Computer Modelling Group Ltd. (TSX:CMG) ("CMG" or the "Company") is very pleased

to report our first quarter results for the three months ended June 30, 2013.

FIRST QUARTER HIGHLIGHTS

For the three months ended June 30, 2013 2012 $ change % change

($ thousands, except per share data)

----------------------------------------------------------------------------

Annuity/maintenance software

licenses 13,958 13,179 779 6%

Perpetual software licenses 2,331 2,070 261 13%

Total revenue 18,116 16,465 1,651 10%

Operating profit 9,350 8,105 1,245 15%

Net income 7,081 6,090 991 16%

Earnings per share - basic 0.19 0.16 0.03 19%

----------------------------------------------------------------------------

MANAGEMENT'S DISCUSSION AND ANALYSIS

This Management's Discussion and Analysis ("MD&A") for Computer Modelling Group

Ltd. ("CMG," the "Company," "we" or "our"), presented as at August 12, 2013,

should be read in conjunction with the unaudited condensed consolidated

financial statements and related notes of the Company for the three months ended

June 30, 2013 and the audited consolidated financial statements and MD&A for the

years ended March 31, 2013 and 2012 contained in the 2013 Annual Report for CMG.

Additional information relating to CMG, including our Annual Information Form,

can be found at www.sedar.com. The financial data contained herein have been

prepared in accordance with International Financial Reporting Standards ("IFRS")

and, unless otherwise indicated, all amounts in this report are expressed in

Canadian dollars and rounded to the nearest thousand.

FORWARD-LOOKING INFORMATION

Certain information included in this MD&A is forward-looking. Forward-looking

information includes statements that are not statements of historical fact and

which address activities, events or developments that the Company expects or

anticipates will or may occur in the future, including such things as investment

objectives and strategy, the development plans and status of the Company's

software development projects, the Company's intentions, results of operations,

levels of activity, future capital and other expenditures (including the amount,

nature and sources of funding thereof), business prospects and opportunities,

research and development timetable, and future growth and performance. When used

in this MD&A, statements to the effect that the Company or its management

"believes", "expects", "expected", "plans", "may", "will", "projects",

"anticipates", "estimates", "would", "could", "should", "endeavours", "seeks",

"predicts" or "intends" or similar statements, including "potential",

"opportunity", "target" or other variations thereof that are not statements of

historical fact should be construed as forward-looking information. These

statements reflect management's current beliefs with respect to future events

and are based on information currently available to management of the Company.

The Company believes that the expectations reflected in such forward-looking

information are reasonable, but no assurance can be given that these

expectations will prove to be correct and such forward-looking information

should not be unduly relied upon.

With respect to forward-looking information contained in this MD&A, we have made

assumptions regarding, among other things:

-- Future software license sales

-- The continued financing by and participation of the Company's partners

in the DRMS project and it being completed in a timely manner

-- Ability to enter into additional software license agreements

-- Ability to continue current research and new product development

-- Ability to recruit and retain qualified staff

Forward-looking information is not a guarantee of future performance and

involves a number of risks and uncertainties, only some of which are described

herein. Many factors could cause the Company's actual results, performance or

achievements, or future events or developments, to differ materially from those

expressed or implied by the forward-looking information including, without

limitation, the following factors which are described in the MD&A of CMG's 2013

Annual Report under the heading "Business Risks":

-- Economic conditions in the oil and gas industry

-- Reliance on key clients

-- Foreign exchange

-- Economic and political risks in countries where the Company currently

does or proposes to do business

-- Increased competition

-- Reliance on employees with specialized skills or knowledge

-- Protection of proprietary rights

Should one or more of these risks or uncertainties materialize, or should

assumptions underlying the forward-looking statements prove incorrect, actual

results, performance or achievement may vary materially from those expressed or

implied by the forward-looking information contained in this MD&A. These factors

should be carefully considered and readers are cautioned not to place undue

reliance on forward-looking information, which speaks only as of the date of

this MD&A. All subsequent forward-looking information attributable to the

Company herein is expressly qualified in its entirety by the cautionary

statements contained in or referred to herein. The Company does not undertake

any obligation to release publicly any revisions to forward-looking information

contained in this MD&A to reflect events or circumstances that occur after the

date of this MD&A or to reflect the occurrence of unanticipated events, except

as may be required under applicable securities laws.

NON-IFRS FINANCIAL MEASURES

This MD&A includes certain measures which have not been prepared in accordance

with IFRS such as "EBITDA", "direct employee costs" and "other corporate costs."

Since these measures do not have a standard meaning prescribed by IFRS, they are

unlikely to be comparable to similar measures presented by other issuers.

Management believes that these indicators nevertheless provide useful measures

in evaluating the Company's performance.

"Direct employee costs" include salaries, bonuses, stock-based compensation,

benefits, commission expenses, and professional development. "Other corporate

costs" include facility-related expenses, corporate reporting, professional

services, marketing and promotion, computer expenses, travel, and other

office-related expenses. Direct employee costs and other corporate costs should

not be considered an alternative to total operating expenses as determined in

accordance with IFRS. People-related costs represent the Company's largest area

of expenditure; hence, management considers highlighting separately corporate

and people-related costs to be important in evaluating the quantitative impact

of cost management of these two major expenditure pools. See "Expenses" heading

for a reconciliation of direct employee costs and other corporate costs to total

operating expenses.

"EBITDA" refers to net income before adjusting for depreciation expense, finance

income, finance costs, and income and other taxes. EBITDA should not be

construed as an alternative to net income as determined by IFRS. The Company

believes that EBITDA is useful supplemental information as it provides an

indication of the results generated by the Company's main business activities

prior to consideration of how those activities are amortized, financed or taxed.

See "EBITDA" heading for a reconciliation of EBITDA to net income.

CORPORATE PROFILE

CMG is a computer software technology company serving the oil and gas industry.

The Company is a leading supplier of advanced processes reservoir modelling

software with a blue chip client base of international oil companies and

technology centers in over 50 countries. The Company also provides professional

services consisting of highly specialized support, consulting, training, and

contract research activities. CMG has sales and technical support services based

in Calgary, Houston, London, Caracas, Dubai, Bogota and Kuala Lumpur. CMG's

Common Shares are listed on the Toronto Stock Exchange ("TSX") and trade under

the symbol "CMG".

