Allied Properties Real Estate Investment Trust Announces Acquisition of Strategic Infill Properties in Montreal and Calgary a...

20 Janeiro 2014 - 7:50PM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) announced today that it has entered into

agreements to purchase the following properties for $69.2 million:

Total Office Retail Parking

Address GLA GLA GLA Spaces

----------------------------------------------------------------------------

85 Rue St. Paul, Montreal 79,778 79,778 - 25

The Pilkington Building, 402 - 11th Avenue

S.E., Calgary 48,223 48,223 - 44

The Biscuit Block, 438 - 11th Avenue S.E.,

Calgary 54,073 54,073 - 39

----------------------------------------------------------------------------

182,074 182,074 - 108

----------------------------------------------------------------------------

"We continue to find high-quality infill properties that fit squarely within our

investment parameters," said Michael Emory, President & CEO. "In addition to

being immediately accretive, each of these properties is close to one or more of

our existing properties. The Calgary properties form nearly half a city block in

the heart of the Warehouse District."

Allied also announced the establishment of a fourth intensification joint

venture with RioCan REIT through the acquisition of an undivided 50% interest in

491 College Street and 289 Palmerston Avenue in Toronto. "This is our fourth

intensification JV with RioCan," said Mr. Emory. "It will enable both of us to

build on the collaborative relationship that has been developed through the

College & Manning JV, the King & Portland JV and the Downtown West JV, all of

which are progressing well."

The Montreal Property

Located on the northeast corner of Rue St. Paul and Rue St. Sulpice, this

property is comprised of 79,778 square feet of GLA, all of which is leased to

tenants consistent in character and quality with Allied's tenant base. Built in

1861, the building was renovated and upgraded in 2001.

The Pilkington Building, Calgary

Located on northeast corner of 11th Avenue S.E. and 3th Street S.E., this

property is comprised of 48,223 square feet of GLA, all of which is leased to

tenants consistent in character and quality with Allied's tenant base, and 44

surface parking spaces. Built in 1913, the building was renovated and upgraded

in 2012.

The Biscuit Block, Calgary

Located on northwest corner of 11th Avenue S.E. and 4th Street S.E., this

property is comprised of 54,073 square feet of GLA, all of which is leased to

tenants consistent in character and quality with Allied's tenant base, nine

surface parking spaces and 30 underground parking spaces. Built in 1912, the

building was renovated and upgraded in 2013.

Closing and Financing

The acquisitions in Montreal and Calgary are expected to close in February and

March of 2014, subject to customary conditions. The purchase price for the three

properties represents a capitalization rate of approximately 6.8% applied to the

current annual net operating income ("NOI"). The properties will be free and

clear of mortgage financing immediately prior closing. Allied plans to place

mortgage financing on the properties on or soon after closing and will fund the

equity component of the acquisitions with cash-on-hand.

College & Palmerston Joint Venture, Toronto

491 College Street and 289 Palmerston Avenue are comprised of 15,651 square feet

of land on the south side of College and the east side of Palmerston. The

College portion has 90 feet of frontage and includes a heritage building with

just over 10,000 square feet of GLA. The Palmerston portion is separated from

the College portion by a public laneway and is currently used for ancillary

parking. The property was acquired by Allied and RioCan on a 50/50 basis in late

December of 2013 for $7.7 million without the use of mortgage financing. While

currently operating the property for rental purposes, the joint venture intends

to intensify it over time by creating a mixed-use office, retail and residential

complex, similar in concept to the one contemplated by the College & Manning JV.

Cautionary Statements

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The actual results and

performance of Allied discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ materially from

expectations include, among other things, general economic and market factors,

competition, changes in government regulations and the factors described under

"Risk Factors" in Allied's Annual Information Form, which is available at

www.sedar.com. These cautionary statements qualify all forward-looking

statements attributable to Allied and persons acting on Allied's behalf. Unless

otherwise stated, all forward-looking statements speak only as of the date of

this press release and the parties have no obligation to update such statements.

"Capitalization rate" is not a measure recognized under International Financial

Reporting Standards ("IFRS") and does not have any standardized meaning

prescribed by IFRS. Capitalization rate is presented in this press release

because management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the properties being acquired. Capitalization

rate, as computed by Allied, may differ from similar computations as reported by

other similar organizations and, accordingly, may not be comparable to

capitalization rate reported by such organizations.

NOI is not a measure recognized under IFRS and does not have any standardized

meaning prescribed by IFRS. NOI is presented in this press release because

management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the property being acquired. NOI, as computed

by Allied, may differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to NOI reported by such

organizations.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

FOR FURTHER INFORMATION PLEASE CONTACT:

Allied Properties Real Estate Investment

Michael R. Emory

President and Chief Executive Officer

(416) 977-0643

memory@alliedreit.com

www.alliedreit.com

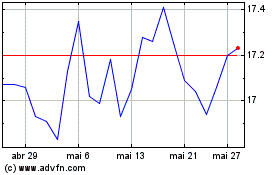

Allied Properties Real E... (TSX:AP.UN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Allied Properties Real E... (TSX:AP.UN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024