Notification That Annual Report Will Be Submitted Late (nt 10-k)

16 Março 2023 - 5:59PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 12b-25 | | |

SEC FILE NUMBER

1-11657 |

CUSIP NUMBER

899896104 |

NOTIFICATION OF LATE FILING

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Check One) | ☒ | Form 10-K | ☐ | Form 20-F | ☐ | Form 11-K | ☐ | Form 10-Q | ☐ | Form 10-D | ☐ | Form N-CEN | ☐ | Form N-CSR |

| For Period Ended: December 31, 2022 |

| ☐ | Transition Report on Form 10-K |

| ☐ | Transition Report on Form 20-F |

| ☐ | Transition Report on Form 11-K |

| ☐ | Transition Report on Form 10-Q |

For the Transitional Period Ended: ________________________________________

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates: ______________________

| | |

| PART I - REGISTRANT INFORMATION |

|

| Tupperware Brands Corporation |

| Full Name of Registrant |

|

| Not applicable |

| Former Name if Applicable |

|

| 14901 South Orange Blossom Trail |

Address of Principal Executive Office (Street and Number) |

|

| Orlando, Florida 32837 |

| City, State and Zip Code |

|

PART II - RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| | | | | | | | |

| ☐ | (a) | The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense; |

| (b) | The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, 11-K Form N-CEN or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report of transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| (c) | The accountant's statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III - NARRATIVE

State below in reasonable detail the reasons why Forms 10-K, 20-F, 11-K, 10-Q, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period. (Attach extra sheets if needed)

Tupperware Brands Corporation (the “Company”) is unable to file its Annual Report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K”) by the prescribed due date, without unreasonable effort or expense because it requires additional time to complete the Form 10-K, including the restatement of certain of its previously issued financial statements as described below.

On March 12, 2023, the Audit and Finance Committee of the Board of Directors of the Company, upon recommendation by the management of the Company and in consultation with PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, concluded that the Company’s previously issued consolidated financial statements as of and for the years ended December 26, 2020 and December 25, 2021, and the previously issued unaudited interim condensed consolidated financial statements in 2021 and the first three quarters of 2022 (collectively, the “Relevant Periods”), as well as the associated press releases, were materially misstated and should be restated and no longer be relied upon because of the identification of material prior period misstatements.

To correct for such material misstatements, the Company will restate its consolidated financial statements for the years ended December 26, 2020 and December 25, 2021, in connection with the filing of its Form 10-K. Restated financial information as of and for the impacted 2022 and 2021 quarterly and year-to-date periods will be included in the 2022 Form 10-K. The Company will effect the restatement of its 2022 unaudited condensed consolidated quarterly financial statements in connection with the future filings of its Quarterly Reports on Form 10-Q in 2023.

To date, the misstatements that originated in periods prior to 2020 are expected to result in a $23-28 million reduction to the previously reported 2020 beginning retained earnings, with such reduction primarily resulting from misstatements related to income taxes. The Company also currently estimates that the net impact of the prior period misstatements on the restated financial statements will result in an increase in net income from continuing operations for the year ended December 26, 2020, and a decrease in net income from continuing operations for the year ended December 31, 2021 and for the 2022 unaudited interim periods. However, such estimates are preliminary and are subject to change as the Company completes its financial close process, and such changes could be significant.

The Company also has determined that material weaknesses existed in the Company’s internal control over financial reporting as of December 31, 2022 in the following areas: The Company did not design and maintain effective controls in response to the risks of material misstatement. Specifically, changes to existing controls or the implementation of new controls were not sufficient to respond to changes to the risks of material misstatement in financial reporting. This material weakness contributed to the following material weaknesses: (i) accounting for the completeness, occurrence, accuracy and presentation of income taxes, including the income tax provision and related income tax assets and liabilities; and (ii) completeness, accuracy and presentation of right of use assets and lease liabilities. There can be no assurance that additional material weaknesses will not be identified as the Company completes its financial close process.

Due to the time and effort required to complete the preparation of the restated consolidated financial statements for the Relevant Periods, the Company was unable, without unreasonable effort or expense, to complete and file the Form 10-K within the prescribed time period. The Company is endeavoring to complete its financial close process and Form 10-K filing as promptly as possible; however, there can be no assurance that the Company will be able to file the Form 10-K within the extension period.

Forward-Looking Statements

This Form 12b-25 includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including with respect to the timing of the restatement of the Company’s consolidated financial statements for the Relevant Periods and the Company’s ability to file the 2022 Form 10-K during the extension period. Such forward-looking statements are based on assumptions about many important factors, including the following, which could cause actual results to differ materially from those in the forward-looking statements: whether the Company will identify additional errors in previously issued financial statements and other risks identified in the Company’s most recent filing on Form 10-K and other SEC filings, all of which are available on the Company’s website. The Company does not undertake to update its forward-looking statements unless otherwise required by the federal securities laws.

PART IV - OTHER INFORMATION

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Name and telephone number of person to contact in regard to this notification |

| Mariela Matute | | 407 | | 826-8899 | | | | |

| (Name) | | (Area Code) | | (Telephone Number) | | | | |

| | | | | | | | | |

| (2) | Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) |

| been filed? If answer is no, identify report(s). | ☒ | Yes | ☐ | No |

| |

| (3) | Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected |

| by the earnings statements to be included in the subject report or portion thereof? | ☒ | Yes | ☐ | No |

| If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The Company expects that its Form 10-K will reflect a significant decline in its results of operations for the year ended December 31, 2022 as compared to the year ended December 25, 2021. There have been additional errors identified subsequent to the release of the preliminary results included in the Company’s Form 8-K/A furnished on March 2, 2023. The Company’s Form 10-K is not yet complete and the quantification of all errors is not possible at the time of the filing of this Form 12b-25. |

| | | | | | | | | | | | | | |

| Tupperware Brands Corporation | |

| (Name of Registrant as Specified in Charter) | |

| | | | |

| has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | |

| Date: | March 16, 2023 | By: | /s/ Mariela Matute |

| | | | Mariela Matute |

| | | | Chief Financial Officer |

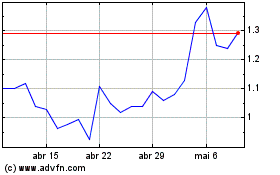

Tupperware Brands (NYSE:TUP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Tupperware Brands (NYSE:TUP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024