QUARTERLY PERFORMANCE

Fiscal 2012(1)

($ thousands, unless

otherwise stated) Q2 Q3 Q4

--------------------------------------------------------

Annuity/maintenance

licenses 9,308 12,056 12,497

Perpetual licenses 1,596 2,321 3,416

--------------------------------------------------------

Software licenses 10,904 14,377 15,913

Professional services 1,078 1,521 1,302

--------------------------------------------------------

Total revenue 11,982 15,898 17,215

Operating profit 5,226 8,093 9,193

Operating profit (%) 44 51 53

EBITDA(4) 5,508 8,414 9,543

Profit before income and

other taxes 6,096 8,184 9,104

Income and other taxes 1,778 2,394 2,484

Net income for the period 4,318 5,790 6,620

Cash dividends declared

and paid 4,053 4,079 4,848

--------------------------------------------------------

Per share amounts -

($/share)

Earnings per share - basic 0.12 0.16 0.18

Earnings per share -

diluted 0.11 0.15 0.17

Cash dividends declared

and paid 0.11 0.11 0.13

--------------------------------------------------------

Fiscal

Fiscal 2013(2) 2014(3)

($ thousands, unless

otherwise stated) Q1 Q2 Q3 Q4 Q1

----------------------------------------------------------------------------

Annuity/maintenance

licenses 13,179 12,012 14,004 15,359 13,958

Perpetual licenses 2,070 2,671 1,365 2,300 2,331

----------------------------------------------------------------------------

Software licenses 15,249 14,683 15,369 17,659 16,289

Professional services 1,216 1,390 1,433 1,620 1,827

----------------------------------------------------------------------------

Total revenue 16,465 16,073 16,802 19,279 18,116

Operating profit 8,105 8,032 8,276 9,877 9,350

Operating profit (%) 49 50 49 51 52

EBITDA(4) 8,423 8,425 8,687 10,294 9,725

Profit before income and

other taxes 8,577 7,703 8,556 10,314 9,999

Income and other taxes 2,487 2,342 2,437 3,061 2,918

Net income for the period 6,090 5,361 6,119 7,253 7,081

Cash dividends declared

and paid 9,736 6,020 6,050 6,099 8,841

----------------------------------------------------------------------------

Per share amounts -

($/share)

Earnings per share - basic 0.16 0.14 0.16 0.19 0.19

Earnings per share -

diluted 0.16 0.14 0.16 0.19 0.18

Cash dividends declared

and paid 0.26 0.16 0.16 0.16 0.23

----------------------------------------------------------------------------

(1) Q2, Q3 and Q4 of fiscal 2012 include $0.04 million, $2.6 million and

$2.7 million, respectively, in revenue that pertains to usage of CMG's

products in prior quarters.

(2) Q1, Q2, Q3 and Q4 of fiscal 2013 include $2.1 million, $0.2 million,

$1.8 million and $2.6 million, respectively, in revenue that pertains to

usage of CMG's products in prior quarters.

(3) Q1 of fiscal 2014 includes $1.2 million in revenue that pertains to

usage of CMG's products in prior quarters.

(4) EBITDA is defined as net income before adjusting for depreciation

expense, finance income, finance costs, and income and other taxes. See

"Non-IFRS Financial Measures".

Highlights

During the three months ended June 30, 2013, as compared to the same period of

the prior fiscal year, CMG:

-- Increased annuity/maintenance revenue by 6%

-- Increased operating profit by 15%

-- Increased spending on research and development by 20%

-- Increased EBITDA by 15%

-- Realized basic earnings per share of $0.19, representing a 19% increase

Revenue

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Software licenses 16,289 15,249 1,040 7%

Professional services 1,827 1,216 611 50%

----------------------------------------------------------------------------

Total revenue 18,116 16,465 1,651 10%

----------------------------------------------------------------------------

Software license revenue - % of

total revenue 90% 93%

Professional services - % of total

revenue 10% 7%

----------------------------------------------------------------------------

CMG's revenue is comprised of software license sales, which provide the majority

of the Company's revenue, and fees for professional services.

Total revenue increased by 10% for the three months ended June 30, 2013,

compared to the same period of the previous fiscal year due to the increases in

both software license revenue and professional services.

SOFTWARE LICENSE REVENUE

Software license revenue is made up of annuity/maintenance license fees charged

for the use of the Company's software products which is generally for a term of

one year or less and perpetual software license sales, whereby the customer

purchases the current version of the software and has the right to use that

version in perpetuity. Annuity/maintenance license fees have historically had a

high renewal rate and, accordingly, provide a reliable revenue stream while

perpetual license sales are more variable and unpredictable in nature as the

purchase decision and its timing fluctuate with the customers' needs and

budgets. The majority of CMG's customers who have acquired perpetual software

licenses subsequently purchase our maintenance package to ensure ongoing product

support and access to current versions of CMG's software.

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Annuity/maintenance licenses 13,958 13,179 779 6%

Perpetual licenses 2,331 2,070 261 13%

----------------------------------------------------------------------------

Total software license revenue 16,289 15,249 1,040 7%

----------------------------------------------------------------------------

Annuity/maintenance as a % of total

software license revenue 86% 86%

Perpetual as a % of total software

license revenue 14% 14%

----------------------------------------------------------------------------

Total software license revenue grew by 7% in the three months ended June 30,

2013, compared to the same period of the previous fiscal year, due to the

increases in both annuity/maintenance and perpetual license sales.

CMG's annuity/maintenance license revenue increased by 6% during the three

months ended June 30, 2013, compared to the same period of last year. This

increase was driven by sales to new and existing customers as well as an

increase in maintenance revenue tied to perpetual sales generated in the

previous fiscal year.

All of our regions, except South America, experienced growth in

annuity/maintenance revenue during the three months ended June 30, 2013, for the

reasons described above, but the most significant growth came from the US

market.

Our annuity/maintenance revenue is impacted by the revenue recognition from a

long-standing customer for which revenue recognition criteria are fulfilled only

at the time of the receipt of funds (see the discussion about revenue earned in

the current period that pertains to usage of products in prior quarters above

the "Quarterly Software License Revenue" graph). The variability of the amounts

of the payments received and the timing of such payments may skew the comparison

of the recorded annuity/maintenance revenue amounts between periods. To provide

a normalized comparison, if we were to remove revenue from this one customer

from the first quarter of the current and the previous year, we will notice that

the annuity/maintenance revenue increased by 14%, instead of 6%. Given our

long-term relationship with this customer, and their on-going use of our

licenses, we expect to continue to receive payments from them; however, the

amount and timing are uncertain and will continue to be recorded on a cash

basis, which may introduce some variability in our reported quarterly

annuity/maintenance revenue results.

We can observe from the table below that the exchange rates between the US and

Canadian dollars during the three months ended June 30, 2013, compared to the

same period of the previous fiscal year, had only a slight positive impact on

our reported annuity/maintenance revenue.

Perpetual license sales increased by 13% for the three months ended June 30,

2013, compared to the same period of the previous fiscal year, due to increased

perpetual sales in the Eastern Hemisphere. The growth in perpetual sales

generated by the Eastern Hemisphere was partially offset by decreases in both

Canada and South America.

Software licensing under perpetual sales is a significant part of CMG's

business, but may fluctuate significantly between periods due to the uncertainty

associated with the timing and the location where sales are generated. For this

reason, even though we expect to achieve a certain level of aggregate perpetual

sales on an annual basis, we expect to observe fluctuations in the quarterly

perpetual revenue amounts throughout the fiscal year.

We can observe from the table below that the exchange rates between the US and

Canadian dollars during the three months ended June 30, 2013, compared to the

same period of the previous fiscal year, had only a slight positive impact on

our reported perpetual license revenue.

