USA Compression Partners Provides Update on 2023 K-1 Availability

21 Fevereiro 2024 - 6:38PM

Business Wire

USA Compression Partners, LP (NYSE: USAC) (“USA Compression”)

today provided an update on the expected availability of the

partnership’s 2023 Investor Tax Packages including Schedule K-1 for

its common unitholders.

Historically, USA Compression’s Investor Tax Packages have been

available by the end of February for the preceding tax year;

however, the timing of the availability of USA Compression’s 2023

Investor Tax Packages is dependent upon actions of the U.S.

Congress and the Biden administration with regard to the passage,

or not, of the Tax Relief for American Families and Workers Act of

2024 (referred to as “H.R. 7024”). H.R. 7024 was passed by the

House of Representatives on January 31, 2024 and is now among the

legislative items that the U.S. Senate may or may not consider

after it reconvenes on Monday, February 26, 2024 from its current

two-week recess. This legislation includes changes in tax law which

would be applied retroactively to the 2023 tax year. As passed by

the House of Representatives, certain provisions in H.R. 7024 would

lower USA Compression’s taxable income for 2023 compared to

existing tax law.

H.R. 7024 is subject to the legislative process, which may

include amendments introduced by the Senate and thus reconciliation

of this bill between the House of Representatives and the Senate

and subject to the ultimate approval by the President.

Due to the ongoing consideration of H.R. 7024 by Congress and

thus the uncertainty of the ultimate tax laws applicable to tax

year 2023, USA Compression currently expects that its 2023 Investor

Tax Packages, including Schedule K-1 and all information to

fiduciaries for common units owned in tax exempt accounts, will be

delayed in comparison to previous years and will be available by

early March. Once the applicable tax laws for 2023 are known and

finalized by the passage, or not, of H.R. 7024, USA Compression

will provide an update on the availability of the 2023 Investor Tax

Packages. While these matters are beyond our control, we apologize

for any inconvenience the timing of this pending tax legislation

may cause our partners.

About USA Compression Partners, LP

USA Compression Partners, LP is one of the nation’s largest

independent providers of natural gas compression services in terms

of total compression fleet horsepower. USA Compression partners

with a broad customer base composed of producers, processors,

gatherers, and transporters of natural gas and crude oil. USA

Compression focuses on providing midstream natural gas compression

services to infrastructure applications primarily in high-volume

gathering systems, processing facilities, and transportation

applications. More information is available at

usacompression.com.

FORWARD-LOOKING STATEMENTS

Statements in this press release may be forward-looking

statements as defined under federal law. These forward-looking

statements rely on a number of assumptions concerning future events

and are subject to a number of uncertainties and factors, many of

which are outside the control of USA Compression, and a variety of

risks that could cause results to differ materially from those

expected by management of USA Compression. USA Compression

undertakes no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events, or changes to future operating results over

time.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221043744/en/

USA Compression Partners, LP Nelson Larkin, Tax Director

(512) 369-1604 tax@usacompression.com

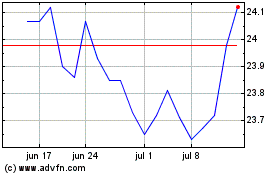

USA Compression Partners (NYSE:USAC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

USA Compression Partners (NYSE:USAC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025