GE and YPF Secure Financing for Two Fastpower Projects in Argentina

05 Julho 2017 - 12:39PM

Business Wire

General Electric (NYSE:GE), through its energy investing unit GE

Energy Financial Services, and YPF Energía Eléctrica, a wholly

owned subsidiary of YPF S.A. (NYSE:YPF), have secured an

approximate $220 million project financing for two jointly owned

thermal power projects in Argentina, the 267-MW Tucumán and 107-MW

Loma Campana II projects. Citi, Credit Suisse and Export

Development Canada (EDC) jointly led the financing, which represent

the first power plant project financing in Argentina in almost 20

years.

Tucumán and Loma Campana II are both more than halfway through

construction. The Tucumán project, located in Tucumán province,

will be powered by a GE 9F.04 gas turbine and will begin commercial

operations in February 2018. The Loma Compana II project, located

in Neuquén province, will be powered by a GE LMS100 gas turbine and

will begin commercial operations in December 2017. GE is the EPC

contractor for both projects.

Once operational, each project will benefit from a 10-year power

purchase agreement (PPA) with the state-run wholesale electricity

market administrator Compañía Administradora del Mercado Mayorista

Eléctrico SA (CAMMESA). The PPAs were awarded in 2016 as part of

the Government of Argentina’s ‘Fast Power’ tender. The tender was

the first of a series aimed at displacing expensive and inefficient

generating capacity, and quickly increasing the country’s

electricity reserve margin.

In response to Argentina’s energy environment, President

Mauricio Macri has enacted several reforms and implemented new

energy policies aimed at increasing electricity supply in the short

term, and changing the country’s energy mix in the long term. The

significant capital requirements for the ongoing and upcoming power

tenders are likely to exceed the appetite of local lenders and draw

participation by international lenders seeking to return to

Argentina, and revive the market for non-recourse project

finance.

“This project finance is an important milestone for YPF as it

completes the funding of all our power projects under construction,

therefore proving the ability of YPF Energía Eléctrica to continue

to grow with its own balance sheet,” said Daniel González, YPF´s

Chief Financial Officer.

GE Energy Financial Services’ Global Capital Advisory team,

which sources financing from third parties including export credit

agencies, development finance institutions and other equity

providers and commercial banks, led the debt raise for Tucumán and

Loma Campana on behalf of the sponsors.

“GE’s technology, global reach and capital expertise enabled a

successful outcome for Argentina’s initial fast power tender and

for an important GE customer, YPF,” said Bob Psaradellis, managing

director, Global Capital Advisory, GE Energy Financial

Services.

Daniel Castagnola, managing director, Latin America, GE Energy

Financial Services, added, “There is a strong pipeline of projects

in Argentina and Latin America broadly and we look forward to

partnering with more international project finance lenders in the

region.”

As part of the Government of Argentina’s ‘Fast Power’ tender in

2016, GE provided equipment to seven projects totaling 896

megawatts comprising 9F, LMS100 and TM2500 gas turbines.

About YPF

YPF is the leading energy company of Argentina, producing 43% of

the total oil and gas in the country and supplying 56% of the fuel

markets through a network of 1500 gas stations and other assets.

YPF is leader in the production of unconventional resources. It is

an integrated energy company that generates a large offering

consisting of natural gas, electricity, fuels, petrochemicals,

lubricants and products for agriculture, among others.

www.ypf.com

About GE Energy Financial Services

A strategic GE Capital business, GE Energy Financial Services is

a global energy investor that provides financial solutions that

help meet the world’s energy needs. Drawing on its technical

know-how, financial strength and strong risk management, GE Energy

Financial Services invests in long-lived and capital intensive

projects and companies. The firm has 35+ years of experience

managing energy assets through multiple economic cycles, and a

global portfolio that spans conventional and renewable power, and

oil and gas infrastructure projects. More information:

www.geenergyfinancialservices.com; Twitter

@GEEnergyFinServ.

About GE

GE (NYSE:GE) is the world’s Digital Industrial Company,

transforming industry with software-defined machines and solutions

that are connected, responsive and predictive. GE is organized

around a global exchange of knowledge, the "GE Store," through

which each business shares and accesses the same technology,

markets, structure and intellect. Each invention further fuels

innovation and application across our industrial sectors. With

people, services, technology and scale, GE delivers better outcomes

for customers by speaking the language of industry. www.ge.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170705005672/en/

Media:GE Energy Financial ServicesJaclyn Cochrane,

203-961-2934jaclyn.cochrane@ge.com

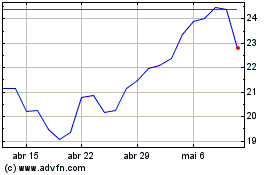

YPF Sociedad Anonima (NYSE:YPF)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

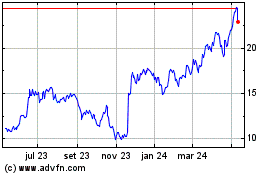

YPF Sociedad Anonima (NYSE:YPF)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025