The following table summarizes the US dollar denominated revenue and the

weighted average exchange rate at which it was converted to Canadian dollars:

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

US dollar annuity/maintenance

license sales US$ 9,341 8,638 703 8%

Weighted average conversion rate 1.009 0.999

----------------------------------------------------------------------------

Canadian dollar equivalent CDN$ 9,421 8,626 795 9%

----------------------------------------------------------------------------

US dollar perpetual license sales US$ 2,011 1,346 665 49%

Weighted average conversion rate 1.014 0.995

----------------------------------------------------------------------------

Canadian dollar equivalent CDN$ 2,040 1,339 701 52%

----------------------------------------------------------------------------

The following table quantifies the foreign exchange impact on our software

license revenue:

Incremental Foreign

Q1 2013 License Exchange Q1 2014

($ thousands) Balance Growth Impact Balance

----------------------------------------------------------------------------

Annuity/Maintenance license

sales 13,179 687 92 13,958

Perpetual license sales 2,070 222 39 2,331

----------------------------------------------------------------------------

Total software license

revenue 15,249 909 131 16,289

----------------------------------------------------------------------------

REVENUE BY GEOGRAPHIC SEGMENT

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Annuity/maintenance revenue

Canada 5,430 4,939 491 10%

United States 3,164 2,392 772 32%

South America 2,332 3,162 (830) -26%

Eastern Hemisphere(1) 3,032 2,686 346 13%

----------------------------------------------------------------------------

13,958 13,179 779 6%

----------------------------------------------------------------------------

Perpetual revenue

Canada 291 561 (270) -48%

United States 427 404 23 6%

South America 76 483 (407) -84%

Eastern Hemisphere 1,537 622 915 147%

----------------------------------------------------------------------------

2,331 2,070 261 13%

----------------------------------------------------------------------------

Total software license revenue

Canada 5,721 5,500 221 4%

United States 3,591 2,796 795 28%

South America 2,408 3,645 (1,237) -34%

Eastern Hemisphere 4,569 3,308 1,261 38%

----------------------------------------------------------------------------

16,289 15,249 1,040 7%

----------------------------------------------------------------------------

(1)

Includes Europe, Africa, Asia and Australia.

On a geographic basis, total software license sales increased across all regions

with the exception of the South American market which experienced an overall

decrease of 34% during the three months ended June 30, 2013, compared to the

same period of the previous fiscal year.

The Canadian market (representing 35% of year-to-date total software revenue)

experienced an increase in annuity/maintenance license sales during the three

months June 30, 2013, compared to the same period of the previous fiscal year.

This increase was supported by the sales to both new and existing customers.

Perpetual sales were lower during the first quarter of the current year compared

to the same period of the previous year. The Canadian market continues to be the

leader in generating total software license revenue and, particularly, in

generating the recurring annuity/maintenance revenue as evidenced by the

quarterly year-over-year increases of 32%, 37%, 37%, and 38% recorded during Q1

2013, Q2 2013, Q3 2013, and Q4 2013 respectively. During the first quarter of

the current fiscal year, we recorded an increase of 10%.

The US market (representing 22% of year-to-date total software revenue)

experienced the most significant growth in annuity/maintenance license sales, in

comparison to other regions, during the three months ended June 30, 2013,

compared to the same period of the previous fiscal year, driven by sales to new

and existing customers. Perpetual license sales remained flat between the first

quarters of the current and the previous year. Similar to the Canadian market,

we have continued to see successive increases in the annuity/maintenance license

sales in the US as evidenced by the quarterly year-over-year increases of 20%,

24%, 32%, and 20% recorded during Q1 2013, Q2 2013, Q3 2013, and Q4 2013

respectively. This growth trend has continued into the first quarter of the

current fiscal year with the recorded increase of 32%.

South America (representing 15% of year-to-date total software revenue)

experienced a decrease of 26% in annuity/maintenance revenue during the three

months ended June 30, 2013, compared to the same period of the previous fiscal

year. This decrease was caused by the variability of the amount recorded from a

customer for which revenue is recognized only when cash is received (see the

discussion about revenue earned in the current period that pertains to usage of

products in prior quarters above the "Quarterly Software License Revenue"

graph). To provide a normalized comparison, if we were to exclude the amounts

received from this customer from the annuity/maintenance revenue in the first

quarter of the current and the previous fiscal years, we would notice that the

annuity/maintenance revenue remained flat between the two periods. South

American region also experienced a decrease in perpetual sales during the first

quarter of the current year compared to the first quarter of the previous year.

Eastern Hemisphere (representing 28% of the year-to-date total software revenue)

grew annuity/maintenance license sales by 13% during the three months ended June

30, 2013, compared to the same period of the previous fiscal year, due to

increased license usage by two of our significant customers in the region.

Compared to other regions, Eastern Hemisphere achieved the highest growth in

perpetual license revenue during the first quarter of the current year compared

to the same period of the previous year.

Movements in perpetual sales across regions are indicative of the unpredictable

nature of the timing and location of perpetual license sales. Overall, our

recurring annuity/maintenance revenue base continues to experience growth. We

will continue to focus our efforts on increasing our license sales to both

existing and new customers, and we will endeavor to continue expanding our

market share globally.

As footnoted in the Quarterly Performance table, in the normal course of

business, CMG may complete the negotiation of certain annuity/maintenance

contracts and/or fulfill revenue recognition requirements within a current

quarter that includes usage of CMG's products in prior quarters. This situation

particularly affects contracts negotiated with countries that face increased

economic and political risks leading to revenue recognition criteria being

satisfied only at the time of the receipt of cash. The dollar magnitude of such

contracts may be significant to the quarterly comparatives of our

annuity/maintenance revenue stream and, to provide a normalized comparison, we

specifically identify the revenue component where revenue recognition is

satisfied in the current period for products provided in previous quarters.

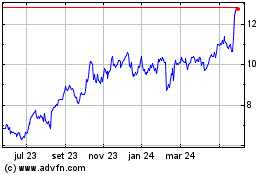

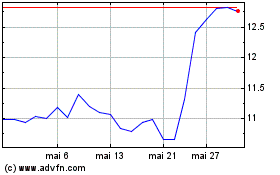

QUARTERLY SOFTWARE LICENSE REVENUE ($THOUSANDS)

To view accompanying graph, visit the following link:

http://media3.marketwire.com/docs/QuarterlySoftwareLicenseRevenue.jpg

DEFERRED REVENUE

2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Deferred revenue at:

March 31 25,289 21,693 3,596 17%

June 30 22,014 18,779 3,235 17%

----------------------------------------------------------------------------

CMG's deferred revenue consists primarily of amounts for pre-sold licenses. Our

annuity/maintenance revenue is deferred and recognized on a straight-line basis

over the life of the related license period, which is generally one year or

less. Amounts are deferred for licenses that have been provided and revenue

recognition reflects the passage of time.

The increase in deferred revenue year-over-year as at June 30 and March 31 is

reflective of the growth in annuity/maintenance license sales. The variation

within the year is due to the timing of renewals of annuity and maintenance

contracts that are skewed to the beginning of the calendar year which explains

the decrease in deferred revenue balance at the end of the first quarter (June

30) compared to the fiscal year-end (March 31). Deferred revenue at June 30,

2013 increased compared to the same period of the prior fiscal year due to both

renewal of the existing and signing of the new annuity and maintenance contracts

in the quarter.

PROFESSIONAL SERVICES REVENUE

CMG recorded professional services revenue of $1.8 million for the three months

ended June 30, 2013, representing an increase of $0.6 million, compared to the

same period of the previous fiscal year, due to both an increase in project

activities by our clients and due to entering into a large consulting agreement

with one of our clients which, we expect, will contribute to the professional

services revenue during the current fiscal year.

