Canadian General Investments Reports June 30, 2010 Interim Results

20 Julho 2010 - 3:03PM

Marketwired Canada

Canadian General Investment, Limited's (CGI)

(TSX:CGI)(TSX:CGI.PR.B)(TSX:CGI.PR.C)(LSE:CGI) net asset value at June 30, 2010

was $378,050,000, representing a 6.0% decrease from the $402,001,000 at the end

of 2009. CGI's net asset value per share (NAV) at June 30, 2010 was $18.12, down

from $19.27 at year end 2009. The NAV return, with dividends reinvested, for the

six months ended 2009 was -5.4%, compared with a -2.5% total return for the

benchmark S&P/TSX Composite Index.

CGI's underperformance of the benchmark was primarily the result of the leverage

afforded by the $150 million in preference shares the Company has outstanding.

This leverage serves to enhance NAV moves both up and down. The first six months

of 2010 saw the portfolio increase the weighting of cash and short-term

securities, now at 3.3% and 7.6%, respectively. These increasing balances have

been built up to offset a portion of the leverage in an effort to provide

protection to falling markets. A reduction in the weighting of the Materials

sector was the primary result, which dropped from 27.0% at the end of 2009, to

21.5% at June 30, 2010.

During each of the first two quarters of both 2010 and 2009, CGI paid regular

income dividends of $0.06 per share to its common shareholders.

CGI is a closed-end equity fund, focused on medium to long-term investments in

primarily Canadian corporations. Its objective is to provide better than average

returns to investors through prudent security selection, timely recognition of

capital gains and appropriate income-generating instruments.

FINANCIAL HIGHLIGHTS

(in thousands of dollars, except per share amounts)

For the Six Months Ended

---------------------------------

June 30, 2010 June 30, 2009

---------------------------------

Net investment income (loss) (1,478) 582

Net gain (loss) on investments (16,697) 33,817

---------------------------------

Increase (decrease) in net assets

resulting from operations (18,175) 34,399

Increase (decrease) in net assets

resulting from operations per share (0.87) 1.65

As at

---------------------------------

June 30, 2010 December 31, 2009

---------------------------------

Selected data(1)

------------------------------------

Net asset value 378,050 402,001

Net asset value per share 18.12 19.27

Selected data according to GAAP(1)

------------------------------------

Net assets 376,616 399,804

Net assets per share 18.05 19.17

(1) The Company calculates the net asset value and net asset value per share

on the basis of the valuation principles set out in its annual information

form. These valuation principles differ from the requirements of Canadian

generally accepted accounting principles (GAAP), with the main difference

relating to securities that are listed on a public stock exchange. While the

Company generally values such securities based on the latest sale price,

GAAP requires the use of the closing bid price. Accordingly, bid prices are

used in determining net assets and net assets per share for purposes of the

interim and annual financial statements.

In the United Kingdom, copies of the Company's financial reports will be made

available at the U.K. branch transfer agent, Computershare Investor Services

PLC, P.O. Box 82, The Pavilions, Bridgwater Road, Bristol, BS99 6ZY. Phone

0870-702-0000.

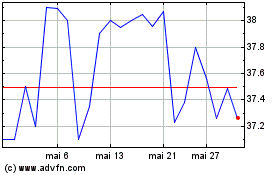

Canadian General Investm... (TSX:CGI)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Canadian General Investm... (TSX:CGI)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024