Belo Sun Focuses on High Grade Zones and Provides Company Update

08 Maio 2014 - 6:15PM

Marketwired Canada

Belo Sun Mining Corp. (TSX:BSX) (the "Company" or "Belo Sun") has commenced a

new drill program, with two rigs on its Grota Seca and Ouro Verde deposits. In

February the Company received its Preliminary Licence (LP) approving its

Environmental Impact Assessment (EIA), in respect of the Company's 100%-owned

Volta Grande gold project in Para State, Brazil (the "Project"). The LP is the

key license in the development process and incorporates the results of Public

Hearings and subsequent public input.

The drill program will focus on four high-grade areas in the Ouro Verde and

Grota Seca deposits, as identified in the mineral resource estimate completed in

October 2013 (please refer to the press release of the Company issued on October

3, 2013). The planned drill campaign will total approximately 2000 metres and is

expected to provide additional details on these near surface high grade areas of

the deposit with a view to improving the overall project economics.

The Company received its Preliminary License ("LP") in February this year

approving the Environmental and Social Assessment for the Project (see press

release dated December 2, 2013). The LP was issued with conditions related to

training and capacity building, environmental monitoring, social education and

development of local industries.

Belo Sun is currently building a training centre in the local village and will

commence training and capacity building workshops in conjunction with Federal

and Para State agencies.

The Company has commenced a study on the indigenous peoples in the region as

part of the conditions of its LP. This study will involve consultation with the

indigenous tribes and other potential indigenous stakeholders in the region.

The Company continues to advance the Project and has requested proposals for

Engineering, Procurement and Construction Management services (EPCM) to move the

Project towards the execution phase. It is expected that this EPCM work will be

awarded during the month of June.

Mark Eaton, President and CEO of the Company, commented, "Belo Sun believes that

this project is one of the premier gold projects in the world and as such we

will continue to move towards production."

The current mineral resource estimate(1), as provided below, for the project

contains:

-- Measured and Indicated Pit Constrained Mineral Resources of 5.1 Million

Ounces of gold at an average grade of 1.68 g/t Au, which represents an

increase of approximately 10% in these resource categories (from 4.7

Million Ounces) compared with the previous April 2013 update; and

-- Inferred Pit Constrained Mineral Resources of 2.4 Million Ounces of gold

at an average grade of 1.69g/t Au.

VOLTA GRANDE RESOURCES ESTIMATE MEASURED +

(SEP 2013) MEASURED INDICATED INDICATED INFERRED

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Ouro Verde Pit

Constrained Tonnes ('000s) 24,036 20,087 44,123 22,602

Grade (g/t Au) 1.78 1.61 1.70 1.48

Ounces ('000s) 1,379 1,037 2,416 1,079

Grota Seca Pit

Constrained Tonnes ('000s) 31,384 15,671 47,055 18,265

Grade (g/t Au) 1.61 1.56 1.59 1.59

Ounces ('000s) 1,620 788 2,408 932

South Block Pit

Constrained Tonnes ('000s) 2,503 2,503 2,921

Grade (g/t Au) 3.06 3.06 3.94

Ounces ('000s) 246 246 370

----------------------------------------------------------------------------

Total Pit Constrained Tonnes ('000s) 55,420 38,261 93,682 43,788

(0.5 g/t Au cut-off) Grade (g/t Au) 1.68 1.68 1.68 1.69

Ounces ('000s) 2,999 2,072 5,070 2,381

----------------------------------------------------------------------------

Ouro Verde

Underground Tonnes ('000s) 64 64 831

Grade (g/t Au) 2.66 2.66 3.13

Ounces ('000s) 5 5 84

Grota Seca

Underground Tonnes ('000s) 53 53 695

Grade (g/t Au) 2.88 2.88 3.38

Ounces ('000s) 5 5 75

South Block

Underground Tonnes ('000s) 24 24 193

Grade (g/t Au) 4.24 4.24 4.05

Ounces ('000s) 3 3 25

----------------------------------------------------------------------------

Total Underground Tonnes ('000s) 140 140 1,719

(2.0 g/t Au cut-off) Grade (g/t Au) 3.01 3.01 3.33

Ounces ('000s) 14 14 184

----------------------------------------------------------------------------

Tonnes ('000s) 55,420 38,402 93,822 45,507

TOTAL Grade (g/t Au) 1.68 1.69 1.69 1.75

Ounces ('000s) 2,999 2,085 5,084 2,565

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Audited mineral resource statement prepared by SRK Consulting (Canada)