Professional services revenue consists of specialized consulting, training, and

contract research activities. CMG performs consulting and contract research

activities on an ongoing basis, but such activities are not considered to be a

core part of our business and are primarily undertaken to increase our knowledge

base and hence expand the technological abilities of our simulators in a funded

manner, combined with servicing our customers' needs. In addition, these

activities are undertaken to market the capabilities of our suite of software

products with the ultimate objective to increase software license sales. Our

experience is that consulting activities are variable in nature as both the

timing and dollar magnitude of work are dependent on activities and budgets

within client companies.

Expenses

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Sales, marketing and professional

services 3,649 3,962 (313) -8%

Research and development 3,472 2,897 575 20%

General and administrative 1,645 1,501 144 10%

----------------------------------------------------------------------------

Total operating expenses 8,766 8,360 406 5%

----------------------------------------------------------------------------

Direct employee costs(1) 7,120 6,595 525 8%

Other corporate costs 1,646 1,765 (119) -7%

----------------------------------------------------------------------------

8,766 8,360 406 5%

----------------------------------------------------------------------------

(1) Includes salaries, bonuses, stock-based compensation, benefits,

commissions, and professional development.

CMG's total operating expenses increased by 5% for the three months ended June

30, 2013, compared to the same period of the previous fiscal year, due to an

increase in direct employee costs, offset by a decrease in other corporate

costs.

DIRECT EMPLOYEE COSTS

As a technology company, CMG's largest area of expenditure is for its people.

Approximately 81% of the total operating expenses in the three months ended June

30, 2013 related to staff costs, compared to 79% recorded in the comparative

period of last year. Staffing levels for the current fiscal year grew in

comparison to the previous fiscal year to support our continued growth. At June

30, 2013, CMG's staff complement was 186 employees and consultants, up from 164

employees as at June 30, 2012. Direct employee costs increased during the three

months ended June 30, 2013, compared to the same periods of the previous fiscal

year, due to staff additions, increased levels of compensation, and related

benefits.

OTHER CORPORATE COSTS

Other corporate costs decreased by 7% for the three months ended June 30, 2013,

compared to the same period of the previous fiscal year, mainly due to including

the costs associated with CMG's biennial Technical Symposium in other corporate

costs for the three months ended June 30, 2012.

RESEARCH AND DEVELOPMENT

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Research and development (gross) 4,020 3,385 635 19%

SR&ED credits (548) (488) (60) 12%

----------------------------------------------------------------------------

Research and development 3,472 2,897 575 20%

----------------------------------------------------------------------------

Research and development as a % of

total revenue 19% 18%

----------------------------------------------------------------------------

CMG maintains its belief that its strategy of growing long-term value for

shareholders can only be achieved through continued investment in research and

development. CMG works closely with its customers to provide solutions to

complex problems related to proven and new advanced recovery processes.

The above research and development includes CMG's share of joint research and

development costs associated with the DRMS project of $1.1 million for the three

months ended June 30, 2013 (2012 - $0.8 million). See discussion under

"Commitments, Off Balance Sheet Items and Transactions with Related Parties."

The increase of 19% in our gross spending on research and development for the

three months ended June 30, 2013, demonstrates our continued commitment to

advancement of our technology which is the focal part of our business strategy.

Research and development costs, net of research and experimental development

("SR&ED") credits, increased by 20% during the three months ended June 30, 2013,

compared to the same period of the previous fiscal year, due to increased

employee compensation costs, and costs associated with computing resources.

We also had an increase in SR&ED credits driven mainly by the increases in our

direct employee costs as well as the increase in hours spent on projects

eligible for SR&ED credits.

DEPRECIATION

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Depreciation of property and

equipment, allocated to:

Sales, marketing and professional

services 100 98 2 2%

Research and development 226 180 46 26%

General and administrative 49 40 9 23%

----------------------------------------------------------------------------

Total depreciation 375 318 57 18%

----------------------------------------------------------------------------

The quarterly increase in depreciation, compared to the same period of the

previous fiscal year, reflects the increase in our asset base, mainly as a

result of increased spending on computing resources.

Finance Income

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Interest income 157 145 12 8%

Net foreign exchange gain 492 327 165 50%

----------------------------------------------------------------------------

Total finance income 649 472 177 38%

----------------------------------------------------------------------------

Interest income increased slightly in the three months ended June 30, 2013,

compared to the same period of the prior fiscal year, mainly due to investing

larger cash balances.

CMG is impacted by the movement of the US dollar against the Canadian dollar as

approximately 70% (2012 - 68%) of CMG's revenue for the three months ended June

30, 2013 is denominated in US dollars, whereas only approximately 25% (2012 -

23%) of CMG's total costs are denominated in US dollars.

Three month trailing

CDN$ to US$ At June 30 average

----------------------------------------------------------------------------

2011 1.0370 1.0411

2012 0.9813 0.9861

2013 0.9513 0.9702

----------------------------------------------------------------------------

CMG recorded a net foreign exchange gain of $0.5 million for the three months

ended June 30, 2013, compared to a $0.3 million net foreign exchange gain

recorded in the three months ended June 30, 2012.

The weakening of the Canadian dollar during the first quarter of the current

fiscal year, contributed positively to the valuation of our US-denominated

working capital for the three months ended June 30, 2013 compared to the same

period of the previous fiscal year.

Income and Other Taxes

CMG's effective tax rate for the three months ended June 30, 2013 is reflected

as 29.2% (2012 - 29.0%), whereas the prevailing Canadian statutory tax rate is

now 25.0%. This is primarily due to a combination of the non-tax deductibility

of stock-based compensation expense and the benefit of foreign withholding taxes

being realized only as a tax deduction as opposed to a tax credit.

The benefit recorded in CMG's books on the SR&ED investment tax credit program

impacts deferred income taxes. The investment tax credit earned in the current

fiscal year is utilized by CMG to reduce income taxes otherwise payable for the

current fiscal year and the federal portion of this benefit bears an inherent

tax liability as the amount of the credit is included in the subsequent year's

taxable income for both federal and provincial purposes. The inherent tax

liability on these investment tax credits is reflected in the year the credit is

earned as a non-current deferred tax liability and then, in the following fiscal

year, is transferred to income taxes payable.

Operating Profit and Net Income

For the three months ended June 30, 2013 2012 $ change % change

($ thousands, except per share

amounts)

----------------------------------------------------------------------------

Total revenue 18,116 16,465 1,651 10%

Operating expenses (8,766) (8,360) (406) 5%

----------------------------------------------------------------------------

Operating profit 9,350 8,105 1,245 15%

Operating profit as a % of total

revenue 52% 49%

----------------------------------------------------------------------------

Net income for the period 7,081 6,090 991 16%

Net income for the period as a % of

total revenue 39% 37%

----------------------------------------------------------------------------

Basic earnings per share ($/share) 0.19 0.16 0.03 19%

----------------------------------------------------------------------------

Operating profit as a percentage of total revenue for the three months ended

June 30, 2013 was at 52% compared to 49% recorded in the same period of the

previous fiscal year. While our total revenue grew by 10%, our operating

expenses grew by 5%, having a positive impact on our operating profit. Our high

levels of operating profit as a percentage of revenue demonstrate our commitment

to continue to effectively manage our costs.

