Belo Sun Announces a Preliminary Economic Assessment on a Staged

Development Approach for Its Volta Grande Gold Project, Brazil

TORONTO, ONTARIO--(Marketwired - Feb 20, 2014) - Belo Sun Mining

Corp. (TSX:BSX) (the "Company" or "Belo Sun") has completed a

Preliminary Economic Assessment (PEA) of a staged development

approach based on the updated mineral resource (see press release

dated October 3rd, 2013), for its 100%-owned Volta Grande gold

project in Para State, Brazil.

The PEA contemplates the construction of a 3.0 million

tonne/year processing facility for the first seven years of

production and an expansion of the facility to a nominal 6.0

million tonne/year processing facility from Year 9 to the end of

mine life. Higher grade material will be processed in the initial

years of mine life with lower grade material stockpiled to expedite

the project payback. Mineral resources that are not mineral

reserves do not have demonstrated economic viability.

|

Preliminary Economic Assessment |

|

|

|

|

Project Data |

Units |

Years 1-6 |

L.O.M |

|

|

|

|

|

|

Life of Mine |

Years |

|

21 |

|

Average Annual Mining Rate |

Mtpa |

24.8 |

27.3 |

|

Annual Mill Throughput |

Mtpa |

3.0 |

4.9 |

|

Metallurgical Recovery |

% |

94.1% |

92.8% |

|

Average Annual Gold Production |

oz recovered |

147,900 |

167,309 |

|

Average Waste to Mill Feed Strip Ratio |

Waste:Feed |

6.32 |

4.30 |

|

Average Waste to Mill Feed Strip Ratio |

Waste:(Feed+Stockpile) |

3.31 |

4.30 |

|

Average Feed Grade (diluted) |

grams/tonne |

1.66 |

1.14 |

|

Mine Operating Costs |

|

|

|

|

Per Feed Tonne |

|

|

|

|

Mining |

US$/tonne feed |

19.27 |

13.25 |

|

Process |

US$/tonne feed |

9.13 |

8.64 |

|

General and Administration |

US$/tonne feed |

3.49 |

2.22 |

|

Total Operating Cost |

US$/tonne feed |

31.89 |

24.11 |

|

Total Operating Cost including Royalties |

US$/tonne feed |

32.53 |

24.55 |

|

|

|

|

|

|

Per Gold Ounce |

|

|

|

|

Mining |

US$/oz gold recovered |

383 |

373 |

|

Process |

US$/oz gold recovered |

182 |

279 |

|

General and Administration |

US$/oz gold recovered |

69 |

63 |

|

Total Operating Cost |

US$/oz gold recovered |

634 |

715 |

|

Total Operating Cost including Royalties |

US$/oz gold recovered |

647 |

727 |

|

|

|

|

|

|

CAPITAL COST (including tax) |

|

Pre-Production |

LOM |

|

Initial CAPEX |

US$ ('000's) |

328.7 |

|

|

Sustaining CAPEX |

US$ ('000's) |

|

104.8 |

|

Expansion CAPEX |

US$ ('000's) |

|

203.6 |

Mineral Resources

For the PEA, Belo Sun used the October 2013 mineral resource

estimate (see press release dated October 3rd, 2013). Mineral

resources that are not mineral reserves do not have demonstrated

economic viability. External mining dilution is calculated at 12.3%

at zero grade. The diluted life of mine mill feed grade will

average 1.14 g/t gold with an average cutoff of 0.48 g/t gold.

Based on current metallurgical testing, the average gold recovery

is expected to be 92.8% overall for the life of mine. The ultimate

pit design was based on an optimised pit shell using a US$ 1020 /oz

gold price. Internal phases were designed within that ultimate

shell. For the purposes of the PEA, only measured and indicated resources

were included in the PEA mine design.

