Triton Container

International Limited and TAL International Group, Inc., each of

which merged under Triton on July 12, 2016 to create the world’s

largest lessor of intermodal freight containers. With a container

fleet of approximately 5.3 million twenty-foot equivalent units,

the Triton group’s global operations include acquisition, leasing,

re-leasing and subsequent sale of multiple types of intermodal

containers.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170905006483/en/

Investors:Triton International LimitedAndrew

Greenberg, 914-697-2900Senior Vice PresidentFinance & Investor

Relations

Triton (NYSE:TRTN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

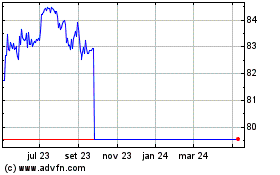

Triton (NYSE:TRTN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024