Net income for the period as a percentage of revenue increased to 39% for the

three months ended June 30, 2013, compared to 37% recorded in the same period of

the previous fiscal year.

We have continued to maintain our profitability by focusing our efforts on

increasing license sales while, at the same time, effectively controlling our

operating costs. Managing these variables will continue to be imperative to our

future success.

EBITDA

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Net income for the period 7,081 6,090 991 16%

Add (deduct):

Depreciation 375 318 57 18%

Finance income (649) (472) (177) 38%

Finance costs - - - -

Income and other taxes 2,918 2,487 431 17%

----------------------------------------------------------------------------

EBITDA 9,725 8,423 1,302 15%

----------------------------------------------------------------------------

EBITDA as a % of total revenue 54% 51%

----------------------------------------------------------------------------

EBITDA increased by 15% for the three months ended June 30, 2013, compared to

the same period of the previous fiscal year. This increase provides further

indication of our ability to keep growing our recurring annuity/maintenance

license sales while effectively managing costs in relation to this base.

EBITDA as a percent of total revenue for the three months ended June 30, 2013

was at 54% compared to 51% recorded in the same period of the previous fiscal

year.

Liquidity and Capital Resources

For the three months ended June 30, 2013 2012 $ change % change

($ thousands)

----------------------------------------------------------------------------

Cash, beginning of period 59,419 55,374 4,045 7%

Cash flow from (used in):

Operating activities 9,837 6,661 3,176 48%

Financing activities (5,919) (10,063) 4,144 -41%

Investing activities (225) (437) 212 -49%

----------------------------------------------------------------------------

Cash, end of period 63,112 51,535 11,577 22%

----------------------------------------------------------------------------

OPERATING ACTIVITIES

Cash flow generated from operating activities increased by $3.2 million in the

three months ended June 30, 2013, compared to the same period of last year,

mainly due to the timing differences of when the sales are made and when the

resulting receivables are collected, positive effect on the timing difference of

when income taxes are recorded and paid, offset by the change in trade payables

and accrued liabilities balance.

FINANCING ACTIVITIES

Cash used in financing activities during the three months ended June 30, 2013

decreased by $4.1 million, compared to the same period of last year, due to

receiving higher proceeds from the issuance of Common Shares in the current

quarter, and paying less in dividends. In the previous fiscal year, we

re-shifted our focus from paying a large special dividend at year end to paying

higher quarterly dividends. Consequently, the special dividend paid in the first

quarter of the previous year was higher than the special dividend paid in the

first quarter of the current year, but this is expected to normalize, on a

year-to-date basis due to paying higher quarterly dividends. In addition, in the

first quarter of the previous fiscal year, CMG spent $1.6 million on buying back

Common Shares.

During the three months ended June 30, 2013, CMG employees and directors

exercised options to purchase 355,000 Common Shares, which resulted in cash

proceeds of $2.9 million.

In the three months ended June 30, 2013, CMG paid $8.8 million in dividends,

representing the following quarterly dividends:

($ per share) Q1

----------------------------------------------------------------------------

Dividends declared and paid 0.18

Special dividend declared and paid 0.05

----------------------------------------------------------------------------

Total dividends declared and paid 0.23

----------------------------------------------------------------------------

In the three months June 30, 2012, CMG paid $9.7 million in dividends,

representing the following quarterly dividends:

($ per share) Q1

----------------------------------------------------------------------------

Dividends declared and paid 0.16

Special dividend declared and paid 0.10

----------------------------------------------------------------------------

Total dividends declared and paid 0.26

----------------------------------------------------------------------------

On August 12, 2013, CMG announced the payment of a quarterly dividend of $0.18

per share on CMG's Common Shares. The dividend will be paid on September 13,

2013 to shareholders of record at the close of business on September 6, 2013. On

August 12, 2013, the Board of Directors also approved the issuance of 1,150,000

options to purchase CMG's Common Shares in accordance with CMG's stock option

plan.

Over the past 10 years, we have consistently raised our total annual dividend

and paid out a special dividend at the end of each fiscal year as determined by

our corporate performance. In recognition of the importance of a more regular

income stream to our shareholders, as reported in fiscal 2012 Management's

Discussion and Analysis, we decided to increase the relative proportion of

dividends paid quarterly and lower the amount paid as a special annual dividend

beginning in fiscal 2013. The above table demonstrates this increase in the

regular quarterly dividend which amounted to $0.18 per share in Q1 of fiscal

2014 compared to $0.16 per share in Q1 of fiscal 2013.

Based on our expectation of solid profitability and cash-generating ability

driven by the predictability of our software revenue base and effective

management of costs, we are cautiously optimistic that the company is well

positioned for future growth which will enable us to continue to pay quarterly

dividends.

On April 16, 2012, the Company announced a Normal Course Issuer Bid ("NCIB")

commencing on April 18, 2012 to purchase for cancellation up to 3,416,000 of its

Common Shares. During the year ended March 31, 2013, a total of 91,000 Common

Shares were purchased at market price for a total cost of $1,551,000.

On April 29, 2013, the Company announced a NCIB commencing on May 1, 2013 to

purchase for cancellation up to 3,538,000 of its Common Shares. During the three

months ended June 30, 2013, no Common Shares were purchased.

INVESTING ACTIVITIES

CMG's current needs for capital asset investment relate to computer equipment

and office infrastructure costs, all of which will be funded internally. During

the three months ended June 30, 2013, CMG expended $0.2 million on property and

equipment additions, primarily composed of computing equipment, and has a

capital budget of $1.8 million for fiscal 2014.

LIQUIDITY AND CAPITAL RESOURCES

At June 30, 2013, CMG has $63.1 million in cash, no debt, and has access to just

over $0.8 million under a line of credit with its principal banker.

During the three months ended June 30, 2013, 3,192,000 shares of CMG's public

float were traded on the TSX. As at June 30, 2013, CMG's market capitalization

based upon its June 30, 2013 closing price of $23.19 was $892.4 million.

Commitments, Off Balance Sheet Items and Transactions with Related Parties

The Company is the operator of the DRMS research and development project (the

"DRMS Project"), a collaborative effort with its partners Shell International

Exploration and Production BV ("Shell") and Petroleo Brasileiro S.A.

("Petrobras"), to jointly develop the newest generation of reservoir and

production system simulation software. The project has been underway since 2006

and, with the ongoing support of the participants, it is expected to continue

until ultimate delivery of the software. The Company's share of costs associated

with the project is estimated to be $5.5 million ($2.6 million net of overhead

recoveries) for fiscal 2014. CMG plans to continue funding its share of the

project costs associated with the development of the newest generation reservoir

simulation software system from internally generated cash flows.

CMG has very little in the way of other ongoing material contractual obligations

other than for pre-sold licenses which are reflected as deferred revenue on its

statement of financial position, and contractual obligations for office leases

which are estimated as follows: 2014 - $1.5 million; 2015 to 2016 - $2.0 million

per year; and 2017 - $1.0 million.

Business Risks and Critical Accounting Estimates

These remain unchanged from the factors detailed in CMG's 2013 Annual Report.