| VOLTA GRANDE RESOURCES ESTIMATE (OCT 2013) |

MEASURED |

INDICATED |

MEASURED + INDICATED |

INFERRED |

|

|

|

|

|

|

| Ouro

Verde Pit Constrained |

Tonnes ('000s) |

24,036 |

20,087 |

44,123 |

22,602 |

|

Grade

(g/t Au) |

1.78 |

1.61 |

1.70 |

1.48 |

|

Ounces ('000s) |

1,379 |

1,037 |

2,416 |

1,079 |

|

|

|

|

|

|

| Grota

Seca Pit Constrained |

Tonnes ('000s) |

31,384 |

15,671 |

47,055 |

18,265 |

|

Grade

(g/t Au) |

1.61 |

1.56 |

1.59 |

1.59 |

|

Ounces ('000s) |

1,620 |

788 |

2,408 |

932 |

|

|

|

|

|

|

|

| Total

Pit Constrained |

Tonnes ('000s) |

55,420 |

35,758 |

91,178 |

40,867 |

| (0.5

g/t Au cut-off) |

Grade

(g/t Au) |

1.68 |

1.59 |

1.65 |

1.53 |

|

|

Ounces ('000s) |

2,999 |

1,825 |

4,824 |

2,011 |

| (1) Audited mineral resource statement prepared by SRK

Consulting (Canada) Inc. The effective date of the audited mineral

resource statement is October 1, 2013. Mineral resources are not

mineral reserves and have not demonstrated economic viability. All

figures have been rounded to reflect the relative accuracy of the

estimates. |

Open pit mineral resources are reported at a cut-off grade of

0.5 g/t gold. Cut-off grades are based on a number of parameters

and assumptions including gold price of US$1,400 per troy ounce,

94% metallurgical gold recovery for weathered and unweathered rock,

open pit mining costs of US$1.41/tonne, process costs of US$11.98/

tonne, General and Administrative costs of US$2.89/tonne and

selling costs (refining, transport, insurance and environment) of

US$ 13.82 per troy ounce.

Mineral resources are constrained within low, medium and high

grade domains delineated from drilling data within Ouro Verde and

Grota Seca.

The quantity and grade of the reported inferred mineral

resources are uncertain in nature and there has been insufficient

exploration to define the inferred mineral resources as indicated

or measured mineral resources and it is uncertain if further

exploration will result in upgrading them to an indicated or

measured mineral resource category. The mineral resources have been

classified according to the Canadian Institute of Mining,

Metallurgy and Petroleum Definition Standards for Mineral Resources

and Mineral Reserves (November 2010).

SRK Consulting (Canada) Inc. is not aware of any legal,

political, environmental or other risks that could materially

affect the potential development of the mineral resources.

Mining

The mine design, mining costs and mining fleet requirements for

the Project were prepared by AGP Mining Consultants Inc. The PEA

contemplates conventional open pit mining utilizing owner operated

trucks and loaders to provide the initial 3.0 million tonnes per

year of mill feed. Backhoe support is provided in each of the pits

for assistance in grade control. Plant throughput will ramp up from

3.0 million tonnes to 6.0 million tonnes per year starting in Year

8 and reaching full production in Year 9. The ramp up coincides

with planned mining equipment replacement. The mine is designed as

a two pit operation with multiple phases in each pit mined over 21

years, plus a year of pre-production.

The average waste to mill feed strip ratio for the life of the

mine is estimated to be 4.3:1. Bench heights of 10 meters will be

mined initially using 14.5 m3 loaders with 97 tonne haul trucks.

This provides the greatest flexibility for grade control in the pit

and flexibility of operations while maintaining reasonable

operating costs and production capability. When the plant

throughput increases, the fleet size will also be increased so

production can be maintained in a cost effective manner while not

sacrificing grade control. The smaller 97 tonne trucks will be

replaced with larger trucks carrying 134 tonnes of material. The

smaller loaders will be replaced with 19 m3 loaders and 22 m3

shovels. At both production levels, grade control support will be

provided with backhoes and reverse circulation drilling.

Mill feed grade has been increased in the initial years using an

elevated cutoff to assist with project payback. The lower grade

material will be stockpiled near the primary crushing plant and fed

to the plant in the later years of the project. Waste rock will be

hauled to dedicated waste management facilities adjacent to the

open pits. Saprolite feed material will be stockpiled and up to 10%

will be fed to the plant annually.

Metallurgy

Based on recent test work completed at SGS Chile, the

run-of-mine feed material from the Ouro Verde and Grota Seca open

pits feed material is amenable to conventional crush, grind,

gravity concentration, CIP / CIL flow sheet. Test work results

indicate that 40% to 50% of the gold is expected to be recovered in

a gravity concentrate. Overall gold recovery is estimated between

92% and 94% depending on the head grade.

