Canadian General Investments, Limited Reports June 30, 2012 Interim Results

25 Julho 2012 - 11:23AM

Marketwired Canada

Canadian General Investments, Limited's (CGI or the Company)

(TSX:CGI)(TSX:CGI.PR.B)(TSX:CGI.PR.C)(LSE:CGI) net asset value at June 30, 2012

was $433,668,000, representing a 1.7% increase from the $426,413,000 at the end

of 2011. CGI's net asset value per share (NAV) at June 30, 2012 was $20.79, up

from $20.44 at year end 2011. The NAV return, with dividends reinvested, for the

six months ended June 30, 2012 was 2.3%, and the market value total return to

shareholders was -4.6% compared with a -1.5% total return for the benchmark

S&P/TSX Composite Index (S&P/TSX).

At June 30, 2012 the portfolio was overweight in Industrials and Consumer

Discretionary and underweight Financials and Energy, as compared to the sector

weightings in the S&P/TSX.

Equities in the Materials and Energy sectors have succumbed to lower pricing for

oil, gas, fertilizers and most other commodities resulting in year-to-date price

returns of -11.2% and -9.1%, respectively. These were by far the second and

third worst performing groups in the S&P/TSX. Fortunately for CGI, though not

unscathed, its better performance relative to the benchmark was assisted by

continued underweighting in Energy. Holdings in these areas did generate the

greatest individual losses for the Company. However, two of the top five

positive contributors for CGI also come from these groups. Franco-Nevada

Corporation, a royalties company and a top 10 holding of the Company, had an

outstanding result with its 18.7% return standing in stark contrast to the

-16.5% return for the Gold sub-sector overall. Pacific Rubiales Energy Corp. was

the other major contributor in this regard, rebounding in 2012 with a return of

over 15% compared to the overwhelmingly negative results for most of its peers

in the Energy sector.

Health Care, one of the smallest of the sectors in the S&P/TSX, had the second

best performance in the index based on a substantial return by SXC Health

Solutions Corp., a health technology company. SXC is presently the largest

holding in the portfolio with an approximate 5% weighting.

During each of the first two quarters of both 2012 and 2011, CGI paid regular

income dividends of $0.06 per share to its common shareholders.

CGI is a closed-end equity fund, focussed on medium to long-term investments in

primarily Canadian corporations. Its objective is to provide better than average

returns to investors through prudent security selection, timely recognition of

capital gains/losses and appropriate income generating instruments.

FINANCIAL HIGHLIGHTS

(in thousands of dollars, except per share amounts)

For the Year Ended

June 30, June 30,

2012 2011

------------------------

Net investment loss (203) (2,286)

Net gain (loss) on investments 9,696 (15,971)

Increase (decrease) in net assets resulting from

operations 9,493 (18,257)

Increase (decrease) in net assets resulting from

operations per share 0.46 (0.88)

As at

June 30, December 31,

2012 2011

--------------------------

Selected data(1)

Net asset value 433,668 426,413

Net asset value per share 20.79 20.44

Selected data according to GAAP(1)

Net assets 431,759 424,875

Net assets per share 20.70 20.37

(1) The Company calculates the net asset value and net asset value per share on

the basis of the valuation principles set out in its annual information form.

These valuation principles differ from the requirements of Canadian generally

accepted accounting principles (GAAP), with the main difference relating to

securities that are listed on a public stock exchange. While the Company values

such securities based on the latest sale price, GAAP requires the use of the

closing bid price. Accordingly, bid prices are used in determining net assets

and net assets per share for purposes of the interim and annual financial

statements.

In the United Kingdom, copies of the Company's financial reports are available

from the National Storage Mechanism (http://www.hemscott.com/nsm.do). PDF

versions are also available at www.mmainvestments.com and at www.sedar.com.

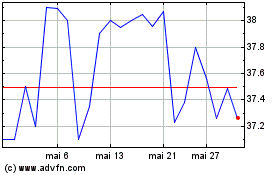

Canadian General Investm... (TSX:CGI)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Canadian General Investm... (TSX:CGI)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024