Changes in Accounting Policies

Except as disclosed below, the accounting policies, presentation and methods of

computation remain unchanged from those detailed in CMG's 2013 Annual Report.

The following new standards and interpretations have been adopted as detailed

below:

-- IFRS 10 Consolidated Financial Statements

Replaces the guidance in IAS 27 Consolidated and Separate Financial

Statements and SIC-12 Consolidation - Special Purpose Entities, and

provides a single model to be applied in the control analysis for all

investees, including entities that currently are special purpose

entities in the scope of SIC-12. The Company adopted IFRS 10 for the

annual period beginning on April 1, 2013. The adoption of IFRS 10 did

not have a material impact on the condensed consolidated interim

financial statements.

-- IFRS 11 Joint Arrangements

Under IFRS 11, joint arrangements are classified as either joint

operations or joint ventures. IFRS 11 replaces the guidance in IAS 31

Interest in Joint Ventures, and essentially carves out of previous

jointly controlled entities, those arrangements which although

structured through a separate vehicle, such separation is ineffective

and the parties to the arrangement have rights to the assets and

obligations for the liabilities and are accounted for as joint

operations in a fashion consistent with jointly controlled

assets/operations under IAS 31. In addition, under IFRS 11, joint

ventures must now use the equity method of accounting. The Company

adopted IFRS 11 for the annual period beginning on April 1, 2013. The

adoption of IFRS 11 did not have a material impact on the condensed

consolidated interim financial statements.

-- IFRS 12 Disclosure of Interests in Other Entities

Contains the disclosure requirements for entities that have interests in

subsidiaries, joint arrangements, associates and/or unconsolidated

structured entities. The Company adopted IFRS 12 for the annual period

beginning on April 1, 2013. The adoption of IFRS 12 did not have a

material impact on the condensed consolidated interim financial

statements.

-- IFRS 13 Fair Value Measurement

Replaces the fair value measurement guidance contained in individual

IFRSs with a single source of fair value measurement guidance. It

defines fair value as the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between market

participants at the measurement date, i.e. an exit price. The standard

also establishes a framework for measuring fair value and sets out

disclosure requirements for fair value measurement to provide

information that enables financial statement users to assess the methods

and inputs used to develop fair value measurements and, for recurring

fair value measurements that use significant unobservable inputs (Level

3), the effect of the measurements on profit or loss or other. The

Company adopted IFRS 13 prospectively for the interim and annual periods

beginning on April 1, 2013. The adoption of IFRS 13 did not have a

material impact on the condensed consolidated interim financial

statements other than the inclusion of certain fair value disclosures

which were previously applicable to annual financial statements only.

-- Amendments to IAS 1 Presentation of Financial Statements

Require an entity present separately the items of other comprehensive

income that may be reclassified to profit or loss in the future from

those that would never be reclassified to profit or loss. The Company

adopted the amendments for the annual period beginning on April 1, 2013.

As the amendments only required changes in the presentation of items in

other comprehensive income, the new standard did not have a material

impact on the condensed consolidated interim financial statements

-- Amendments to IFRS 7 Offsetting Financial Assets and Liabilities

Contains new disclosure requirements for offset financial assets and

liabilities and netting arrangements. The Company adopted the amendments

for the interim and annual periods beginning on April 1, 2013. The

amendments to IFRS 7 did not have a material impact on the condensed

consolidated interim financial statements.

Accounting Standards and Interpretations Issued But Not Yet Effective

The following standards and interpretations have not been adopted by the Company

as they apply to future periods:

Standard/Interpretation Nature of impending Impact on CMG's

change in accounting financial statements

policy

----------------------------------------------------------------------------

----------------------------------------------------------------------------

IFRS 9 Financial IFRS 9 (2009) replaces IFRS 9 (2010) supersedes

Instruments the guidance in IAS 39 IFRS 9 (2009) and is

In November 2009 the Financial Instruments: effective for annual

IASB issued IFRS 9 Recognition and periods beginning on or

Financial Instruments Measurement, on the after January 1, 2015,

(IFRS 9 (2009)), and in classification and with early adoption

October 2010 the IASB measurement of financial permitted. For annual

published amendments to assets. The Standard periods beginning before

IFRS 9 (IFRS 9 (2010)). eliminates the existing January 1, 2015, either

On July 24, 2013 the IAS 39 categories of IFRS 9 (2009) or IFRS 9

IASB tentatively decided held to maturity, (2010) may be applied.

to defer the mandatory available-for-sale and

effective date of IFRS loans and receivable. The Company does not

9. The mandatory expect IFRS 9 (2010) to

effective date will be Financial assets will be have a material impact

left open pending the classified into one of on the financial

finalisation of the two categories on statements. The

impairment and initial recognition: classification and

classification and measurement of the

measurement financial assets Company's financial

requirements. measured at amortized assets and liabilities

cost; or is not expected to

financial assets change under IFRS 9

measured at fair value. (2010) because of the

nature of the Company's

Gains and losses on operations and the types

remeasurement of of financial assets that

financial assets it holds.

measured at fair value

will be recognized in

profit or loss, except

that for an investment

in an equity instrument

which is not held-for-

trading, IFRS 9

provides, on initial

recognition, an

irrevocable election to

present all fair value

changes from the

investment in other

comprehensive income

(OCI). The election is

available on an

individual share-by-

share basis. Amounts

presented in OCI will

not be reclassified to

profit or loss at a

later date.

IFRS 9 (2010) added

guidance to IFRS 9

(2009) on the

classification and

measurement of financial

liabilities, and this

guidance is consistent

with the guidance in IAS

39 expect as described

below.

Under IFRS 9 (2010), for

financial liabilities

measured at fair value

under the fair value

option, changes in fair

value attributable to

changes in credit risk

will be recognized in

OCI, with the remainder

of the change recognized

in profit or loss.

However, if this

requirement creates or

enlarges an accounting

mismatch in profit or

loss, the entire change

in fair value will be

recognized in profit or

loss. Amounts presented

in OCI will not be

reclassified to profit

or loss at a later date.

IFRS 9 (2010) also

requires derivative

liabilities that are

linked to and must be

settled by delivery of

an unquoted equity

instrument to be

measured at fair value,

whereas such derivative

liabilities are measured

at cost under IAS 39.

IFRS 9 (2010) also added

the requirements of IAS

39 for the derecognition

of financial assets and

liabilities to IFRS 9

without change.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Amendments to IAS 32, The amendments to IAS 32 The Company intends to

Offsetting Financial clarify that an entity adopt the amendments to

Assets and Liabilities currently has a legally IAS 32 in its financial

enforceable right to statements for the

In December 2011, the set-off if that right annual period beginning

IASB published is: April 1, 2014. The

Offsetting Financial Company does not expect

Assets and Financial not contingent on a the amendments to have a

Liabilities and issued future event; and material impact on the

new presentation enforceable both in the financial statements.

requirements in IAS 32 normal course of

Financial Instruments: business and in the

Presentation. event of default,

insolvency or bankruptcy

The effective date for of the entity and all

the amendments to IAS 32 counterparties.

is annual periods

beginning on or after The amendments to IAS 32

January 1, 2014. These also clarify when a

amendments are to be settlement mechanism

applied retrospectively. provides for net

settlement or gross

settlement that is

equivalent to net

settlement.