Other test work completed at SGS Chile included Bond work

indices, JK drop weight and SMC tests. These results were used to

model the Volta Grande grinding circuit and have confirmed that the

feed material is amenable to a SAG / ball mill grinding

configuration.

Infrastructure

The Project is located in Para State in central Brazil

approximately 60 kilometres south-east of the city of Altamira. The

climate at Volta Grande is tropical, with a rainy season from

January to April and a dry season extending from May to December.

The mean temperature is nearly the same (25°C to 30°C) throughout

the year. The relative humidity ranges from about 65% to 85%.

Access to site will be via an existing 60 kilometer upgraded gravel

road. Power for the project will originate from Belo Monte's

Pimental distribution station requiring the construction of a 20

kilometer 230 kV high tension power line. Water sufficient to meet

mining needs is readily available at the Project site.

In addition to the mine and process facilities, a camp will be

established at the project site to house workers on a shift

rotation basis. Provision will be made for the storage of critical

supplies on site. Mineral resources that are not mineral reserves

do not have demonstrated economic viability

|

|

Capital Cost |

|

Pre Production Costs |

(US$ millions) |

|

Open Pit |

$12.6 |

|

Processing |

$114.4 |

|

Infrastructure |

$76.0 |

|

Indirects, Contingency, Owners Costs |

$97.3 |

|

Subtotal |

$300.3 |

|

Tax |

$28.4 |

|

Total |

$328.7 |

|

|

|

|

|

|

Post Tax Evaluation |

Units |

Base Case |

Sensitivity |

|

Gold Price |

US$ Ounce |

1300 |

1450 |

|

NPV 0% |

US$ Million |

1,062 |

1,472 |

|

NPV 5% |

US$ Million |

418 |

637 |

|

IRR |

% |

16.1 |

21.1 |

|

Payback |

years |

4.2 |

3.3 |

Mark Eaton, President and CEO of the Company, commented, "Belo

Sun has completed this study of a staged development approach in

order to respond to the current financial environment for large

capital gold projects and mitigate against some of the start-up

risks of large tonnage projects. With the positive results of this

PEA we anticipate using a staged development approach for the

execution of the project."

Qualified Persons

The scientific and technical information contained in this news

release pertaining to the Project has been reviewed and approved by

the following Qualified Persons under NI 43-101 who consent to the

inclusion of their names in this release: Dr. Jean-Francois

Couture, PGeo and Dr. Oy Leuangthong, P.Eng (Mineral Resource), of

SRK Consulting (Canada) Inc., Gordon Zurowski, P.Eng (Mining and

Author Technical Report), and Lyn Jones, P. Eng (Metallurgy and

Process), of AGP Mining Consultants Inc, each of whom are

independent of Belo Sun.

The technical report will be filed on SEDAR within 45 days of

the date of this press release. The Company's previous

prefeasibility study entitled "Pre-feasibility Study on the Volta

Grande Project, Pará, Brazil, NI 43-101 Technical Report" dated

June 21, 2013 is no longer current and should not be relied

upon.

Forward-Looking Information

This press release contains "forward-looking information"

within the meaning of applicable Canadian securities legislation.

Forward-looking information includes, without limitation, mineral

resource estimates regarding t the conclusions of the PEA and the

projected economics of the project, the Company's understanding of

the project; statements with respect to the development potential

and timetable of the project; production forecast;, life of mine

estimates; the estimation of mineral resources; realization of

mineral resource estimates; the timing and amount of estimated

future exploration; costs of future activities; capital and

operating expenditures; success of exploration activities; currency

exchange rates; government regulation of mining operations; and

environmental risks. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including risks

inherent in the mining industry and risks described in the public

disclosure of the Company which is available under the profile of

the Company on SEDAR at www.sedar.com and on the Company's website

at www.belosun.com. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

Belo Sun Mining Corp.Mark EatonPresident and CEO(416)

309-2137

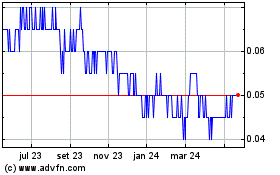

Belo Sun Mining (TSX:BSX)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

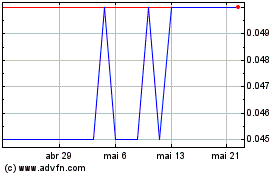

Belo Sun Mining (TSX:BSX)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025