Inc. The effective date of the audited mineral resource statement is October

1, 2013. Mineral resources are not mineral reserves and have not

demonstrated economic viability. All figures have been rounded to reflect

the relative accuracy of the estimates.

Open pit mineral resources are reported at a cut-off grade of 0.5 g/t gold,

and underground mineral resources are reported at a cut- off grade of 2.0

g/t gold. Cut-off grades are based on a number of parameters and assumptions

including gold price of US$1,400 per troy ounce, 94% metallurgical gold

recovery for weathered and unweathered rock, open pit mining costs of

US$1.41/tonne, process costs of US$11.98/ tonne, General and Administrative

costs of US$2.89/tonne and selling costs (refining, transport, insurance and

environment) of US$13.82 per troy ounce.

Mineral resources are constrained within low, medium and high grade domains

delineated from drilling data within Ouro Verde and Grota Seca

The quantity and grade of the reported inferred mineral resources are

uncertain in nature and there has been insufficient exploration to define

the inferred mineral resources as indicated or measured mineral resources

and it is uncertain if further exploration will result in upgrading them to

an indicated or measured mineral resource category.

The mineral resources have been classified according to the Canadian

Institute of Mining, Metallurgy and Petroleum Definition Standards for

Mineral Resources and Mineral Reserves (November 2010).

Qualified Person

David Gower, P.Geo., and Carlos Costa, P.Geo., both Qualified Persons as defined

by NI 43-101, have reviewed and approved the scientific and technical

information in this release.

About the Company

Belo Sun Mining Corp. is a Canadian-based mineral exploration company with a

portfolio of properties focused on gold in Brazil. Belo Sun's primary focus is

on advancing and expanding its 100% owned Volta Grande Gold Project, located in

Para State. Belo Sun trades on the TSX under the symbol "BSX". For more

information about Belo Sun please visit www.belosun.com.

This press release contains "forward-looking information" within the meaning of

applicable Canadian securities legislation. Forward-looking information

includes, without limitation, statements regarding: the impact of the drill

program and studies on Belo Sun and its understanding of the project; the

development potential and timetable of the company's projects; the estimation of

mineral resources; realization of mineral resource estimates; the timing and

amount of estimated future exploration; costs of future activities; capital and

operating expenditures; success of exploration activities; currency exchange

rates; government regulation of mining operations; and environmental risks.

Generally, forward-looking information can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not expect", "is

expected", "budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates" or "does not anticipate", or "believes", or variations of such

words and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause the actual results, level of activity,

performance or achievements of the Company to be materially different from those

expressed or implied by such forward-looking information, including risks

inherent in the mining industry and risks described in the public disclosure of

the Company which is available under the profile of the Company on SEDAR at

www.sedar.com and on the Company's website at www.belosun.com. Although the

Company has attempted to identify important factors that could cause actual

results to differ materially from those contained in forward-looking

information, there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that such

information will prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking information. The

Company does not undertake to update any forward-looking information, except in

accordance with applicable securities laws.

FOR FURTHER INFORMATION PLEASE CONTACT:

Belo Sun Mining Corp.

Mark Eaton

President and CEO

(416) 309-2137

www.belosun.com

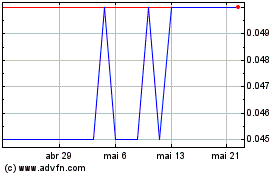

Belo Sun Mining (TSX:BSX)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

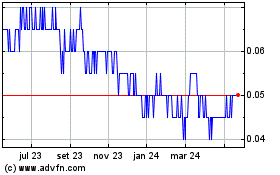

Belo Sun Mining (TSX:BSX)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024