DREAM Unlimited Corp. Announces $50 Million Equity Offering

08 Abril 2014 - 6:07PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED

STATES.

DREAM Unlimited Corp. (TSX:DRM)(TSX:DRM.PR.A) ("DREAM") announced today that it

has entered into an agreement to sell 3,200,000 Class A subordinate voting

shares ("Shares") on a bought deal basis at a price of $15.70 per Share to a

syndicate of underwriters led by TD Securities Inc. for gross proceeds of

$50,240,000. In addition, DREAM has granted the underwriters an over-allotment

option, exercisable for a period of 30 days following closing, to purchase up to

an additional 480,000 Shares which, if exercised, would increase the gross

offering size to $57,776,000. The offering is scheduled to close on or about

April 29, 2014, and is subject to regulatory approval.

The net proceeds of the offering will be used by DREAM to invest, indirectly

through its 70% owned subsidiary, DREAM Asset Management Corporation ("DAM"), in

land development and housing and condominium development activities, to fund

renewable power projects under contract and for general corporate purposes. DAM

has a number of acquisitions under contract which it anticipates funding over

the next several months. In particular, a portion of the net proceeds of the

offering, together with cash on hand in DAM, may be used to make payments on

approximately 1,000 acres of land in Western Canada this year for approximately

$50 million (as previously disclosed) and payments on an additional 358 acres of

land currently under contract in Saskatoon for approximately $10 million; and to

fund approximately $19 million in renewable power projects currently under

contract.

DAM also entered into an agreement to acquire an interest in a new development

project in Ottawa's National Capital Region. Specifically, DAM has agreed to

acquire a 50% interest in the limited partner and a 35% interest in the general

partner of a partnership that has the right to acquire 37 acres of land in the

National Capital Region consisting of Albert Island and Chaudiere Island plus

lands along the Gatineau waterfront. This land area is larger than the

Distillery District and the Pan Am Athletes Village project combined. This

acquisition and, in turn, DAM's investment in the partnership, is subject to

customary conditions, including the obtaining of required zoning approvals.

DREAM will invest the net proceeds of the offering into preference shares and

common shares of DAM. The preference shares of DAM will have terms similar to

DREAM's outstanding first preference shares, Series 1 (TSX:DRM.PR.A), except for

the conversion feature, and will have a subscription price equal to the market

price of DREAM's first preference shares, Series 1 ($7.45 per preference share

for a total of approximately $44.7 million). The remaining net proceeds of the

offering will be used by DREAM to subscribe for additional common shares of DAM.

Amounts paid by DAM on these new preference shares to be owned by DREAM will

provide DREAM with an improved ability to fund dividend payments, any potential

redemption requests or amounts due at maturity of its first preference shares,

Series 1 by effectively mirroring the preference shares in the capital structure

of DAM with the one currently in DREAM. Proceeds of the offering are not

intended to be used to fund redemptions of any preference shares. Following the

completion of DREAM's equity offering and DREAM's additional investment in DAM,

a corporation controlled by Michael Cooper will continue to have the right to

exchange its DAM shares into approximately 34.2 million Class A subordinate

voting shares of DREAM, representing a decrease from a 31.3% to a 30.3% equity

interest in DREAM, on the basis that DREAM's first preference shares, Series 1

will be repaid in cash.

This press release is not an offer of securities for sale in the United States.

The Shares being offered have not been and will not be registered under the

United States Securities Act of 1933 and accordingly are not being offered for

sale and may not be offered, sold or delivered, directly or indirectly within

the United States, its possessions and other areas subject to its jurisdiction

or to, or for the account or for the benefit of a U.S. person, except pursuant

to an exemption from the registration requirements of that Act.

About DREAM:

DREAM is one of Canada's leading real estate companies with approximately $13

billion of assets under management in North America and Europe. The scope of the

business includes residential land development, housing and condominium

development, asset management for three TSX-listed real estate investment

trusts, investments in Canadian renewable energy infrastructure and commercial

property ownership. DREAM has an established track record for being innovative

and for its ability to source, structure and execute on compelling investment

opportunities.

Forward Looking Information

This press release may contain forward-looking information within the meaning of

applicable securities legislation. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and uncertainties,

many of which are beyond DREAM's control, which could cause actual results to

differ materially from those that are disclosed in or implied by such

forward-looking information. These risks and uncertainties include, but are not

limited to general and local economic and business conditions, employment

levels, regulatory risks, mortgage rates and regulations, environmental risks,

consumer confidence, seasonality, adverse weather conditions, reliance on key

clients and personnel and competition. All forward looking information in this

press release speaks as of April 8, 2014. DREAM does not undertake to update any

such forward looking information whether as a result of new information, future

events or otherwise. Additional information about these assumptions and risks

and uncertainties is disclosed in filings with securities regulators filed on

SEDAR (www.sedar.com).

FOR FURTHER INFORMATION PLEASE CONTACT:

DREAM Unlimited Corp.

Michael J. Cooper

Chief Executive Officer

(416) 365-5145

mcooper@dream.ca

DREAM Unlimited Corp.

Pauline Alimchandani

Chief Financial Officer

(416) 365-5992

palimchandani@dream.ca

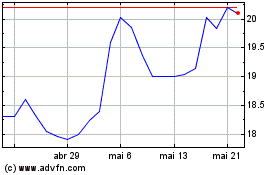

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

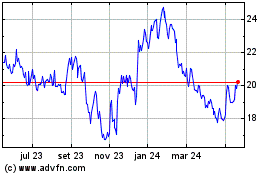

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024