Dream Announces Successful Creation of Dream Hard Asset Alternatives Trust and Trading of Units on TSX

08 Julho 2014 - 9:13AM

Marketwired Canada

This news release contains forward-looking information that is based upon

assumptions and is subject to risks and uncertainties as indicated in the

cautionary note contained within this press release.

Dream Unlimited Corp. (TSX:DRM) ("Dream") and Dream Hard Asset Alternatives

Trust (TSX: DRA.UN) ("Dream Alternatives") announced today the closing of the

previously announced reorganization of the: ROI Canadian High Income Mortgage

Fund (TSX:RIH.UN); ROI Canadian Mortgage Income Fund (TSX:RIL.UN); ROI Canadian

Real Estate Fund (TSX:RIR.UN) and ROI Institutional Private Placement Fund,

(collectively the "ROI Funds"). As part of the reorganization, all of the assets

within the ROI Funds have been indirectly transferred to the newly-formed Dream

Alternatives. Dream Alternatives will be managed by a subsidiary of Dream.

Dream Alternatives will begin trading on the Toronto Stock Exchange at market

open on July 8, 2014 with approximately 73 million units and an opening equity

book value of approximately $725 million. We expect to make monthly

distributions of $0.033 per unit ($0.40 per unit on an annual basis) on the 15th

of each month.

About Dream:

Dream is an innovative real estate manager and developer primarily focused on

the commercial and residential sectors in Canada and Germany and renewable power

in Canada. From its creation, DREAM has successfully identified and executed on

opportunities for the benefit of the business, shareholders and clients.

As at July 8, 2014, Dream owns or provides asset management for approximately

$14.6 billion of assets. Dream is the asset manager for four publicly listed

vehicles in Canada including: Dream Office REIT, Canada's largest office REIT,

Dream Global REIT, Canada's largest REIT that invests only outside of Canada,

Dream Industrial REIT, one of Canada's largest dedicated industrial REITs and

Dream Alternatives, a Canadian growth-oriented, diversified hard asset

alternatives Trust.

DREAM is also the co-manager of a $345 million infrastructure fund with a focus

on wind and solar Canadian renewable power projects. The total value of these

projects is about $1.45 billion, including debt.

Its asset management team consists of 178 real estate professionals with

backgrounds in property management, architecture, engineering, construction,

finance, accounting, sales and marketing and law. The team brings experience

from virtually all the major real estate organizations in Canada and has

expertise in capital markets, structured finance, real estate investments and

management across a broad spectrum of property types in diverse geographic

markets. It carries out its own research and analysis, financial modeling, due

diligence and financial planning. Dream has an established track record for

being innovative and for its ability to source, structure and execute on

compelling investment opportunities. Website: www.dream.ca

About Dream Alternatives

Dream Alternatives will provide its unitholders with exposure to real estate,

real estate lending and infrastructure, including renewable power, and

accordingly leverage Dream's asset management platform, track record and

expertise in these areas. Website: www.dreamalternatives.ca

The objectives of Dream Alternatives are to:

-- provide an opportunity for unitholders to invest in hard asset

alternative investments, including real estate, real estate loans, and

infrastructure, including renewable power, managed by an experienced

team with a successful track record;

-- build and maintain a growth-oriented portfolio of real estate, real

estate lending and infrastructure (including renewable power) assets;

-- provide predictable and sustainable cash distributions to unitholders on

a tax efficient basis; and

-- re-position and grow our assets to increase the value of our business

and our distributions to unitholders over time.

Forward Looking Information

This press release may contain forward-looking information within the meaning of

applicable securities legislation. Forward-looking information is based on a

number of assumptions and is subject to a number of risks and uncertainties,

many of which are beyond Dream's control, which could cause actual results to

differ materially from those that are disclosed in or implied by such

forward-looking information. These risks and uncertainties include, but are not

limited to general and local economic and business conditions, employment

levels, regulatory risks, mortgage rates and regulations, environmental risks,

consumer confidence, seasonality, adverse weather conditions, reliance on key

clients and personnel, competition and the satisfaction of all remaining

conditions to the closing of the reorganization and the initial public offering

of the Dream Alternatives units. All forward looking information in this press

release speaks as of July 8, 2014. Dream does not undertake to update any such

forward looking information whether as a result of new information, future

events or otherwise. Additional information about these assumptions and risks

and uncertainties is disclosed in filings with securities regulators filed on

SEDAR (www.sedar.com).

FOR FURTHER INFORMATION PLEASE CONTACT:

Dream Unlimited Corp.

Michael J. Cooper

Chief Executive Officer

(416) 365-5145

mcooper@dream.ca

Dream Unlimited Corp.

Pauline Alimchandani

Chief Financial Officer

(416) 365-5992

palimchandani@dream.ca

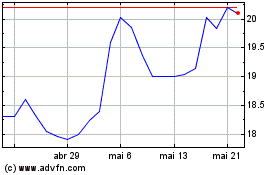

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

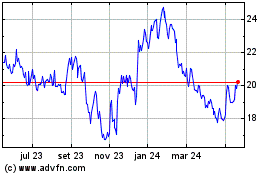

DREAM Unlimited (TSX:DRM)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024