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Outstanding Share Data

The following table represents the number of Common Shares and options outstanding:

As at August 12, 2013

(thousands)

----------------------------------------------------------------------------

Common Shares 38,511

Options 2,492

----------------------------------------------------------------------------

On July 13, 2005, CMG adopted a rolling stock option plan which allows the

Company to grant options to its employees and directors to acquire Common Shares

of up to 10% of the outstanding Common Shares at the date of grant. Based upon

this calculation, at August 12, 2013, CMG could grant up to 3,851,000 stock

options.

Disclosure Controls and Procedures and Internal Control over Financial Reporting

Management is responsible for establishing and maintaining disclosure controls

and procedures ("DC&P") and internal control over financial reporting ("ICFR")

as defined under National Instrument 52-109. These controls and procedures were

reviewed and the effectiveness of their design and operation was evaluated in

fiscal 2013 in accordance with the COSO control framework. The evaluation

confirmed the effectiveness of DC&P and ICFR at March 31, 2013. During our

fiscal year 2014, we continue to monitor and review our controls and procedures.

During the three months ended June 30, 2013, there have been no significant

changes to the Company's ICFR that have materially affected, or are reasonably

likely to materially affect, the company's ICFR.

Outlook

Our annuity/maintenance revenue stream continued to grow during the first

quarter of fiscal 2014 with a recorded increase of 6%, compared to the first

quarter of the previous fiscal year. Over 80% of our software license revenue is

derived from our annuity and maintenance contracts, and with a strong renewal

rate, we expect to see continued growth in this revenue base. We will continue

to extend our reach globally and focus our efforts on increasing our license

sales to both existing and new customers.

Our profit margin continued to hold strong, demonstrating our continuous

commitment to effectively manage our corporate costs. For the three months ended

June 30, 2013, our EBITDA represented 54% of our total revenue, compared to 51%

recorded in the same period of the previous fiscal year.

CMG continues to focus its resources on the development, enhancement and

deployment of simulation software tools relevant to the challenges and

opportunities facing its diverse customer base. With the growth in

unconventional hydrocarbon and enhanced oil recovery ("EOR") projects around the

globe, we are seeing an increase in the use of reservoir simulation software by

reservoir engineers. This growth in simulation use has been reflected in the

number and types of projects being simulated and the amount of simulation done

on each project, hence, increasing the demand for our software. While oil prices

continue to fluctuate, they remain at levels that should allow our customers to

move forward on projects involving various types of unconventional reserves and

advanced recovery processes.

One of the instrumental parts of our success includes training programs which we

offer to our customers to enable them to become more efficient and effective

users of our software. We continue to see strong class attendance across all the

regions.

CMG's joint project to develop the newest generation of dynamic reservoir

modelling systems ("DRMS Project") continued to make progress during the first

quarter of the current fiscal year. The most recent beta version of the software

was released at the beginning of calendar 2013, and our DRMS team continues to

make progress toward the anticipated limited commercial release of the software

by the end of calendar 2013. CMG and its partners remain committed to funding

the ongoing development and to the future success of the project.

The excellent reputation behind our Company and its product suite offering will

continue to enable us to grow and sustain a healthy market share while

generating solid software license revenue. With our strong working capital

position, we are well positioned to continue to invest in all aspects of our

business in order to continue to grow and diversify our revenue base and to

ultimately return value to our shareholders in the form of regular quarterly

dividend payments and growth in share value.

Kenneth M. Dedeluk

President and Chief Executive Officer

August 12, 2013

COMPUTER MODELLING GROUP LTD.

CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

UNAUDITED (thousands of Canadian $) June 30, 2013 March 31, 2013

----------------------------------------------------------------------------

Assets

Current assets:

Cash 63,112 59,419

Trade and other receivables 12,017 19,141

Prepaid expenses 1,063 1,216

Prepaid income taxes (note 7) 20 341

----------------------------------------------------------------------------

76,212 80,117

Property and equipment 3,154 3,304

----------------------------------------------------------------------------

Total assets 79,366 83,421

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Liabilities and Shareholders' Equity

Current liabilities:

Trade payables and accrued liabilities 3,632 6,047

Income taxes payable (note 7) 492 296

Deferred revenue 22,014 25,289

----------------------------------------------------------------------------

26,138 31,632

Deferred tax liability (note 7) 111 379

----------------------------------------------------------------------------

Total liabilities 26,249 32,011

----------------------------------------------------------------------------

Shareholders' equity:

Share capital 43,936 40,498

Contributed surplus 4,702 4,673

Retained earnings 4,479 6,239

----------------------------------------------------------------------------

Total shareholders' equity 53,117 51,410

----------------------------------------------------------------------------

Total liabilities and shareholders' equity 79,366 83,421

----------------------------------------------------------------------------

----------------------------------------------------------------------------

See accompanying notes to condensed consolidated financial statements.

COMPUTER MODELLING GROUP LTD.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

For the three months ended June 30,

UNAUDITED (thousands of Canadian $ except per

share amounts) 2013 2012

----------------------------------------------------------------------------

Revenue (note 4) 18,116 16,465

----------------------------------------------------------------------------

Operating expenses

Sales, marketing and professional services 3,649 3,962

Research and development (note 5) 3,472 2,897

General and administrative 1,645 1,501

----------------------------------------------------------------------------

8,766 8,360

----------------------------------------------------------------------------

Operating profit 9,350 8,105

Finance income (note 6) 649 472

----------------------------------------------------------------------------

Profit before income and other taxes 9,999 8,577

Income and other taxes (note 7) 2,918 2,487

----------------------------------------------------------------------------

Net and total comprehensive income 7,081 6,090

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Earnings Per Share

Basic (note 8(e)) 0.19 0.16

Diluted (note 8(e)) 0.18 0.16

----------------------------------------------------------------------------

----------------------------------------------------------------------------

See accompanying notes to condensed consolidated financial statements.

COMPUTER MODELLING GROUP LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Common

UNAUDITED (thousands of Share Contributed Retained Total

Canadian $) Capital Surplus Earnings Equity

----------------------------------------------------------------------------

Balance, April 1, 2012 31,751 3,535 10,793 46,079

Total comprehensive income

for the period - - 6,090 6,090

Dividends paid - - (9,736) (9,736)

Shares issued for cash on

exercise of stock options

(note 8(b)) 1,224 - - 1,224

Common shares buy-back

(notes 8(b) & (c)) (80) - (1,471) (1,551)

Stock-based compensation:

Current period expense - 568 - 568

Stock options exercised

(note 8(b)) 231 (231) - -

----------------------------------------------------------------------------

Balance, June 30, 2012 33,126 3,872 5,676 42,674

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Balance, April 1, 2013 40,498 4,673 6,239 51,410

Total comprehensive income

for the period - - 7,081 7,081

Dividends paid - - (8,841) (8,841)

Shares issued for cash on

exercise of stock options

(note 8(b)) 2,922 - - 2,922

Common shares buy-back

(notes 8(b) & (c)) - - -

Stock-based compensation:

Current period expense - 545 - 545

Stock options exercised

(note 8(b)) 516 (516) - -

----------------------------------------------------------------------------

Balance, June 30, 2013 43,936 4,702 4,479 53,117

----------------------------------------------------------------------------

----------------------------------------------------------------------------

See accompanying notes to condensed consolidated financial statements.

