Current Report Filing (8-k)

18 Novembro 2022 - 10:15AM

Edgar (US Regulatory)

0001660734false00016607342022-11-182022-11-180001660734us-gaap:CommonStockMemberexch:XNYS2022-11-182022-11-180001660734us-gaap:SeriesAPreferredStockMemberexch:XNYS2022-11-182022-11-180001660734us-gaap:SeriesBPreferredStockMemberexch:XNYS2022-11-182022-11-180001660734exch:XNYSus-gaap:SeriesCPreferredStockMember2022-11-182022-11-180001660734us-gaap:SeriesDPreferredStockMemberexch:XNYS2022-11-182022-11-180001660734us-gaap:SeriesEPreferredStockMemberexch:XNYS2022-11-182022-11-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 18, 2022

TRITON INTERNATIONAL LIMITED

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

| | | | | | | | | | | | | | |

| Bermuda | | 001-37827 | | 98-1276572 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

Victoria Place, 5th Floor, 31 Victoria Street Hamilton HM 10, Bermuda

(Address of Principal Executive Offices, including Zip Code)

Telephone: (441) 294-8033

(Registrant's Telephone Number, Including Area Code)

Not applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares, $0.01 par value per share | TRTN | New York Stock Exchange |

| 8.50% Series A Cumulative Redeemable Perpetual Preference Shares | TRTN PRA | New York Stock Exchange |

| 8.00% Series B Cumulative Redeemable Perpetual Preference Shares | TRTN PRB | New York Stock Exchange |

| 7.375% Series C Cumulative Redeemable Perpetual Preference Shares | TRTN PRC | New York Stock Exchange |

| 6.875% Series D Cumulative Redeemable Perpetual Preference Shares | TRTN PRD | New York Stock Exchange |

| 5.75% Series E Cumulative Redeemable Perpetual Preference Shares | TRTN PRE | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 18, 2022, Triton International Limited (the "Company") announced that Michael Pearl has been appointed Chief Financial Officer of the Company, effective January 1, 2023. Mr. Pearl will succeed John Burns, who, as previously announced, will retire as Chief Financial Officer, effective December 31, 2022.

Mr. Pearl, age 46, has served as the Company's Senior Vice President, Treasurer since February 2022, and prior to that served as Vice President, Treasurer since July 2016. He joined the Company in July 2009 as Assistant Treasurer and Director, Business Development, and from April 2014 to July 2016 served as Assistant Treasurer and Head of Credit.

In connection with Mr. Pearl's appointment, he will receive the following compensation package, effective as of January 1, 2023: (i) a base salary of $415,000, (ii) an annual incentive target equal to 70% of base salary, and (iii) a long-term incentive plan annual equity award with a target value of $415,000, expected to be granted in February 2023 concurrently with the grant of long-term annual equity incentive awards to the Company’s other executive officers. Mr. Pearl will also be eligible for severance benefits under the Company’s Executive Severance Plan as a "Group 2 Participant," as defined in the Executive Severance Plan. In addition, the Company intends to enter into the Company's standard form of indemnification agreement for directors and certain officers (which was previously filed as Exhibit 3.1 to the Company's Current Report on Form 8-K filed on July 14, 2016) with Mr. Pearl.

There are no family relationships between Mr. Pearl and any director or executive officer of the Company or any transactions in which Mr. Pearl has an interest requiring disclosure under Item 404(a) of Regulation S-K.

In connection with Mr. Burns' retirement, in recognition of his valuable and active contributions in facilitating a smooth succession process and transition of his responsibilities prior to his retirement, the Company will provide him with the compensation and benefits to which he would have been entitled under the Company’s Executive Severance Plan in the event of a termination without "Cause," as defined in the Executive Severance Plan, subject to his execution and non-revocation of a retirement agreement that includes a general release of claims, as well as other customary separation provisions. Mr. Burns will continue to be subject to certain restrictive covenants following his retirement, including non-competition, non-solicitation, confidentiality and non-disparagement provisions. Mr. Burns' outstanding equity incentive plan awards will vest upon his retirement, with the exception of his performance-based restricted shares granted in 2022, which will vest following the end of the three-year performance period, subject to the achievement of the applicable performance targets for those awards. Additionally, the Company expects to enter into a consulting agreement with Mr. Burns pursuant to which he will provide ongoing advisory services to support the transition to his successor for a period of one year after his retirement for a fee of $42,900 per month.

Item 7.01. Regulation FD Disclosure.

On November 18, 2022, the Company issued a press release announcing Mr. Pearl’s appointment, which is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description of Exhibit |

| |

| |

| 104 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | Triton International Limited |

| | | |

| Date: November 18, 2022 | | By: | /s/ Carla L. Heiss |

| | | Name: | Carla L. Heiss |

| | | Title: | Senior Vice President, General Counsel and Secretary |

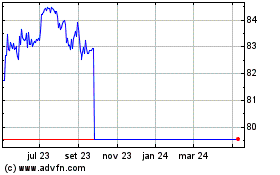

Triton (NYSE:TRTN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

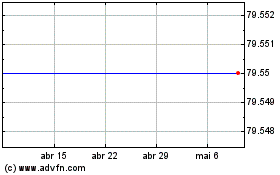

Triton (NYSE:TRTN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024