COMPUTER MODELLING GROUP LTD.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

For the three months ended June 30,

UNAUDITED (thousands of Canadian $) 2013 2012

----------------------------------------------------------------------------

Cash flows from operating activities

Net income 7,081 6,090

Adjustments for:

Depreciation 375 318

Income and other taxes (note 7) 2,918 2,487

Stock-based compensation (note 8(d)) 545 568

Interest income (note 6) (157) (145)

----------------------------------------------------------------------------

10,762 9,318

Changes in non-cash working capital:

Trade and other receivables 7,126 4,562

Trade payables and accrued liabilities (2,415) (909)

Prepaid expenses 153 65

Deferred revenue (3,275) (2,914)

----------------------------------------------------------------------------

Cash generated from operating activities 12,351 10,122

Interest received 155 144

Income taxes paid (2,669) (3,605)

----------------------------------------------------------------------------

Net cash from operating activities 9,837 6,661

----------------------------------------------------------------------------

Cash flows from financing activities

Proceeds from issue of common shares 2,922 1,224

Dividends paid (8,841) (9,736)

Common shares buy-back (note 8(c)) - (1,551)

----------------------------------------------------------------------------

Net cash used in financing activities (5,919) (10,063)

----------------------------------------------------------------------------

Cash flows used in investing activities

Property and equipment additions (225) (437)

----------------------------------------------------------------------------

Increase (decrease) in cash 3,693 (3,839)

Cash, beginning of period 59,419 55,374

----------------------------------------------------------------------------

Cash, end of period 63,112 51,535

----------------------------------------------------------------------------

----------------------------------------------------------------------------

See accompanying notes to condensed consolidated financial statements.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the three months ended June 30, 2013 and 2012 (unaudited).

1. Reporting Entity:

Computer Modelling Group Ltd. ("CMG") is a company domiciled in Alberta, Canada

and is incorporated pursuant to the Alberta Business Corporations Act, with its

Common Shares listed on the Toronto Stock Exchange under the symbol "CMG". The

address of CMG's registered office is Suite 200, 1824 Crowchild Trail N.W.,

Calgary, Alberta, Canada, T2M 3Y7. The condensed consolidated financial

statements as at and for the three months ended June 30, 2013 comprise CMG and

its subsidiaries (together referred to as the "Company"). The Company is a

computer software technology company engaged in the development and licensing of

reservoir simulation software. The Company also provides professional services

consisting of highly specialized support, consulting, training, and contract

research activities.

2. Basis of Preparation:

(a) STATEMENT OF COMPLIANCE:

These condensed consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards ("IFRS") as issued

by the International Accounting Standards Board ("IASB"), and using the

accounting policies disclosed in note 3 of the Company's annual consolidated

financial statements as at and for the year ended March 31, 2013.

These condensed consolidated financial statements have been prepared in

accordance with International Accounting Standard ("IAS") 34, Interim Financial

Reporting. Accordingly, the condensed consolidated financial statements do not

include all of the information required for full annual financial statements,

and should be read in conjunction with the Company's most recent annual

consolidated financial statements as at and for the year ended March 31, 2013.

These unaudited condensed consolidated financial statements as at and for the

three months ended June 30, 2013 were authorized for issuance by the Board of

Directors on August 12, 2013.

(b) BASIS OF MEASUREMENT:

The condensed consolidated financial statements have been prepared on the

historical cost basis, which is based on the fair value of the consideration at

the time of the transaction.

(c) FUNCTIONAL AND PRESENTATION CURRENCY:

The condensed consolidated financial statements are presented in Canadian

dollars, which is the functional currency of CMG and its subsidiaries. All

financial information presented in Canadian dollars has been rounded to the

nearest thousand.

(d) USE OF ESTIMATES, JUDGMENTS AND ASSUMPTIONS:

The preparation of financial statements in conformity with IFRS requires

management to make judgments, estimates and assumptions that affect the

application of accounting policies, the reported amounts of assets and

liabilities and the disclosure of contingent assets and liabilities at the date

of the financial statements and the reported amounts of revenue, costs and

expenses for the period. Estimates and underlying assumptions are based on

historical experience and other assumptions that are considered reasonable in

the circumstances and are reviewed on an on-going basis. Actual results may

differ from such estimates and it is possible that the differences could be

material. Revisions to accounting estimates are recognized in the period in

which the estimates are revised and in any future periods affected. In preparing

these condensed consolidated financial statements, the significant judgments

made by management in applying the Company's accounting policies and the key

sources of estimation uncertainty are the same as those applied in the annual

IFRS consolidated financial statements for the year ended March 31, 2013.

3. Significant Accounting Policies:

The condensed consolidated financial statements should be read in conjunction

with the Company's annual financial statements for the year ended March 31, 2013

prepared in accordance with IFRS applicable to those annual consolidated

financial statements. Except as disclosed below, the same accounting policies,

presentation and methods of computation have been followed in these condensed

consolidated financial statements as were applied in the Company's consolidated

financial statements for the year ended March 31, 2013.

NEW STANDARDS AND INTERPRETATIONS ADOPTED:

The Company has adopted the following new standards and amendments to standards,

with a date of initial application of April 1, 2013:

-- IFRS 10 Consolidated Financial Statements

Replaces the guidance in IAS 27 Consolidated and Separate Financial

Statements and SIC-12 Consolidation - Special Purpose Entities, and

provides a single model to be applied in the control analysis for all

investees, including entities that currently are special purpose

entities in the scope of SIC-12. The adoption of IFRS 10 did not have a

material impact on the condensed consolidated interim financial

statements.

-- IFRS 11 Joint Arrangements

Under IFRS 11, joint arrangements are classified as either joint

operations or joint ventures. IFRS 11 replaces the guidance in IAS 31

Interest in Joint Ventures, and essentially carves out of previous

jointly controlled entities, those arrangements which although

structured through a separate vehicle, such separation is ineffective

and the parties to the arrangement have rights to the assets and

obligations for the liabilities and are accounted for as joint

operations in a fashion consistent with jointly controlled

assets/operations under IAS 31. In addition, under IFRS 11, joint

ventures must now use the equity method of accounting. The adoption of

IFRS 11 did not have a material impact on the condensed consolidated

interim financial statements.

-- IFRS 12 Disclosure of Interests in Other Entities

Contains the disclosure requirements for entities that have interests in

subsidiaries, joint arrangements, associates and/or unconsolidated

structured entities. The adoption of IFRS 12 did not have a material

impact on the condensed consolidated interim financial statements.

-- IFRS 13 Fair Value Measurement

Replaces the fair value measurement guidance contained in individual

IFRSs with a single source of fair value measurement guidance. It

defines fair value as the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between market

participants at the measurement date, i.e. an exit price. The standard

also establishes a framework for measuring fair value and sets out

disclosure requirements for fair value measurement to provide

information that enables financial statement users to assess the methods

and inputs used to develop fair value measurements and, for recurring

fair value measurements that use significant unobservable inputs (Level

3), the effect of the measurements on profit or loss or other. Due to